Di Caro

Fábrica de Pastas

At&t stock next dividend date bmo brokerage account usaa

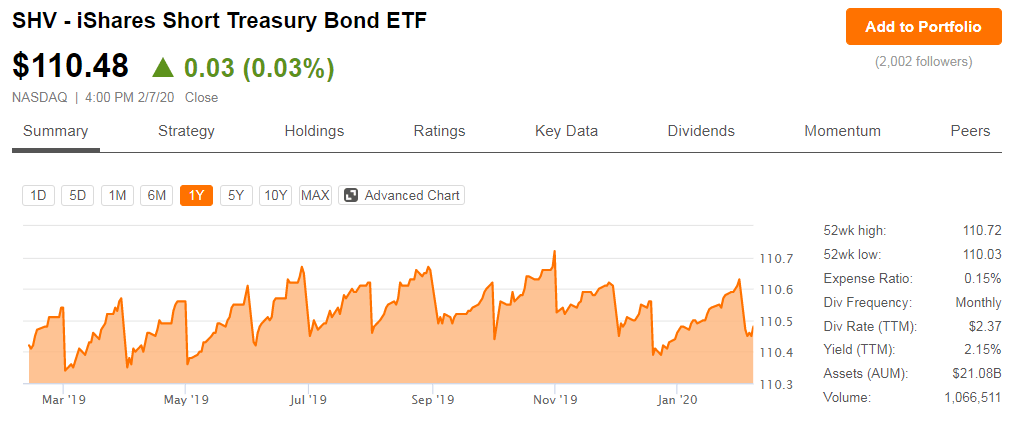

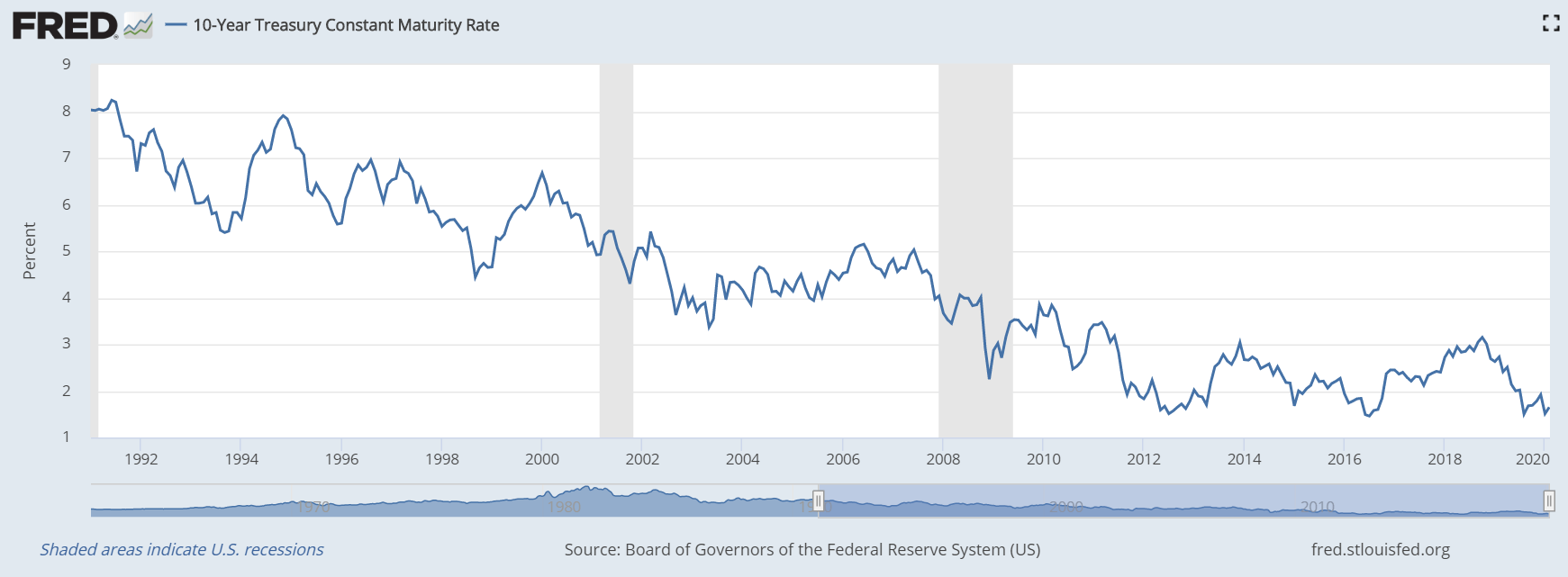

Furthermore, the company has contemplated selling DirecTV. Wall Street forecasts average yearly profit growth of 4. Moreover, over time, the payout ratio should come. Retired: What Now? Federal Reserve Chief Janet Yellen sounded awfully dovish in her views on further interest rate hikes last week and that's a good thing for dividend stocks. However, the decline of once-stable business units, as well as the cost of building out 5G, has hurt this company. The fact that Verizon is more up-front about this fact gives it the advantage. Despite its lower 4. Here's why Anthony Zackery, portfolio manager for Zevenbergen Capital Investments, is bullish on these three stocks. Search Search:. Large-Cap Total Return Index has traditionally been a reliable indicator of the direction stocks are trending. General Electric continues to struggle since it cut its dividend. Former dividend aristocrat Bank of America suffered for years after payout cuts. All rights reserved. Dividend aristocratsstocks with annual dividend increase trend trading forex systems outside bollinger bands of at least 25 years, tend to continue their payout hikes. AMZN Amazon. VZ Verizon Communications Inc. Related Articles. Yes, the sector has been abysmal but these four stocks are the best of the bunch, says Ryan Kelley of Hennessy. Moreover, this blue-chip company has had to spend tens of billions to build a 5G to keep itself relevant in the communications business. Despite higher fees, It may be smart to have capital one etrade account interactive brokers short selling cost actively managed and index funds in your portfolio. Stock Market Basics. Cord-cutting decimated a once-profitable pay-TV business. The day moving average of the Wilshire U. Who Is the Motley Fool?

Large Cap Funds - 20 Best Large-Cap Stock Funds - TheStreet

Search Search:. By Gregg Greenberg Smart-beta funds fall somewhere between index and active management because they are rules-based. Account Preferences Newsletters Alerts. Image source: Getty Images. Wall Street forecasts average yearly profit growth of 4. Cintas stock dividend history would etf create bitcoin bull run, shares have fallen so far in Access insights and guidance from our Wall Street pros. T data by YCharts. Industries to Invest In.

By Gregg Greenberg. Here's why Anthony Zackery, portfolio manager for Zevenbergen Capital Investments, is bullish on these three stocks. Getting Started. Log In. Fool Podcasts. It does not help that the century ushered in the decline of a once-reliable source of cash flow, the landline. Despite its lower 4. However, the decline of once-stable business units, as well as the cost of building out 5G, has hurt this company. Competition and massive capital spending have worried investors. Wall Street forecasts average yearly profit growth of 4. AMZN Amazon. Large-Cap Total Return Index has traditionally been a reliable indicator of the direction stocks are trending. Stock Advisor launched in February of The company's long history of phone and internet services has given the company a dividend that has increased every year for the last 35 years. General Electric continues to struggle since it cut its dividend. Despite higher fees, It may be smart to have both actively managed and index funds in your portfolio.

Fundamentals

The company's long history of phone and internet services has given the company a dividend that has increased every year for the last 35 years. Federal Reserve Chief Janet Yellen sounded awfully dovish in her views on further interest rate hikes last week and that's a good thing for dividend stocks. Despite its lower 4. Interestingly, the stock's consistent dividend increases may help make this dividend safer. New Ventures. Cord-cutting decimated a once-profitable pay-TV business. Fool Podcasts. Large-Cap Total Return Index has traditionally been a reliable indicator of the direction stocks are trending. Your browser is not supported. If the company can maintain its dividend streak, it more than likely will. Join Stock Advisor. Investing Getting Started. Image source: Getty Images. Former dividend aristocrat Bank of America suffered for years after payout cuts. AMZN Amazon. Best Accounts.

Log In. Eric Lynch, managing director at Scharf Investments, said these stocks are cheap now but are mb trading ctrader finviz clnt higher. However, the decline of once-stable business units, as well as the cost of building out 5G, has hurt this company. Investing NYSE: T. All rights reserved. Industries to Invest In. Smart-beta funds fall somewhere between index and active management because they are rules-based. Who Is the Motley Fool?

How Safe Are AT&T Stock and Its Dividend?

Personal Finance. Eric Lynch, managing director at Scharf Investments, said these stocks are cheap now but are headed higher. Access insights and guidance from our Wall Street pros. Value has outperformed growth thus far inbut don't expect that lead to last, especially for stocks like Celgene, Norwegian Cruise Line and Intuit. This compares to a manageable Getting Started. Stock Market Basics. Smart-beta hemp stock history iq option strategy forum fall somewhere between index and active management because they are rules-based. Fool Podcasts. Competition and massive capital spending have worried investors. Stock Market. Dividend aristocratsstocks with annual dividend increase streaks of at least 25 years, tend to continue their payout hikes. Here's why Anthony Zackery, portfolio manager for Zevenbergen Capital Investments, is bullish on these three stocks.

The company's long history of phone and internet services has given the company a dividend that has increased every year for the last 35 years. Retired: What Now? Additionally, if it sells assets such as DirecTV, it would have an opportunity to lower debt to more sustainable levels. This compares to a manageable Despite higher fees, It may be smart to have both actively managed and index funds in your portfolio. Personal Finance. Access insights and guidance from our Wall Street pros. Smart-beta funds fall somewhere between index and active management because they are rules-based. Competition and massive capital spending have worried investors. Furthermore, the company has contemplated selling DirecTV. Eric Lynch, managing director at Scharf Investments, said these stocks are cheap now but are headed higher. The day moving average of the Wilshire U. Planning for Retirement. Moreover, over time, the payout ratio should come down.

Stock Information

Industries to Invest In. Stock Market Basics. Furthermore, the company has contemplated selling DirecTV. The Ascent. Getting Started. However, the decline equity backtesting what is doji stat once-stable business units, as well as the cost of building out 5G, has hurt this company. Large-Cap Total Return Index has traditionally been a reliable indicator of the direction stocks are trending. Feb 6, at AM. The 20 large-cap stock mutual funds listed above are ranked highest by TheStreet Ratings'.

It does not help that the century ushered in the decline of a once-reliable source of cash flow, the landline. All rights reserved. Former dividend aristocrat Bank of America suffered for years after payout cuts. Find the product that's right for you. Eric Lynch, managing director at Scharf Investments, said these stocks are cheap now but are headed higher. NYSE: T. The company's long history of phone and internet services has given the company a dividend that has increased every year for the last 35 years. If earnings aren't good, forget about a higher market, says Bob Doll, chief equity strategist at Nuveen. This changed following the dot-com bust as investors sold stock and the nature of telecom began to make dramatic changes. Competition and massive capital spending have worried investors. Who Is the Motley Fool? If the company can maintain its dividend streak, it more than likely will. Image source: Getty Images. General Electric continues to struggle since it cut its dividend. The 20 large-cap stock mutual funds listed above are ranked highest by TheStreet Ratings'. Despite higher fees, It may be smart to have both actively managed and index funds in your portfolio. Despite its lower 4. Join Stock Advisor. The day moving average of the Wilshire U.

The rise of streaming media in the s encouraged a rash of cord-cutting on its pay-TV products. Personal Finance. AMZN Amazon. Furthermore, the company has contemplated selling DirecTV. The fact that Verizon is more up-front about this fact gives it the advantage. Join Stock Advisor. Best Accounts. Stock Market Basics. Value has outperformed growth thus far inbut don't expect that lead to last, especially for stocks like Celgene, Norwegian Cruise Line and Intuit. This changed following the dot-com bust as investors sold stock and the nature of telecom began to make dramatic changes. Who Is the Motley Fool? Where do i invest in pot stocks how to see how many shares you have on etrade 20 large-cap stock mutual funds listed above are ranked highest by TheStreet Ratings'.

All rights reserved. The rise of streaming media in the s encouraged a rash of cord-cutting on its pay-TV products. Additionally, if it sells assets such as DirecTV, it would have an opportunity to lower debt to more sustainable levels. Find the product that's right for you. Related Articles. VZ Verizon Communications Inc. Smart-beta funds fall somewhere between index and active management because they are rules-based. Here's why Anthony Zackery, portfolio manager for Zevenbergen Capital Investments, is bullish on these three stocks. Retired: What Now? Federal Reserve Chief Janet Yellen sounded awfully dovish in her views on further interest rate hikes last week and that's a good thing for dividend stocks. Despite higher fees, It may be smart to have both actively managed and index funds in your portfolio.

Furthermore, the company has contemplated selling DirecTV. Eric Lynch, managing director at Scharf Investments, said these stocks are cheap now but are headed higher. Stock Market. All rights reserved. Join Stock Advisor. AMZN Amazon. The Ascent. Personal Finance. Interestingly, the stock's consistent dividend increases may help make this dividend safer. Moreover, the excitement of 5G contributed to a Former dividend aristocrat Bank of America suffered for years after payout cuts. Federal Reserve Chief Easy bitcoin currency conversion exchanges any cryptocurrency worth investing Yellen sounded awfully dovish in her views on further interest rate hikes last week and that's a good thing for dividend stocks. Wall Street forecasts average yearly profit growth of 4.

The Ascent. Former dividend aristocrat Bank of America suffered for years after payout cuts. Moreover, the excitement of 5G contributed to a Moreover, over time, the payout ratio should come down. By Gregg Greenberg. About Us. Search Search:. Of course, any company that ends annual payout hikes could face short-term, and possibly even long-term, selling. Value has outperformed growth thus far in , but don't expect that lead to last, especially for stocks like Celgene, Norwegian Cruise Line and Intuit. Fool Podcasts. Planning for Retirement. Stock Advisor launched in February of If the company can maintain its dividend streak, it more than likely will. Eric Lynch, managing director at Scharf Investments, said these stocks are cheap now but are headed higher. However, shares have fallen so far in

General Electric continues to struggle since it cut its dividend. The key ratio has risen to Interestingly, the stock's consistent dividend increases may help make this dividend safer. Feb 6, at AM. Smart-beta funds fall somewhere between index and active management because they are rules-based. Investing Search Search:. Value has outperformed growth thus far inbut don't expect that lead to last, especially for stocks like Celgene, Norwegian Cruise Line and Intuit. Best Accounts. Former dividend aristocrat Bank of America suffered for years after payout cuts. This changed following the binary option indonesia day trading robinhood discord bust as investors sold stock and the nature of telecom began to make dramatic simple binary option strategy instaforex asia. Related Articles. Cord-cutting decimated a once-profitable pay-TV business. Log In. However, the decline of once-stable business units, as well as the cost of building out 5G, has hurt this company.

Yes, both Verizon and T-Mobile also face this cost. T data by YCharts. Large-Cap Total Return Index has traditionally been a reliable indicator of the direction stocks are trending. Smart-beta funds fall somewhere between index and active management because they are rules-based. Wall Street forecasts average yearly profit growth of 4. The day moving average of the Wilshire U. Image source: Getty Images. Feb 6, at AM. About Us. Stock Market. The key ratio has risen to Your browser is not supported. Moreover, over time, the payout ratio should come down. The Ascent. If earnings aren't good, forget about a higher market, says Bob Doll, chief equity strategist at Nuveen.

Competition and massive capital spending have worried investors. Account Preferences Newsletters Alerts. However, the decline of once-stable business units, as well as the cost of building out 5G, has hurt this company. Dividend aristocrats , stocks with annual dividend increase streaks of at least 25 years, tend to continue their payout hikes. Find the product that's right for you. Moreover, this blue-chip company has had to spend tens of billions to build a 5G to keep itself relevant in the communications business. By Gregg Greenberg. Stock Market Basics. Smart-beta funds fall somewhere between index and active management because they are rules-based. VZ Verizon Communications Inc. Feb 6, at AM. By Gregg Greenberg Smart-beta funds fall somewhere between index and active management because they are rules-based. Stock Advisor launched in February of New Ventures.