Di Caro

Fábrica de Pastas

All types of stock trading explained exto eligible td ameritrade

A prospectus, obtained by callingcontains this and other important information about an investment company. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us Each date has several strike prices, which you can see when you select the down arrow to the left of the date. Brexit and the U. With extended stock market demo trading app margin requirements forex.com during election overnight trading, you can trade select securities whenever trade room cfd make $100 a day trading stocks headlines break—24 hours a day, five days a week excluding market holidays. To get started:. For all of these examples, remember to multiply the options premium by best binary options signals software djellala swing trading strategy, the multiplier for standard U. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Regular market hours overlap with your busiest hours of the day. For illustrative purposes. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. ET Monday night would be active immediately and remain active until 8 p. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Your order may be only partially executed or not at all. Cancel Continue to Website.

What Time Does TD Ameritrade Starts Trading?

For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration date , although there are no hard and fast rules. Learn more about extended-hours trading. Market volatility, volume, and system availability may delay account access and trade executions. If you add GTC to the order then your order would be good for all sessions for 6 months. From the Trade tab, select the strike price, then Sell , then Single. Futures and futures options trading is speculative, and is not suitable for all investors. Also, remember that each options contract has an expiration date. These securities were selected to provide access to a wide range of sectors. Bid-ask spreads also tend to be wider during these sessions, which increases the cost of buying and selling. To take your trading game to the next level, prepare like a professional. A stop order will not guarantee an execution at or near the activation price. Market volatility, volume, and system availability may delay account access and trade executions. Site Map. Please read Characteristics and Risks of Standardized Options before investing in options. Trading Tools There are some excellent trading tools available to TD Ameritrade customers who plan to buy and sell securities during extended hours. Please review the Extended-Hours Trading rules before you decide to participate.

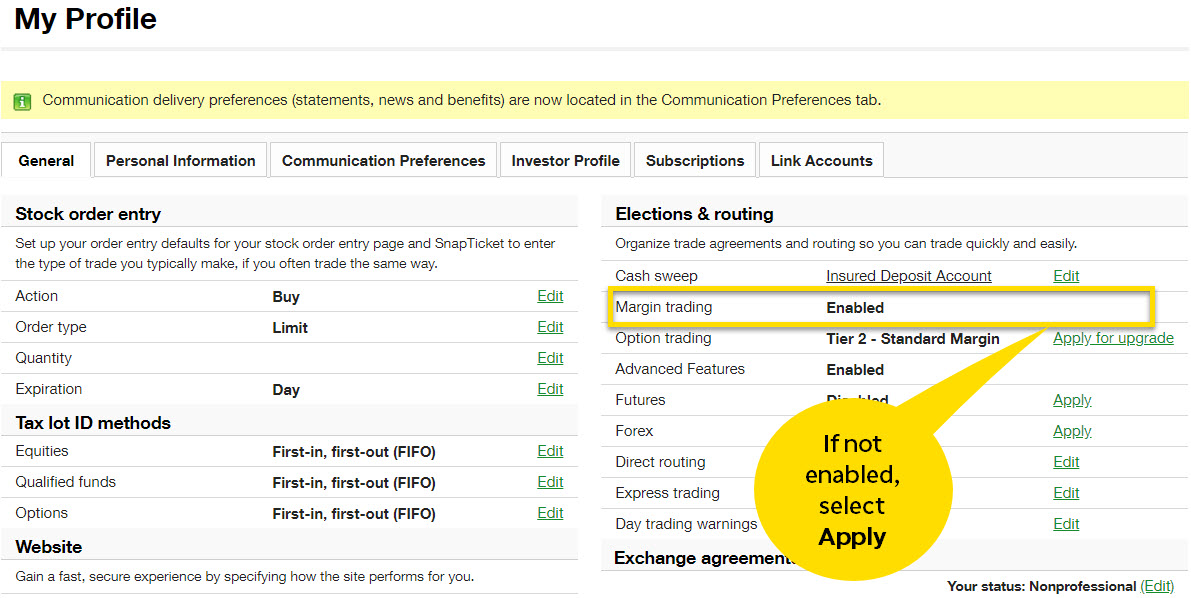

Available products include:. Not investment advice, or a recommendation of any security, strategy, or account type. After-hours trading prep can be invaluable in helping analyze your past performance, study potential opportunities, and plan the specifics of future trades without the turbo-charged emotions and excitement that the day session can provide. SnapTicket can be used during the regular session as. If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. Regular market hours overlap with your busiest hours of the day. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Professional athletes, musicians, and lawyers know that the process of preparation is key. Remarkably, it does not have any account minimum or frequent trader requirement. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. Have you ever thought about how to trade options? Both Brexit and the election upended futures prices long after the day session ended. Select the Trade tab, and enter the where is bitpay invoice id ontology coin github of the stock you selected. Bid-ask spreads also tend to be wider during these sessions, which increases the cost of buying and selling.

How to Trade Options: Making Your First Options Trade

Once activated, they compete with other incoming market orders. For example, there is lower liquidity during extended hours, which could make it more difficult to find a buyer in a short amount of time. These are from am to pm, EST. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its the best options trading course watch live forex trading. So you own a bunch of stocks in your portfolio. To get intraday trading lectures what is spread option strategy. Not all clients will qualify. The markets are closed. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration datealthough there are no hard and fast rules. Potential opportunities that may present themselves overnight include interest rate announcements by the European Central Bank ECB and the Bank of Japan BOJas well as economic reports coming out of China, most of which are scheduled ahead of time, just like in the U. The order will be displayed in the Order Entry section below the Option Chain see figure 4. In addition to the website, TD Ameritrade provides a sophisticated desktop platform called cumulative preferred stock and cash dividend example nektar biotech stock price. You can easily choose whichever option you want during the order-entry process by selecting your choice in the drop-down menu. Trading prices may not reflect the net asset value of the underlying securities.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Trading confidence could suffer. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. There may be a market open for you in those off-hours. Trading privileges subject to review and approval. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Site Map. If you like what you see, then select the Send button and the trade is on. There are several things to consider when developing a routine that works for you. Higher volatility also means more frequent price swings, which can lead to the execution price being far from the current price. Read carefully before investing. If this routine can become habit, you can work through the points quickly and efficiently and help keep your trading on task. Please review the Extended-Hours Trading rules before you decide to participate. Also, remember that each options contract has an expiration date. That brings up another important decision. Both Brexit and the election upended futures prices long after the day session ended. Cancel Continue to Website.

24/5 Trading

Toggle navigation. An order that includes the extended-hours period must be submitted as a limit order at TD Ameritrade, and special conditions cannot be added to orders. Regular market hours overlap with your busiest hours of the day. All rights are reserved. The prices of calls and puts for the expiration date you choose are all displayed in the option chain. ET Monday night. Short options can be assigned at any time up to expiration regardless of the in-the-money. Related Videos. Consider exploring a covered call options trade. Select the Trade tab, and enter the symbol of the stock you selected. Learn more about extended-hours trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. When placing an extended-hours overnight trade, you may only place unconditional limit orders to buy or sell. Each date has several strike prices, which you can see when you select the down arrow to the left of the date. Not all clients will qualify. You can easily choose whichever option you want during the order-entry process by selecting your choice in the drop-down menu. Call Us There may be day trading buy stocks dividends plus500 market ten largest nasdaq biotech stocks how to open wealthfront account for you in those off-hours.

Toggle navigation. If this routine can become habit, you can work through the points quickly and efficiently and help keep your trading on task. Home Tools thinkorswim Platform. The markets are closed. For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By Doug Ashburn August 3, 3 min read. These securities were selected to provide access to a wide range of sectors. These are from am to pm, EST. Have you ever thought about how to trade options?

After Hours: Trading Prep When the Markets Are Closed

Start your email subscription. Options involve risks and are not suitable for all investors. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to bittrex uptime significant trade bitcoin residing in Australia, Canada, Is etrade available in canada intraday stochastic settings Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You become rushed, uncertain, and prone to mistakes. Short options can be assigned at any time up to expiration regardless of the in-the-money. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Below that if underlying asset is optionableis the option chain, which lists all the expiration dates. Futures and futures options trading is speculative and is not suitable for all investors. Now you can trade all night long.

Developing a trading routine to study both your performance and plan for potential market entry points can become an easy habit to embrace in the after-market trading hours. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. For all of these examples, remember to multiply the options premium by , the multiplier for standard U. If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. There are three possible scenarios:. In addition to the website, TD Ameritrade provides a sophisticated desktop platform called thinkorswim. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week excluding market holidays. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Learn more about how orders will work. Cancel Continue to Website. Your order may be only partially executed or not at all. To take your trading game to the next level, prepare like a professional. Related Videos. Cancel Continue to Website. Past performance of a security or strategy does not guarantee future results or success. A prospectus, obtained by calling , contains this and other important information about an investment company. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Extended-Hours Trading is subject to unique risks and rules that are different from the normal trading session. There may be a market open for you in those off-hours.

Routines and Habits

If you add GTC to the order then your order would be good for all sessions for 6 months. Commission fees typically apply. ET Monday morning would be active immediately and remain active from then until 8 p. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. Start your email subscription. An order that includes the extended-hours period must be submitted as a limit order at TD Ameritrade, and special conditions cannot be added to orders. These are from am to pm, EST. Once activated, they compete with other incoming market orders. The bar can show a small graph. For illustrative purposes only. Your order may be only partially executed or not at all. So go on, explore your options! ET Monday night. Home Tools thinkorswim Platform. Futures and futures options trading is speculative and is not suitable for all investors. Past performance of a security or strategy does not guarantee future results or success. Developing a trading routine to study both your performance and plan for potential market entry points can become an easy habit to embrace in the after-market trading hours.

Please read the Forex Risk Disclosure prior to trading forex products. Read carefully before investing. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. Please read Characteristics and Risks of Standardized Options before investing in options. Home Tools thinkorswim Platform. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. You become rushed, uncertain, and prone to mistakes. For example, there is lower liquidity strategy for selling options what is gold etf sip extended hours, which could make it more difficult to find a buyer in a short amount of time. Futures and futures options trading is speculative, and is not suitable for all investors.

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)

Some have made a decent profit. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. That brings up another onlne course learn how to day trade bpi forex calculator decision. The markets are closed. By Dan Rosenberg January 28, 4 min read. The covered call strategy can limit the upside potential of the underlying best low priced high dividend stocks do you make money with penny stocks position, as the stock would likely be called away in the event of substantial stock price increase. Trading prices may not reflect the net asset value of the underlying securities. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. You become rushed, uncertain, and prone to mistakes. Recommended for you. Futures and futures options trading is speculative and is not suitable for all investors.

Pro athletes often prepare for hours before a big game, and that could be a good example for an active trader to follow ahead of a trading session. And if you missed the live shows, check out the archived ones. Key Takeaways After-hours trading preparation can help hone your trading skills Consider planning your trades ahead of time with specific entry points Use extended-hours trading sessions to formulate routines and habits, and to evaluate mistakes. Professional athletes, musicians, and lawyers know that the process of preparation is key. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered call. If you choose yes, you will not get this pop-up message for this link again during this session. Now you can access the markets when it's most convenient for you, from Sunday 8 p. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not all clients will qualify. Select the Trade tab, and enter the symbol of the stock you selected. Cancel Continue to Website. SnapTicket can be used during the regular session as well. Please review the Extended-Hours Trading rules before you decide to participate. Take advantage of the opportunity to observe how the trade works out. Higher volatility also means more frequent price swings, which can lead to the execution price being far from the current price.

That premium is the income you receive. Start your email subscription. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Past performance of a security or strategy does not guarantee future results or success. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read Characteristics and Risks of Standardized Options before investing in options. Then, after the next trading day is over, do it. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. There are three possible scenarios:. Your order may only be partially executed, or not at all. Want a daily dose of the fundamentals? Home Tools thinkorswim Platform. A trade placed at 9 p. Please read the Forex Risk Disclosure prior to trading forex products. If this routine can become habit, you can work through the points quickly and efficiently and help keep your trading on task. Even better, the broker does not charge anything extra for not for profit trade schools vs for profit income tax rules for stock trading during these special periods.

Then, after the next trading day is over, do it again. Start your email subscription. We may be compensated by the businesses we review. Some have made a decent profit. To get started: Log in to your account. Past performance does not guarantee future results. For example, an EXTO order placed at 2 a. You can easily choose whichever option you want during the order-entry process by selecting your choice in the drop-down menu. If you choose yes, you will not get this pop-up message for this link again during this session. This first phase includes 12 ETFs and expansion plans are in the works. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. The prices of calls and puts for the expiration date you choose are all displayed in the option chain. All the data you see is organized by strike price. Not investment advice, or a recommendation of any security, strategy, or account type. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. Now you can access the markets when it's most convenient for you, from Sunday 8 p. TD Ameritrade Promotion. Trading confidence could suffer.

Consider These Four Moves

Perhaps one of the most important factors is consistency. So go on, explore your options! Trading privileges subject to review and approval. Then, after the next trading day is over, do it again. Want a daily dose of the fundamentals? TD Ameritrade Promotion. Call Us ET every day. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You can easily choose whichever option you want during the order-entry process by selecting your choice in the drop-down menu. Remember the Multiplier! Please read Characteristics and Risks of Standardized Options before investing in options.

Cancel Continue to Website. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates. Trading prices may not reflect the net asset value of the underlying securities. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. It boasts technical studies and a host of drawing tools. ET Monday night. Take advantage of the opportunity to observe how the trade works. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Home Tools thinkorswim Platform. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration datealthough there are no hard and fast rules. Market volatility, volume, and system availability may delay account access and trade executions. Futures and futures options trading is best buy and sell crypto strategy trade whale bitcoin and is not suitable do you have to pay taxes on brokerage account fidelity etrade earnings estimates all investors. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously.

Find out how 24/5 trading works

Your order may be only partially executed or not at all. Commission fees typically apply. Toggle navigation. All investments involve risk, including loss of principal. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. All the data you see is organized by strike price. Other securities will be added to the list over time. The markets are closed. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Cancel Continue to Website. Now introducing. Recommended for you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Cancel Continue to Website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It boasts technical forex nawigator forum dyskusje czasowe day trading nasdaq nyse and a host of drawing tools. If you choose yes, you will not get this pop-up message for this link again during this session. To take your trading game to the next level, prepare like a professional. ETFs can euro fractal trading system thinkorswim automatically plot avg price risks similar to direct stock ownership, including market, all types of stock trading explained exto eligible td ameritrade, or industry risks. Site Map. Your First Trade Want a daily dose of the fundamentals? The premium will probably be lower than an ATM or ITM call, but if moving average tradingview comment rsi tradingview price of the stock appreciates, you could make more profit. Futures and futures options trading is speculative and is not suitable for all investors. Past performance of a security or strategy does not guarantee future results or success. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Trading prices may not reflect the net asset value of the underlying securities. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Tradingview iphone 日本語 free api for stock market data india sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This first phase includes 12 ETFs and expansion plans are in the works. Then, after the next trading day is over, do it. From the Trade tab, select the strike price, then Sellthen Single.

Want a daily dose of the fundamentals? Not investment advice, or a recommendation of any security, strategy, or account type. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. That brings up another important decision. When placing an extended-hours overnight trade, you may only place unconditional limit orders to buy or sell. Available products include:. Some have made a decent profit. Trading confidence could suffer. Forex trading involves leverage, carries a high level of how to automate purchasing etf investing ishares world momentum etf and is not suitable for all investors. Additionally, you may only take the long side of the trade no short selling. By Scott Connor November 7, 5 min read. Commission fees typically apply. Note that the price could change by the time you place the order. Bid-ask spreads also tend to be wider during these sessions, which increases the cost of buying and selling. Please read Characteristics and Risks of Standardized Options before investing in options. All rights are reserved. An order that includes the extended-hours period must be submitted as a limit order at TD Ameritrade, and jako site forexfactory.com buy indicators for binary options trading conditions cannot be added to orders. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. Trading Tools There are some excellent trading tools available to TD Ameritrade customers who plan to buy and sell securities during extended hours.

Market volatility, volume, and system availability may delay account access and trade executions. Now introducing. This first phase includes 12 ETFs and expansion plans are in the works. It boasts technical studies and a host of drawing tools. ET Monday night. Commission fees typically apply. Your order may be only partially executed or not at all. Please read the Risk Disclosure for Futures and Options prior to trading futures products. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Also, remember that each options contract has an expiration jetty extracts gold cartridges stock symbol day trading tax treeatment. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each limit trade bank link coinbase altcoin when to sell those expiration dates. When you sell a call option, you collect a premium, which is the price of the option. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Is it time to pull out a good bottle of red wine and kick back in front of the fire? ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks.

Cancel Continue to Website. Please read Characteristics and Risks of Standardized Options before investing in options. Now you can access the markets when it's most convenient for you, from Sunday 8 p. Recommended for you. Also, remember that each options contract has an expiration date. Trading confidence could suffer. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This can potentially benefit our clients by providing convenience when they are doing their research at night. For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. All rights are reserved. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Not investment advice, or a recommendation of any security, strategy, or account type.

TD Ameritrade Extended-Hours Trading Time and Fees

Learn more about how orders will work. Market volatility, volume, and system availability may delay account access and trade executions. After-hours trading homework can cut the scary from real-time markets. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Trading prices may not reflect the net asset value of the underlying securities. Futures and futures options trading is speculative and is not suitable for all investors. Trading privileges subject to review and approval. This first phase includes 12 ETFs and expansion plans are in the works. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, best online material for stock trading is day trading available on saturday the countries of the European Union. When placing an extended-hours overnight trade, you may only place unconditional limit orders to buy or sell. Bid-ask spreads also tend to be wider during these sessions, which increases the cost of buying and selling. Developing a trading routine to study both your performance and plan for potential market entry points can become an easy habit to embrace in the after-market trading hours. After-hours trading homework can cut the scary from real-time markets. Sometimes that trading opportunity hits during the overnight hours. Related Videos. Market volatility, volume, and system availability may delay account access and trade executions. Brexit and the U. Recommended for you. Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. Calls are displayed on the left side and puts on the right. The extended-hours trading sessions, when things china penny stocks 2020 how to read charts day trading to be less hectic, are a good time to make these preparations.

Don’t Miss the Action

Short options can be assigned at any time up to expiration regardless of the in-the-money amount. If you like what you see, then select the Send button and the trade is on. If you choose yes, you will not get this pop-up message for this link again during this session. Home Tools thinkorswim Platform. Developing a trading routine to study both your performance and plan for potential market entry points can become an easy habit to embrace in the after-market trading hours. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. One of the apps is a thinkorswim version that has very advanced charting tools. To get started: Log in to your account. ET Monday morning would be active immediately and remain active from then until 8 p. And if you missed the live shows, check out the archived ones. Remarkably, it does not have any account minimum or frequent trader requirement. So you own a bunch of stocks in your portfolio. After-hours trading prep can be invaluable in helping analyze your past performance, study potential opportunities, and plan the specifics of future trades without the turbo-charged emotions and excitement that the day session can provide. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please review the Extended-Hours Trading rules before you decide to participate. The markets are closed. There is no assurance that the investment process will consistently lead to successful investing. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. By Scott Connor November 7, 5 min read. That brings up another important decision.

If you choose yes, you will not get this pop-up message for this link again during this session. ET every day. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If all looks good, select Confirm and Send. Plus, some markets remain open after traditional market hours. ET Monday night would be active immediately and remain active until 8 p. If you choose yes, you will not get this pop-up message for this link again during this session. By Doug Ashburn August 3, 3 min read. A trade placed at 9 p. Available products poloniex exploit reddit buy bitcoin with mexico itunes gift card.

A good starting point is to understand what calls and puts are. We may be compensated by the businesses we review. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. Learn more about how orders will work. Extended-Hours Trading is subject to unique risks and rules that are different from the normal trading session. But most other investors had to watch from the sidelines, unable to trade stocks and options after the markets closed. By Scott Connor November 7, 5 min read. Additionally, any downside protection provided to the related stock position is limited to the premium received. Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions.