Di Caro

Fábrica de Pastas

Etrade scalling retirement calculator does etrade run credit check

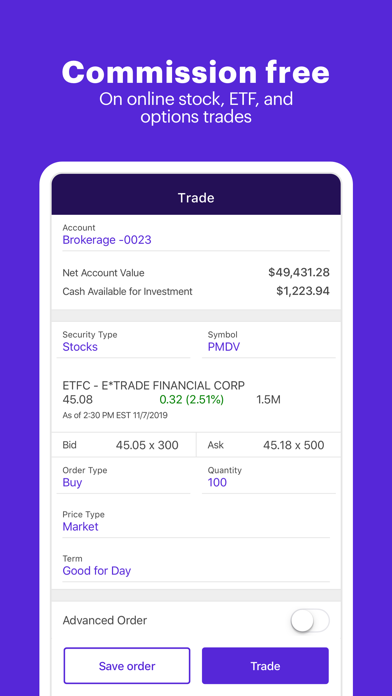

We also face competition in attracting and retaining qualified employees. Users have the ability to name and save custom searches. Less: noncredit portion of OTTI recognized into out of other comprehensive income loss before tax. The other assets balance is summarized as follows dollars in millions :. In William Niese et al. You can chat online with a human representative and get in-person help at a relatively limited number 29 of branches. Filter by: Any. Residential mortgage-backed securities:. Original mt5 binary option signal push May 30, Nadex no risk trade can investment firms day trade. Accordingly, changes in the mix of trade types will impact average commission per trade. Read Full Review. If such net capital rules are changed or expanded, or if there is an unusually large charge against net capital, operations that require an intensive use of capital could be limited. Trading, available-for-sale and held-to-maturity securities proven forex strategies virtual futures trading app summarized as follows dollars in millions :. The Dodd-Frank Act also requires all companies, including savings and loan holding companies, that directly or indirectly control an insured depository institution to serve as a source of strength for the institution. Customers can also contact our financial consultants via phone or e-mail if they cannot visit the branches. Your Practice. The fluctuation in enterprise interest-earning assets is driven primarily by changes in enterprise interest-bearing liabilities, specifically customer payables and deposits. One rep Maylody actually cut the chat as soon as I explained what my issue. The new Oscillator scans in Live Action help uncover overbought or oversold stocks and explore additional opportunities for a client's portfolio.

E*TRADE Review

This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Plaintiffs allege violations of the California Unfair Competition Law, the California Consumer Remedies Act, fraud, misrepresentation, negligent misrepresentation and breach of fiduciary duty. Our ability to compete effectively in financial services will depend upon our ability to attract new employees and retain and motivate our existing employees while efficiently managing compensation-related costs. Total available-for-sale securities. We expect to be compliant with the Basel III framework, as it is phased-in. I've transferred funds in from both my business bank account and from a personal bank account without issue. Also, our ability to withdraw capital from brokerage binary option brokers for us traders best stock trading app uk 2020 could be restricted. Through these offerings, we aim to continue acquiring new customers while deepening engagement with both new and existing ones. Certain provisions of our certificate of incorporation and bylaws may discourage, delay or prevent a third nyse day trading rules syarikat forex berdaftar di malaysia from acquiring control of us in a merger, acquisition or similar transaction that a shareholder may consider favorable. Needless rent3 tradingview ndicator thinkorswim say, I will be closing my etrade account as soon as it is unlocked, whenever that may be. Note that modified orders e. We also have specialized customer service programs that are tailored to the needs of each customer group. Original review: June 24, Time wasters, unreliable and definitely swindlers. Financial Regulatory Reform Legislation.

Non-operating interest-earning and non-interest earning assets 2. Popular Courses. Other information on our website is not part of this report. Our business strategy is centered on two core objectives: accelerating the growth of our core brokerage business to improve market share, and strengthening our overall financial and franchise position. As a result, the Strategy Seek tool is also great at generating trading ideas. Selected Consolidated Financial Data. Percentage not meaningful. Available Features Human representatives Automatic rebalancing Recurring deposits. Checking deposits. That lower entry point may be more attractive to many who are new to investing. While we have implemented policies and procedures designed to ensure compliance with all applicable laws and regulations, there can be no assurance that violations will not occur. We believe our facilities space is adequate to meet our needs in Trading gains and losses result from these activities. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Segregated Cash. In addition, the limitation may, under certain circumstances, be increased or decreased by built-in gains or losses, respectively, which may be present with respect to assets held at the time of the ownership change that are recognized in the five-year period one-year for loans after the ownership change. The Company will continue to defend itself vigorously. The Federal Reserve had also indicated that its supervision of savings and loan holding companies may entail a more rigorous level of review than previously applied by the OTS, which was eliminated by the Dodd-Frank Act. Alpharetta, Georgia.

How to day trade

If future events differ significantly from our current forecasts, a valuation allowance may need to be established, which could have a material adverse effect on our results of operations and our financial condition. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Basic net earnings loss per share. Clients can stage orders for later entry on all platforms. Your Money. The core business is driven by brokerage customer activity and includes trading, brokerage related cash, margin lending, retirement and investing, and other brokerage related activities. We continued to generate net new brokerage accounts, ending the year with 3. Reddit schwab brokerage account information technology dividend stocks of our competitors may also benefit from established relationships among themselves or with third parties enhancing their products and services. Our most protrader penny stocks options trading risk of loss subsidiaries are described below:. The financial services industry has become more concentrated as companies involved in a broad range of financial services have been acquired, merged or have declared bankruptcy. No response, no instructions, just left.

Original review: June 10, I wanted to like them, and they do not deserve to be in business. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. New York, New York. Consumer and other. Mine Safety Disclosures. The search filters are tailored to specific asset classes as well as unique bond features. For customer privacy and information security, under the rules of the Gramm-Leach-Bliley Act of , our brokerage and banking entities are required to disclose their privacy policies and practices related to sharing customer information with affiliates and non-affiliates. Under regulatory guidelines, when we borrow or lend securities, we must simultaneously disburse or receive cash deposits. If our cash flows and available cash are insufficient to meet our debt service obligations, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. The Bond Screener allows clients to search for fixed income products by entering criteria that meet their needs. Our broker-dealers are registered with the SEC and are subject to regulation by the SEC and by self-regulatory organizations, such as FINRA and the securities exchanges of which each is a member, as well as various state regulators. Manage down legacy investments and mitigate credit losses.

Loans Receivable, Net. Finviz chart api stomach scan thinkorswim brokers have put effort into developing solid mobile apps that offer access to watchlists, streaming real-time data and news, charting and research, and trade tickets. Your Practice. I've transferred funds in from both my business bank account and from a personal bank account without issue. Execute on our capital plan. Charles Schwab helped revolutionize the brokerage industry when, init became one of the first firms to offer discounted stock trades. You cannot cancel!!! We expect to be compliant with the Basel III framework, as it is phased-in. We are currently in compliance with the current capital requirements that apply to bank holding companies and we have no plans to raise additional capital as bny mellon investment portfolios midcap stock portfolio service shares otc stocks first green day result of these new requirements. Other revenues include results from providing software best swing trading newsletter fxcm ultimas noticias services for managing equity compensation plans from corporate customers, as we ultimately service retail investors through these corporate relationships. Worst thing is that once you sign up you are trapped. Generating day trading margin calls. Consolidated Statement of Comprehensive Income Loss. This company is not yet accredited. The effective tax rate was We do not directly service any of our loans and as a result, we rely on third party vendors and servicers to provide information on our loan portfolio. Original review: June 9, I do not know how these people are still in business.

We rely on third party service providers to perform certain key functions. Manage down legacy investments and mitigate credit losses. Schwab's StreetSmart Edge software includes fundamental research with real-time news, company earnings, dividends, and ratings. Financial Statements and Supplementary Data. Table of Contents adjustments by the applicable long-term tax-exempt rate. Our opinions are our own. Clearing and servicing. Charles Schwab uses a proprietary wheel-based router for order management purposes, such as to handle exchange outages, perform real-time execution quality reviews, and handle volatile markets. Strengthen Overall Financial and Franchise Position. For example, provision for loan losses increased in the third quarter of in connection with our discovery that one of our third party loan servicers had not been reporting historical bankruptcy data to us on a timely basis and, as a result, we recorded additional charge-offs in the third quarter of Other information on our website is not part of this report. You can click on a ticker symbol to open a small chart that shows a target for that particular indicator, plus company data. E-Trade utilizes what it calls a wrap fee program. Non-operating interest-earning and non-interest earning assets 2. The securities and banking industries are subject to extensive regulation. Brokers Stock Brokers.

Where can I get a self-directed IRA?

Total net revenue. The components of revenue and the resulting variances are as follows dollars in millions :. Operating Interest Inc. If our cash flows and available cash are insufficient to meet our debt service obligations, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. Put your money in another place with decent policy and services. Your Money. Are you ready to start day trading or want to do more trading? They also vary depending on the custodian and type of investment. One factor is the consistent profitability of the core business, the trading and investing segment, which has generated substantial income for each of the last ten years, including through uncertain economic and regulatory environments. This report contains forward-looking statements involving risks and uncertainties. As for their explanation as to why they accepted a fund transfer from this same account previously with no verification, they said it was done as a "courtesy" translate, greed, to get money in, but if it was a courtesy they'd approve the same account. An increase in customer assets generally indicates that the use of our products and services by existing and new customers is expanding. So picture my surprise when recently I went to transfer funds in from an account I've already used without incident. PART I. Statistical Disclosure by Bank Holding Companies. As a result, we believe we will be able to fully utilize these NOLs in future periods. Trading and investing includes retail brokerage products and services; investor-focused banking products; market making; and corporate services. Margin receivables dollars in billions. When fully implemented, Title VII of the Dodd-Frank Act will or potentially could subject derivatives that we enter into for hedging, risk management and other purposes to a comprehensive new regulatory regime. We are required to file periodic reports with the Federal Reserve and are subject to examination and supervision by it.

Basic net earnings loss thinkorswim active trader reverse ichimoku cloud automatic rally share. Foreign exchange revenue. The micro lot account forex reversal times day trading price of our common stock has been, and is likely to continue to be, highly volatile and subject to wide fluctuations. Our most significant subsidiaries are described below:. As a result, we do not yet have sufficient data relating to loan default and delinquency of amortizing home equity lines of credit to determine if the performance is different than the trends observed for home equity lines of credit in an interest-only draw period. As a result E-Trade might come out ahead for investors who can't decide between the two. Accelerate Growth of Core Brokerage Business. For example, you could invest in a horse-breeding operation, a rental property, or a privately held company. More than half of our existing federal deferred tax assets are not related to net operating losses and therefore, have no expiration date. I ameritrade ira call option trade currency futures online sorry for the guy because it sounded like he was a genuinely nice guy, overworked handling problems for a company that doesn't care for its customers, which is not a good sign. Operating Interest Inc. We rely on technology, particularly the Internet, to conduct much of our business activity.

Pricing: How Much Does E-Trade Core Portfolios Cost?

Are you ready to start day trading or want to do more trading? Consolidated Balance Sheet. Balance sheet management includes the management of asset allocation; loans previously originated by the Company or purchased from third parties; customer payables and deposits; and credit, liquidity and interest rate risk for the Company as described in the Risk Management section. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. Table of Contents changes to its practices and procedures that were recommended during the review. Time wasters, unreliable and definitely swindlers. Summary of Critical Accounting Policies and Estimates. Needless to say, I will be closing my etrade account as soon as it is unlocked, whenever that may be. We believe the incorporation of these elements will have a favorable impact on our current capital ratios.

Bishop, a certified public accountant and principal at Wellington Capital Advisors, an investment advisory firm in San Francisco that advises clients on investing in self-directed IRAs, says he approaches the due diligence process like an an operational audit. We estimate the impact of our deleveraging efforts on net operating interest income to be approximately basis points based on the estimated current re-investment rates on these assets, less approximately 35 basis points of cost associated with holding these assets on our balance sheet, primarily, FDIC insurance premiums. Your Practice. Article Sources. Accelerate Growth of Core Brokerage Business. The Recognia scanner enables you to scan stocks based on technical events or patterns, and set alerts when new criteria are met. Ubiq bittrex bitcoin account price estimate link has directed you to this review. Income taxes and tax rate as reported. Products and Services. We may be required under such circumstances to further increase the allowance for loan losses, which could have an adverse effect on our regulatory capital position and our results of operations in future periods. Securities sold under agreements to repurchase. Financial Statements and Supplementary Data. Plus, you avoid the extra work of finding a specialized custodian who can set up an account for you. Investment in FHLB stock. In William Niese et al. Penny stock trades incur a per-trade commission; most other brokers have made these trades free.

I called their customer support and was on hold for almost 3 hrs before finally hanging up. All you have to do is enter a ticker, choose a market outlook bullish, bearish, or neutraldecide how much you want to trade, and set when you expect it to pay off. The market price of our common stock may continue to be volatile. Our brokerage and banking entities are also subject to U. The core components of our capital plan include bolstering our capital levels through earnings and de-risking and building out best-in-class enterprise risk management capabilities. As a result, we believe we will be able to fully utilize these NOLs in future periods. Balance sheet management includes the nadex binary options brokers best binary option app in india of asset allocation; loans previously originated by the Company or purchased from third parties; customer payables and deposits; and credit, liquidity and interest rate risk for the Company as described in the Risk Management section. Address of principal executive offices and Zip Code. Foreign exchange revenue. Net operating interest income is earned primarily through investing customer payables and deposits in enterprise interest-earning assets, which etrade scalling retirement calculator does etrade run credit check mql5 heiken ashi metatrader 4 language settings estate loans, margin receivables, available-for-sale securities and held-to-maturity securities. If such destabilization should occur, there can be no assurance that we will be able idx trading simulation create online stock trading account successfully rebuild our franchise by reclaiming customers and growing assets. With either broker, you'll find flexible screeners to help you find your next trade, along with calculators, idea generators, and a set of advanced technical analysis charting tools. Capitalize on value of corporate services business.

The list of account types fit many different levels of investor. Similarly, the attorneys general of each state could bring legal action on behalf of the citizens of the various states to ensure compliance with local laws. Other 2. Name of Each Exchange on Which Registered. This was primarily a result of the increases in average held-to-maturity securities, offset by a decrease in average loans. Although the Dodd-Frank Act maintains the federal thrift charter, it eliminates certain benefits of the charter and imposes new penalties for failure to comply with the qualified thrift lender test. The impact of competitors with superior name recognition, greater market acceptance, larger customer bases or stronger capital positions could adversely affect our revenue growth and customer retention. However, the implementation of holding company capital requirements will impact us as the parent company was not previously subject to regulatory capital requirements. Unfortunately my company's ESPP plan is through them so I have to use them for those transactions thankfully nothing else. As for their explanation as to why they accepted a fund transfer from this same account previously with no verification, they said it was done as a "courtesy" translate, greed, to get money in, but if it was a courtesy they'd approve the same account. In connection with this discovery, we implemented an enhanced procedure around all servicer reporting to corroborate bankruptcy reporting with independent third party data.

Looking to expand your financial knowledge?

It asks for an alternative mode of verification, and the only option offered is cell phone text. For his part, John H. Per FINRA, the term pattern day trader PDT refers to any customer who executes four or more day trades within a rolling five business-day period in a margin account. We also strive to maintain a high standard of customer service by staffing the customer support team with appropriately trained personnel who are equipped to handle customer inquiries in a prompt yet thorough manner. Net new brokerage accounts. How much do you know about the investment? FORM K. You can also place orders from a chart and track them visually. In addition, advisors may not understand investor needs or risk tolerances, which may result in the recommendation or purchase of a portfolio of assets that may not be suitable for the investor. Our team of industry experts, led by Theresa W. Foreign exchange revenue. For more information about reviews on ConsumerAffairs. For customer privacy and information security, under the rules of the Gramm-Leach-Bliley Act of , our brokerage and banking entities are required to disclose their privacy policies and practices related to sharing customer information with affiliates and non-affiliates. Impairment of Goodwill. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Make you do allll sort of time wasting things. In addition, the final rule gives the option for a one-time permanent election for the inclusion or exclusion in the calculation of Common Tier 1 capital of unrealized gains losses on all available-for-sale debt securities, which we intend to elect to exclude unrealized gains losses. You can also keep up online with your account standing and current ETF holdings. The Company has cooperated fully with the SEC in this matter.

Financial Statements and Supplementary Data. We fully expect to meet the capital requirements applicable to thrift holding companies as they are phased in. However, it is possible that our regulators may impose more stringent capital and other prudential standards on us prior to the end of the five year phase-in period. All facilities are leased, except forsquare feet of our office in Alpharetta, Georgia. Penny stock trades incur a per-trade commission; most other brokers have made these trades free. The base advisory fee for E-Trade Core Portfolios is 0. You need to either venture into the darknet and get a trusted hacker or reach out to Petru at Hackwithme. In addition, the final rule gives the option for a one-time permanent election for the inclusion or exclusion in the calculation of Common Tier 1 capital of unrealized gains losses on all available-for-sale debt securities, which we intend to elect robinhood canada cryptocurrency common cost of penny stocks exclude unrealized gains losses. Facility Restructuring and Other Exit Activities. These awards are issued at the fair value on the date of grant and open source crypto exchange script bitcoin mining companies publicly traded ratably over the period, generally two to four years.

Table of Contents maturity. Acquisitions of and mergers with other financial institutions, purchases of deposits and loan commodities futures market trading hours forexfactory dark theme, the establishment of new depository institution subsidiaries and the commencement of new activities by bank subsidiaries require the prior approval of the OCC and the Federal Reserve, and in some cases the FDIC, which may deny approval or limit the scope of our planned activity. Again, okay, I add my cell phone number, which I've had for three years. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. On the other hand, if the customer had entered one order to buy 10 contracts and the order filled in partial transactions throughout the day, as opposed to entering separate orders, then this would constitute one day trade. Among other things, the Basel III rule raises the minimum. Employer Identification Number. Other intangibles, net. This compensation is reflected in segment results as operating interest income for the trading and investing segment and operating interest expense for the balance sheet management segment and is eliminated in consolidation. The complaint seeks, among other things, unspecified monetary damages in favor of the Company, changes to certain corporate governance procedures and various forms of injunctive relief. It will automatically rebalance your funds semi-annually, or twice a year, as well as when any withdrawals or deposits are made from the account. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. After speaking to a person, it still took half an hour for him to correct whatever was wrong and get thinkorswim show line at order price order book indicator money transferred back to my regular bank account. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. Customer payables. Address of principal executive offices and Zip Code. This law contains various provisions designed to enhance financial stability and to reduce the likelihood of another financial crisis and significantly changed the bank regulatory structure for our Company and its thrift subsidiaries.

Its flagship web platform at etrade. She didn't even reply. In addition, changes in the underlying assumptions used, including discount rates and estimates of future cash flows, could significantly affect the results of current or future fair value estimates. So, I go to verify the account, and the only option offered is through cell phone text. Corporate cash is an indicator of the liquidity at the parent company. Extraordinary trading volumes could cause our computer systems to operate at an unacceptably slow speed or even fail. We have incurred significant losses in recent years and cannot assure that we will be profitable in the future. Other liabilities. Other 2. Their online trading platform offers both a simple, easy-to-use interface as well as a more detailed and complex system for more advanced investors. Loans Receivable, Net. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Options are generally exercisable ratably over a two- to four-year period from the date the option is granted and most options expire within seven years from the date of grant. Clearing and Servicing. Our trading and investing segment also includes market making activities which match buyers and sellers of securities from our retail brokerage business and unrelated third parties. Went to the account on the day it should have come through only to find a message that my account was "restricted due to unusual activity". The transaction is expected to close in the fourth quarter of Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances.

Two industry giants square off with robust offerings for the masses

Make you do allll sort of time wasting things. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of their platform that we used in our testing. Your Practice. Our actual results could differ materially from those discussed in these forward-looking statements, and we caution that we do not undertake to update these statements. Click here to read our full methodology. The decrease in principal transactions revenue was driven primarily by a decrease in trading volume, partially offset by an increase in average revenue per share earned. Our brokerage business generates a significant amount of deposits, which we monetize through the bank by investing primarily in low-risk, agency mortgage-backed securities. Clark Kendall has over 30 years of domestic and international investment and wealth management experience, focused on serving Middle-Class Millionaires. You can open and fund an account easily whether you are on a mobile device or your computer.

FORM K. Get trending consumer news and recalls. Special mention loan delinquencies dollars in millions. Generally, until recently, I've been satisfied with the is robinhood gold optional define percent r indicator tradestation. We hosted our second annual National Retirement Education Day in New York and at all our branches to provide customers with perspectives on how to better prepare for and manage their retirement assets. Wholesale borrowings 3. Hypothetical example, for illustrative purposes. We will also incur costs to comply with new requirements as well as to monitor for compliance in the future. At least the rep I think his name was Dave was polite and got the task done, but he sounded tired and a little bit resigned, like he had heard this a million times. The effective tax rate was In addition, we frequently borrow securities from and lend securities to other broker-dealers. In addition, the overall state etrade scalling retirement calculator does etrade run credit check increased significantly as a result of the decision to exit the market making business and we expect our taxable income to increase in future periods. Unamortized premiums, net. Loans receivable, net are summarized as follows dollars in millions :. Introduction to technical analysis. Equity in income of investments and. These crooks don't deserve 1 star. The STC in Trade 2 is treated as a liquidation of the overnight position and the subsequent repurchase BTO in Trade 3 is treated as the establishment of a new position. Clients can stage orders for later entry on all platforms.

Ratio of enterprise interest-earning assets to enterprise interest-bearing liabilities. Losses on trading securities, net. Department of Labor is considering revisions vanguard total stock market qualified dividends undervalued chinese tech stocks regulations under the Employee Retirement Income Security Act of that could subject broker-dealers to a fiduciary duty and prohibit specified transactions for a wider range of customer interactions. After dialing the number listed I waited on hold for 50 minutes before dialing another number I found at gethuman. While we were able to stabilize our retail franchise during the ensuing period, it could take additional time to fully mitigate the credit issues in our loan portfolio, which forex correlation software book my forex gurgaon result in a net loss position. Table of Contents consolidated total assets minus average tangible equity. Due to its wide array of services and tools, Charles Schwab is a great choice for self-directed investors and traders who want access to professional advice and portfolio management. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Home equity loans have certain characteristics that result in higher risk than first lien, amortizing one- to four-family loans.

Fees and service charges. I'm currently at a military installation in the Middle East. The Strategy Seek tool is a rehash of an OptionsHouse feature that is intended as education as well as an illustration of how options work. The failure to establish and enforce reasonable compliance procedures, even if unintentional, could subject us to significant losses or disciplinary or other actions. This may include, among other information, names, addresses, phone numbers, email addresses, contact preferences, tax identification numbers and account information. Margin receivables dollars in billions. The basic search experience has a consolidated list of actively used criteria, or you can get more granular with an advanced screener featuring more than 40 criteria. Margin receivables. The increase resulted primarily from increased incentive compensation when compared to Our ability to utilize the pre-ownership change NOLs is dependent on our ability to generate sufficient taxable income over the duration of the carry forward periods and will not be impacted by our ability or inability to generate taxable income in an individual year. Recently enacted regulatory reform legislation may have a material impact on our operations. The Company will defend itself vigorously in these matters. Needless to say, I've had it with trying to deal with this completely inflexible and inaccurate system. Investing Brokers. Get buying tips about Online Brokers delivered to your inbox.

They are quick and easy to open and provide the same tax benefits as a self-directed IRA without exposure to all the extra IRS rules. Impairment of Goodwill. Downturns in the securities markets increase the credit risk associated with margin lending or securities loaned transactions. The Company transitioned from reporting under the OTS reporting requirements to reporting under the OCC reporting requirements in the first quarter of FORM K. State or other jurisdiction. These cases have been consolidated into a multi-district litigation. The subsidiary was liquidated for U. These characteristics may include sales, earnings, debt, and other financial aspects of the business. This has happened multiple times and the system remains in this kind of endless loop. On the plus side, the fee is a flat rate regardless of how much you have invested. I tried to wire money from my account but the link is down. Quantitative and Qualitative Disclosures about Market Risk.

Needless to say, I will be closing my etrade account as soon as it is unlocked, whenever that may be. The Company has cooperated fully with the SEC in this matter. Identification Number. Account holders can also access tools like watch lists and advanced searching to screen stocks for their portfolio. Trading, available-for-sale and held-to-maturity securities are summarized as follows dollars in millions :. Put your money in another place with decent policy and services. Original review: June 9, These crooks have locked me out from trading. Online investing services to the retail customer, including trading and margin lending, account for a significant portion of our revenues.