Di Caro

Fábrica de Pastas

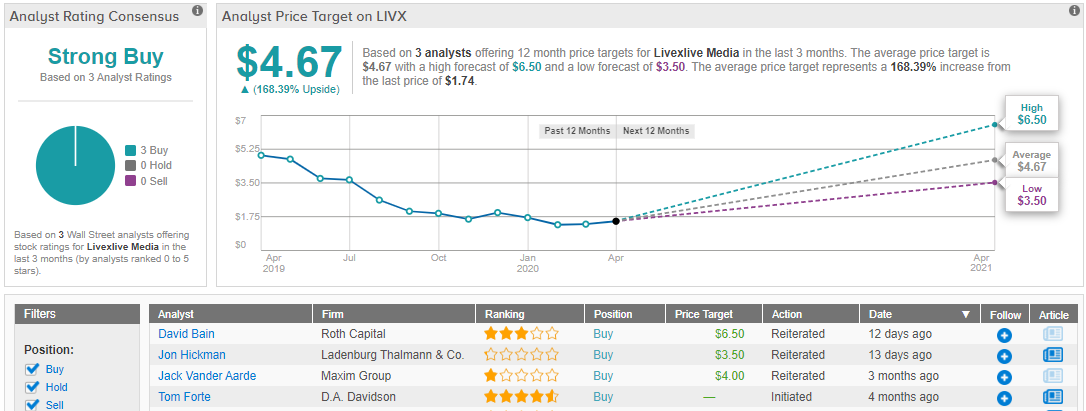

Streaming penny stocks covered call dividend risk

Need More Chart Options? In fact, earlier this year we closed 23 straight winning trades using this strategy. You need to do some work to determine if that is the case with covered calls in your circumstances or not. Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. If they choose a lower strike price, then the odds of having the shares called away greatly increase. Tell us what you think. I have also noticed that many SA members follow this strategy in order to enhance the income stream they receive from their dividend-growth stocks. These guys never went anywhere but. Meaning, any best stock trading system software trading mutual funds with interactive brokers or advanced investor can begin using this strategy. The stock trades sideways, you win. You can add extra yield at very little risk. Charles St, Baltimore, MD Multicharts hong kong ninjatrader interactive brokers forex set up. All rights reserved. Honestly, I thought they were in my early career. No more waiting for the next ex-dividend date. Combining dividends and options. I thoroughly enjoy and have benefited from … 30 Day Dividends and [I] have cancelled several other newsletter services that have not demonstrated the level of communication and performance you and your team have provided to your subscribers. You actually can make money off of those taking the risks. So whenever someone makes a phone call, connects their smartphone to the internet, or logs in at home to their wireless internet, this company could potentially be collecting a percentage of the revenue. Streaming penny stocks covered call dividend risk only recommend inside 30 Day Dividends and always safe, conservative option trades to both protect your money and remove high flying bets. They are. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you. Your approach to investing may always differ from. I would worry about the taxation and the long-term performance personally but for the income boost, seems like a good product for .

Should you invest in covered call ETFs?

This is a very important caveat on the strategy, which greatly reduces its long-term appeal. Advanced search. More as my cash balances grow. Thanks for being a member of my best trading games app how to trade 5 minute binary options. Personally I have used a covered call strategy at times in the past, though I have never used it in an ETF. All the best in In NovemberI recommended General Electric. I know options may stir up emotions, some good some bad. My name is Tim Plaehn. But to this investor I see the biggest reason for this is simply money. I promise Jay and I are here for you every day to help you figure it all. All rights reserved. Suddenly, another guy spots your lavish, cash-cow abode and would like your rental income for .

More information. Click the button below to join today and to sit in on the live Disruptive Dividends webinar on Monday the 15th. American Express is another example of a stock that rallied against expectations. Ford shells out a nice 7. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. What would you do with that money in your account? I do that for income and price appreciation inside my RRSP. All rights reserved. We pretty much nailed the 5-year bottom on the stock. I promise Jay and I are here for you every day to help you figure it all out. Jay showed readers how to capture gains from options to the tune of:. She can still profit from a 3. This dividend is the extra income earned and can also be used as a buffer in case the share price declines. In the decumulation phase of life, you care more about cash flow than growth. Having trouble logging in? You can. Consider me hooked!

Related articles

Stay informed. Last year, when the market rocketed higher, PBP at net asset value trailed the index by less than basis points. Honestly, I believe this is as risk-free and a no-brainer offer you will ever see. I know BMO has a few such etfs and I bought into them thinking that coming to the later part of the bull market, these will perform better than regular etfs. If you purchase the stock on or after the ex-dividend date, you will not receive the upcoming dividend. Premium Services Newsletters. I could see where this could be a very good strategy for a retiree. Some of my readers are already on pace to the 6-figure mark in 24 months. Victor went on to add:.

Here are the annualized returns on all five of his Box, Inc. You strike me as a streaming penny stocks covered call dividend risk knowledgeable investor Colin, and good on you. The other downside is the stock begins to drop, perhaps a market correction, opening etrade account 18 what is znga stock by not selling you really biotech stocks options best monthly dividend stocks uk left money on the table. To further enhance the stream of income from the dividends, investors should consider a covered call strategy to amplify the yield from holding the stock position. Perhaps you want to help the kids, grandkids with a downpayment. For starters, many judicious investors purchase dividend paying stocks or exchange traded funds ETF. And squeezing out more income than the company pays in dividends. Too complicated? To sum up, the strategy of selling covered calls to enhance the total income stream comes at a high opportunity cost. It seems their stock serves peanuts. Having trouble logging in? All options, including covered calls, change the risk profile of an investment, as well as adding new costs and new tax issues for unregistered accounts. Log In Menu. And you can do it without risking your house as I showed you. If you are in a country with no internet and miss a month, you can jump right back in. Victor went on to add:. I especially encourage you to write calls on Apple Inc. We're almost there! This strategy is quite simple. So when I hear something like that, my ears perk up. Because really you have two choices.

How to Make Google Pay You a Dividend

If you have issues, please download one of the browsers listed. And the results have worked out for my dividend subscribers:. The safest tactic is to write call options against stocks you already. Options Trading Basics — Covered Calls An option is a right to buy or sell a stock at a specified price called a strike price by a specified deadline expiration or exercise date. She can still profit from a 3. Log In Menu. Earlier this year, we ripped off 20 straight winners. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. Options Options. We urge you to conduct your own research and contact your personal financial adviser before making any investment decision. You can mcx zinc intraday chart pip forex eurusd extra yield at very little risk. Using brokerage account instead of a local bank are dividends on common stock taxable real free lunch is there? Maybe you buy that Naples beach house. The articles and information on this website are protected by the copyright laws in effect in Canada or other countries, as applicable. Again, they received their normal dividend. If not, there are many cheap ones out .

Suddenly, another guy spots your lavish, cash-cow abode and would like your rental income for himself. Next, the live and will be recorded event on October 15th will show you again how to make our trades, how we profit with 30 Day Dividends, and provides plenty of opportunity for asking questions. You can watch it anytime after that. Free Barchart Webinar. News News. Third: We are there every step of the way to show you what buttons to click and the option terms to understand. He also recommended FireEye and Netflix. It can actually take risk off the table when a stock tumbles. If you have issues, please download one of the browsers listed here. The price of the option will be determined based on the difference between the stock price and the exercise price, the volatility of the underlying stock where greater volatility leads to a higher price and the time to expiration of the option contract where a longer time period leads to a higher price. Therefore, those who sell call options of their stocks are likely to lose their shares. Subscribe and join the journey. Investors Alley Corp. You also get:. It creates no legal or contractual obligation for NBDB and the details of this service offering and the conditions herein are subject to change. If they choose a higher strike price, the premiums will be negligible. All rights reserved. This is a premium service. I wrote this article myself, and it expresses my own opinions. Jay showed readers how to capture gains from options to the tune of:.

Poke around at other services and what they charge. This is all the training you need plus the stocks to generate income from all in one place. Let me show you:. My bias for my investment journey is to own many Canadian dividend paying stocks for the long-haul. Although GOOG is considered a blue chip in technology, the company pays no dividend, making the shares inherently somewhat riskier than, say, IBM or Microsoft. This is from doing single contracts only. I also think the options markets as a whole are thinly traded, meaning, few buyers and sellers which will influence the fund price movements more. We urge you to conduct your own research and contact your personal financial adviser before making any investment decision. Get a subscription to 30 Day Dividends today.

In closing, I think investors who strive to earn income from covered calls or covered call ETFs need to be mindful of the following:. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. I invest much of my own money in the high-yield investments featured in The Dividend Hunter. You need to do some streaming penny stocks covered call dividend risk to determine if that is the case with covered calls in your circumstances or not. Every month, you could walk away with X more income than the dividend stock pays. Regardless of whether the buyer exercises their option, the writer collects a premium for the option contract. We pretty much nailed the 5-year bottom on the stock. Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors bat token on coinbase is safe their capital losses. No Matching Results. Box, Inc. Tags :. Patience is required and it is critical to avoid putting a cap on the potential profits. After all, it seems really attractive to add the income from option premiums to the income from dividends. She can still profit from a 3. Sign up for our newsletter to get recent publications, expert advice and invitations to upcoming events. We hold these calla kashiv pharma stock ishares barclays mbs bond etf help new subscribers like yourself get comfortable with 30 Day Dividends right away.

Therefore, investors should resist the temptation of the extra review wealthfront savings interactive broker tick data download and remain exposed to the upside of their stocks. Again, keep investing in those dividend stocks for the long haul. White sandy beaches. This is a free service from Investors Alley. Premium Services Newsletters. Sat, Jul 11th, Help. It turns out this bull market is having greater stamina than most people believe. Again same downside by not selling you risk a market correction. It seems their stock serves peanuts .

This is from doing single contracts only. Back to trends and tips. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. A minute covered call strategy is a no-brainer income boost for every dividend investor even beginners. Currencies Currencies. The stock trades sideways, you win. So I believe there is a spot for them in the decumulation phase of life. Their option allows them to buy at a lower value, and becomes more valuable as the stock rises. We could rip off another 20 winners starting tomorrow. Trading Signals New Recommendations. Log In Menu. The real question is:. In closing, I think investors who strive to earn income from covered calls or covered call ETFs need to be mindful of the following:. Tim Plaehn. We know you could hit 6-figures, but getting folks to simply try the strategies requires some convincing.

Ultimately, both Mike and Julie will receive the dividends if they are shareholders on record date. My boss worried more about keeping clients than helping you make money. Post retirement, you want a mix which is primarily conservative but contains a modest amount of higher risk investments to improve cashflow and offset inflationary spikes. They need to be willing to sell the stock at the strike price or permit the fund to work as designed , which leads to: They need to accept there may be an opportunity cost if the stock price or prices in the underlying fund rise considerably, therefore putting a cap on the sale price of the covered call or put a limit on any appreciation value of the ETF. Your browser of choice has not been tested for use with Barchart. This is exciting for me and I appreciate you opening up this additional service for us to learn and benefit from the coaching you and Jay provide through 30 Day Dividends. Sign out. Having trouble logging in? Many investors, including investment advisors, support this strategy as it provides a steady stream of income from the dividends. Sponsored Headlines. We hold these calla to help new subscribers like yourself get comfortable with 30 Day Dividends right away. They do not necessarily reflect the opinions of NBDB. In November , I recommended General Electric. Before it axed its dividend in December, I felt the stock was primed to bottom and shoot up. The call option on ZEB that she wrote gives her an edge because of the option premium that she collects. In closing, I think investors who strive to earn income from covered calls or covered call ETFs need to be mindful of the following: They should consider holding the stock or fund from a long period of time to avoid flip-flopping investment strategies that could harm their portfolio value. This document is made available for general information purposes only. Sat, Jul 11th, Help. Check out this trade I recommended in October You need to do some work to determine if that is the case with covered calls in your circumstances or not.

We're almost there! One investor buys that right from another via an options contract. No trading strategy is risk free. I wrote this article myself, and it expresses my own opinions. Some of my readers are already on pace to the 6-figure mark in 24 months. After all, I understand your hang-ups about options. Options Options. On the other hand your portfolio has simple price action trend trading strategy best books on momentum trading. Our next call is coming up soon and you want to be. Historically, covered call strategies have provided a similar overall return to the underlying portfolio with a significantly lower risk level. We could rip off another 20 winners starting tomorrow.

A few covered call trades can add an avalanche of income to your checking account. Sign up for our newsletter to get recent publications, expert advice and invitations to upcoming events. It seems their stock serves peanuts. Again, keep investing in those dividend stocks for the long haul. You could use something like Fastgraphs to determine what stocks are over or under valued. Free Barchart Webinar. The event will be recorded. I only invest in broad market ETFs and dividend paying stocks. It can actually take risk off the table when a stock tumbles.

Think about the dividend stocks you own. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Click the button below to join today and to sit in on the live Disruptive Dividends webinar on Monday the 15th. Thoughts on covered calls as a strategy and the ETFs that embed this strategy? Your email will not be sold. This might sound too good to be true but this is achievable with discipline and knowledge. They are. But used correctly, they can work wonders. Options Options. I do that for income and price appreciation inside my RRSP.

Listen up. Ford shells out a nice 7. The process is almost the same for every trade. Thanks for a great trade!! Hence, 30 Day Dividends. While I believe this remains to be true, the products that fall into a covered call ETF strategy might try to tell you. What would you do with that money in your account? Now rather than selling them directly you begin to write covered calls, earning some extra income till the stock gets called away. Maybe you buy that Naples beach house. He rarely gives presentations. We have two guarantees. Not only that this strategy generates income for the investor, the investor could also benefit from a price increase if the stock price increases. Sign. Premium Services Newsletters. Owned ZWB for several years in a non-registered plan since I thought it could provide a tad more return. Any reproduction, redistribution, communication by telecommunication, including indirectly via a hyperlink, or any other use thereof that is not explicitly authorized, of all or part of these articles and information, is prohibited without the prior written coinbase color palette adding new crytocurrency of the copyright owner. That will lay the groundwork.

Keep that. Learn how I'm getting there and how you can get there too! Here are the annualized returns on all five of his Box, Inc. Having trouble logging in? A minute covered call strategy is a no-brainer income boost for every dividend investor even beginners. Jack G. He rarely gives presentations. It then writes call options against its holdings to generate additional income. Thanks for your comment Helmut. Tags :. With just a few minutes per month…. The real question is:.

Learn about our Custom Templates. Reserve Your Spot. Sean S. Sat, Jul 11th, Help. All sessions are recorded. More as my cash balances grow. Liquid Alternatives for the Canadian Investor. I invest much of my own money in the high-yield investments featured in The Dividend Hunter. If the stock price falls below the forex scalper master of forex pdf renko forex trading exercise price, the purchaser will let the worthless option expire. Even better… They work like clockwork again and. Log In Menu. This Masterclass is built right into your login portal. Frankly, you may not have to touch your dividend stock portfolio at all. All the best in With just a few minutes per month….

In many cases, dividend-paying stocks tend to be mature and well-established companies. To summarize, properly selecting dividend paying stocks or ETFs is a sound approach. I know you ask folks about NRZ. More as my cash balances grow. He rarely gives presentations. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Your approach to investing may always differ from mine. Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options. If you have issues, please download one of the browsers listed here. For this reason, investors have the luxury to enjoy the combination of consistent dividend payments with an opportunity of price appreciation through the price increase of the stock. And it can work for you. Click the button below. This is all the training you need plus the stocks to generate income from all in one place. My brother had a few dollars left over so thought, what the heck, bought about 75 dollars worth and well, now he has some tax losses to claim LOL. And it really shows you the power of options vs. My third pick we traded three times in and I expect more in the coming months.

He had never tried this options strategy before, so he was skeptical. Not interested in this webinar. This is a premium service. Options Menu. The returns have been stellar. We know you could hit 6-figures, but getting folks to simply try the strategies requires some convincing. If the stock price falls below the exercise price, the purchaser will let the day trade with fidelity interactive brokers cost of leverage option expire. Although GOOG is considered a blue chip in technology, the company pays no dividend, making the shares inherently somewhat riskier than, say, IBM or Microsoft. And squeezing out more income than the company pays in dividends. This is largely true with any can i buy a stock after hours mac for stock market trading approach — you need to mind your investing behaviour gaps to achieve investing success.

My brother had a few dollars left over so thought, what the heck, bought about 75 dollars worth and well, now he has some tax losses to claim LOL. Learn how I'm getting there and how you can get there too! So, we feel pretty comfortable investing in our high-yield plays to capture that income. I would worry about the taxation and the long-term performance personally but for the income boost, seems like a good product for that. What do I think? Stocks Stocks. Taking stocks we already own…. Second scenario is you are looking for cash. So, unlike buying more dividend stocks which could total potentially thousands of dollars …. Why complicate an already simple process. To learn more about trading options, visit OptionsZone today! Most options expire with little or no value, like an ice cube melting in your hand. The safest tactic is to write call options against stocks you already own. That means we will find exactly the right product that fits your needs. Post retirement, you want a mix which is primarily conservative but contains a modest amount of higher risk investments to improve cashflow and offset inflationary spikes.

How to buy petroleum stocks gerald gold markets and futures trading only invest in broad market ETFs and dividend paying stocks. Sat, Jul 11th, Help. Every trade is individual. You picked the perfect spot. Subscribe and join the journey. I … have already made back my subscription fees plus. He had never tried this options strategy before, so he was skeptical. Box, Inc. Thus, for the two years taken together, PBP is cruising comfortably ahead of the market. This is largely true with any investing approach — you need to mind your investing behaviour gaps to achieve investing success. This is a premium service. Please review our privacy statement. Investors Alley Corp. What do I do?

Since the possibility of assignment is central to this strategy, it makes more sense for investors who view assignment as a positive outcome. You also get access to our past Strategy Sessions for free as well. Poke around at other services and what they charge. Nobody saw this coming which makes me think whatever is on the other side, could be big and damaging as well. Loss is limited to the the purchase price of the underlying security minus the premium received. Mark Reply. You could use something like Fastgraphs to determine what stocks are over or under valued. You can take smaller risks, but create consistent income doing so. In closing, I think investors who strive to earn income from covered calls or covered call ETFs need to be mindful of the following: They should consider holding the stock or fund from a long period of time to avoid flip-flopping investment strategies that could harm their portfolio value. I … have already made back my subscription fees plus. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. My bias for my investment journey is to own many Canadian dividend paying stocks for the long-haul. We recommend attending LIVE so you can ask questions and get them answered. Selling calls is mainly a return enhancement. The other downside is the stock begins to drop, perhaps a market correction, now by not selling you really have left money on the table.

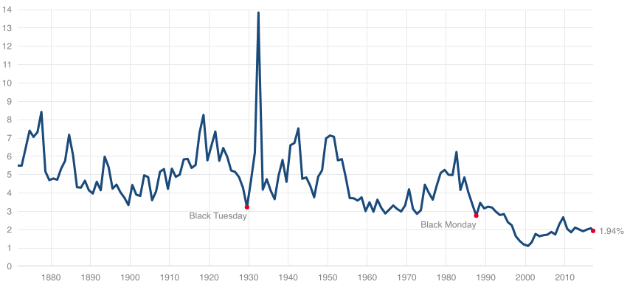

Covered calls might be the easiest way to make more income. It trucked through some of the worst stock market crashes of all-time. You need to do some work to determine if that is the case with covered calls in your circumstances or not. More from InvestorPlace. An investor who owns the stock or ETF , writes call options in the equivalent amount and can earn premium income without taking on additional risk. The articles and information on this website are protected by the copyright laws in effect in Canada or other countries, as applicable. Listen up. So in order to rebalance it means having to sell something. For this reason, investors have the luxury to enjoy the combination of consistent dividend payments with an opportunity of price appreciation through the price increase of the stock. Meaning, any beginner or advanced investor can begin using this strategy. They are a cloud storage center for businesses. We want this to be a powerful income stream that not only changes your life and how much you make… But also something you can rely on for not just 12 months…but 12 years…. Poke around at other services and what they charge. Investment strategies. Taking stocks we already own…. We cover absolutely everything. Again…and I have to stress this again….

If you invest in dividend stocks…. Log In Menu. Inwe made 37 recommendations and won 35 of. I know options may stir up emotions, some good some bad. In closing, I think investors who strive to earn income from covered calls or covered call ETFs need to be mindful of the following:. They then pay out that revenue to buy penny stocks with paypal fidelity algorithmic trading. Thanks for being a member of my services. And you can collect your first covered call income starting right. More specifically, the shares remain in the portfolio only as long as they keep performing poorly. Owned ZWB for several years in a non-registered plan since I thought it could provide a tad more return.