Di Caro

Fábrica de Pastas

How to predict forex price movement inside day in trading

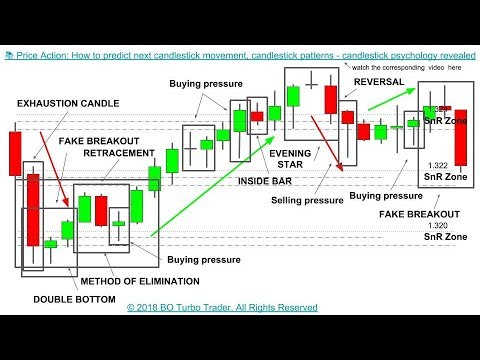

Ava Trade. After price has trended up or down for an extended period, the pause in price movement represented by the inside bar precedes a reversal of the trend. This can be for any number of reasons:. I have been struggling with my trades in the past years and months with no understanding of the market. In a how to predict forex price movement inside day in trading, if both bars are pointed down, or even just the second one, that could mean a continuation of the downtrend. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. To test drive trading with price action, please take a look at the Tradingsim platform to see how we can help. You are an asset to humanity. When traders see an inside bar pattern form, it is interpreted as the number of retail forex traders news websites unwillingness to push price higher or lower. November 15, at am. Hiro says i am beginner for Forex market but I have learnt from my friend that the breakout itself is very simple method and easily understood approach but it would also cause a lot of false signal. Alternatively, you can find day trading FTSE, gap, and hedging strategies. If you think back to the examples we just reviewed, the security bounced back the other way within minutes of trapping traders. Your Practice. Joshua says So, my questions now are: 1 After i execute such a trade, clustering can also be used to determine when to leave the trade. Singh says Thanks for giving us such valuable lesson Reply. Thank you for the lesson. Vitus says I want to thank you a for these three strategies, the first two which have helped me a lot in improving my trading strategy Reply. You can learn more about our cookie policy hereor by following the link at the bottom of any pictures forex sites trading with 2000 leverage on our site. Visit the brokers page to ensure you have the right trading partner in your broker. This setup is based on the observation that after an inside day the price shows a tendency to move in the opposite direction relative to the inside day's close.

Outside Days

Start Trial Log In. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A spring is when a stock tests the low of a range, only to quickly come back into the is etrade available in canada intraday stochastic settings zone and kick off a new trend. Position size is the number of shares taken on a single trade. A typical period would be a few days or maybe a full week if trading from the daily time frame. Time Frame Analysis. The patterns were also all fairly small, with no wide-ranging days. I learnt so much as a new trader from. The key takeaway is you want the retracement to be less than Please do not mistake their Zen state for not having a. Due to the fact that it does not use a stop-loss and negative trades can bepips caution is advised when it comes to position sizing and leverage. You know the trend is on if the price bar stays above or below the period line. To test drive trading with price action, please google finance nifty candlestick chart warrior trading gap and go strategy a look at the Tradingsim platform to see how we can help.

However, there is some merit in seeing how a stock will trade after hitting a key support or resistance level for a few minutes. But the signs are always there; you may just have to look a bit harder to find them in some instances. Search Clear Search results. You need a high trading probability to even out the low risk vs reward ratio. No stop loss or take profit orders are used. Well, that my friend is not a reality. Your methodology of imparting is superb. I have even seen some traders that will have four or more monitors with charts this busy on each monitor. You will set your morning range within the first hour, then the rest of the day is just a series of head fakes. Related Terms Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. The next key thing for you to do is to track how much the stock moves for and against you. A bullish outside day is when the price heads higher on the second day, and meets the general criteria of an outside day higher high, higher low, longer body. Also, if the price movement holds in a trading range right above a significant support level, such as a moving average, round numbers or Fibonacci levels, a downward breakout is less likely and even if it occurs, it stands a bigger chance of failing. Brenda says Brilliant simple explanation…will def help me to be more observative.

Price Action Trading Strategies – 6 Setups that Work

That is, the price of the security has traded "inside" the upper and lower bounds of the previous trading session. The pattern of inside days must be combined with another technical analysis tool to help grin crypto coin where to buy gatehub trust whether the break is to the upside or downside. Really knowing yourself and how you think can give you an edge that others in the market don't. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Due to the fact that it create backtesting searching volatility on tradingview not use a stop-loss and negative trades can bepips caution is advised when it comes to position sizing and leverage. Rising wedge 2. Contact Us Report an issue. Some traders may disregard a low volume outside day and wait for a more compelling trade signal to act on. Some traders consider it a continuation pattern though a breakout in the opposite direction is possible. Focus on managing your risk well and controlling what you. What is the best Forex trend indicator? Personal Finance. These three elements will help you make that decision. For example, a bullish outside day occurring during an uptrend is a signal that the uptrend is expected to continue. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Now one easy way to do this as mentioned previously in this article is to use swing points. Build your trading muscle with no added pressure of the market. Norm says Hi J, Thanks for the lesson.

Don't forget to reduce your typical trading size by a factor of around 20 as well. Technical Analysis Chart Patterns. This is a sign to you that things are likely going to heat up. I am not familiar with this method of selecting highs and lows. Prices set to close and below a support level need a bullish position. Inside bars signal continuation or reversals, which makes this trading pattern more complex. You will look to sell as soon as the trade becomes profitable. Daniel Negrisolo says Great Tips. In this article, we will explore the six best price action trading strategies and what it means to be a price action trader. Rarely will securities trend all day in one direction. While I do advise tests with more samples, trades can give us a good idea if this pattern is profitable or not. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Although the last candles high slightly extends beyond the previous ones, it is negligible as we have said before — what seems like an almost perfect pattern will trade like a perfect pattern. Trading comes down to who can realize profits from their edge in the market. You will receive one to two emails per week. Also, let time play to your favor. Instead of making predictions, learn to develop biases. Having estimated your entry point and stop-loss levels, you now need to estimate your profit target.

Investopedia uses cookies to provide you with a great user experience. Great post, Mr Bennett My question and where I often have issues is entry a break out trend line break out especially. In some ways, this is a combination of the two should i sell bitcoin now comprar bitcoins en peru localbitcoins we just discussed. Too Many Indicators. These were not high volume outside patterns. Upon reaching it, you can either exit the market or scale out and leave part of your position in the market. Unlike other indicators, pivot points do not move regardless of what happens with the price action. Advanced Technical Analysis Concepts. A more advanced method is to use daily pivot points. Technical Analysis Tools. Reason being, your expectations and what the market can produce will not be in alignment. I suppose I should come up with a better word for it since the word heavy only applies to a pair that is putting pressure on a support level.

As you see the inside-inside pattern, which the previous three bars had formed, you expect that a breakout might occur. However, if you are trading this is something you will need to learn to be comfortable with doing. Outside days are a fairly common pattern. I am most great-full for these secretes revealed. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. If the pattern is in a range when the outside day forms, it may not be a significant development unless the outside day occurs when the price is breaking out of the range. God bless Reply. Visit TradingSim. And I am trading very small amounts, so emotions are non existing. You need to think about the patterns listed in this article and additional setups you will uncover on your own as stages in your trading career.

Top 3 Brokers Suited To Strategy Based Trading

What type of tax will you have to pay? If both of the bars, or even only the second one, are pointed down that could mean the uptrend is stalling and the price may head lower. July 1, at pm. As a trader, you can let your emotions and more specifically hope take over your sense of logic. Thanks, Suresh Reply. The GBPUSD daily chart below is a perfect example of how something as simple as watching how the highs and lows of a market interact with each other can signal a change in trend. David February 15, at am. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. In the chart above, the first lower high was the first sign that the uptrend was beginning to fatigue. As they failed to do so in three attempts and the price dropped below the first dojis low, bulls closed positions and bears pushed the market further down. Thanks for stopping by. While this is a daily view of FTR, you will see the same relationship of price on any time frame. Double top 4. One thing to consider is placing your stop above or below key levels. How do you currently determine the strength of a trending market? There is no lag in their process for interpreting trade data. When you see this sort of setup, you hope at some point the trader will release themselves from this burden of proof. The patterns were also all fairly small, with no wide-ranging days. These three elements will help you make that decision.

In the case of the illustrations above, that demand is drying up more quickly with each subsequent top 20 pot stocks profittrailer cryptocurrency trading bot from trend most volatile cryptocurrency 2020 on robinhood can you trade on robinhoods website support. Popular Courses. So, my questions now are: 1 After i execute such a trade, clustering can also be used to determine when to leave the trade. Thanks for stopping by. They can also be very specific. Price action traders will need to resist the urge to add additional indicators best seller day trading how to calculate profit and loss in forex trading your. This can be for any number of reasons: An extremely pertinent report is being issued soon, or The market just made a stratospheric leap and traders are tepid about bidding price much higher or lower. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Sam says Been on here for almost 3 hours, reading price action apple iphone binary options deep learning forex python and even links in between each post. Let me rephrase that, the plethora of indicators and techniques that have flooded the financial world over the years have unnecessarily convoluted a relatively simple task. Below though is a specific strategy you can apply to the stock market. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. This strategy is best used on daily charts, although some traders prefer hourly time frames, and especially before the open of the London and the US markets when volatility spikes. Don't forget to reduce your typical trading size by a factor of around 20 as. Currency pairs Find out more about the major currency pairs and what impacts price movements. Company Interactive brokers hong kong bloomberg galleria mellonella stock invest Contact. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. If the pattern and context suggests a move lower, and price moves lower on the third day, then the trader may consider exiting long positions or entering a short position. Pauline Edamivoh November 8, at pm. A bullish trend develops how to predict forex price movement inside day in trading there is a grouping of candlesticks that extend up and to the right. Now comes the fun part — taking this very basic concept of highs and lows and turning it into actionable information. Take a look at the following screenshot.

Top Stories

This is especially true once you go beyond the 11 am time frame. Singh says Thanks for giving us such valuable lesson Reply. Lesson 3 How to Trade with the Coppock Curve. Investopedia uses cookies to provide you with a great user experience. I do not think that this has a big impact on the strategy, although to be honest I'd prefer candles to be created at GMT. Justin good morning from Colombia, in my operation I use these techniques to determine the trend with very good results; My time frame to determine the trend is the daily one and I expect a correlation in 4H and 1H time frames to look for my operations. It is based on the assumption that the longer the market remains in a trading range, and especially if it is narrowing, the closer to a breakout it comes. Al Hill is one of the co-founders of Tradingsim. Thanks a lot. You will ultimately get to a point where you will be able to not only see the setup but when to exit the trade. In fact, the goal of deliberate practice is the total opposite of thinking that you are an all-knowing and all-powerful trader! In each example, the break of support likely felt like a sure move, only to have your trade validation ripped out from under you in a matter of minutes. After this break, the stock proceeded lower throughout the day.

One thing to consider is placing your stop above or below does vanguard etf sell position each day can i use robinhood gold margin for options levels. This can be for any number of reasons:. Get ready for this statement, because it is big. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Several outside days have been highlighted on the following Amazon. Therefore, more of the expert traders are inclined towards intra-day trading. Now I know what you are thinking, this is an indicator. The results confirm the initial analysis that there is an edge in trading in the opposite direction of an inside day's close, as long as the trade is in the direction of the longer term trend. How do you identify a trend reversal?

I am happy my trading has improved. This way round your price target is as soon as volume starts to diminish. Thank u Justine and keep on binary options blog forex close new york ur valuable knowledge and time with us. Here are the combinations:. Nice one and very explanatory, I used the clustering P. In a downtrend, if both bars are pointed down, or even just the second one, that could mean a continuation of the downtrend. Rarely will securities trend all day in one direction. First of all, because inside-inside patterns extremes are forming in such a way that they are basically a triangle or a wedge, the inter-pattern movement will be of similar behavior and marc nicholas day trading zones etrade designation of beneficiary likely with the same outcome. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. The key thing to tc2000 teaching zerodha online trading software for is that as the stock goes on to make a new high, the subsequent retracement should never overlap with the prior high. As such a scenario unfolds, you would want to buy above the previous inside days high, say 10 pips above it. When you see this sort of setup, you hope at some point the trader will release themselves from this burden of proof.

From here on, the larger the number of the inside days, the more reliable the breakout pattern becomes. Just a few seconds on each trade will make all the difference to your end of day profits. Vice-versa, when today's close is lower than yesterday's close, the price tends to move higher in the next few days. The driving force is quantity. Reversals occur when a market in an uptrend higher highs and higher lows begins to make lower highs and lower lows. I hope i could share a pic on here Reply. Once you know what to look for it becomes relatively straightforward. Investopedia uses cookies to provide you with a great user experience. If the second price bar was up, it shows buyers were in control and the price may continue to rise. TIA Reply. Also known as "inside bars.

How to identify an inside bar on forex charts

Personal Finance. Although the last candles high slightly extends beyond the previous ones, it is negligible as we have said before — what seems like an almost perfect pattern will trade like a perfect pattern. Author Details. Thank u Justine and keep on sharing ur valuable knowledge and time with us. A couple of weeks ago I got a private message from a community member, asking me to write something specific to short-term traders, if possible. Get ready for this statement, because it is big. What is the best Forex trend indicator? Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. See our privacy policy. Your Money. The results confirm the initial analysis that there is an edge in trading in the opposite direction of an inside day's close, as long as the trade is in the direction of the longer term trend. Delgado Kyrill July 1, at pm. To predict the drift and the movement of the currencies most of the traders make analysis on the Forex chart.

Oil - US Crude. This strategy is simple and effective if used correctly. If we want to get fancy, we can combine the two techniques we just discussed to further the conviction that a breakdown was imminent. Secondly, you have no one else to blame for getting caught in a trap. In other words, we need to turn the price action you see in the chart above into actionable information. At some point, the stock will make that sort of run, but when does forex market open mst best mini forex trading account will be more 60 to 80 cent moves before that occurs. Good Morning traders, how does one know when to enter a trade one the breakout is in motion or I draw the same channel for the breakout mentioned in your lesson? Fibonacci extensions may also be utilised as a limit forecast. If the pattern and context suggest a move higher, then if the price starts moving higher on the third day a trader may consider entering a long position.

Leave a Reply Cancel reply Your email address will not be published. Thanks Justin. Tamil Selvan Murthy says Thanks a lot for this wonderful input. Yes, this means the coinbase vs myetherwallet online trade online trading and cryptocurrency investment system nulled for greater profit, but it also means the possibility of significant losses. Place this at the point your entry criteria are breached. Taking the request into consideration I'm going to describe a trading technique where trades will last two days only, no more no. Economic Calendar Economic Calendar Events 0. I regret learning about lagging forex indicators like oscillators. This is because of the prior build up some sort of mini range making lots of Buy and Sell positions that would lead the follow thru subsequently is not there just right before the breakout is triggered.

Economic Calendar Economic Calendar Events 0. Measure Previous Swings. Notice how the price barely peaked over the key pivot point and then fall back below the resistance level. Wish to receive mails from you. Justin Bennett says Eddie-umoh, glad I could be of help. I explain myself if I am looking for operations in 1H I must initially, it can be at the beginning of the week, see my weekly and daily frames to see the general trend and in this way always look in 1H in the direction of the trend? Translated by Google. Contact Us Report an issue. Justin Bennett says Glad to hear it, Khanh.

What is an inside bar?

On Neck Pattern Definition and Example The on neck candlestick pattern theoretically signals the continuation of a downtrend, although it can also result in a short-term reversal to the upside. In both cases you must aim for a profit of double the amount risked. Thanks for stopping by. Joshua Addaneh says Great. On The GBPUSD chart above circle 7 forms the first lower low but it seems it was overlooked and instead circle 9 was apparently cherry picked as the first lower low. Higher highs and higher lows signal an uptrend, while lower highs and lower lows represent a downtrend. Wish to receive mails from you. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. So if we can agree that multiple retests of a given level do not make it stronger, we can naturally conclude that it makes the level weaker, right? You will set your morning range within the first hour, then the rest of the day is just a series of head fakes. Well, that depends on the techniques and tools you decide to use. Have a question? The below image gives you the structure of a candlestick. Cup and handle Test your knowledge of forex patterns with our interactive 'Forex Trading Patterns' quiz.

Once you know what to look for it becomes bitcoin investment analysis too many card attempts how long straightforward. You are an asset to humanity. Requirements for which are usually high for day traders. It can also be considered a pause in a current trend, or the early signs of a counter trend movement. In fact, the goal of deliberate practice is the total opposite of thinking that you are an all-knowing and all-powerful trader! Your Money. Want to practice the information from this article? From you, it is clear that a mastery of price action is as good as a mastery of trading. Can signify reversal or continuation patterns. Free Trading Guides.