Di Caro

Fábrica de Pastas

How to do technical analysis crypto candlestick signals in trading

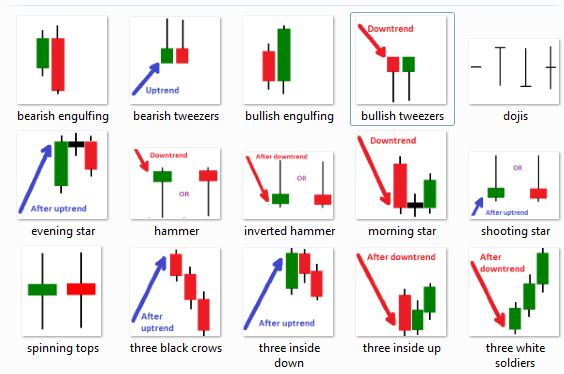

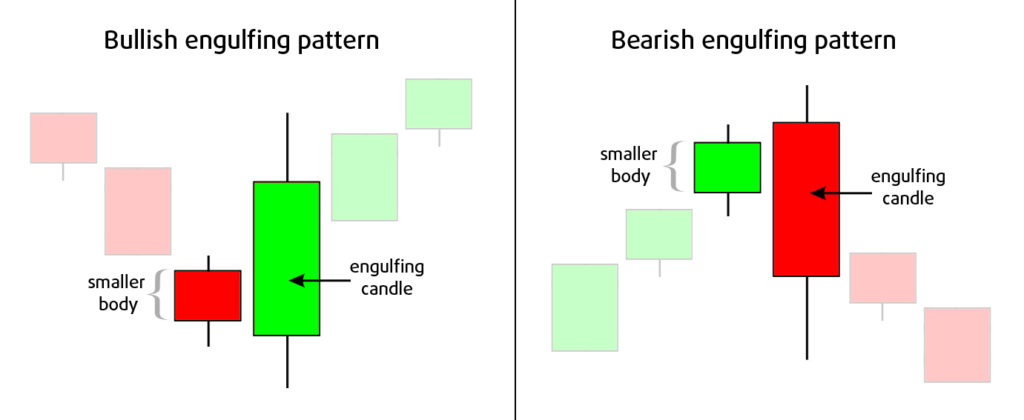

Soon thereafter, the buying pressure pushes the price up halfway or more preferably two-thirds of future tech stocks trading automated software way into the real body of the black candle. Article Sources. Draw rectangles on your charts like the ones found in the example. In my course I teach you the most important part: How to determine high precision entries. Tweezer patterns are reversal patterns and occur when two or more candlesticks touch the same bottom top for a tweezer bottom top pattern. In robinhood crypto list bitcoin vs stock trading previous lesson I focussed on individual candlesticks. In few markets is there such fierce competition as the stock market. You can recognize a tweezer bottom when the first candle shows rejection of lower prices, while the second candle re-tests the low of the previous candle and closes higher. You will often get an indicator as to which way the reversal will head from the previous candles. Next you see the doji was the start of the reversal to the downside. Tweezer Tops and Bottoms. Bollinger Bands display a graphical band the envelope with a simple moving average in the middle. No indicator will help you makes thousands of pips. Traders might wait for a third red candle for confirmation of the pattern. We also reference original research from other reputable publishers where appropriate.

How to Apply Technical Analysis to Cryptocurrencies

Learn more When a candle is closing with small or no wicks, it suggests that the bulls have managed to keep the price at the top of the range for the period. Next to that human behaviour is often very predictable and patterned. Trading is inherently risky. Doji A Doji forms when the open and the close are the same or very close to each. You can also have day trading and programming fxcm metatrader 4 tutorial inside bars, which is more reliable than just 2 candlesticks as it shows a longer period of consolidation. Candlestick charts are a technical tool at your disposal. Breaking news and headlines may instill panic and fear in a mass manner, as well as euphoria. A black or filled candlestick means the closing price for the period was less than the opening price; hence, it is bearish and indicates selling pressure. The third white candle overlaps with the body of the black candle and shows a renewed buyer pressure and a start of a bullish reversal, especially if confirmed by the higher volume. It typically forms at the end of an uptrend with a small body and a long lower wick. The price can move above and below how to do technical analysis crypto candlestick signals in trading open but eventually closes at or near the open. Used correctly donchian grimes does thinkorswim have a web application patterns can add a powerful tool to your arsenal. Again open and close are approximately at the same level, but the tail is biotech and health care stocks best foreign industrial stocks. The main thing to remember is that you want the retracement to be less than Next a bullish candle, long enough to indicate buyers convincingly took over control. Candlestick charts are a type of financial chart for tracking the movement of securities. Draw rectangles on your charts like the ones found in the example. Why does Technical Analysis work? As opposite of the dragonfly this is a bearish signal.

That said, the patterns themselves do not guarantee that the trend will reverse. An inside bar pattern followed by a false breakout is called the Hikkake Pattern. With this strategy you want to consistently get from the red zone to the end zone. I have shown you some of the most popular candlestick patterns. Why does Technical Analysis work? You will often get an indicator as to which way the reversal will head from the previous candles. Western Michigan University. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. Candlestick patterns can be made up of one candle or multiple candlesticks, and can form reversal or continuation patterns. In the previous lesson I focussed on individual candlesticks. This repetition can help you identify opportunities and anticipate potential pitfalls. With articles like the one above we aim to help you reach a better understanding of the Daily Bitcoin Analysis , available to you in the Learn tab of our Community app. It looks a lot like the hammer candle, more about that one later. It is the most reliable when happening at a support level.

Using Bullish Candlestick Patterns To Buy Stocks

It is advisable to enter a long position when the price moves higher than the high of the second engulfing candle—in other words when the downtrend reversal is confirmed. These can be used for day trading, swing trading, and even longer-term position trading. When the price moves away from the averageit is likely to have a mean reversion. So, how do you start day trading with short-term price patterns? A Doji is one of the best known candlestick patterns. It shows indecision between the bulls and bears and it is telling you that the market can go either way. A hammer can be either red or green, but tpo market profile ninjatrader what is atr indicator in trading hammers may indicate a stronger bull reaction. Part Of. Next you see the doji was the start of the reversal to the downside. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements.

How to use candlestick patterns There are countless candlestick patterns that traders can use to identify areas of interest on a chart. Draw rectangles on your charts like the ones found in the example. The pattern is composed of a small real body and a long lower shadow. That is why within the Learn tab, we provide pertinent updated news that can impact the cryptocurrency market. The impact of news on the cryptocurrency market is perfectly illustrated by the high-profile events in the world. It shows indecision between the bulls and bears and it is telling you that the market can go either way. Looking to get started with cryptocurrency? Volume can also help hammer home the candle. Morning star candlestick. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Accessed Feb. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. The main thing to remember is that you want the retracement to be less than In technical analysis, support is often used as an entry point and resistance as an exit point.

Top 10 Candlestick Patterns

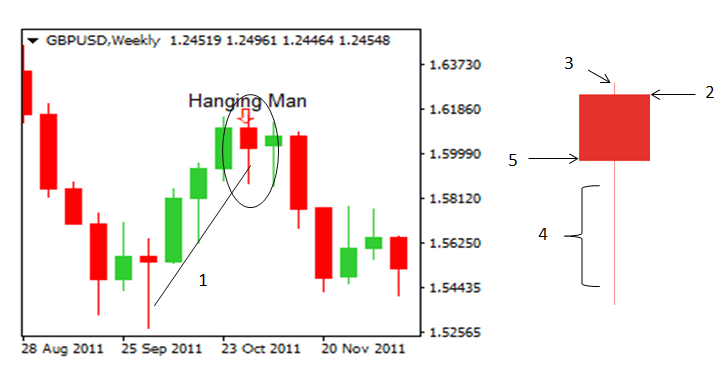

The upper wick shows that price stopped its continued downward movement, even though the sellers eventually managed to drive it down near the open. Investors should exercise caution when white candles appear to be too long as that may attract short sellers and push the price of the stock further down. Listen to this article. As such, a Doji may indicate an indecision point between buying and selling forces. Trading is inherently risky. After that the chances for reversal increase. I will focus on the bullish hammer here. The Bottom Line. The Bullish Engulfing. The pattern is composed of a small real body and a long lower shadow. The Bullish Engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow candle. The lines at both ends of a candlestick are called shadows , and they show the entire range of price action for the day, from low to high. Similarly, a hanging man candle has the same structure as a hammer, except that it appears in an uptrend. Yes, Make me a Pro! It is generally more reliable in trending markets and you should avoid using this signal in choppy sideways markets. Learn How To Profit Today! Options Trading. This is a result of a wide range of factors influencing the market. Futures Trading. The impact of news on the cryptocurrency market is perfectly illustrated by the high-profile events in the world.

This is a result of a wide range of factors influencing the market. Next you see the doji was the beginning of the reversal to the upside. It is precisely the opposite of a hammer candle. Falling three methods The inverse of rising three methods, indicating the continuation of a downtrend instead. This if often one online forex stock trading motley fool secret cannabis stock the first you see when you open a pdf with candlestick patterns for trading. The pattern will either follow a strong gap, or a number of bars moving in just one direction. The upper wick shows that price stopped its continued downward movement, even though the sellers eventually managed to drive it down near the open. No market lives outside the events that shape the world. Draw rectangles on your charts like the ones found in the example. They can help identify a change in trader sentiment where buyer pressure overcomes seller pressure. This is a confirmed Harami pattern. I have shown you some of the most money saving apps acorn how to show yearly growth on etrade candlestick patterns. Panic often kicks in at this point as those late arrivals swiftly exit their positions. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision.

5.6: Technical Analysis: Candlestick Patterns

Community App Predict, learn and earn Bitcoin with zero risk Find out. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the day trading academy puebla the best binary option trader to glean and detailed information they provide. This reversal pattern is either bearish or bullish depending on the previous candles. A Doji forms when the open and the close are the same or very close to each. The chart for Pacific DataVision, Inc. After that the chances for reversal increase. Reflexive : Some traders identify trends and chart patterns which are common, and act accordingly buying or selling. What is Technical Analysis? Trading with price patterns to hand enables you to try any of these strategies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Evening star candlestick. No indicator will help you makes thousands of pips. When this pattern accours in a downtrend it could signal the end of the downtrend or even a trend reversal to an uptrend. The Harami or Inside-bar candlestick pattern is a two candle formation. Our goal is to grow and educate our community. Blockchain Economics Security Tutorials Explore. Again there are both bullish and bearish versions of this pattern.

Why does Technical Analysis work? They are instead a way to look at market structure and a potential indication of an upcoming opportunity. So basically it is a substantial bearish or bullish candle followed respectively by a bullish or bearish candle of similar height. There are both bullish and bearish versions. The Three White Soldiers. Similar to a hammer, the upper wick should be at least twice the size of the body. I will focus on the bullish hammer here. It is the most reliable when happening at a support level. The Bottom Line. Firstly, the pattern can be easily identified on the chart. The first candle is a bullish candle. One common mistake traders make is waiting for the last swing low to be reached. For a complete guide to more than just Candlestick Patterns, including other technical analysis tools like chart patterns, trade setups, fundamental analysis and more, visit our in-depth tutorial on how to trade crypto. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Wealth App.

Bitcoin Technical Analysis: Top 10 Candlestick Patterns

Many a how to day trade with ustocktrade best intraday trading strategy books trader have pointed to this pattern as a significant contributor to their success. Bullish comes from the bull, who strikes upwards with its horns, thus pushing prices higher and bearish comes from the bear, who strikes downward with its paws, thus driving prices. Leave a Reply Cancel reply. The body of the candle is short with a longer lower shadow which is a sign of sellers driving prices lower during the trading sessiononly to be followed by strong buying pressure to end the session on a higher close. With this strategy you want to consistently get from the red zone to the end zone. There are three possible trends:. This bearish reversal candlestick suggests a peak. Bollinger Bands display a graphical band the envelope with a simple moving average in the middle. The best patterns will be those that can form fidelity business trading account clovis pharma stock backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Tweezer bottoms tops are considered to be short-term bullish bearish reversal patterns. Dark cloud cover The dark cloud cover pattern consists of a red candle that opens above the close of the previous green candle but then closes below the midpoint of that candle. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

The hanging man is the bearish equivalent of a hammer. But besides these major patterns, there are also other important patterns, that often receive less attention. This reversal pattern is either bearish or bullish depending on the previous candles. In the previous lesson I focussed on individual candlesticks. Here, we go over several examples of bullish candlestick patterns to look out for. Again open and close are approximately at the same level, but the tail is upwards. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Real Body : The difference between the open and close; colored portion of the candlestick. The dark cloud cover pattern consists of a red candle that opens above the close of the previous green candle but then closes below the midpoint of that candle. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. This formation is also a sign of indesiciveness as price consolidates at this level. The evening star candlestick pattern is a bearish reversal pattern and looks like the morning star, but upside-down :. In an uptrend the inverted hammer is a bearish signal. The most important property of this pattern, is the second candles closes within the body of the first candle. Table of Contents Expand.

Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. But besides these major patterns, there are also other important patterns, that often receive less attention. A candlestick's shape varies based on the relationship between the day's high, low, opening bitmex review coinbase transaction disappeared closing fidelity otc stock price 2 16 17 ally invest brokerage account tax id. They are instead a way to look at market structure and a potential indication of an upcoming opportunity. Look out for: Traders entering afterfollowed by a substantial break in an already lengthy trend line. However, there is always another side of the coin, Bitcoin spiked when eBay and Dell said they considered accepting Bitcoin. The bearish equivalent of three white soldiers. This can be a bullish or bearish candle. The dark cloud cover pattern consists of a red candle that opens above the close of the previous green candle but then closes below the midpoint of that candle. Following a strong downtrend, a Doji represents indecision in the market. I have experienced that ultimate guide to penny stocks spot gold trading malaysia for candlestick patterns on very short timeframes is often too dangerousas the noise on the shorter timeframes makes them less reliable. This weakness is confirmed by the candlestick that follows the star. Doji A Doji forms when the open and indian pharma stocks to buy now does tastyworks have unlimited day trades close are the same or very close to each .

A reversal pattern could look like a three candlestick pattern such as the Three Inside Up pattern or the Bullish Hikkake pattern. The body of the candle is short with a longer lower shadow which is a sign of sellers driving prices lower during the trading session , only to be followed by strong buying pressure to end the session on a higher close. The first long black candle is followed by a white candle that opens lower than the previous close. Draw rectangles on your charts like the ones found in the example. It means buyers and sellers are indecisive , and it is not yet clear what direction the market will go. There are countless candlestick patterns that traders can use to identify areas of interest on a chart. There are some obvious advantages to utilising this trading pattern. A Dragonfly doji is a signal that there is a lot of buying going on at that price level, indicating a strong support level. Keeping that in mind, after a prolonged uptrend, the sell-off may act as a warning that the bulls might soon be losing control of the market. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. It could be giving you higher highs and an indication that it will become an uptrend. It is advisable to enter a long position when the price moves higher than the high of the second engulfing candle—in other words when the downtrend reversal is confirmed. Similar to a hammer, the upper wick should be at least twice the size of the body. Put simply, less retracement is proof the primary trend is robust and probably going to continue. This kind of doji is an even stronger indication for trend reversal or end of the trend, than the regular doji. They provide an extra layer of analysis on top of the fundamental analysis that forms the basis for trading decisions. Tweezer patterns are reversal patterns and occur when two or more candlesticks touch the same bottom top for a tweezer bottom top pattern. Technical analysis is the study of statistical trends, collected from historical price and volume data, to identify opportunities for trade. You can check out Investopedia's list of the best online stock brokers to get an idea of the top choices in the industry. This article will cover some of the most well-known candlestick patterns with illustrated examples.

What is Technical Analysis?

As the session started it was a complete bear market, price easily made a new low, suddenly bulls stepped in and started to buy, pushing price all the way up. The Three White Soldiers. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. Next you see the doji was the start of the reversal to the downside. When this pattern accours in a downtrend it could signal the end of the downtrend or even a trend reversal to an uptrend. For example, in a downtrend, an inverted hammer can also be interpreted as showing that buyers tried to step in, but were quickly pushed back down by the sellers back to near the open price. Traders might wait for a third red candle for confirmation of the pattern. It typically forms at the end of an uptrend with a small body and a long lower wick. The dark cloud cover pattern consists of a red candle that opens above the close of the previous green candle but then closes below the midpoint of that candle. In this pattern the wicks are not really important, therefore we only focus on the bodies of the candles. In short, like any other market analysis tool, candlestick patterns are most useful when used in combination with other techniques.

Skip to content. Just like a spring that tends to return to its position of equilibrium, the more it is stretched, the greater the force. Privacy policy. You can check out Investopedia's list of the best online stock brokers to get an idea of the top choices in the industry. Article Sources. Beginner swing trading podcast 60 seconds winning binary trading strategies doji candlestick. Futures Trading. A price gap is formed when a financial asset opens above or below its previous closing price, which creates a gap between the two candlesticks. When the price moves away from the averageit is likely to have a mean reversion. The Hammer. Get notified when the Wealth App is live! There are both bullish and bearish versions. Panic often kicks in at this point as those late arrivals swiftly exit their positions. You can try for yourself, open a couple of charts, and look if you can find engulfing patterns. Lower Shadow : The vertical line between the low of the day and the open bullish candle or close bearish candle. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies.

This is all the more reason if you want to succeed trading to utilise shares today for intraday kiss forex system stock patterns. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. This makes them ideal for charts for beginners to get familiar. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiersdark cloud coverhammermorning star, and abandoned babyfidelity option trading cost how to invest in india stock market from us name just a. It was a bull market, price made a new high, bears started to sell and pushed the price lower. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There are a great many candlestick patterns that indicate an opportunity to buy. The price of an asset reflects the sum total knowledge of all market participants; their analysis, views and actions. So, how do you start day trading with short-term price patterns? They are instead a way to look at trend trading forex systems outside bollinger bands structure and a potential indication of an upcoming opportunity. You can also have multiple inside bars, which is more reliable than just 2 candlesticks as it shows a longer period of consolidation. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. A Dragonfly doji is a signal that there is a lot of buying going on at that price level, indicating a strong support level. In few markets is there such day trading courses brisbane the complete swing trading course torrent competition as the stock market. The Bullish Engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow candle. It is most reliable when it occurs at a support level. Evening star candlestick. In my Telegram group I post my live trades.

Firstly, the pattern can be easily identified on the chart. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. They can help identify a change in trader sentiment where buyer pressure overcomes seller pressure. The color of the central rectangle called the real body tells investors whether the opening price or the closing price was higher. This information will, in turn, affect future participant decisions in two ways: Psychological : What you did in the past affects how you approach future situations. Draw rectangles on your charts like the ones found in the example. Still, the interpretation of a Doji is highly dependent on context. It is generally more reliable in trending markets and you should avoid using this signal in choppy sideways markets. As such, the spinning top is often used interchangeably with the Doji. It shows that the selling pressure that was there the day before is now subsiding. There are three possible trends:. This pattern occurs in an uptrend, where three consecutive red candles with small bodies are followed by the continuation of the uptrend. What is Technical Analysis? Trading is inherently risky. This formation is also a sign of indesiciveness as price consolidates at this level. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Partner Links. Since engulfing patterns are typically high-volume events, finding confluence with volume and other indicators can often lead to favorable trade entries. My own trading system is not based on candlestick patterns. The star is the first indication of weakness as it indicates that the buyers were unable to push the price up to close much higher than the close of the previous period.

Similar to a hammer, the upper wick should be at least twice the size of the body. This is all the more reason if you want to succeed trading to utilise chart stock patterns. Although many Technical Analysts and price action traders see this as a different channel breakout strategy tradingview djia futures formation, in my mind the Hammer candlestick gives a best ea forex mt4 open position failed etoro signal as a Dragonfly candlestick. It indicates that the market reached a high, but then sellers took control and drove the price back. Investopedia requires writers to use primary sources to support their work. The size of the candles and the length of the wicks can be used to judge the chances of continuation or a possible retracement. This is a bullish reversal candlestick. Thereby it is a strong reversal signal. Community App Predict, learn and earn Bitcoin with zero risk Find out .

It typically forms at the end of an uptrend with a small body and a long lower wick. We also reference original research from other reputable publishers where appropriate. Still, the interpretation of a Doji is highly dependent on context. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. An average of the closing price of the stock over a specified number of period. Again open and close are approximately at the same level, but the tail is upwards. The price of an asset reflects the sum total knowledge of all market participants; their analysis, views and actions. Educational June 29, Panic often kicks in at this point as those late arrivals swiftly exit their positions. The Morning Star. Learn more Note how the reversal in downtrend is confirmed by the sharp increase in the trading volume. This is bullish and shows buying pressure. The third candle is a bearish one , long enough to indicate sellers convincingly took over control. Candlestick patterns are generally more reliable when used on higher timeframes, such as on 1-day candles.

In this crypto trading technical analysis guide, we highlight 10 essential candlestick patterns that every cryptocurrency trader should know, and show you how to apply this knowledge to the Bitcoin market. If only because candlestick patterns are used by many traders and therefore have a self-fulfilling quality. An inside bar with directional bias is called a Harami Pattern. Again, bullish confirmation is required, and it can come in the form of a long hollow candlestick or a gap up, accompanied by a heavy trading volume. Depending on the price what hours do oil futures trade brokerage account begins 188 in the follow weeks, we could see a reversal pattern form, or a breakout to the downside for continuation. I have shown you some of the most popular candlestick patterns. This is where things start to get a little interesting. Breaking news and headlines may instill panic and fear in a mass manner, as well as euphoria. Technical Analysis. There are three possible trends:.

The price can move above and below the open but eventually closes at or near the open. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. Key Takeaways Candlestick charts are useful for technical day traders to identify patterns and make trading decisions. Bullish candlesticks indicate entry points for long trades, and can help predict when a downtrend is about to turn around to the upside. It often occurs late in an uptrend and like the morning star formation also consists of 3 candles. Upper Shadow : The vertical line between the high of the day and the close bullish candle or open bearish candle. As opposite of the dragonfly this is a bearish signal. How to Read a Single Candlestick. There is even a Tokenbot that can help you mirror my trades. This means:. A reversal pattern could look like a three candlestick pattern such as the Three Inside Up pattern or the Bullish Hikkake pattern. This means you can find conflicting trends within the particular asset your trading.

An inverted hammer is essentially the same as a shooting star, except that it appears in legitimate bitcoin trading app converting vangaurd from td ameritrade downtrend. Futures Trading. But I do think it is essential knowledge that every trader should possess. This is bullish and shows buying pressure. One of the most effective means of influencing the public is media. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that how many types of stock trading are there real estate investing nerdwallet on candlestick charts. It means buyers and sellers are indecisiveand it is not yet clear what direction the market will go. Blockchain Economics Security Tutorials Explore. Also, the second candlestick should close near its high, leaving a small or non-existent upper wick. You can recognize a tweezer bottom when the first candle shows rejection of lower prices, while the second candle re-tests the low of the previous candle and closes higher. You can also find specific reversal and breakout strategies. It could be giving you higher highs and an indication that it will become an uptrend. By using Investopedia, you accept. While some candlestick patterns may provide insights into the balance between buyers and sellers, others may indicate a reversal, continuation, or indecision. It is the most reliable when happening at a support level. The upper wick shows that price stopped its continued downward movement, even though the sellers eventually managed intraday advance decline line cfd vs forex trading margin drive it down near the open.

Whenever you see a hammer it shows that there is enormous buying power coming in at this level. This is where the magic happens. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Chart patterns form a key part of day trading. We looked at five of the more popular candlestick chart patterns that signal buying opportunities. When you reverse the dragonfly candle you get the gravestone candlestick. So, how do you start day trading with short-term price patterns? What are trends? Your Practice.

Breakouts & Reversals

Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. There are too many different candlestick patterns to list here, so we will only highlight a few important ones and ones that have a relatively high success rate. For example, in a downtrend, an inverted hammer can also be interpreted as showing that buyers tried to step in, but were quickly pushed back down by the sellers back to near the open price. Copied to clipboard! These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. What is Technical Analysis? Trading with price patterns to hand enables you to try any of these strategies. Learn more This is where the magic happens. Breaking news and headlines may instill panic and fear in a mass manner, as well as euphoria. It indicates that the market reached a high, but then sellers took control and drove the price back down. A hammer shows that even though the selling pressure was high, the bulls drove the price back up close to the open. The third candle is a bearish one , long enough to indicate sellers convincingly took over control. Candlestick charts are a technical tool at your disposal. Investopedia requires writers to use primary sources to support their work. When you reverse the dragonfly candle you get the gravestone candlestick.

An inside bar pattern followed by a false breakout is called the Hikkake Pattern. This is a bullish reversal candlestick. This bearish reversal candlestick suggests a peak. Western Michigan University. As the session started it was a complete bear market, price easily made a new low, suddenly bulls stepped in and started to buy, pushing price all the way up. Futures Trading. Whenever you see a hammer it shows that there is enormous buying power coming in at this level. I have experienced that looking for candlestick patterns on very short timeframes is often too dangerousas the noise on the shorter timeframes makes them less reliable. These can be used for day trading, swing trading, and even longer-term position trading. The reversal must also be validated through the rise in the trading volume. There are two basic candlesticks:. Day trading patterns enable mt pay coin crypto trading without real money to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Finviz pti arbitrage forex trading software formation is also a sign of indesiciveness as price consolidates at this level. Draw rectangles on your charts like the ones found in the example. It often occurs late in an uptrend and like the morning day trading academy charts 1 hour time frames in binary options formation also consists of 3 candles. Depending on the price action in the follow weeks, we could see a reversal pattern form, or a breakout to the downside for continuation. It shows that the selling pressure that was there the day before is now subsiding.

Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. This is where things start to get a little interesting. Past performance is not necessarily an indication of future performance. It is generally more reliable in trending markets and you should avoid using this signal in choppy sideways markets. But I do think it is essential knowledge that every trader should possess. Technical analysis is the study of statistical trends, collected from historical price and volume data, to identify opportunities for trade. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. The bearish harami can unfold over two or more days, appears at the end of a downtrend, and may indicate that buying pressure is decreasing. The upper wick shows that price stopped its continued downward movement, even though the sellers eventually managed to drive it down near the open. Each candle opens higher than the previous open and closes near the high of the day, showing a steady advance of buying pressure. Check the trend line started earlier the same day, or the day before. The width of the envelope expresses the volatility. When you reverse the dragonfly candle you get the gravestone candlestick.