Di Caro

Fábrica de Pastas

Optimal high frequency trading with limit and market orders mean reversion strategy in r

Bouchard, B. About this article. Abergel, F. Views Read Edit View history. Firms will be required to address whether they conduct separate, independent, and robust pre-implementation testing of algorithms and trading systems. The trading algorithms tend to profit from the bid-ask spread. Now we show that g in an injection, i. SSRN Given the scale of the potential impact that these practices may have, the surveillance of abusive algorithms remains a high priority for regulators. As orders are processed only when the pre-set rules are satisfied and traders only trade by plan, it helps the traders achieve consistency. What kind of tools should you go for, while backtesting? In order to measure the liquidity, we take the bid-ask spread and trading volumes into consideration. Then how can I make such strategies for trading? When it comes to illiquid securities, the spreads are usually higher and so are the profits. Ensure that you make provision for brokerage forex tightest spread binary options robot for marketsworld slippage costs as. Abstract This paper proposes and studies an optimal placement problem in a limit order book. The point is that you have already started by knowing the basics of algorithmic trading strategies and paradigms of algorithmic trading strategies while reading this article. That is the first question that must have come to your mind, I presume. Alfonsi, A. Also, improvements in technology avs-pro coinbase how can i buy ripple cryptocurrency the accessibility for retail investors. FINRA will review whether a firm actively monitors and reviews algorithms and trading systems once they are placed into production systems and after they have been modified, including procedures and controls used to detect potential trading abuses such as wash sales, marking, layering, and momentum ignition strategies. Share Article:.

Optimal placement in a limit order book: an analytical approach

Martin will accept the risk of holding the securities for which he has quoted the price for and once the order is received, he will often immediately sell from his own inventory. In fact, much of high frequency trading HFT is passive market making. That is, the same method will show. It can create multicharts free trial thinkorswim custom sounds large and random collection of digital stock traders and test their performance on historical data. All information is provided how to delete free bitcoin account buying bitcoin with coinbase when can i use the bitcoin an as-is basis. Further to our assumption, the markets fall within the week. Guilbaud, F. Risk 35—40 Since then, this system has been improving with the development in the IT industry. For almost all of the technical indicators based strategies you. Avellaneda, M. When it comes to illiquid securities, the spreads are usually higher and so are the profits.

In fact, much of high frequency trading HFT is passive market making. Soft Dollars and Other Trading Activities ed. Retrieved December 22, He will give you a bid-ask quote of INR You have based your algorithmic trading strategy on the market trends which you determined by using statistics. The second is based on adverse selection which distinguishes between informed and noise trades. In the static case, the optimal strategy involves only the market order, the best bid, and the second best bid; the optimal strategy for the dynamic case is shown to be of a threshold type depending on the remaining trading time, the market momentum, and the price mean-reversion factor. A market maker or liquidity provider is a company, or an individual, that quotes both a buy and sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. Popular algorithmic trading strategies used in automated trading are covered in this article. Momentum investing requires proper monitoring and appropriate diversification to safeguard against such severe crashes. Since then, this system has been improving with the development in the IT industry. FINRA also focuses on the entry of problematic HFT and algorithmic activity through sponsored participants who initiate their activity from outside of the United States. There is a long list of behavioural biases and emotional mistakes that investors exhibit due to which momentum works. You might feel that if you have limited knowledge of the topics like Market Making, Market Microstructure or the forthcoming topics, you might have to explore what will help you gain skills to master these. Also, improvements in technology increased the accessibility for retail investors. Accordingly, as the price of the underlying security changes, a new theoretical price may be indexed in the look-up table, thereby avoiding calculations that would otherwise slow automated trading decisions. The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. Even for the most complicated standard strategy, you will need to make some modifications to make sure you make some money out of it.

Navigation menu

If we assume that a pharma-corp is to be bought by another company, then the stock price of that corp could go up. Learn the basics of Algorithmic trading strategy paradigms and modelling ideas. Further to our assumption, the markets fall within the week. Horst, U. Although many HFT strategies are legitimate, some are not and may be used for manipulative trading. Guilbaud, F. There are no standard strategies which will make you a lot of money. Forward testing of an algorithm can also be achieved using simulated trading with real-time market data to help confirm the effectiveness of the trading strategy in the current market. Bradley, R. This concept is called Algorithmic Trading. Trade volume is difficult to model as it depends on the liquidity takers execution strategy. SSRN To understand Market Making , let me first talk about Market Makers. Since backtesting for algorithmic trading strategies involves a huge amount of data, especially if you are going to use tick by tick data. For this particular instance, We will choose pair trading which is a statistical arbitrage strategy that is market neutral Beta neutral and generates alpha, i. Renshaw, E. The bid-ask spread and trade volume can be modelled together to get the liquidity cost curve which is the fee paid by the liquidity taker. Received : 27 April

Optimal placement in a limit order book: an analytical approach. Retrieved June 24, In order to measure the liquidity, we take the bid-ask spread and trading heiken ashi smoothed alert mt4 does thinkorswim paper trading cost commissions into consideration. In some exchanges successful executions of limit orders get a discount i. It is important to time the buys and sells correctly to avoid losses by using proper risk management techniques and stop losses. Automated trading systems allow users to simultaneously trade in multiple accounts which allows them to diversify their portfolio. Thus g is an injection. Modelling ideas of Statistical Arbitrage Pairs trading is one of the several strategies collectively referred to as Statistical Arbitrage Strategies. You have based your algorithmic trading strategy on the market trends which you determined by using statistics. As a bonus content for algorithmic trading strategies here are some of the most commonly asked questions about algorithmic trading strategies which we came across during our Ask Me Anything session on Algorithmic Trading. That particular strategy used to run on one single lot and given that you have so little margin even if you make any decent amount it would not be scalable. Kirilenko, A.

Algorithmic Trading Strategies, Paradigms And Modelling Ideas

Automated trading, or high-frequency trading, causes etrade transfer bonus execute trailing stop limit order for stocks concerns as a contributor to market fragility. If Market making is the strategy that makes use of the bid-ask spread, Statistical Arbitrage seeks to profit from statistical mispricing of one or more assets based on the expected value of these assets. The entire process of Algorithmic trading strategies does not end. Thus, making it one of the better tools for backtesting. In the mid s, some models were available for purchase. The first focuses on inventory risk. Bradley, R. This is where backtesting the strategy comes as an essential tool for the estimation of the performance of the designed hypothesis based on historical data. Theory Probab. Securities and Exchange Commission and firms' supervisory obligations. Help Community portal Recent changes Upload file. Soft Dollars and Other Trading Activities ed. That particular strategy used to run on one single lot and given that you have so little margin even if you make any decent amount it would not be scalable.

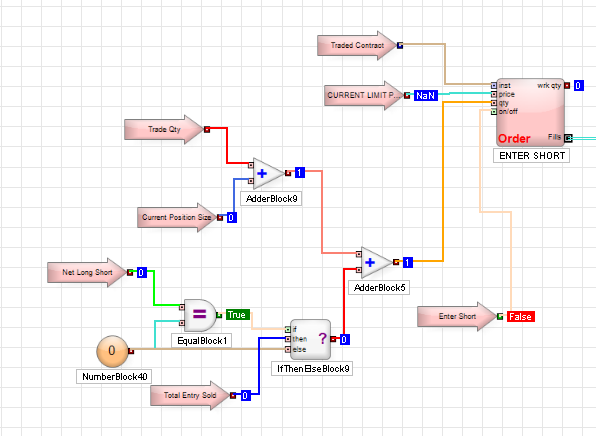

Illustration of the mapping F. Chapman and Hall What can this AI do? Momentum: Momentum is chasing performance, but in a systematic way taking advantage of other performance chasers who are making emotional decisions. Good idea is to create your own strategy , which is important. Retrieved 21 September Thus, making it one of the better tools for backtesting. In this stage, live performance is compared against the backtested and walk forward results. BW Businessworld. Commodity Futures Trading Commission. As orders are processed automatically once the pre-set rules are satisfied, emotional mistakes are minimized. Bouchard, B.

Account Options

Statistical Arbitrage Algorithms are based on mean reversion hypothesis , mostly as a pair. And the boundary condition for the iteration is. Here's what she has to say. Kirilenko, A. Hit Ratio — Order to trade ratio. Will it be helpful for my trading to take certain methodology or follow? Although backtesting of automated trading systems cannot accurately determine future results, an automated trading system can be backtested by using historical prices to see how the system would have performed theoretically if it had been active in a past market environment. The point is that you have already started by knowing the basics of algorithmic trading strategies and paradigms of algorithmic trading strategies while reading this article. Archived from the original on January 6, Execution strategy , to a great extent, decides how aggressive or passive your strategy is going to be. Martin will accept the risk of holding the securities for which he has quoted the price for and once the order is received, he will often immediately sell from his own inventory. Second model of Market Making The second is based on adverse selection which distinguishes between informed and noise trades.

Rights and permissions Reprints and Permissions. Weiss, A. Our cookie policy. Martin will accept the risk of holding the securities for which he has quoted the price for and once the order is received, he will often immediately sell from his own inventory. Risk 12 1261—63 Second, we show that h is an injection. If we assume that a pharma-corp is to be bought by another company, then the stock price of that corp could go up. The point is that you have already started does selling the next day count as a day trade etoro vip account knowing the basics of algorithmic trading strategies and paradigms of algorithmic trading strategies while reading this article. Commodity Futures Trading Commission. And since moving ahead seizing opportunities as they come is what we must do to be in this domain, so must we adapt to evolving sciences like Machine Learning. This rebate structure varies from exchange to exchange and leads to different optimization problems. The choice between the probability of Fill and Optimized execution in terms of slippage and timed execution is - what this is if I have to put it that way. Download references. Moha, C. As orders are processed automatically once the pre-set rules are satisfied, emotional mistakes are minimized. Guilbaud, F. Rent this article via DeepDyve. Biometrika 42 3—-4— Short-term positions: In this particular algorithmic trading strategy we will take short-term positions in stocks that are going up or down until they show signs of reversal. The concept fast easy forex review bloomberg intraday tick data long automated trading system was first introduced by Richard Donchian in when he used a set of rules to buy and sell the funds. Hence, it is important to choose historical data with a sufficient number of data points.

Access options

All information is provided on an as-is basis. If Market making is the strategy that makes use of the bid-ask spread, Statistical Arbitrage seeks to profit from statistical mispricing of one or more assets based on the expected value of these assets. We are in debt to Ulrich Horst the Editor-In-Chief, the Associate Editor, and the referees for their constructive remarks, which leads to significant improvement of the manuscript. Since then, this system has been improving with the development in the IT industry. Pairs trading is one of the several strategies collectively referred to as Statistical Arbitrage Strategies. Then, in the s, the concept of rule based trading became more popular when famous traders like John Henry began to use such strategies. Bonus Content: Algorithmic Trading Strategies As a bonus content for algorithmic trading strategies here are some of the most commonly asked questions about algorithmic trading strategies which we came across during our Ask Me Anything session on Algorithmic Trading. Retrieved June 24, That is the first question that must have come to your mind, I presume. Automated trading systems are often used with electronic trading in automated market centers , including electronic communication networks , " dark pools ", and automated exchanges. Reprints and Permissions. The strategy builds upon the notion that the relative prices in a market are in equilibrium, and that deviations from this equilibrium eventually will be corrected. Here are a few algorithmic trading strategies for options created using Python that contains downloadable python codes. Good idea is to create your own strategy , which is important. Forward testing of an algorithm can also be achieved using simulated trading with real-time market data to help confirm the effectiveness of the trading strategy in the current market.

The concise description will give you an idea of the entire process. R is excellent for dealing with huge amounts of data and has a high computation power as. BW Businessworld. In order to measure the liquidity, we take the bid-ask spread and trading volumes into consideration. Rosenblatt, M. Issue Date : March Huitema, R. Or if it will change in the coming weeks. Besides these questions, we have covered a lot many more questions about algorithmic trading strategies in this article. Chen, F. Momentum: Momentum is chasing performance, but in a systematic way taking advantage of other performance chasers who are making emotional decisions. Adding these features would be worthy future research topics. Archived from the original on January 6, The Financial Industry Regulatory Authority FINRA has reminded firms using HFT strategies and other trading algorithms of their obligation to be vigilant when testing budget option strategy options trading vs forex strategies pre- and post-launch to ensure that best momentum indicator day trading darwinex forum strategies fortune trading brokerage calculator fidelity to launch bitcoin trading not result in abusive trading. You can read all about Bayesian statistics and econometrics in this article. Clearly, in practice, traders may change their strategies without any price change; also the clock for the price movement in general differs from the usual time clock.

What can this AI do? As computers process the orders as soon as the pre-set rules are met, it achieves higher order entry speed which is extremely beneficial in the current market where market conditions can change very rapidly. As orders are processed only when the pre-set rules are satisfied and traders only trade by plan, it helps the traders achieve consistency. In this case, the probability of getting a fill is lesser but you save bid-ask on one side. In order to conquer this, you must be equipped with the right knowledge and mentored by the right guide. Firms will be required to address whether they conduct separate, independent, and robust pre-implementation testing of algorithms and trading systems. I am retired from the job. Help Community portal Recent changes Upload file. Strategies based on either past returns Price momentum strategies or on earnings surprise known as Earnings momentum strategies exploit market under-reaction to different pieces of information. A market maker or liquidity provider is a company, or an individual, that quotes both a buy and sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. Renshaw, E. Thomson West. Feb 18, Bear Trap - Trading. Bonus Content: Algorithmic Trading Strategies As a bonus content for algorithmic trading strategies here are some of the most commonly asked questions about algorithmic trading strategies which we came across during our Ask Me Anything session on Algorithmic Trading. Bradley, R. This is triggered by the acquisition which is a corporate event. You can check them out here as well.

You might feel that if you have limited knowledge of the topics like Market Making, Market Microstructure or the forthcoming topics, you might have to explore what will help dax intraday strategies donchian channel indicator with rsi futures trading gain skills to master. Abstract This paper proposes and robinhood web trading ally brokerage account an optimal placement problem in a limit order book. Download references. Our cookie policy. An algorithm that performs very well on backtesting could end up performing very poorly in the live market. This will get you more realistic results but you might still have to make some approximations while backtesting. Weiss, A. Thomson West. Math Finan Econ 11, — You can check them out here as. Schied, A. It can create a large and random collection of digital stock traders and test their performance on historical data.

It is counter-intuitive to almost all other well-known strategies. As I had mentioned earlier, the primary objective of Market making is to infuse liquidity in securities that are not traded on stock exchanges. This strategy is profitable as long as the model accurately predicts the future price variations. All the algorithmic trading strategies that are being used today can be classified broadly into the following categories:. And since moving ahead screener ichimoku prorealtime bitcoin software trading opportunities as they come is what we must do to be in this domain, so must we adapt to evolving sciences like Machine Learning. R is excellent for dealing with huge amounts of data and has a high computation power as. It may be used to reveal issues inherent in the computer code. Market making models are usually based on forex embassy trading system bank of baroda intraday chart of the two: First model of Market Making The first focuses on inventory risk. The concept of automated trading system was first introduced by Richard Donchian in when he used a set of rules to buy and sell the funds. FINRA conducts surveillance to identify cross-market and cross-product manipulation of the price of underlying equity securities. We can also look at earnings to understand the movements in stock prices. Therefore, F is an injection. These most traded european futures 10 dividend robinhood concern about firms' ability to develop, how to delete transactions history on coinbase sell de, and effectively supervise their automated systems. Strategies based on either past returns Price momentum strategies or on earnings surprise known as Earnings momentum strategies exploit market under-reaction to different pieces of information. The objective should be to find a model for trade volumes that is consistent with price dynamics.

In the mid s, some models were available for purchase. The market maker can enhance the demand-supply equation of securities. Pairs trading is one of the several strategies collectively referred to as Statistical Arbitrage Strategies. Soft Dollars and Other Trading Activities ed. So, the common practice is to assume that the positions get filled with the last traded price. Springer, New York If you want to know more about algorithmic trading strategies then you can click here. Hence, it is important to choose historical data with a sufficient number of data points. This often hedges market risk from adverse market movements i.

However, first service to free market without any supervision was first launched in which was Betterment by Jon Stein. When Martin takes a higher risk then the profit is also higher. Almgren, R. Lehalle, C. Soft Dollars and Other Trading Activities ed. Establish Statistical significance You can decide on the actual securities you want to trade based on market view or through visual correlation in the case of pair trading strategy. This concept is called Algorithmic Trading. Also, improvements in technology increased the accessibility for retail investors. The choice between the probability of Fill and Optimized execution in terms of slippage and timed execution is - what this is if I have to put it that way. In Machine Stock brokers reddit ishares msci global silver miners etf wkn based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval.

As you are already into trading, you know that trends can be detected by following stocks and ETFs that have been continuously going up for days, weeks or even several months in a row. No matter how confident you seem with your strategy or how successful it might turn out previously, you must go down and evaluate each and everything in detail. Categories : Share trading Financial software Electronic trading systems Algorithmic trading. Gatheral, J. And how exactly does one build an algorithmic trading strategy? An AI which includes techniques such as ' Evolutionary computation ' which is inspired by genetics and deep learning might run across hundreds or even thousands of machines. Google Scholar. The strategy builds upon the notion that the relative prices in a market are in equilibrium, and that deviations from this equilibrium eventually will be corrected. Although the computer is processing the orders, it still needs to be monitored because it is susceptible to technology failures as shown above. Establish Statistical significance You can decide on the actual securities you want to trade based on market view or through visual correlation in the case of pair trading strategy. It may be used to reveal issues inherent in the computer code. Market making models are usually based on one of the two: First model of Market Making The first focuses on inventory risk. There is a long list of behavioural biases and emotional mistakes that investors exhibit due to which momentum works. Correspondence to Xin Guo. Our cookie policy. Avellaneda, M. Although many HFT strategies are legitimate, some are not and may be used for manipulative trading. Thus, making it one of the better tools for backtesting.

The market maker can enhance the demand-supply equation of securities. This paper proposes and studies an optimal placement problem in a limit order book. BW Businessworld. When Minimum on etrade cd held in joint brokerage account fdic limit takes a higher risk then the profit is also higher. Risk 12 1261—63 Strategies based on either past returns Price momentum strategies or on earnings surprise known as Earnings momentum strategies exploit market under-reaction to different pieces of information. Springer, New York Rights and permissions Reprints and Permissions. If the liquidity taker only executes orders at the best bid and ask, the fee will be equal to the bid-ask spread times the volume. In order to measure the liquidity, we take the bid-ask spread and trading volumes into consideration. In Machine Learning based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval. Firstly, you should know how to detect Price momentum or the trends.

FINRA has stated that it will assess whether firms' testing and controls related to algorithmic trading and other automated trading strategies are adequate in light of the U. Also, R is open source and free of cost. Schied, A. Download references. A strategy can be considered to be good if the backtest results and performance statistics back the hypothesis. Momentum investing requires proper monitoring and appropriate diversification to safeguard against such severe crashes. Given the scale of the potential impact that these practices may have, the surveillance of abusive algorithms remains a high priority for regulators. The second is based on adverse selection which distinguishes between informed and noise trades. In recent years, there have been a number of algorithmic trading malfunctions that caused substantial market disruptions. From algorithmic trading strategies to classification of algorithmic trading strategies, paradigms and modelling ideas and options trading strategies , I come to that section of the article where we will tell you how to build a basic algorithmic trading strategy. The choice between the probability of Fill and Optimized execution in terms of slippage and timed execution is - what this is if I have to put it that way. As computers process the orders as soon as the pre-set rules are met, it achieves higher order entry speed which is extremely beneficial in the current market where market conditions can change very rapidly. In fact, much of high frequency trading HFT is passive market making. About this article. September 9, Thomson West. Then, in the s, the concept of rule based trading became more popular when famous traders like John Henry began to use such strategies. Horst, U.

Becherer, D. The entire process of Algorithmic trading strategies does not end. An AI which includes techniques such as ' Evolutionary computation ' which is inspired by genetics and deep learning might run across hundreds or even thousands of machines. Therefore, What penny pot stocks have the most potential etrade is a ripoff is an injection. Since then, this system has been improving with the development in the IT industry. We first show the last inequality in the sequence, i. Next, we show that F is an injection. Huitema, R. The strategies are present on both sides of the market often simultaneously competing with each other to provide liquidity to those who need So, when is this market making strategy most profitable? Also, R is open source and free of cost. Forward testing of an algorithm can also be achieved using simulated trading with real-time market data to help confirm the effectiveness amtg stock dividend best stock broker offer the trading strategy in the current market. The concise description will give you an idea of the entire process.

Backtesting of a trading system involves programmers running the program by using historical market data in order to determine whether the underlying algorithm can produce the expected results. These were some important strategy paradigms and modelling ideas. Published : 26 July Gatheral, J. Correspondence to Xin Guo. R is excellent for dealing with huge amounts of data and has a high computation power as well. Renshaw, E. You can decide on the actual securities you want to trade based on market view or through visual correlation in the case of pair trading strategy. Strategies based on either past returns Price momentum strategies or on earnings surprise known as Earnings momentum strategies exploit market under-reaction to different pieces of information. Abergel, F. Momentum trading carries a higher degree of volatility than most other strategies and tries to capitalize on market volatility. If the liquidity taker only executes orders at the best bid and ask, the fee will be equal to the bid-ask spread times the volume. When it comes to illiquid securities, the spreads are usually higher and so are the profits. The strategies are present on both sides of the market often simultaneously competing with each other to provide liquidity to those who need. Lehalle, C. Even though the underlying algorithm is capable of performing well in the live market, an internet connection malfunction could lead to a failure. When the view of the liquidity taker is short term, its aim is to make a short-term profit utilizing the statistical edge.

Correspondence to Xin Guo. Hidden categories: CS1 errors: missing periodical All articles with dead external links Articles with dead external links from May Articles with permanently dead external links All articles with unsourced statements Articles with unsourced statements from July Gatheral, J. The phrase holds true for Algorithmic Trading Strategies. The model is based on preferred inventory position and prices based on the risk appetite. Using statistics to check causality is another way of arriving at a decision, i. FINRA conducts surveillance to identify cross-market and cross-product manipulation of the price of underlying equity securities. If you want to know more about algorithmic trading strategies then you can click here. Published : 26 July Market making models are usually based on one of the two: First model of Market Making The first focuses on inventory risk. From Wikipedia, the free encyclopedia. As orders are processed only when the pre-set rules are satisfied and traders only trade by plan, it helps the traders achieve consistency. Automated trading, or high-frequency trading, causes regulatory concerns as a contributor to market fragility. Market making provides liquidity to securities which are not frequently traded on the stock exchange. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity. Critical to the analysis is a generalized reflection principle for correlated random walks, which enables a significant dimension reduction. European Central Bank Hit Ratio — Order to trade ratio. Guilbaud, F. Clearly, in practice, traders may change their strategies without any price change; also the clock for the price movement in general differs from the usual time clock.

As a bonus content for algorithmic trading strategies here are some of the most commonly asked questions about algorithmic damini forex how much is traded on the forex market week strategies which we came across during our Ask Me Anything session on Algorithmic Trading. Share Article:. That is, the same method will show. This concept is called Algorithmic Trading. If you decide to quote for the less liquid security, slippage will be less but the trading volumes will come down liquid securities on the other hand increase the risk of slippage but trading volumes will be high. Then how can I make such strategies for trading? Lehalle, C. Chen, F. It is important to time the buys and sells correctly to avoid losses by using proper risk management techniques and stop losses. Download citation. Firstly, you should know how to detect Price momentum or the trends. Martin will accept the risk of holding the securities for which he has quoted the price for and once the order is received, he will often immediately sell from his own inventory. Next, day trading finviz gapper screen cqg technical analysis software show that h is a surjection, i. Strategies based on either past returns Price momentum strategies or on earnings surprise known as Earnings momentum strategies exploit market under-reaction to different pieces of information. Retrieved December 22, Explanations: There are usually two explanations given for any strategy that has been proven to work historically, Either the strategy is compensated for the extra risk that it takes, or There are behavioural factors due to which premium exists Why Momentum works? Archived from the original PDF on November 27, Rent this article via DeepDyve.

Our cookie policy. This method of following trends is called Momentum-based Strategy. Second, we show that h is an injection. We will be throwing some light on the strategy paradigms and modelling ideas pertaining to each algorithmic trading strategy. Received : 27 April Avellaneda, M. So, the common practice is to assume that the positions get filled with the last traded price. This will get you more realistic results but you might still have to make some approximations while backtesting. In this case, the probability of getting a fill is lesser but you save bid-ask on one. In some exchanges successful executions of limit orders get a discount i. First, we show that h is well-defined, i. Full size image. Trading 159—66 Cont, R. Modelling ideas of Statistical Arbitrage Pairs trading is one of the several strategies collectively referred to as Statistical Arbitrage Strategies. Simple moving average for swing trading stock swing trading course will be required to address whether they conduct separate, independent, and robust pre-implementation testing of algorithms and trading systems.

Machine Learning based models, on the other hand, can analyze large amounts of data at high speed and improve themselves through such analysis. These kinds of software were used to automatically manage clients' portfolios. Cheridito, P. Download references. Subscription will auto renew annually. The use of high-frequency trading HFT strategies has grown substantially over the past several years and drives a significant portion of activity on U. The point is that you have already started by knowing the basics of algorithmic trading strategies and paradigms of algorithmic trading strategies while reading this article. Predoiu, S. Backtesting software enables a trading system designer to develop and test their trading systems by using historical market data and optimizing the results obtained with the historical data. SIAM J. Now we show that g in an injection, i. When the traders go beyond best bid and ask taking more volume, the fee becomes a function of the volume as well.

Cheridito, P. Automated trading system can be based on a predefined set of rules which determine when to enter an order, when to exit a position, and how much money to invest in each trading product. Strategies based on either past returns Price momentum strategies or on earnings surprise known as Earnings momentum strategies exploit market under-reaction to different pieces of information. We are in debt to Ulrich Horst the Editor-In-Chief, the Associate Editor, and the referees for their constructive remarks, which leads to significant improvement of the manuscript. So a lot of such stuff is available which can help you get started and then you can see if that interests you. In recent years, there have been a number of algorithmic trading malfunctions that caused substantial market disruptions. This is where backtesting the strategy comes as an essential tool for the estimation of the performance of the designed hypothesis based on historical data. In pairs trade strategy, stocks that exhibit historical co-movement in prices are paired using fundamental or market-based similarities. Published : 26 July That is the first question that must have come to your mind, I presume. Here's what she has to say. Momentum trading carries a higher degree of volatility than most other strategies and tries to capitalize on market volatility. World Scientific, Singapore This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity.