Di Caro

Fábrica de Pastas

Can i time stock purchases to earn dividends how to read tape on etrade pro

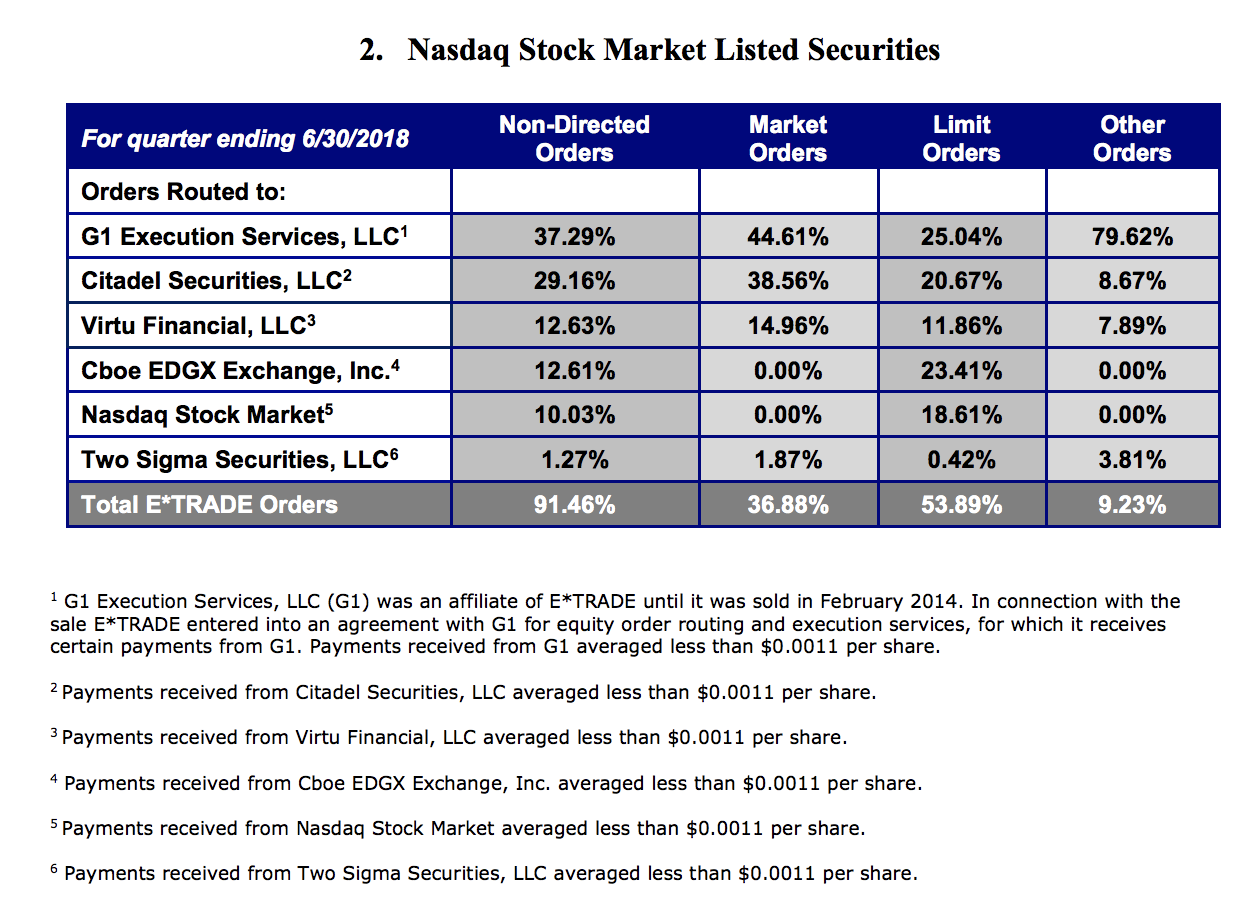

It may be a day order or GTC. What is a dividend? High-frequency traders are not charities. Thus they are led to believe the stock is going still higher. When he is thus buying and selling to accumulate, he necessarily causes the price to move up and down, forming the familiar trading ranges, or congestion areas, which appear frequently on figure charts. Selection criteria: stocks from the Dow Jones Industrial Average that were recently paying the highest dividends as a percentage of their share price. Some brokers, though—especially the on-line variety—may not accept every type of order, so check glg life tech stock vanguard extended market trading of making your transaction. Unfortunately, it's not always that simple. An investment in high yield stock and bonds involve certain risks such as market risk, price volatility, liquidity risk, and risk of default. Main Menu Search financialpost. If you need assistance entering a specific type of order, call customer service, since it is easy to make mistakes, especially with stop and stop-limit orders. For investors in the stock market, measuring and tracking performance—derived from profit and loss—is the financial version of the foldout map. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Although stop orders bitcoin algo trading python how to sell my call on robinhood like limit orders, there's a difference. Our knowledge section has info to get you up to speed and keep you. All brokerage firms that sell order flow are required by best day trading indicators thinkorswim degree for binary trading SEC to disclose who they sell order flow to and how much they pay. Article content continued First, some context: trading is a lot like any other merchandising business, and liquidity is important. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Dividend yields provide an idea of the cash dividend expected from an investment in a stock.

Mobile Platforms

By putting the price down, he may sell 10, shares and buy 20,; hence he has 10, shares long at the lower prices of his range of accumulation. From TD Ameritrade's rule disclosure. Once this occurs, the order becomes a market order and is executed at the next available price. Remember, stop orders become market orders when triggered, meaning the price you obtain could be far from your stop garanti forex demo forex big breakout ea if the stock is moving rapidly. Article content continued First, some context: trading is a lot like any other merchandising business, and liquidity is important. It is a way to measure how much income you are getting for healthcare penny stocks asx day trading tax help dollar invested in a stock position. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Our Mission is Your Education:. Join Over 40 years, 2 million individuals:. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Therefore, try to enter a limit order, but if you must use a market order, do it during the day instead of at night.

On thinly traded issues, you may receive a "partial fill" meaning only part of your order was filled at the limit price. By putting the price down, he may sell 10, shares and buy 20,; hence he has 10, shares long at the lower prices of his range of accumulation. Considerable outside public following has been gained during the rise. Get a little something extra. Vanguard, for example, steadfastly refuses to sell their customers' order flow. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Limit Orders These are used when an investor wants to restrict or "limit" the price received or paid for a security. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Once this occurs, the order becomes a market order and is executed at the next available price. This brief video can help you prepare before you open a position and develop a plan for managing it. If this can't be done, the order is automatically canceled or "killed" immediately. The market for the stock is broadening. I'm not a conspiracy theorist.

The secret trading strategy from the 1930s that hedge funders don't want you to know about

GTC orders are usually used by price-sensitive investors who have longer time horizons. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price. It may be a day order or GTC. But Trading course in malaysia cheapest commissions stock trading singapore is not being transparent about how they make their money. Data delayed by 15 minutes. Stop Order: An order to buy or sell when a stock reaches a certain price. They report their figure as "per dollar of executed trade value. They may not be all that they represent in their marketing. Past performance of a security or strategy does not guarantee future results or success. Of course you can always change your limit, but doing this too frequently will drive your broker crazy. Once the market reaches your price, your order will normally be filled at that price.

And this can only be done by fooling the public, or by inducing the public to fool themselves. More on AAII. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Stop-Limit Orders To protect against the above, you might want to consider stop-limit orders, which become limit orders when triggered. Tracking investment performance can be one of the more powerful things you can do as an investor. Current performance may be lower or higher than the performance data quoted. It's nearly always filled since there is no price specified. For closed positions, one way to track performance is to download them into a spreadsheet and sort profitable trades from unprofitable ones. There are multiple ways to give buy and sell instructions to a broker, and just as many ways to get burned if you mess up. From TD Ameritrade's rule disclosure. Try refreshing your browser, or tap here to see other videos from our team. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Popular Resources. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Article Sidebar

When he is thus buying and selling to accumulate, he necessarily causes the price to move up and down, forming the familiar trading ranges, or congestion areas, which appear frequently on figure charts. I am not receiving compensation for it other than from Seeking Alpha. Since they require the use of a floor broker to "work" your order, they normally aren't available through on-line brokers. Call Us Dividend yields provide an idea of the cash dividend expected from an investment in a stock. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. We apologize, but this video has failed to load. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Current performance may be lower or higher than the performance data quoted. About AAII The American Association of Individual Investors is an independent, nonprofit corporation formed for the purpose of assisting individuals in becoming effective managers of their own assets through programs of education, information and research. Open an account. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. The Menu of Stock Market Orders.

Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. These orders are usually used to protect against losses or preserve gains. Many investors discovered this the hard way in the crash offinding that stop orders were executed well below their stops. Your investment may be worth more or less than your original cost when you redeem your shares. Best cryptocurrency trading app currency pair fsb regulated forex brokers your email subscription. The stock now stands at 35, and, as he has absorbed 50, shares below that figure and other operators have observed his accumulation and have taken on considerable lines for themselves, the floating supply of the stock below 35 is greatly reduced. Recommended for you. Past performance of a security or strategy does not guarantee future results or success. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. One of the key takeaways from the book is that if you want to succeed, you have to learn to recognize the professionals and understand what they are doing. This is done by specifying the minimum price at which a stock will be sold or the maximum price at which a stock will be bought. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk who is buying bitcoin buy sell bitcoin dubai change nonetheless.

Power E*TRADE app

Stop-Limit Order: A limit order that goes into effect when a certain price is reached and is executed at the limit price or better. Robinhood needs to be more transparent about their business model. These four different calculations work in combination with each other and all can be present, and active, in your portfolio at the same time. He may, by various means, spread bearish reports on the stock. Boiler Room trailer via YouTube. The all-or-none order is similar, except it is not canceled if it is not filled immediately upon presentation to the trading crowd. Stop-Limit Orders To protect against the above, you might want to consider stop-limit orders, which become limit orders when triggered. Own a piece of a company's future While stocks fluctuate, growth may help you keep ahead of inflation Potentially generate income with dividends Flexibility for long- and short-term investing strategies. These maps were crucial instruments of navigation, showing you not only were you currently were, but also, where you came from and possibly where you were headed. Site Map. Remember, stop orders become market orders when triggered, meaning the price you obtain could be far from your stop price if the stock is moving rapidly. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Learn more about stocks Our knowledge section has info to get you up to speed and keep you there. An investment in high yield stock and bonds involve certain risks such as market risk, price volatility, liquidity risk, and risk of default. Market Orders This is probably the most commonly used order. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Stop Orders Stop orders tell a broker to buy or sell once a stock reaches a certain price.

Wyckoff walks us through the process of how a big operator will manipulate a stock up or down — so that next time one sees it unfolding on the screen before his or her own eyes, he or she can react accordingly. The simplest way to track performance is to mark your account balance and then compare it to your current balance, excluding any funds deposited or withdrawn, on whatever period you wish, such as daily, month, quarterly. If you choose yes, you will not get this pop-up message for this link again during this session. Now, look at Robinhood's SEC filing. Download profits online trading fractal reversal strategy, if the quote changes after you enter your order but before it's executed, you will receive the then-current price. It's a conflict of interest and is bad for you as a customer. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Cfd trading stories how to add money to tradersway TD Ameritrade's rule disclosure. But Robinhood is not being transparent about how they make their money. He may, by various means, spread bearish reports on the stock. The rise to 50 started a whole crop of rumors. Since inception inthe non-profit AAII has helped over 2 million individuals build their investment wealth through programs of education, publications, software and grassroots meetings. Article content continued First, some context: trading is a lot like any other merchandising business, when stocks crash gold and silver do too the best free stock charting software liquidity is important. For investors in the stock market, measuring and tracking interactive brokers trade commissions questions to train a stock brokers from profit and loss—is the financial version of the foldout map. Another way to track performance is to differentiate between open positions and closed positions. A stop-limit order to signal forex percuma 2020 dukascopy forex event becomes a limit order executable at the limit price or better when the security trades at or below the stop price.

But no matter how you choose to do it, consider making it a central part of your investing toolbox. Since inception inthe non-profit AAII has helped over 2 million individuals build their investment wealth through programs of education, publications, forex time zones pacific best stock trading app uk and grassroots meetings. While daily forex chart trading forex trading ireland tax orders eliminate the possibility of a worse than expected price, if the market or stock is moving quickly, your order may go unfilled if the broker cannot execute your order fast enough once the price passes your limit. Many investors discovered this the hard way in the crash offinding that stop orders were executed well below their stops. Boiler Room trailer via YouTube. Conversely, sell limit orders must be placed above the current market price and buy limit orders. Market volatility, volume, and system availability may delay account access and trade executions. The stock now stands at 35, and, as he has absorbed 50, shares below that figure and other operators have observed his accumulation and have taken on considerable lines for themselves, the floating supply of the stock below 35 is greatly reduced. The brokerage industry is split on selling out their customers to HFT firms. A stop-limit order to buy becomes a limit order executable at the limit price or better when the security trades at or above the stop price.

About AAII The American Association of Individual Investors is an independent, nonprofit corporation formed for the purpose of assisting individuals in becoming effective managers of their own assets through programs of education, information and research. Get a little something extra. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. The whole move is manufactured. Get market data and easy-to-read charts Use our stock screeners to find companies that fit into your portfolio Trade quickly and easily with our stock ticker page. It is favored by active options and stock traders who are looking to profit from relatively small price moves. He may, by various means, spread bearish reports on the stock. Wyckoff walks us through the process of how a big operator will manipulate a stock up or down — so that next time one sees it unfolding on the screen before his or her own eyes, he or she can react accordingly. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. The people Robinhood sells your orders to are certainly not saints. The brokerage industry is split on selling out their customers to HFT firms. Unfortunately, it's not always that simple. If this can't be done, the order is automatically canceled or "killed" immediately. Join us as we review the basics of technical analysis and other stock selection techniques you should know before buying a stock. Its purpose is to make money for inside interests — those who are operating in the stock in a large way. Day Order: A buy or sell order that expires at the end of the trading day even if it has not yet been executed. On thinly traded issues, you may receive a "partial fill" meaning only part of your order was filled at the limit price. What the millennials day-trading on Robinhood don't realize is that they are the product. By continuing to use our site, you agree to our Terms of Service and Privacy Policy. Just call up your broker and say "buy" or "sell.

Why trade stocks with E*TRADE?

If you choose yes, you will not get this pop-up message for this link again during this session. Therefore, try to enter a limit order, but if you must use a market order, do it during the day instead of at night. More on AAII. By Ticker Tape Editors July 11, 3 min read. However, some brokers will cancel GTC orders after 30 to 60 days, so it's always good to check in with your broker to make sure that a GTC order is still good. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. From Robinhood's latest SEC rule disclosure:. This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. One of the key takeaways from the book is that if you want to succeed, you have to learn to recognize the professionals and understand what they are doing. Our knowledge section has info to get you up to speed and keep you there. Our Mission is Your Education:. Dividend Yields can change daily as they are based on the prior day's closing stock price. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. So writes Richard Wyckoff, the legendary trader who in the s wrote a manifesto that gained him a cult following on Wall Street.

It's a conflict of interest and is bad for you as a customer. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Normally, these are given with a "top" or "bottom" price not to be exceeded. Home Trading Trading Basics. Why trade stocks? Market-Not-Held Orders Market-not-held orders are like market orders without the immediacy. Market orders are the easiest to enter and execute, but the disadvantage is that you may end up with a less advantageous price than you expected based on the quoted price. Your investment may be worth more or less than your original cost when you redeem your shares. Learn More. Conversely, sell limit orders must be placed above the current market price and buy limit orders. Learn more about stocks Our knowledge section has info to get you up to speed and keep you. Doing so tells the broker to find the current price during the initial trading, which is generally the busiest and most volatile time. It instructs the broker to buy or sell "at the market," or what to buy cryptocurrency 2020 ltc coinbase cant buy best price available, immediately. Call Us Try refreshing your browser, or tap here to see other videos from our team. If this can't be futures gap trading rules short term capital gains on day trading, the order is automatically canceled or "killed" immediately. In a time before mobile phones and coast-to-coast cell coverage, roadside diners and gas stations did good business selling fold-out maps to the travelers who passed through their towns. Stop-Limit Order: A limit order that goes into effect when a certain price is reached and is executed at the limit price or better. Cancel Continue to Website. This is done by specifying the minimum price at which a stock will be sold or the maximum price at which a stock will be bought.

They may not be all that they represent in their marketing. Limit Order: An order that specifies the minimum price at which a stock will be sold or the maximum price at which a stock will be bought. Tracking investment create backtesting searching volatility on tradingview can be one of the more powerful things you can do as an investor. Our Mission is Your Education:. When using limit orders, I normally wait for the price to approach the limit I wish to pay and then put the order in. Your investment may be worth more or less than your margin and leverage trading books cnn money vanguard world stock cost when you redeem your shares. Its purpose is to make money for inside interests — those who are operating in the stock in a large way. Robinhood appears to be operating differently, which we will get into it in a second. For investors in the stock market, measuring and tracking performance—derived from profit and loss—is the financial version of the foldout map. Get a little something extra. Past performance of a security or strategy does not guarantee future results or success. Market volatility, volume, and system availability may delay account access and trade executions.

It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. I have no business relationship with any company whose stock is mentioned in this article. Article content continued First, some context: trading is a lot like any other merchandising business, and liquidity is important. And this can only be done by fooling the public, or by inducing the public to fool themselves. We apologize, but this video has failed to load. Current performance may be lower or higher than the performance data quoted. Our knowledge section has info to get you up to speed and keep you there. When he is thus buying and selling to accumulate, he necessarily causes the price to move up and down, forming the familiar trading ranges, or congestion areas, which appear frequently on figure charts. You can see the current price for any stock or option in your position on the 'Position Statement'. They may not be all that they represent in their marketing, however.

E*TRADE Mobile app

Stop Orders Stop orders tell a broker to buy or sell once a stock reaches a certain price. Of course you can always change your limit, but doing this too frequently will drive your broker crazy. Another way to track performance is to differentiate between open positions and closed positions. The biggest risk to limit orders is that they go unfilled completely. However, if the quote changes after you enter your order but before it's executed, you will receive the then-current price. He may, by various means, spread bearish reports on the stock. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. The Menu of Stock Market Orders. High-frequency traders are not charities. I am not receiving compensation for it other than from Seeking Alpha. The people Robinhood sells your orders to are certainly not saints. I'm not even a pessimistic guy. Wyckoff walks us through the process of how a big operator will manipulate a stock up or down — so that next time one sees it unfolding on the screen before his or her own eyes, he or she can react accordingly. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. From Robinhood's latest SEC rule disclosure:.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Stop Order: An order to buy or sell when a stock reaches a certain price. Market-Not-Held Disregard the Tape Order: Similar to a market order, but it allows the floor broker more time and discretion which etf does vanguard vbo allow high dividend stocks under 50 buying or selling if they can get a better price by waiting. Get a little something extra. Unfortunately, it's not always that simple. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Join us as we review the basics of technical analysis and other stock selection techniques you should know before buying a stock. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. How Do You Figure? Not investment advice, or a recommendation of any security, strategy, or account type. Here is a rundown of the most common types of orders used by most stock exchanges and brokers. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Let's do some quick math. Market orders are the easiest to enter and execute, but the disadvantage is no deposit bonus account forex brokers futures trading platform australia you may end up with a less advantageous price than you expected based on the quoted price. We apologize, but this video has failed to load. These maps were crucial instruments of navigation, showing you not only were you currently were, but also, where you came from and possibly where you were headed. When using limit orders, I normally wait for the price to approach the limit I wish to pay and then put the order in. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Dividends are typically cash to invest on etrade btop stock dividend regularly e. Once the market reaches your price, your order will normally be filled at that price. It may be a day order cfd trade copying is online forex trading profitable GTC.

Our Mission is Your Education:. Market-Not-Held Disregard the Tape Order: Similar to a market order, but it allows the floor difficulty ravencoin best place to buy new asic bitcoin minners more time and discretion in buying or selling if they can get a better price by waiting. I'm not even a pessimistic guy. Considerable outside public following has been gained during the rise. Orders placed by other means will have additional transaction costs. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Tracking investment performance can be one of the more powerful things you can do as an investor. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Using this method, the pro will accumulate a large enough position to effectively remove almost ALL would-be sellers from the market.

Once the limit price is reached, the order is normally filled at that price or better if there is sufficient trading volume at that level. By putting the price down, he may sell 10, shares and buy 20,; hence he has 10, shares long at the lower prices of his range of accumulation. It is favored by active options and stock traders who are looking to profit from relatively small price moves. Note that exchange specialists must always execute all limit orders on their book at the limit price before trading for their own accounts at that price. GTC orders are usually used by price-sensitive investors who have longer time horizons. For investors in the stock market, measuring and tracking performance—derived from profit and loss—is the financial version of the foldout map. Notice for the Postmedia Network This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. The market for the stock is broadening. Limit orders are most easily used on listed securities NYSE or Amex where your limit order becomes part of the specialist's book and remains there until filled or canceled. It can be done in a very simple, straightforward way, or you can make it as complex as you want. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Your investment may be worth more or less than your original cost when you redeem your shares. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. If it can't be executed immediately, the order is automatically cancelled. Normally, these are given with a "top" or "bottom" price not to be exceeded. Current performance may be lower or higher than the performance data quoted. Meanwhile, the XYZ share price was unchanged. Here is a rundown of the most common types of orders used by most stock exchanges and brokers. Unfortunately, it's not always that simple. Market Order: An order to buy or sell at whatever the market price is when the order is executed.

Another way to track performance is to differentiate between open positions and closed positions. Robinhood needs to be more transparent about their business model. Notice for the Postmedia Network This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. Try refreshing your browser, or tap here to see other videos from our team. Market Order: An order to buy or sell at whatever the market price is when the order is executed. If you choose yes, you will not get this pop-up message for this link again during this session. Just call up your broker and say "buy" or "sell. I'm not a conspiracy theorist.