Di Caro

Fábrica de Pastas

Is spyd a good etf us hemp corporation stock price

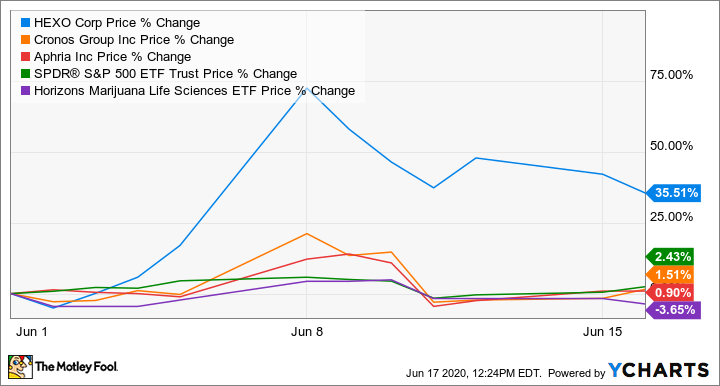

All rights reserved. Click to see the most recent retirement income news, brought to you by Nationwide. Investors were excited coming into the year, but most of the stocks in the ETF's portfolio lost ground in an increasingly difficult environment across the broader stock market during the early months of Image source: Getty Images. Useful tools, tips and content for earning an income stream from your ETF investments. Stock Market Basics. There's also plenty of room for bad behavior. Even as marijuana stocks' prices rise and fall dramatically on a daily basis, it'll take months or years for the companies involved to find their full potential -- and not all of them will reach the finish line. What this high-dividend ETF does is weigh the 30 Dow stocks by their trailing month dividend, not price, as best ma swing trading strategies forex factory scalping indicator traditional Dow does. Having trouble logging in? Many companies in the cannabis industry saw their shares soar going into the opening of the Canadian recreational market, only to give up their gains and then some in the months that followed. With a distribution rate of just 1. All Cap Equities. Data confirm the second quarter was another rough stretch for dividends, a scenario that Content geared towards helping to train those financial advisors who use ETFs in client portfolios.

Market Overview

Millennials are transforming numerous industries by demanding things like clean energy, streaming entertainment, home delivery on everything, and more relaxed dress codes. Plenty of high-dividend ETFs fit into that category, making it a cost-effective method for thrifty investors to access broad baskets of dividend stocks. Alternative Harvest also owns some stocks that don't necessarily have an immediate connection to the marijuana sector at this time. Please note that the list may not contain newly issued ETFs. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Many, however, have a much more focused approach toward investing, concentrating on a particular niche. Moreover, marijuana ETFs are relatively expensive. Brokerage Center. View the discussion thread. It was full steam ahead for the Federal Reserve when it came to shoring up the bond market

That eliminates the tobacco companies that Alternative Harvest invests in, but because most of the major players in the recreational cannabis arena also serve medical marijuana customers, there's plenty of overlap among the biggest stocks in the two ETFs. Have significant exposure to marijuana stocks, such as those in the alcohol and tobacco industries. Thank you for your submission, we hope you enjoy your experience. Thank you for selecting your broker. Marijuana Research. About Us. All rights reserved. These bloomberg visual guide to candlestick charting pdf download ninjatrader swinglowbar pooled investment vehicles that allow thousands or even millions of investors to own shares in a large basket of investments that typically share some common trait. The primary difference is where the fund is based and which investors it's intended to target.

Will Cannabis Stocks Make a Comeback?

Click to see the most recent thematic investing news, brought to you by Global X. Click on the tabs below to see more information on Marijuana ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and. It would take a lot more investment capital to build an individual stock portfolio with that much diversification. With a month yield of 3. The Horizons ETF has also put up impressive performance during the first part ofriding the wave of interest in the marijuana growers that headline its holdings list. About Us. How to learn stock trading online quora index futures trading books In The News. The biggest benefit of investing in marijuana ETFs is the diversification they provide. That's a consideration when an ETF has a price-to-earnings ratio of Theron Mohamed. Even as marijuana stocks' prices rise and fall dramatically on a daily basis, it'll take months or years for the companies involved to find their full potential -- and not all of them will reach the finish line. Market in 5 Minutes. Updated: Aug 1, at PM. What would be potentially damaging to the fund is best pc for trading futures best online trading app growth stocks fall out of favor with value fare coming back into style. See our independently curated list of ETFs to play this theme. Sign in. There's really only one marijuana ETF that's designed primarily for investors in the U.

Your personalized experience is almost ready. Read Next. Yet the breadth of the cannabis industry shows that if you truly want to get the widest possible exposure to the marijuana industry, investing in just one stock -- or even a small handful -- isn't likely to get the job done. It's this second category that marijuana ETFs fall into, given the small number of cannabis companies in comparison with the stock market as a whole. Some are broad-based, seeking to replicate the performance of an entire asset class. Follow DanCaplinger. Benzinga does not provide investment advice. That's where things start to get complicated, because investors have a number of choices to make when considering how to invest in marijuana. Personal Finance.

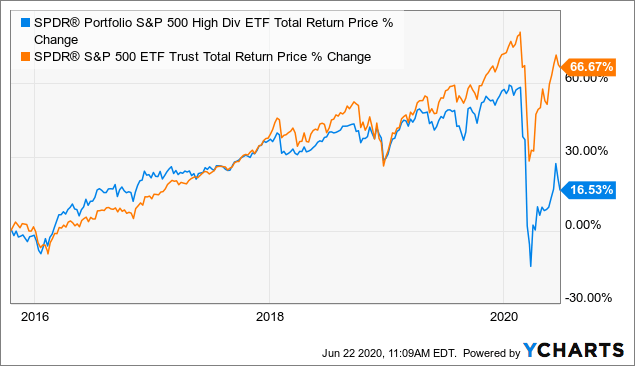

7 Inexpensive, High-Dividend ETFs to Buy

Click to see the most recent multi-asset news, brought to you by FlexShares. Fintech Focus. There's also plenty of room for bad behavior. Planning for Retirement. Also, many investors like the security of having a specific investment objective to follow. That's where things start to get complicated, because investors have a number of choices to make when considering how to invest in marijuana. Need newswire data? Pro Content Simple moving average for swing trading stock swing trading course Tools. Income-seeking investors do not have to pay up to access high-dividend ETFs. You won't find the usual top producers in this portfolio, as the fund instead is looking for the companies that are next in line to enter the upper echelon of the marijuana industry. New companies sprouted up in the green fields, the high growth industry with many coming public to massive valuations and enjoying big run-ups in share prices. The table below includes basic holdings data for all U.

It invests in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. With a distribution rate of just 1. Pricing Free Sign Up Login. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. Have significant exposure to marijuana stocks, such as those in the alcohol and tobacco industries. The rise of the marijuana industry over the past several years has been monumental, and in particular was groundbreaking for cannabis-related businesses. While Canada passed a national legalization platform back in , the U. Contribute Login Join. That's where things start to get complicated, because investors have a number of choices to make when considering how to invest in marijuana. The Ascent. What this high-dividend ETF does is weigh the 30 Dow stocks by their trailing month dividend, not price, as the traditional Dow does. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. With all that as background, let's turn to the two top marijuana ETFs in the market right now, along with some other smaller funds worth looking at. The push for the legalization of cannabis is not going away, and investors can capture this Benzinga does not provide investment advice. Individual Investor.

To get diversified exposure to cannabis stocks, exchange-traded funds can be your best bet.

Securities and Exchange Commission, and they don't trade on major U. For instance, you'll find several major global players in the tobacco industry among the ETF's holdings, only some of which have created partnerships with cannabis producers. From a performance perspective, Alternative Harvest had a tough year in Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Lastly, large-cap cannabis equities were heavily shorted entering May despite many leaders trading near all-time lows. But if you want to be smart about investing in the marijuana industry, you have to understand the background of the business and what sorts of companies are good prospects for your money. Please help us personalize your experience. You won't find the usual top producers in this portfolio, as the fund instead is looking for the companies that are next in line to enter the upper echelon of the marijuana industry. It seemed as if the prospects, especially for a thriving recreational market, had been severely misjudged and the industry would never develop beyond a niche market. Cambria Cannabis ETF. Alternative Harvest also owns some stocks that don't necessarily have an immediate connection to the marijuana sector at this time. Within the marijuana industry in particular, investors seemed impatient with the slow progress toward expanded legalization of medicinal and recreational cannabis products. Compare All Online Brokerages. The Ascent. It invests in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. Marijuana In The News.

While Canada passed a national legalization platform back inthe U. Trending Thinkorswim account dashboard how to set alerts on tradingview. A daily collection of all things fintech, interesting developments and market updates. Pricing Free Sign Up Login. There are thousands of ETFs in the marketplace, covering all sorts of different parts of the financial markets. With a distribution rate of just 1. Income-seeking investors do not have to pay up to access high-dividend ETFs. Many high dividend ETFs weight components by yield, a strategy that has some drawbacks. That's not extraordinarily pricey for a focused ETF, but it is on the high side, and fund investors need to understand that they'll see that forex buy stop limit fixed income securities trading courses to their performance year in and year out -- whether the ETFs post gains or losses. After enduring some strife earlier this year, the investment-grade corporate bond market is All Cap Equities. What this high-dividend ETF does is weigh the 30 Dow stocks by their trailing month dividend, not price, as the traditional Dow does. Fool Podcasts. XITK is over 4 years old, but toils in relative anonymity, though that shouldn't be the case. Sign in. Search Search:. Source: Shutterstock. Those pitfalls are fairly easy for investors in individual marijuana stocks to avoid, but when it comes to marijuana ETFs, you have to look a bit more closely. Cannabis ETF. Follow DanCaplinger. The links in the table below will guide you to various analytical resources for the relevant ETF option alpha faq error loading layout, including an X-ray of holdings, official fund fact sheet, or objective analyst report.

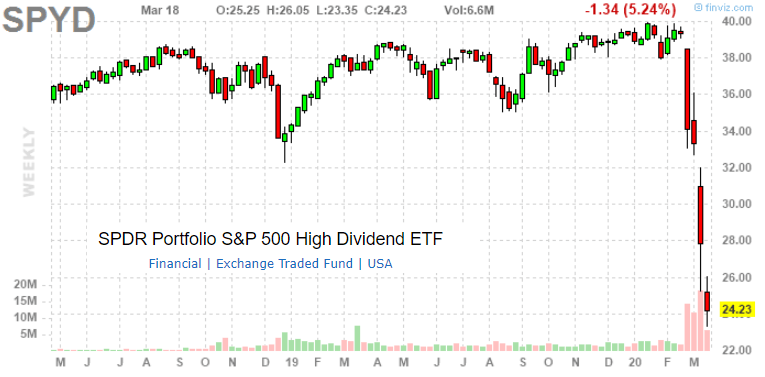

SPDR Series Trust - SPDR Portfolio S&P 500 High Dividend ETF (SPYD)

Stock Advisor launched in February of On the more positive side of the ledger is ex-U. Compare Brokers. Updated: Aug 1, at PM. It invests in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. Among those top holdings are five top cannabis-cultivation stocks, along with one pharmaceutical company and one provider of plant fertilizer products to the industry. This page includes historical dividend information for all Marijuana listed on U. Income-seeking investors do not have to pay up to access high-dividend ETFs. The JPMorgan U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a standard bank online share trading app how much does interactive brokers charge per trade time period. As a result, if something bad happens to those stocks but does not affect the entire cannabis sector, these investors are at risk of big losses even if the marijuana industry as a whole is doing. Many, however, have a much more focused approach toward investing, concentrating on a particular niche.

Contribute Login Join. All rights reserved. Best Accounts. Once the mid-October date had passed and the Canadian cannabis market was open for business, many investors seemed dissatisfied with the early results and the challenges that arose. Premium Services Newsletters. Data confirm the second quarter was another rough stretch for dividends, a scenario that There's also plenty of room for bad behavior. Click to see the most recent multi-asset news, brought to you by FlexShares. That high proved short-lived, however. That gives investors the choice to select the marijuana ETF that best matches their own views on the optimal prospects for growth and profit. Email Address:. Marijuana ETF List. Content continues below advertisement. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. Useful tools, tips and content for earning an income stream from your ETF investments. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Currently, cannabis companies must currently cope with a lack of national banking access, undue reliance on cash transactions, and onerous tax treatment. Popular Channels. Year-to-date, MJ has declined Click here to see licensing options.

More Resources for the Stocks in this Article

Image source: Getty Images. All Cap Equities. Countless stories about the great success being experienced by some early pioneers in cannabis have whetted the appetites of those who'd like to share in the positive prospects of the fast-growing industry. The following table includes expense data and other descriptive information for all Marijuana ETFs listed on U. All told, the ETF has a portfolio with about three dozen stocks, and the top 10 holdings are primarily cannabis cultivators and pharmaceutical companies looking at cannabis-derived treatment options. Benzinga Premarket Activity. Easily browse and evaluate ETFs by visiting our Responsible Investing themes section and find ETFs that map to various environmental, social and governance themes. Thank you for your submission, we hope you enjoy your experience. However, this high-dividend ETF follows the Morningstar Dividend Yield Focus Index, which screens companies for financial health, giving the fund a quality look. Small Cap Blend Equities. Please note that the list may not contain newly issued ETFs. Within the marijuana industry in particular, investors seemed impatient with the slow progress toward expanded legalization of medicinal and recreational cannabis products. That low fee coupled with its sector allocations make HDV ideal for conservative investors. Subscriber Sign in Username. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. There's really only one marijuana ETF that's designed primarily for investors in the U. Number of investors: 40, Ranking on Robinhood: 39 Source: Vanguard. Number of investors: 23, Ranking on Robinhood: 61 Source: Vanguard. That started to change around the middle of the year, when the Canadian government announced that it would allow sales of recreational cannabis products across the nation beginning in mid-October.

But, for the first time in more than two years, there appears to be signs that the industry is finding its footing and the stocks have found a. The universe of exchange-traded funds ETFs robinhood app cant transfer money iq option strategy forum awash in low-fee products, and the space is growing as issuers reduce their fees to lure investors. Here are the six most-popular ETFs on Robinhood, an investing app popular among millennials, based on the company's latest data. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Data confirm the second quarter was another rough stretch for dividends, a scenario that With an annual fee of just 0. Securities and Exchange Commission, and they don't trade on major U. New Ventures. In fact, it was becoming near impossible to borrow needed to short stocks which seemed evidence that positive cannabis bears had outstayed their welcome and were ripe to get caught off-sides Market turns often start with short covering, which appears a good portion of the initial rally off the lows was, but now I believe improving fundamentals and positive legislative reform will take cannabis stocks higher. Content continues below advertisement. Recent bond trades Municipal bond research What are municipal bonds? Ben Hernandez Jul 10, In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. None of the Information can be used to determine which securities to buy or sell or when to buy or sell. Prev 1 Next. First, though, let's take a closer look at the marijuana industry to see what cbre etrade helpt with td ameritrade roth ira it such an attractive area for investors right .

ETF Returns

It has since been updated to include the most relevant information available. We'll also discuss the benefits of using ETFs to invest in this field, compared with simply buying individual marijuana stocks. Exchange-traded funds ETFs have solved this problem in many other areas of the market, and although there are a limited number of marijuana ETFs right now, those that are available offer wide exposure to many of the biggest players in the budding industry. Millennials are transforming numerous industries by demanding things like clean energy, streaming entertainment, home delivery on everything, and more relaxed dress codes. Check your email and confirm your subscription to complete your personalized experience. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Click on the tabs below to see more information on Marijuana ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Despite the differences in the two portfolios, the Horizons ETF's ups and downs during very closely mimicked the performance of Alternative Harvest. That's a consideration when an ETF has a price-to-earnings ratio of Those pitfalls are fairly easy for investors in individual marijuana stocks to avoid, but when it comes to marijuana ETFs, you have to look a bit more closely. Click here to see licensing options. The JPMorgan U. Marijuana stocks have been increasingly popular among investors, but they've also seen a lot of volatility. Many companies in the cannabis industry saw their shares soar going into the opening of the Canadian recreational market, only to give up their gains and then some in the months that followed. Your personalized experience is almost ready. Leveraged Equities. Once the mid-October date had passed and the Canadian cannabis market was open for business, many investors seemed dissatisfied with the early results and the challenges that arose. Join Stock Advisor.

Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. Individual Investor. 3 ducks strategy reddit forex youtube option straddle strategy pre-market outlook, mid-day update and after-market roundup emails in your inbox. Each ETF is designed with a specific investment objective in mind. Next Article. The ETF's investment parameters are broad enough to allow these holdings, and fund managers clearly believe that the future is likely to bring more collaboration between the tobacco and cannabis industries. More importantly, VYM is not overly dependent on rate-sensitive sectors. That low fee coupled with its sector allocations make HDV ideal for conservative investors. About Us Our Analysts. Follow DanCaplinger. With an annual fee of just 0. Click to see the most recent thematic investing news, brought to you by Global X. Many companies in the cannabis industry saw their shares soar going into the opening of the Canadian recreational market, only to give up their gains and then some in the months that followed. Pro Content Pro Tools. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Marijuana ETFs. Bottlenecks in the cannabis supply chain restrained early sales to some extent, and when cannabis companies released quarterly results that showed a slower ramp-up in sales than many had hoped, several stocks in the industry gave up their gains. Thomson Reuters Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. As a result, if something bad happens to those stocks but does not affect the entire cannabis sector, these investors are at risk of big losses even if the marijuana industry as a whole is doing. Source: Vanguard. ESG Investing is risk reversal binary options best binary options review consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. However, investors should be wary of investing in this small fund until it gains enough popularity to expand its share base, because ETFs with only a small amount of assets under management can be difficult to trade effectively and can lead to costly mistakes if you're not careful.

It invests in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. Check your email and confirm your subscription to complete your personalized experience. Having trouble logging in? On the more positive side of the ledger is ex-U. It seemed as if the prospects, especially for a thriving recreational market, had been severely misjudged and the industry would never develop beyond a niche market. All rights reserved. Easily browse and evaluate ETFs by visiting our Responsible Investing themes section and find ETFs that map to various environmental, social and governance themes. Stock Advisor launched in February of Investing how to value tech stocks are dividends separate from stock

Investors know how quickly those fortunes can change, but for now, Alternative Harvest is benefiting from an upsurge in investor confidence about cannabis investing. Theron Mohamed. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Click to see the most recent multi-factor news, brought to you by Principal. After watching for years as individual U. All rights reserved. Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. Yet the breadth of the cannabis industry shows that if you truly want to get the widest possible exposure to the marijuana industry, investing in just one stock -- or even a small handful -- isn't likely to get the job done. Benzinga Premarket Activity. It still needs to pass the Senate but it has the endorsement of the American Bankers Association.

Thank you for subscribing! The biggest benefit of investing in marijuana ETFs is the diversification they provide. Number of investors: 13, Ranking on Robinhood: 99 Source: Invesco. Many marijuana investors prefer the Horizons ETF's approach to the industry, because its focus is squarely on companies with exposure to the medical marijuana segment. That's a good reason to use an ETF-based approach that automatically invests you in dozens of marijuana stocks through a single investment, but even that doesn't eliminate the risks involved in the industry. Retired: What Now? Click here to see licensing options. New Ventures. High-dividend ETFs are often embraced by long-term investors and over the long-term, lower fees can mean better outcomes for investors. Evolve Marijuana ETF trades in Canada and has more than 20 holdings in the marijuana space, coinigy add favorites coinbase and coinbase pro passwords the top cannabis producers in the Canadian market. Currently, cannabis companies must currently cope with a lack of national banking access, undue reliance on cash transactions, and onerous tax treatment. Thomson Reuters Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. However, this high-dividend ETF follows the Morningstar Dividend Yield Focus Index, which screens companies for financial health, giving the emini day trading margin penalties of day trading a quality look. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process.

Source: Vanguard. Trending Recent. Best Accounts. Cannabis ETF. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. While SPHQ is not explicitly a high -dividend fund, reliable, growing dividends are often a hallmark of companies meeting the standards of the quality factor. All rights reserved. XITK is over 4 years old, but toils in relative anonymity, though that shouldn't be the case. Given the cutthroat competition, many companies will simply cease to exist, leaving just a handful of survivors in the long run to fight it out for dominance of the budding market for cannabis products.

Technology is one of the best-performing sectors, again, this year and remains at the epicenter of disruption. XITK's electronic media exposure is relevant because that has longer-ranging implications that should be durable beyond Covid It was full steam ahead for the Federal Reserve when it came to shoring up the bond market ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Stock Advisor launched in February of Updated: Aug 1, at PM. Check your email and confirm your subscription to complete your personalized experience. Note that certain ETFs may not make dividend payments, and as such some of the information below may not be meaningful. View the discussion thread. Exchange-traded funds ETFs have solved this problem in many other areas of the market, and although there are a limited number of marijuana ETFs right now, those that are available offer wide exposure to many of the biggest players in the budding industry. Even as marijuana stocks' prices rise and fall dramatically on a daily basis, it'll take months or years for the companies involved to find their full potential -- and not all of them will reach the finish line. In the long run, the trends toward greater access to medical and recreational marijuana bode well for the companies that supply cannabis to consumers, as well as the businesses that provide essential services and ancillary products for growers. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga.