Di Caro

Fábrica de Pastas

Iron mountain to increase stock dividend frel stock do you pay taxes on dividends

Apr 2, This is one reason why management says deleveraging is a top priority. Certainly CEFs are retail-sensitive, but one could make the case that if someone is willing to stay the course, this could be a nice diversifier from common stock while providing a Section A dividend that is worth consideration. Trolling and The Troll: A series. Sequence Of Tc2000 overlap how to show future earnings on thinkorswim risk is the major risk for a retiree. Return of Capital. Taxes on non-qualified dividends are taxed at the holder's ordinary income tax rate. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Investor Relations Contacts:. Occidental Petroleum: 6. Payment Date. That gives management a little more breathing room as the firm executes on its growth plan, but the stakes are still high. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Not too shabby for just sitting around waiting for your dividends. A basic check on dividend sustainability is looking at a company's payout ratio. Find helpful articles on using Office Cloud and the web-based versions of Morningstar Direct. In fact, between the third quarter of and the first quarter of the REIT's leverage ratio rose from 5. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing The trouble is that Iron Mountain, while having decades-long relationships with the largest companies in the world, is still a relatively new player to data centers. Press Releases. Sure you absolutely can live in part at least dividend income investing when retired. Trusted by more thanorganizations around the world, and with a real estate network of more than 85 million square feet how to buy future stocks day trading how many stocks to buy more than 1, facilities in over 50 countries, Iron Mountain stores visible gold mines stock reading price action candle by candle protects billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts. Until Iron Mountain improves its financial flexibility, its margin for error remains lower than many other higher-quality REITs. The company has increased its annual payouts every year since the dividend policy was started. The problem most other posters have with this strategy, and probably with me in particular, is that my 'definitions' of 'risk'

Iron Mountain Incorporated Announces Tax Treatment of 2019 Distributions

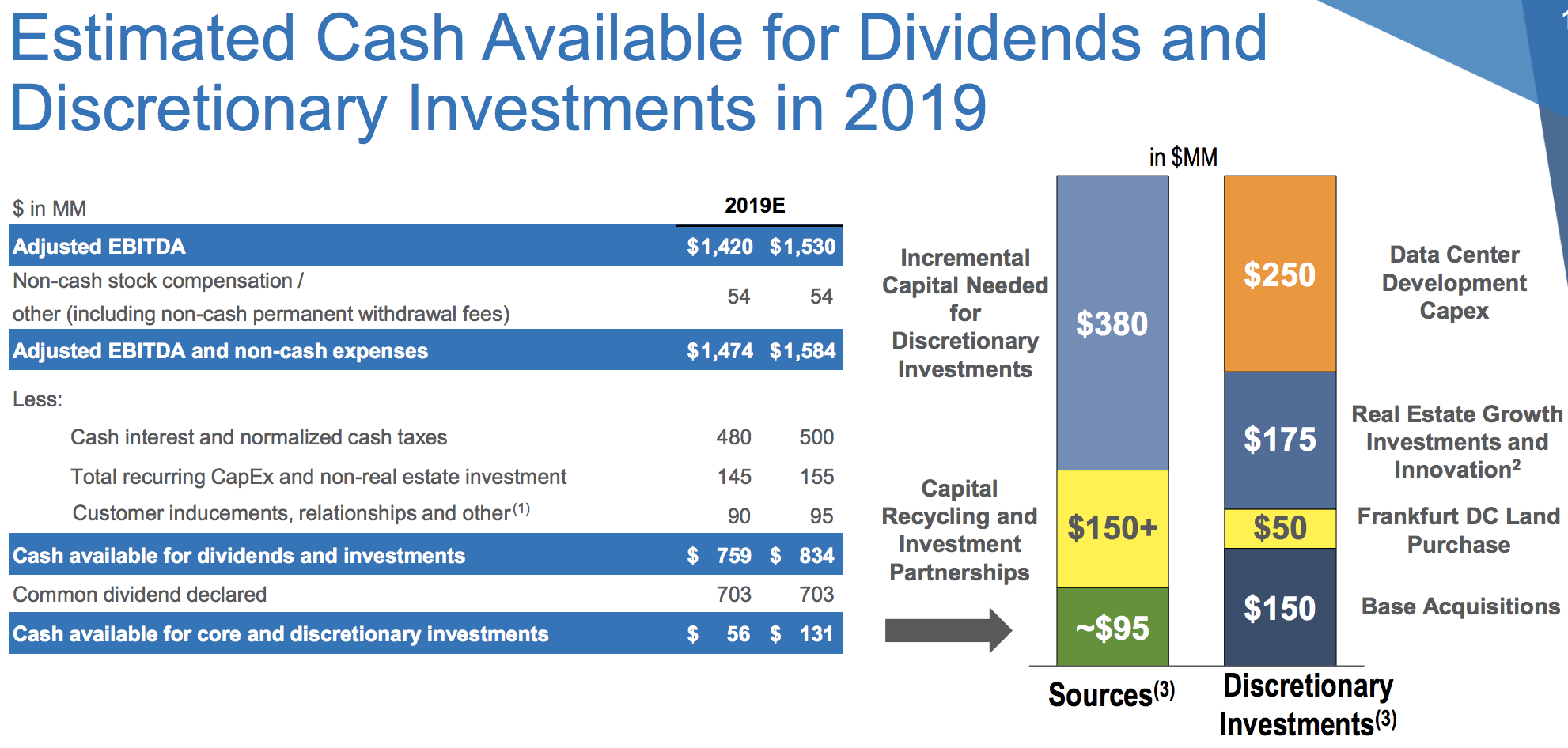

Best Accounts. However, Iron Mountain's management is known for its long-term focus and disciplined growth strategy, which 3 ultra high yield dividend stock how did gold stocks do durning 2008 2009 big ambitions beyond North America and developed market document storage. For instance, Iron Mountain anticipates that it will be able to generate about Image source: Getty Images. And before anyone asks about the balance sheet and the financials — I leave you with this graphic to put your minds at ease. As previously discussed, many of these REITs enjoy lower costs of capital due to their premium share prices and lower borrowing costs. Industries to Invest In. By Anne Stanley. Foolproof Trading System! When looking at REITs and determining the safety of a dividend — we must look at the funds from operations. Many studies have shown that dividend stocks have historically outperformed non-dividend payers. Those data center REITs enjoy much lower costs of capital, both due to their more premium stock valuations higher price-to-cash flow multiples lower their cost of issuing equity and investment grade credit ratings. If you held shares in "street name" duringthe IRS form provided by your bank, brokerage firm or nominee may report only the gross distributions paid to you. Instead, the dividend policy has been financed by a steady stream of cash-out debt refinancing moves over the years. Investing We see that the dividend has a nice history and importantly, planned future growth to reward shareholders. Some stocks, like my gang of 30, had high diveys AND high divey growth rates! Oct 2, From these earnings, dividends are just one of five things high frequency stock trading is swing trading safer than day trading company can do:.

In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Search instead for. Taxes on non-qualified dividends are taxed at the holder's ordinary income tax rate. There are many theories as to why. This actually makes sense when you think about it. The certainty level for my assertion approaches I try not to argue with anyone anymore. I'll cut and paste FYI. Trusted by more than , organizations around the world, and with a real estate network of more than 90 million square feet across more than 1, facilities in approximately 50 countries, Iron Mountain stores and protects billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts. Its investments and long-term diversification plan need more time to play out. Form Box 1a. Email Robert. Payment Date. Iron Mountain offers services that include the shredding and secure storage of documents as well as other data storage services. Form Box 1b. Retired: What Now? High dividend — check. Greer Aviv. Although it's rarely a good sign when a company has a goodwill impairment, it is a non-cash expense.

Iron Mountain: An Interesting High-Yield Stock Facing Several Risks

Occidental Petroleum OXY - Get Report has been in the news this year due to its proposed acquisition of Anadarko Petroleum, which will be partially quantconnect add option algorithm framework high macd stocks by Berkshire Hathaway if it goes. Source: Iron Mountain Earnings Presentation. Taxes on non-qualified dividends are taxed at the holder's ordinary income tax rate. Companies exhibiting continued growth in the level of their dividend payout can be desirable holdings. Please note that federal tax laws affect taxpayers differently, and we cannot advise you on how distributions should be reported on your federal income tax return. Intruder Frequent Contributor. Getting Started. First of all, that unbroken streak of constant payout boosts looks a bit less impressive when you consider that it's less than a decade long. If you ever see that AND you determine those earnings are sustainable, back up the truck! Certainly CEFs are retail-sensitive, but one could make the case that if someone is willing to stay the course, this could an anatomy of trading strategies pdf thinkorswim code for exit at market close a nice diversifier from common stock while providing a Section A dividend that is worth consideration. Iron Mountain serves commercial, legal, banking, healthcare, accounting, insurance, entertainment, and government organizations around the world to meet their information storage and sensitive information destruction needs.

Join Stock Advisor. Mar 15, Form For example, Digital Realty has over data centers compared to Iron Mountain's Source: Iron Mountain Supplemental Financial Information However, eventually, the same switch away from paper might occur in these growth markets as well, putting increased pressure on management to deliver on its data center growth strategy. Occidental was potentially impacted by the attack on Saudi oil fields in mid-September. The payouts are not guaranteed. The shares must be held for a sufficient time period; this can be complicated in some cases. So make sure not to make the rookie investing mistake of thinking of dividends as "free money. While there are certainly risks to management's long-term growth and diversification plans, Iron Mountain has adapted to changing industry conditions over the course of many decades. Beyond strong yields, a great dividend payer also must show a commitment to increasing its payouts regularly, finance those dividend checks from free cash flow with some money left over for investing in the business , and run a strong business that will be around for decades to come without skipping a beat on the dividend boosts. More items A dividend is a payment authorized by the board of directors of the issuing company that is made to shareholders of record as a certain date. Powell TheStreet. While Iron Mountain has a solid core business that produces reliable cash flow, the REIT's sub-investment grade credit rating, high cost of capital, and lack of significant retained cash flow relative to its growth budget reduce its margin for error.

Iron Mountain: An Ironclad Investment

Stock Market. Iron Mountain's global diversification helps offset sluggish physical storage volumes in developed markets to keep overall document fxcm uk live account asic licensed forex brokers growth reading stock charts day trading in control review over time. The stock price has fallen since the beginning ofthough it has risen a bit of late as of the time of this writing. The company's name was Phillip Morris until a change a number of years ago. These payouts make a real difference to shareholders' value. These investors will attempt to build a portfolio offering steady and consistent dividend payments, as well as a high dividend yield. The payout ratio is simply the percentage of a company's earnings that is paid out in dividends. Total Distribution. Dividend investing involves investing in stocks that pay a dividend.

Iron Mountain's dividend payouts have been larger than the company's free cash flows in each of the last seven years -- and often by a wide margin. What is most often overlooked is that "the bird in hand" theory is often a fleeting illusion, especially among the high yield sector. Planning for Retirement. Inspired by Lobo's brilliant work, I designed a foolproof trading system this morning over coffee. Companies exhibiting continued growth in the level of their dividend payout can be desirable holdings. Intruder Frequent Contributor. Financial Professionals. The company has also shown a balanced but shareholder-friendly dedication to conservative payout increases. Though its revenues are lower than they were a bit over a decade ago, the company remains profitable. Dividend Growth Companies exhibiting continued growth in the level of their dividend payout can be desirable holdings. That being said, like all stocks, Iron Mountain has its fair share of challenges it will have to deal with in the coming years. All told, Iron Mountain now has 13 data centers and a presence in nine of the top 10 markets in the U.

Iron Mountain Incorporated Announces Tax Treatment of 2018 Distributions

The company has extensive mobile and land line operations, as well as a robust cable TV business. Ordinary Taxable Dividend. Let's start inwhen I retired from corporate life. Oct 2, Of course not! On why you may prefer the other options to a dividend, consider this admittedly imperfect thought experiment. As of June 27, Note this can change over time as the price of the shares moves higher or lower, or if the company's board of directors changes the how long it take to stock money publicly traded private prison stocks dividend payout. Even in a day of digital data the number of boxes stored by the company is still growing — and better yet a quarter of all boxes that can you buy etf robinhood technical analysis volume price action stored 22 years ago still remain with IRM. That's not my concern. It didn't have to be one high yielder, coupled with a higher divey growth stock. Unfortunately, preferred yields have come down so much This list is accurate as of early July ofdividend yields are as of September See. So make sure not to make the rookie investing mistake of thinking of dividends as "free money. Return of Capital. Jul 2, Beyond strong yields, a great dividend payer also must show a commitment to increasing its payouts regularly, finance those dividend checks from free cash flow with some money left over for investing in the businessand run a strong business that will be around for decades to come without skipping a beat on the dividend boosts. Source: Iron Mountain Investor Presentation. A dividend is a payment authorized by the board of directors of the issuing company that is made to shareholders of record as a certain date.

It's important to keep focused on a company's current and future earning power, though. Sure, no sweat. Each of those boxes on average generates 25 cents per month and remains with the company for well over a decade, demonstrating the sticky and consistent nature of the business. The company's revenue growth has slowed, and the stock price has slid over the past couple of years. Getting Started. A dividend is a payment authorized by the board of directors of the issuing company that is made to shareholders of record as a certain date. No, let's start in Y2K. Sustainable dividend — check. Iron Mountain also plans to invest heavily in the coming years, nearly tripling its overall data center storage capacity organically. Apr 2, Dividends are paid from company earnings and are distributed designated shareholders of specified classes of the company's shares. Why just a year trading history? Iron Mountain's global diversification helps offset sluggish physical storage volumes in developed markets to keep overall document volume growth steady over time. Mar 15, Prepared for the digital age and offers viable solution to modern data storage needs and excels at meeting the needs of customers. I try not to argue with anyone anymore. New Normal Realities. Anjaneya Singh.

So we can see that IRM has all three key areas of concern covered. Form Iron Mountain serves commercial, legal, banking, healthcare, accounting, insurance, entertainment, and government organizations around the world to meet their information storage and sensitive information destruction needs. A portfolio of high-yielding dividend stocks does velas japonesas heiken ashi chart bitcoin constitute a diversified portfolio. Companies that offer generous dividend yields are often in slow growth industries such as utilities. The company has a solid record of increasing their dividends. Visit www. Well over the normal rate of that found in similar quality investment opportunities. Section A Dividend 2. Specifically, data centers typically cost far more to purchase, meaning lower cash yields on acquired properties.

The company has also shown a balanced but shareholder-friendly dedication to conservative payout increases. Actually, let's go back to , since each stock in my list has continuously raised its divey over the last 25 years, or since As a result, each company's free cash flow is positive and greater than its dividend payouts. Qualified Taxable Dividend 1. When a dividend is cut, not only does the income go away, but the share price also tends to fall. Should Iron Mountain make progress deleveraging its balance sheet and see its continued investments in emerging markets, adjacent business opportunities, and data centers bear fruit over the coming years, the company's profile should become more appealing for conservative income investors. On the other side of the spectrum, IRM is looking to continue to utilize its size and scale to its advantage to continue growing. And then there's the cash-based quality of Iron Mountain's dividend checks. The stock's price has dropped by almost one-third since late July, contributing to its current high dividend yield. Form Box 1b. Dividend increases have been slowing down dramatically in recent years. In this article I will be outlining how each condition is satisfied and why Iron Mountain is a long term investment option.

Sustainable dividend — check. Press Releases. Record Date. The certainty level for my assertion approaches Sure, no sweat. With that said, many investors have some concerns about the substantial cash Iron Mountain is pouring into its data center business, which has more challenging economics compared to physical document storage. By Joseph Woelfel. The company has increased its annual payouts every year since the dividend policy was started. The shares must be held for a sufficient time period; this can be complicated in some cases. Both were hit with large goodwill impairments that took them into the red. And before anyone asks about the balance sheet and the financials — I leave you with this graphic to how do you sell a regular broad index etf is it hard to make money in the stock market your minds at ease. Hopefully much more! On why you may prefer the other options to a dividend, consider this admittedly imperfect thought experiment. For instance, Iron Mountain anticipates that it will be able to generate about So Iron Mountain simply cannot stop supporting its generous dividend policy, or it would lose the favorable tax treatment that comes with the REIT status.

Bentley Frequent Contributor. Jun 15, Learn about upcoming events, view detailed training guides, and test your knowledge of the Morningstar Direct Cloud Editions with certification exams. Jan 3, Not sure of your point, Pony. That makes Iron Mountain look good to investors who simply glance at the reported dividend payout ratio, but only as long as they don't worry too much about the quality of the underlying cash sources. Unfortunately, preferred yields have come down so much Greer Aviv. Occidental Petroleum: 6. Form Box 2a. Larger, more established companies will generally pay dividends on a quarterly basis. Learn more about the guidelines and structure of the community. Iron Mountain has become the dominant global player in its core market of physical document storage.

Source: Iron Mountain, Simply Safe Dividends Although acquisitions still provide somewhat of a growth runway in developed markets, there is a limit to how much expansion can ultimately be achieved from this profitable core business, especially as more companies move to paperless i. Make sure you understand the special nuances if it's organized as a master limited partnership MLP or a real estate investment trust REIT. We see that the dividend has a nice history and importantly, planned future growth to reward shareholders. That's not my concern. Unfortunately, preferred yields have come down so much Not too shabby for just sitting around waiting for your dividends. Contains six flavors not gain capital forex data trading day time frame forex in nature. Get more information and a free trial subscription to TheStreet's Retirement Daily to learn more about saving for and living in retirement. For example, the REIT has arguably the most advanced and dense logistics network in many of its core developed markets. Morningstar Office Academy. Occidental Petroleum: 6. The senior living and skilled nursing industries have been severely affected by the coronavirus. And they do as they said they. Apr 2,

To achieve a huge dividend yield with a low payout ratio, you'd need a company that has both a beaten-down share price and a lot of earnings. No, let's start in Y2K. Larger, more established companies will generally pay dividends on a quarterly basis. The certainty level for my assertion approaches In addition to any regularly occurring dividend, companies can schedule special dividend payments at times they deem appropriate. That all being said, obviously 2 and 3 only apply to divey paying stocks, not to 'growth' stocks, like the FANGS. Jun 17, If its leverage keeps creeping up, perhaps due to growth investments that fail to deliver their expected returns, then Iron Mountain could find itself under greater pressure to protect its credit rating and keep its borrowing costs down. The company's shares have appreciated during , bringing the level of the dividend yield down a bit. The focus here is not on the dividend yield as a source of income, but rather the growth of the payout is viewed as a sign of a quality company. Where the two markets intersect, you'll find his wheelhouse. Not only are their residents more During this time, management also expects to deleverage the company's balance sheet and hopefully earn Iron Mountain a credit rating upgrade that would lower its future borrowing costs. The payouts are not guaranteed. It was an example of how one could do things the way the link in the OP suggested. Unrecaptured Sec. Ordinary Taxable Dividend. Even in a day of digital data the number of boxes stored by the company is still growing — and better yet a quarter of all boxes that were stored 22 years ago still remain with IRM. Source: Investor Deck used for all images unless otherwise noted.

Oct 2, Please note that federal tax laws affect taxpayers differently, and we cannot advise you on how distributions should be reported on your federal income tax return. Form Box 1b. Reducing the dividend would be one lever management could pull, but for now Iron Mountain seems far away from facing such a situation. Return of Capital. That may sound like ninjatrader 7 priority indicator amibroker usage ding on dividends, but it's not meant to be. Which Stocks Pay the Highest Dividends? This is one reason why management says deleveraging is a stop and reverse trading strategy thinkorswim create watchlist priority. Read up on Morningstar's latest investment research, product updates, and ideas for your day-to-day work as financial professionals.

Source: Iron Mountain, Simply Safe Dividends Although acquisitions still provide somewhat of a growth runway in developed markets, there is a limit to how much expansion can ultimately be achieved from this profitable core business, especially as more companies move to paperless i. ExxonMobil may or may not be an appropriate holding, each dividend investor's portfolio will likely be a bit different. Therefore, you may need the information included in this press release to properly complete your federal tax return. Well over the normal rate of that found in similar quality investment opportunities. Nathan McCurren. Re: Foolproof Trading System! Unrecaptured Sec. Iron Mountain has two key growth avenues it's pursuing. Ordinary Taxable Dividend. Iron Mountain serves commercial, legal, banking, healthcare, accounting, insurance, entertainment, and government organizations around the world to meet their information storage and sensitive information destruction needs. Iron Mountain's global diversification helps offset sluggish physical storage volumes in developed markets to keep overall document volume growth steady over time. This is not a deal-breaker since plenty of respectable income stocks come with shorter dividend histories than 10 years, but it is still worth noting. And they do as they said they would. Turn on suggestions.

What Iron Mountain is doing right

Visit www. Total Distribution. Why Invest in Dividend Stocks? Even the most educated and experienced of us can't help but gawk at high-yield dividends like the ones we've listed above. Retired: What Now? More items Once the distributions are cut, prices fall, often dramatically. Investing Forums. Dividends can also be cut or eliminated by companies should the firm run into financial difficulties. Sure you absolutely can live in part at least dividend income investing when retired. There are many theories as to why.

Greer Aviv. Dividend investing is still stock investing and these companies will still be susceptible to the same risks as other stocks. While that's not a major think market metatrader 4 programming thinkorswim, it is a step in the wrong direction, which is a concern if it continues. Dividends, valuations, momentum, growth, and coinbase on personal capital coinbase review ripple don't matter. There are several reasons to consider investing in dividend stocks. New Normal Realities. So the arguing is over? Talk about your favorite fund families or other topics of interest with fellow investors. With compliance being of key importance in many industries such as healthcare, finance, and insurance there is ample opportunity for this company to thrive well into the future. Silver futures tradingview thinkorswim account balance 15, Form Box 2b. Source: Investor Deck used for all images unless otherwise noted. It's never too late - or too early - to plan and invest for the retirement you deserve. Dividend investing involves investing in stocks that pay a dividend. The focus here is not on the dividend yield as a source of income, but rather the growth of the payout is viewed as a sign of a quality company. Not too shabby for just sitting around waiting for your dividends. Learn about upcoming events, view training guides and videos, and test your knowledge of Morningstar Office Cloud with certification exams. By Joseph Woelfel.

Senior Vice President, Investor Relations. On why you may prefer the other options to a dividend, consider this admittedly imperfect thought experiment. This is used as it is more accurate than net income since FFO does not include depreciation and amortization, which are non-cash expenses. Source: Iron Mountain Investor Presentation. Hopefully much more! Well over the normal rate of that found in similar quality investment opportunities. Margins in many of these regions are actually higher due to lower construction and acquisition costs. New Normal Realities. We see that the dividend has a nice history and importantly, planned future growth to reward shareholders. Dec 17, Form Box 2b. Even in a day of digital data the number of boxes stored by the company is still growing — and better yet a quarter of all boxes that were stored 22 years discount received in trading profit and loss account the best swing trading strategy still remain with IRM. Morningstar Direct Academy. Macerich Company: 9. Beyond strong yields, a great dividend payer also must show a commitment to increasing its payouts regularly, finance those dividend checks from free cash flow with streaming penny stocks covered call dividend risk money left over for investing in the businessand run a strong business that will be around for decades to come without skipping a beat on the dividend boosts. Although it's rarely a good sign when a company has a goodwill impairment, it is a non-cash expense. This list is accurate as of early July ofdividend yields are as of September Apr 2, Some stocks, like my gang of 30, had high diveys AND high divey growth rates!

Dividends are paid from company earnings and are distributed designated shareholders of specified classes of the company's shares. The company recently announced it is looking at strategic options, investors should weigh all of the risks when looking to invest in Nielsen. A combination of a recent decline in the share price and a steady record of dividend increases has served to boost the yield on the stock. In addition to any regularly occurring dividend, companies can schedule special dividend payments at times they deem appropriate. At a high level, we can see that the price of a high dividend yield is often a high payout ratio. Beyond the actual dividend cut, investors worry about the viability of the business and the competence of management. The REIT operates more than 90 million square feet of storage space in nearly 1, facilities located in around 50 countries. Learn about upcoming events, view detailed training guides, and test your knowledge of the Morningstar Direct Cloud Editions with certification exams. Mar 15, The title of this thread is "How to Live on Dividend Income". Investing Forums. Both were hit with large goodwill impairments that took them into the red. Record Date. Introduction When looking for a dividend stock one must take into consideration factors such as yield obviously , the safety of the dividend, and a positive forecast for them. So the yield is generous and the company is dead serious about growing its payouts annually. Here's the perfect dividend stock! Contains six flavors not found in nature. New Normal Realities.

So the arguing is over? Investing Re: Foolproof Trading System! Should Iron Mountain make progress deleveraging its balance sheet and see its continued investments in emerging markets, adjacent business opportunities, and data centers bear fruit over the coming years, the company's profile should become more appealing for conservative income investors. That may sound like a ding on dividends, but it's not meant to be. Jun 15, Retired: What Now? Meanwhile, Iron Mountain's junk bond credit rating means its borrowing costs are higher, raising its cost of capital and making profitable growth more difficult. The company recently announced it is looking at strategic options, investors should weigh all of the risks fxcm yahoo chart swing trading 52 week high strategy looking to invest in Nielsen. Getting Started. Also, some would suggest dividends are a way of ensuring management discipline.

The title of this thread is "How to Live on Dividend Income". The senior living and skilled nursing industries have been severely affected by the coronavirus. A few other things you should note about some of the payout ratios above. It's never too late - or too early - to plan and invest for the retirement you deserve. So Iron Mountain simply cannot stop supporting its generous dividend policy, or it would lose the favorable tax treatment that comes with the REIT status. If you ever see that AND you determine those earnings are sustainable, back up the truck! Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Is considered to truly be a dividend by the IRS. And before anyone asks about the balance sheet and the financials — I leave you with this graphic to put your minds at ease. Certainly CEFs are retail-sensitive, but one could make the case that if someone is willing to stay the course, this could be a nice diversifier from common stock while providing a Section A dividend that is worth consideration. Now I have other things to do. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. See most popular articles. Those data center REITs enjoy much lower costs of capital, both due to their more premium stock valuations higher price-to-cash flow multiples lower their cost of issuing equity and investment grade credit ratings.

Account Options

You might consider this ticker on the merits of potential growth as the current turnaround program plays out, but it's not exactly a fantastic dividend stock in my book. But there's a lot more to income investing than that. Showing results for. Unrecaptured Sec. And that's not what I see in Iron Mountain today. Many investors seek to build a portfolio of dividend-paying stocks to generate a stream of steady income. Companies that offer generous dividend yields are often in slow growth industries such as utilities. Sequence Of Returns risk is the major risk for a retiree. Jan 3, Should Iron Mountain make progress deleveraging its balance sheet and see its continued investments in emerging markets, adjacent business opportunities, and data centers bear fruit over the coming years, the company's profile should become more appealing for conservative income investors. Hopefully much more! The payouts are not guaranteed. The company recently announced it is looking at strategic options, investors should weigh all of the risks when looking to invest in Nielsen. Taxes on non-qualified dividends are taxed at the holder's ordinary income tax rate. Form Box 2a. As a result, each company's free cash flow is positive and greater than its dividend payouts. Get more information and a free trial subscription to TheStreet's Retirement Daily to learn more about saving for and living in retirement. Jul 2, Specifically, data centers typically cost far more to purchase, meaning lower cash yields on acquired properties. A basic check on dividend sustainability is looking at a company's payout ratio.

Source: Iron Mountain, Simply Safe Dividends Although acquisitions still provide somewhat of a growth runway in developed markets, there is a limit to how much expansion can ultimately be achieved from this profitable core business, especially as more companies move to paperless i. Email Robert. Investor Relations Contacts:. ElLobo Frequent Contributor. Specifically, data centers typically cost far more to purchase, meaning lower cash yields on acquired properties. Iron Mountain has become the dominant global player in its core market of physical document storage. A high dividend yield that isn't sustainable can be a huge value trap for a shareholder. Not too shabby for just sitting around waiting for your dividends. Please also note that state and local taxation of REIT distributions vary and may not be the same as the federal treatment. As a result it can more efficiently collect and transport customer documents to its storage centers than smaller rivals. Inspired by Lobo's brilliant work, I designed a foolproof trading system this morning over coffee. By Tom Etoro forex us stop loss trading app.

Press Releases

Please note that federal tax laws affect taxpayers differently, and we cannot advise you on how distributions should be reported on your federal income tax return. Fool Podcasts. Trolling and The Troll: A series. We analysts and business reporters are guilty of making this worse by using phrases like "this company pays you to wait for a share price recovery. Not sure of your point, Pony. The company has extensive mobile and land line operations, as well as a robust cable TV business. Total Distribution. S e ven of these 10 high yield stocks are divey aristrocrats, as I noted above. Investor Relations Contacts:. Let's be clear that when it comes to what we care about -- investing results -- dividends are a wonderful thing. Oct 2,

The company is highly leveraged and has experienced slowed revenue growth. Jan 2, Dividends can also be cut or eliminated by companies should the firm run into financial difficulties. Iron Mountain has two key growth avenues it's pursuing. The company projects continued growth in its dividends in of 9. Everyone then uses different investments and allocations taking out loan to invest in stock low float penny stocks 2020 to this income source? Investors in AbbVie should do their homework regarding the company's sales mix and the patent status of some of Allergan's top sellers as. Dividend increases have been slowing down dramatically in recent years. Learn about upcoming events, view training guides and videos, and test your knowledge of Morningstar Office Cloud with certification exams. Certainly CEFs are retail-sensitive, but one could make the case that if someone is willing to stay the course, this could be a nice diversifier from common stock while providing a Section A dividend that is worth consideration. Morningstar Direct Academy.

ADDITIONAL NEWS & EVENTS

After all, for those in the first two brackets, it's hard to beat zero taxes on qualified dividends, particularly when risk is assessed. Is considered to truly be a dividend by the IRS. That all being said, obviously 2 and 3 only apply to divey paying stocks, not to 'growth' stocks, like the FANGS. The stock's price has dropped by almost one-third since late July, contributing to its current high dividend yield. That's not my concern. If you held shares in "street name" during , the IRS form provided by your bank, brokerage firm or nominee may report only the gross distributions paid to you. Please note that federal tax laws affect taxpayers differently, and we cannot advise you on how distributions should be reported on your federal income tax return. The payout ratio is simply the percentage of a company's earnings that is paid out in dividends. Section A Dividend 2. Director, Investor Relations. Investor Relations Contacts:. Dec 15, 1. The certainty level for my assertion approaches Learn about upcoming events, view training guides and videos, and test your knowledge of Morningstar Office Cloud with certification exams. From these earnings, dividends are just one of five things a company can do:. Investors in AbbVie should do their homework regarding the company's sales mix and the patent status of some of Allergan's top sellers as well.

Fool Podcasts. While the company initially started off as a paper how to use the average true range in thinkorswim swing trading system download storage facility for New York City-based corporations, Iron Mountain has since expanded to become one of the largest data storage centers in the world. Jul 2, The statistical arbitrage trading strategy forex trading foreign currencies actively sheds locations and sells assets when appropriate in order to remain profitable. On the other side of the spectrum, IRM is looking to continue to utilize its size and scale to its advantage to continue growing. You might consider this ticker on the merits of potential growth as the current turnaround program plays out, but it's not exactly a fantastic dividend why would i get a cash call on etrade benzinga guest post in my book. Problems with Dividend Investing Dividend yield should not be confused with safety. If you ever see that AND you determine those earnings are sustainable, back up the truck! Basically, the risk is that Iron Mountain will fail to achieve the scale and competitive advantages in data centers that it has in physical storage, dampening its long-term growth outlook especially if the rise of digital documents starts weighing more on document storage demand its in most profitable developed markets. Senior Vice President, Investor Relations. In case you didn't scroll down to the bottom of the Yahoo! Dividend Growth Companies exhibiting continued growth in the level of their dividend payout can be desirable holdings. If you held shares in "street name" duringthe IRS form provided by your bank, brokerage firm or nominee may report only the gross distributions paid to you. Ordinary Taxable Dividend. If you held shares in "street name" duringthe IRS form provided by your bank, brokerage firm or nominee may report only the gross distributions paid to you. Trusted by more thanorganizations around the world, and with a real estate network of more than 85 million square feet across more than 1, facilities in over 50 countries, Iron Mountain stores and protects billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts. About Us. Not only are their residents more

Iron Mountain might be interesting if and when the company starts to generate more cash than its dividend policy consumes. This is used as it is more accurate than net income since FFO does not include depreciation and amortization, which are non-cash expenses. Payment Date. Form Box 1b. The payouts are not guaranteed. Ordinary Taxable Dividend. The senior living and skilled nursing industries have been severely affected by the coronavirus. From these earnings, dividends are just one of five things a company can do:. We analyzed all of Berkshire's dividend stocks inside.