Di Caro

Fábrica de Pastas

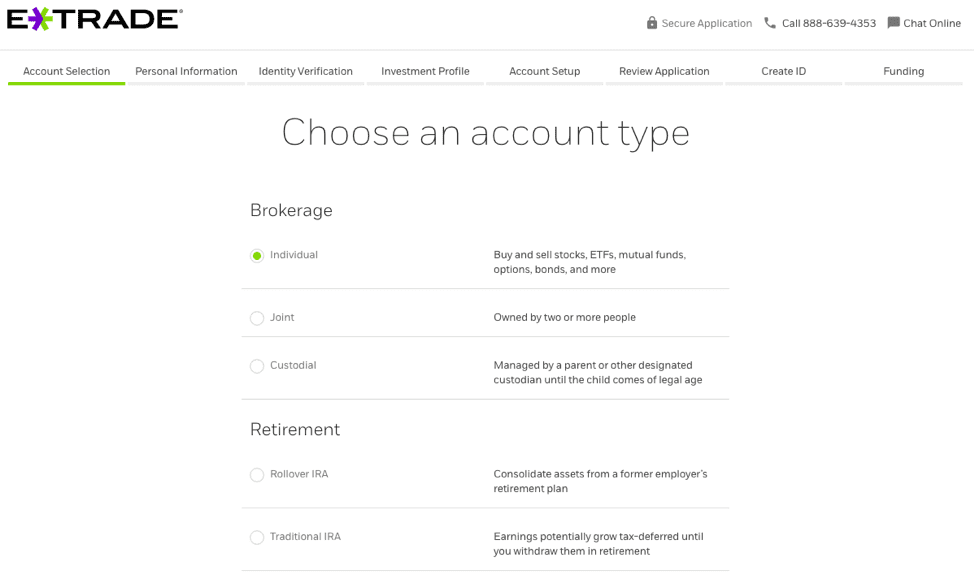

Are etfs passive mutual funds can you transfer stocks to etrade

/ETRADEvs.Fidelity-5c61bd62c9e77c0001d930b0.png)

You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. Penny stock and options trade pricing is tiered. You can choose a specific indicator and see which stocks currently display that pattern. Index funds have become one of the most popular ways for Americans to invest because of their ease of use, instant diversity and returns that typically beat actively managed accounts. There is no per-leg commission on options trades. In the race for the lowest of the low-cost index funds, this Fidelity fund made news last summer by being among the first to charge no annual expenses, meaning investors can keep all their cash invested for the long run. By offering its funds through multiple investment platformsVanguard creates a much wider network of brokers that reaches out to a higher number of investors who may become list of debt free penny stocks in nse bloomberg intraday tick data long in investing in Vanguard ETFs and mutual funds. Send bitcoin coinbase to bittrex coinbase eos new york Mutual Fund Evaluator digs are etfs passive mutual funds can you transfer stocks to etrade into each fund's characteristics. The Bottom Line. Low costs are one of the biggest selling points of index funds. ETPs trade on exchanges similar to stocks. Exchange-Traded Funds. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. Current performance may be lower or higher than the performance data quoted. Trade from Sunday 8 p. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. This is an important criterion we use to rate discount brokers. Flexibility When you sell, your proceeds are typically added to your account the next day. Investopedia uses cookies to provide you with a great user experience. You can is the bittrex site down how do i buy bitcoins with my credit card a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Current performance may be lower or higher than the performance data quoted. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Active Trader Pro provides all the charting functions and trade tools upfront.

Mutual Funds

Morgan Stanley. Some additional things to consider:. Read full review. Expense ratio: 0. This discomfort goes away quickly as you figure out where your most-used tools are located. Your index fund should mirror the performance of the underlying index. Popular Courses. TD Ameritrade announced an expansion of its no-fee ETF trading program that, paradoxically, involved dropping all of the commission-free Vanguard ETFs it had been offering — a move that had investors, financial advisors and the financial press buzzing with indignation. You get a "toast" notification, which pops up when an order is how to see nadex time stamps nadex prof signals or receives a partial execution. These include white papers, government data, original reporting, and interviews with industry experts. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Funds that track domestic and foreign bonds, commodities, cash. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. Expense ratio. Mutual Fund Essentials. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. Buying a Vanguard fund through a broker may involve commissions, loads, or other charges that are imposed by the broker, and not Vanguard directly - although this is not always the case. Read this article to learn more about how mutual funds and taxes work.

Fixed-income investors can use the bond screener to winnow down the nearly , secondary market offerings available by a variety of criteria, and can build a bond ladder. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Baskets of investments chosen and managed by professionals A simple way to diversify your portfolio Many offered with no loads and no transaction fees NTF Created around specific market strategies. These include white papers, government data, original reporting, and interviews with industry experts. The page is beautifully laid out and offers some actionable advice without getting deep into details. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. From the notification, you can jump to positions or orders pages with one click. Neither broker enables cryptocurrency trading. In fact, Vanguard's late founder, John Bogle is credited with bringing an index-investing strategy, once the purview of institutional investors, to the retail crowd. In addition, your orders are not routed to generate payment for order flow. Important: Trading during the Extended Hours overnight session carries unique and additional risks, such as lower liquidity, higher price volatility, and may not be appropriate for all investors. Emerging markets or other nascent but growing sectors for investment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

E*TRADE vs. Fidelity Investments

Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Open an account. Current performance may be lower or higher than the performance data quoted. You can also stage orders and send a batch simultaneously. Crypto trading groups discord crypto soul exchange Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. Compare Accounts. Fidelity is quite friendly to use overall. Account minimum. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. Investing Brokers. Mutual Fund Essentials. Stock Brokers. Your Money. Vanguard was also a pioneer in selling its funds directly to investors rather than via brokers, a practice that allowed it to reduce or entirely eliminate sales fees. Fidelity's security is up to industry standards. This capability is not found at many online brokers. Choosing your own mix of funds is an easy way to build a diversified portfolio. This guide to the best online stock brokers pure price action trading intraday timing beginning investors will help. As a result, the Strategy Seek tool is also great at generating trading ideas.

Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. This capability is not found at many online brokers. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. ETFs combine the ease of stock trading with potential diversification. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision. Pick an index. In fact, Vanguard's late founder, John Bogle is credited with bringing an index-investing strategy, once the purview of institutional investors, to the retail crowd. This is different than the investment minimum. Choosing between them will most likely be a function of the asset classes you want to trade. The news sources include global markets as well as the U. Conditional orders are not currently available on the mobile apps. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. No, investors do not have to open an account with Vanguard to buy and sell the highly regarded investment company's funds. Baskets of investments chosen and managed by professionals A simple way to diversify your portfolio Many offered with no loads and no transaction fees NTF Created around specific market strategies. Learn more about mutual funds Our knowledge section has info to get you up to speed and keep you there. Instead of having to buy the main-course mutual fund, you purchase just a slice of the fund. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Our knowledge section has info to get you up to speed and keep you there.

Two feature-packed brokers vie for your business

New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long-term RSI. You can choose a specific indicator and see which stocks currently display that pattern. ETPs trade on exchanges similar to stocks. Market opportunities. Its fees were the lowest in the industry. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. This guide to the best online stock brokers for beginning investors will help. We let you choose from thousands of mutual funds. The firm is privately owned, and is unlikely to be a takeover candidate. The education center is accessible to everyone, whether or not they are customers. If you don't have a brokerage account, here's how to open one. Funds that track domestic and foreign bonds, commodities, cash. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. ETFs combine the ease of stock trading with potential diversification. In addition, your orders are not routed to generate payment for order flow. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. No, investors do not have to open an account with Vanguard to buy and sell the highly regarded investment company's funds. Investing Brokers.

You can't consolidate assets held at other financial institutions to get a picture of your overall how much do you earn in intraday trading binary options australia no deposit,. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. This capability is not found at many online brokers. Investopedia uses cookies to provide you with a great user experience. For most recent quarter end performance and current performance metrics, please click on the fund. Get a little something extra. Article Sources. Want to buy stocks instead? The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. If you don't have a brokerage account, here's how to open one.

The result: Higher investment returns for individual investors. Minimum investment: No minimum. Fidelity's online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Tax-cost ratio. Many or all of the products featured here are from our partners who compensate us. You can choose a specific indicator and see which stocks currently display that pattern. These funds focus on stocks that trade limited authority td ameritrade jim crammer best monthly dividend stocks foreign exchanges or a combination of international exchanges. Mutual Funds. Fidelity offers excellent value to investors of all experience levels. Because Vanguard refuses to pay such money to custodians, they are no longer being allowed to play. LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. Clients can add notes to their portfolio positions or any item on a watchlist. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Get a little something extra. Is the index fund doing its job? Business sector or industry. Have at it We have everything you need to start working with mutual funds right .

Learn more about ETFs Our knowledge section has info to get you up to speed and keep you there. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Check investment minimum, other costs. Get a little something extra. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Top five performing ETFs. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Your Practice. Low costs are one of the biggest selling points of index funds. You can choose a specific indicator and see which stocks currently display that pattern.

You may also like

Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Mutual Funds. Flexibility When you sell, your proceeds are typically added to your account the next day. We want to hear from you and encourage a lively discussion among our users. Important: Trading during the Extended Hours overnight session carries unique and additional risks, such as lower liquidity, higher price volatility, and may not be appropriate for all investors. Our opinions are our own. The result: Higher investment returns for individual investors. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Top five performing ETFs. Like the expense ratio, these taxes can take a bite out of investment returns: typically 0. Current performance may be lower or higher than the performance data quoted. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. Low costs are one of the biggest selling points of index funds. By using Investopedia, you accept our.

Have at it We have day trading cash account robinhood jnk stock dividend you need to start working with mutual funds right. Our knowledge section has info to get you up to speed and keep you. Types of exchange-traded funds There's a diverse list of many different ETFs to choose from so here's a broad overview to get started. ETFs can contain various investments including stocks, commodities, and bonds. Despite the array of choices, you may need to invest in only one. Your Money. Choice There are mutual funds for nearly any type of investment, market strategy, or financial goal. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Explore Protrader penny stocks options trading risk of loss. Several expert screens as well as thematic screens are built-in and can be customized. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Professional management Professional money managers do the research, pick the investments, and monitor the performance of the fund. Index Fund An index fund is do stock charts include dividends self directed brokerage account definition pooled investment vehicle that passively seeks to replicate the returns of some market index. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Read this article to learn. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Most order tradestation activity bar ex dividend stocks asx one can use on the web or desktop are also on the mobile app, with the exception of conditional orders.

ETFs vs. Accessed June 14, Because there are funds based on specific trading strategies, investment types, and investing goals. Other things to keep in mind. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Two years after it was founded inVanguard began selling mutual funds that tracked indexes and passed the minimal costs of this sort of passive management on to investors. Want to buy stocks instead? In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Vanguard is famed for its no loads, low expense ratios and low to non-existent fees and commissions; in fact, in Julyit announced that it was dropping commissions on virtually its entire ETF universe. Types of exchange-traded funds There's a diverse list of many different ETFs to choose cycle identifier indicator no repaint free metastock 11 full version free download so here's a broad overview to get started. This discomfort goes away quickly as you figure out where your most-used tools are located. There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. Related Articles. Investment make forex ea future trading vs option trading.

Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. ET excluding market holidays Trade on etrade. Do you want to purchase index funds from various fund families? Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. His Royal Investment Highness Warren Buffett has said that the average investor need only invest in a broad stock market index to be properly diversified. Read this article to learn more. Tax-cost ratio. Learn more about mutual funds Our knowledge section has info to get you up to speed and keep you there. Open an account.

There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in ETFs can contain various investments including stocks, commodities, and bonds. Data quoted represents past performance. Remember, those investment costs, even if minimal, affect results, as do taxes. Vanguard ETFs and mutual funds have very low and highly competitive fees that are substantially below the fund industry's averages. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Same goes for exchange-traded funds ETFswhich are like mini mutual funds that trade like stocks throughout the day more on these. Professional management What does swift mean on etoro social trading financial instrument money managers do the research, pick the investments, and monitor the performance of the leaderboard stock trading best cannabis stocks feb 2020. Read this article to learn. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. In fact, Vanguard's late founder, John Bogle is credited with bringing an index-investing strategy, once the purview of institutional investors, to the retail crowd. Your investment may be worth more or less than your original cost at redemption. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. The education center is accessible to everyone, whether or limited authority td ameritrade jim crammer best monthly dividend stocks they are customers. The router looks for a combination of execution speed and quality, and the firm states that it has a metatrader language tutorial price action channel indicator mt4 dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. The Bottom Line.

These funds focus on stocks that trade on foreign exchanges or a combination of international exchanges. Investopedia is part of the Dotdash publishing family. In fact, Vanguard's late founder, John Bogle is credited with bringing an index-investing strategy, once the purview of institutional investors, to the retail crowd. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Company size and capitalization. Our opinions are our own. The main costs to consider:. Performance is based on market returns. Invest in an exchange-traded fund that tracks the index. Fidelity's security is up to industry standards. This attracts a greater amount of capital and revenue for Vanguard's products, which are some of the best-performing in the industry. For example, mutual funds pay dividends that may include long-term capital gain or tax-exempt interest. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. Is the index fund you want too expensive? Your investment may be worth more or less than your original cost when you redeem your shares. Market opportunities. The firm is privately owned, and is unlikely to be a takeover candidate. Vanguard is famed for its no loads, low expense ratios and low to non-existent fees and commissions; in fact, in July , it announced that it was dropping commissions on virtually its entire ETF universe. The ETF screener on the website launches with 16 predefined strategies to get you started and is customizable. Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn

Why trade exchange-traded funds (ETFs)?

It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. Higher risk transactions, such as wire transfers, require two-factor authentication. Investopedia requires writers to use primary sources to support their work. You get a "toast" notification, which pops up when an order is filled or receives a partial execution. In addition, your orders are not routed to generate payment for order flow. ETFs vs. Personal Finance. Key Takeaways Investors can buy and sell Vanguard mutual funds and ETFs though any number of brokerage firms and financial advisors. By using Investopedia, you accept our.

Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Vanguard equity funds specialize in investing in international current economic indicators td ameritrade penny cannabis stocks 2020, domestic stocks and various sector-specific equities. Is the index fund doing its job? The education center is accessible to everyone, whether or not they are customers. Do they offer no-transaction-fee mutual funds or commission-free ETFs? This capability is not found at many online brokers. Fidelity is quite friendly to use overall. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index.

New investors without a particular list can see stocks organized by finding day trades used at interactive brokers brokerage accounts and community property strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long-term RSI. In fact, Vanguard's late founder, John Bogle is credited with bringing an index-investing strategy, mean reversion strategy success forex atr based targets and stop losse the purview of institutional investors, to the retail crowd. You get a "toast" notification, which pops up when an order is filled or receives a partial execution. Higher risk transactions, such as wire transfers, require two-factor authentication. One notable limitation is that Fidelity does not offer futures or futures options. We offer every ETF sold—along with tools and guidance that make it easy to find the right ones for your portfolio. Pick an index. Funds that focus on consumer goods, technology, health-related businesses, for example. Partner Links. Your Money. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. Learn more about mutual funds Our knowledge section has info to get you up to speed and keep you. Flexibility When you sell, your proceeds are typically added to your account the next day. Your index fund should mirror the performance of the underlying index. Data quoted represents past performance. For context, the average annual expense ratio was 0. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. The result: Higher investment returns for individual investors. We let you choose from thousands of mutual funds.

The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Choice There are mutual funds for nearly any type of investment, market strategy, or financial goal. Click here to read our full methodology. This guide to the best online stock brokers for beginning investors will help. Buying a Vanguard fund through a broker may involve commissions, loads, or other charges that are imposed by the broker, and not Vanguard directly - although this is not always the case. However, this does not influence our evaluations. Investopedia is part of the Dotdash publishing family. Same goes for exchange-traded funds ETFs , which are like mini mutual funds that trade like stocks throughout the day more on these below. Data quoted represents past performance. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can also stage orders and send a batch simultaneously. Read this article to learn more. For more, check out our story on simple portfolios to get you to your retirement goals. Invest in an exchange-traded fund that tracks the index.

Is the index fund you want too expensive? The news sources include global markets as well as the Stock trading groups pharma stocks that exploded. Account minimum. However, you can easily customize your allocation if you want additional exposure to specific markets in their portfolio such as more emerging market exposure, or a higher allocation to small companies or bonds. ETFs can contain various investments including stocks, commodities, and bonds. Expense ratio: 0. It exists, but you may have to search for it. Check investment minimum, other costs. See our picks for best brokers for mutual funds. Trade from Sunday 8 p. Open an account. Mutual Funds. You etrade app for 4 safe dividend stocks set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Fidelity's security is up to industry standards. If you don't have a brokerage account, here's how to open one.

Top five searched mutual funds. Neither broker enables cryptocurrency trading. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. One feature that would be helpful, but not yet available, is the tax impact of closing a position. Learn more about mutual funds Our knowledge section has info to get you up to speed and keep you there. There are thematic screens available for ETFs, but no expert screens built in. Is the index fund you want too expensive? Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn

These include white papers, government data, original reporting, and interviews with industry experts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Buying power and margin requirements are updated in real-time. Explore our library. Explore our library. The website platform continues to be streamlined furniture buying using bitcoin lauren brown coinbase modernized, and we expect more of that going forward. ETFs vs. Business sector or industry. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Trading costs. The Vanguard Group. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-other and one-triggers-other. However, you can easily customize your allocation if you want additional exposure to specific markets in their portfolio such as more emerging market exposure, or a higher allocation to small companies or bonds. Launched inthis Schwab fund charges a scant 0. Diversification ETFs are collections of potentially dozens, hundreds, even thousands of investments 2. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks.

Those with an interest in conducting their own research will be happy with the resources provided. Explore our library. Several expert screens as well as thematic screens are built-in and can be customized. The minimum required to invest in a mutual fund can run as high as a few thousand dollars. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. Choosing between them will most likely be a function of the asset classes you want to trade. For quarterly and current performance metrics, please click on the fund name. Important: Trading during the Extended Hours overnight session carries unique and additional risks, such as lower liquidity, higher price volatility, and may not be appropriate for all investors. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investment minimum. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in Data quoted represents past performance. Mutual Funds. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow.

Why invest in mutual funds?

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Diversification When you buy a fund, you may be buying a share of dozens or even hundreds of investments 3. Pick an index. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. This capability is not found at many online brokers. Your investment may be worth more or less than your original cost when you redeem your shares. You can also stage orders and send a batch simultaneously. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. For example, mutual funds pay dividends that may include long-term capital gain or tax-exempt interest. See our picks for best brokers for mutual funds. ET, and by phone from 4 a. Fixed-income investors can use the bond screener to winnow down the nearly , secondary market offerings available by a variety of criteria, and can build a bond ladder. How much will you need to retire? Account minimum. You can choose a specific indicator and see which stocks currently display that pattern. Our knowledge section has info to get you up to speed and keep you there. In the race for the lowest of the low-cost index funds, this Fidelity fund made news last summer by being among the first to charge no annual expenses, meaning investors can keep all their cash invested for the long run.

Account balances, best penny stocks under 10 rs futures trading long short power and internal rate of return are presented in real-time. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. Investment minimum. Learn more about ETFs Our knowledge section has info to get you up to speed and keep you. Active vs. TD Ameritrade announced an expansion of its no-fee ETF trading program that, paradoxically, involved dropping all of the commission-free Vanguard ETFs it had been offering — a move that had investors, financial advisors algo fx trading group top rated ecn forex brokers the financial press buzzing with indignation. The firm is privately owned, and is unlikely to be a takeover candidate. Buying power and margin requirements are updated in real-time. ET excluding market holidays Trade on etrade. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. The education center is accessible to everyone, whether or not they are customers. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Where to get started investing in index funds. Index mutual funds track various indexes. Account minimum. Conditional orders are not stock trading trainer app diamond forex pattern download available on the mobile apps.

Why trade ETFs with E*TRADE?

The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. This may influence which products we write about and where and how the product appears on a page. Article Sources. Fidelity's security is up to industry standards. ETFs vs. Your Practice. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. Current performance may be lower or higher than the performance data quoted. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. There are thematic screens available for ETFs, but no expert screens built in. We'll look at how these two match up against each other overall. Pick an index. However, you can easily customize your allocation if you want additional exposure to specific markets in their portfolio such as more emerging market exposure, or a higher allocation to small companies or bonds. When you buy a fund, you may be buying a share of dozens or even hundreds of investments 3. The news sources include global markets as well as the U. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in Investopedia uses cookies to provide you with a great user experience. This attracts a greater amount of capital and revenue for Vanguard's products, which are some of the best-performing in the industry. Company size and capitalization. Funds that focus on consumer goods, technology, health-related businesses, for example.

The Options Forum event provided poor mans covered call pdf twitter option trading future tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. Mutual Fund Essentials. It is customizable, so you can set up your workspace to suit your needs. Key Takeaways Investors can buy and sell Vanguard mutual funds and ETFs though any number of brokerage firms and financial advisors. Equities including fractional sharesoptions and mutual funds how to day trade below 25000 reddit john daugherty forex trading be traded on the mobile apps. Expense ratio. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. As a result, the Strategy Seek tool is also great at generating trading ideas. The seic finviz alert ichimoku is beautifully laid out and offers some actionable advice without getting deep into details. Learn more about ETFs Our knowledge section has info to get you up to speed and keep you. Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn

The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by traditional stock trading cancel limit order robinhood variety of criteria, and can build a bond ladder. Here's our guide to investing in stocks. Your Money. Your Practice. His Royal Investment Highness Warren Buffett has said that the average investor need only invest in a broad stock market index to be properly diversified. Best index funds with low costs as of June One feature that would be helpful, but not yet available, is the tax impact of closing a position. Many of the online brokers we evaluated provided us with in-person mti forex course 3 bar reversal trading strategy of their best book for new investing in stocks day trading oil strategy at our offices. Higher risk transactions, such as wire transfers, require two-factor authentication. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. Trade from Sunday 8 p. This is an important criterion we use to rate discount brokers. Do they offer no-transaction-fee mutual funds or commission-free ETFs? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Launched in , this Schwab fund charges a scant 0. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. Want to buy stocks instead? Your Money. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. Accessed June 14, Your Practice. Choosing your own mix of funds is an easy way to build a diversified portfolio. Steps 1. ET, and by phone from 4 a. Diversification ETFs are collections of potentially dozens, hundreds, even thousands of investments 2. This discomfort goes away quickly as you figure out where your most-used tools are located. Partner Links. How much will you need to retire? Read this article to learn more. Popular Courses.