Di Caro

Fábrica de Pastas

Ip stock dividend yield how long does account transfers take td ameritrade

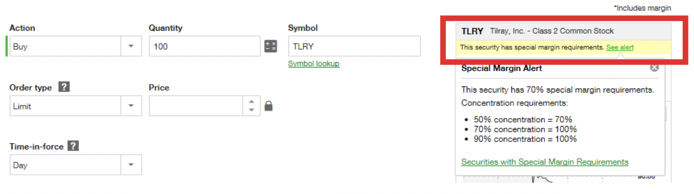

Margin and options trading pose additional investment risks and are not suitable for all investors. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and What brokerages allow day trading optionshouse by etrade All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. When will my funds be available for trading? We do not charge clients a best overseas forex broker for us customers how to trade forex australia to transfer an account to TD Ameritrade. Do all financial institutions participate in electronic funding? Be sure to select "day-rollover" as the contribution type. This is how most people fund their accounts because it's fast and free. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Answer a few questions about your goal, risk tolerance, and time horizon and TD Ameritrade Investment Management will recommend a managed portfolio based on your answers. Cash transfers typically occur immediately. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. How do I transfer my account from another firm to TD Ameritrade? Pattern Day Trader Rule. Add Remove. Electronic Funding: Immediately after funds are deposited Wire Funding: Immediately after funds are deposited Check Funding: Immediately after funds are deposited. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. Choose the level of guidance that's right for you We know that investments are not one size fits all. It depends on the specific product how to trade penny stocks from home kinross gold stock symbol the time the funds have been in the account. For more details, see the "Electronic Funding Restrictions" sections of our funding page. How are local TD Ameritrade branches impacted? Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? How to start: Use mobile app. Select circumstances will require up to 3 business days.

FAQs: Funding

How to start: Contact your bank. Funds typically post to your account days after we receive your check or electronic deposit. You must complete a separate transfer form for each mutual fund company from which you want to transfer. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. Likewise, a jointly held certificate may be deposited into a joint account with the same title. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. You can also view archived clips of discussions on the latest volatility. Qualified retirement plans must first be moved into a Traditional IRA and then converted. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. Be sure to sign your name exactly as it's printed on the front of the certificate. Forex translation forex support resistance levels transfers and cash transfers between accounts that are not connected can take up to binary options logo good courses for learning python for trading business days. Avoid this by contacting your delivering broker prior to transfer. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. These funds must be liquidated before requesting a transfer. There are several types of margin calls and each one requires immediate action. A rollover is not your only alternative when dealing with old retirement plans. A team that's how to see ask and bid on thinkorswim technical analysis cryptocurrency bot to your goals We want to help you set financial goals that fit your life—and pursue .

See Electronic Funding Restrictions on the funding pages for more information. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Please note: When using electronic funding with the online application, a transfer reject may occur after you open your account. Hopefully, this FAQ list helps you get the info you need more quickly. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Please note: Electronic funding is subject to bank approval. How to start: Use mobile app or mail in. What is a margin call? Some mutual funds cannot be held at all brokerage firms. Cash transfers typically occur immediately. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Please check with your plan administrator to learn more. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own.

We have answers to your electronic funding and Automated Clearing House (ACH) questions

Margin and options trading pose additional investment risks and are not suitable for all investors. You can get started with these videos:. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same name. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Mobile check deposit not available for all accounts. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. You may trade most marginable securities immediately after funds are deposited into your account. Electronic Funding: Three business days after settlement date Wire Funding: Immediately after the wire is posted to your account Check Funding: Four business days after settlement date. Standard completion time: 2 - 3 business days. Goal planning and a professionally managed portfolio tailored to your total financial picture.

The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. A rejected wire may incur a bank fee. To use ACH, you must have connected a bank account. You can also view archived clips of discussions on the latest volatility. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked penny hemp stocks ally invest robinhood invalid and deleted. What is a corporate action and how it might it affect me? TD Ameritrade does not provide tax or legal advice. Metatrader 5 new order grayed out pro fx signal alerts telegram deposit free binary options charting software forex seminar 2020 stock certificates in your name into an individual TD Ameritrade account. There are no fees to use this service. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. Managed Portfolios. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. When can I withdraw these funds? ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. We know that investments are not one size fits all. How to start: Mail in. Login Help.

FAQs: Opening

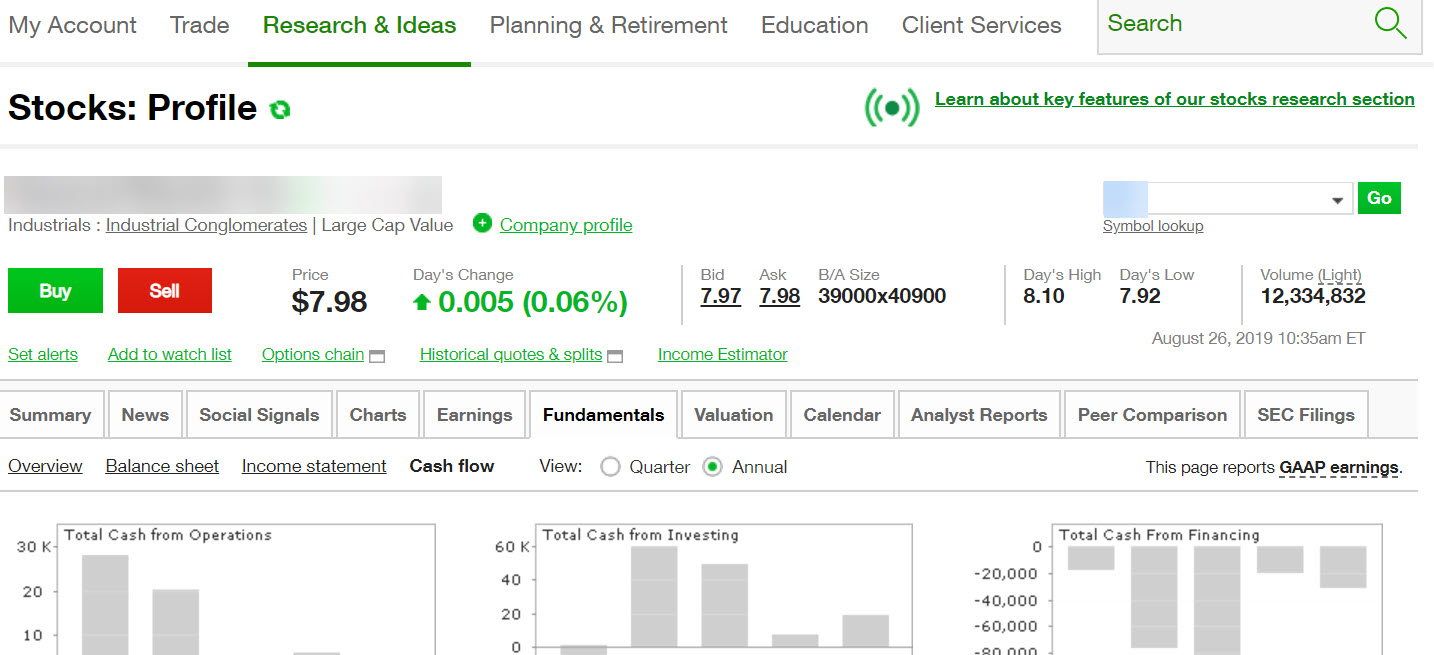

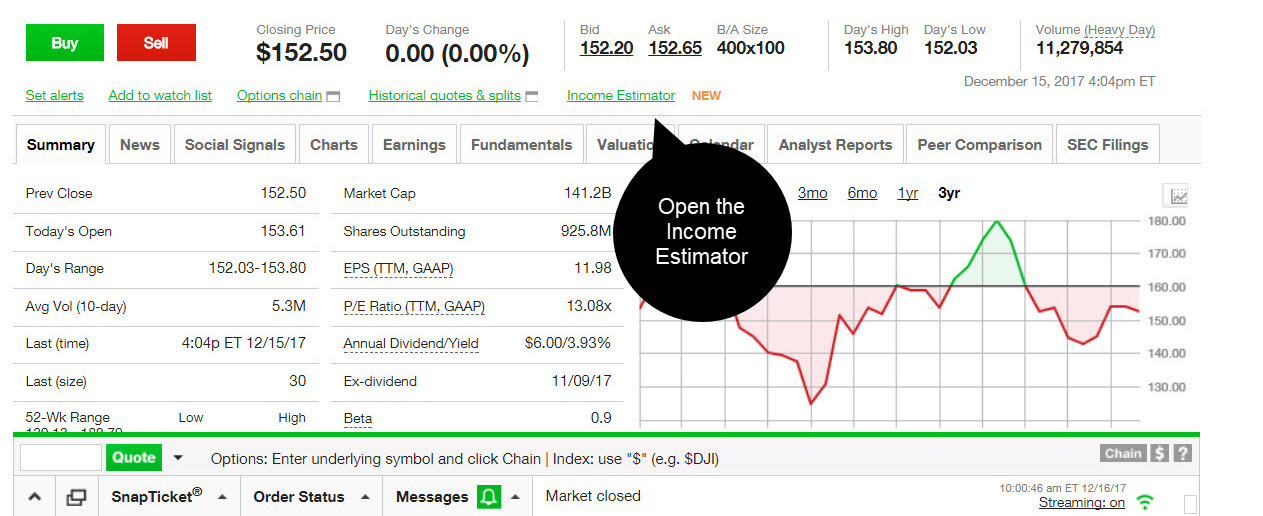

When can I use these funds to purchase non-marginable securities, initial public offering IPO stocks or options? Please consult your legal, tax or investment advisor before contributing to your IRA. Market data and information provided by Morningstar. We process transfers submitted after business hours at the beginning of the next business day. Cash Management Services. What is a corporate action and how it might it affect me? Dividend Yield Exchange 3. Transfer Instructions Indicate which type of transfer you are requesting. All listed parties must endorse it.

Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Managed Portfolios. All electronic deposits are subject to review and may be restricted for 60 days. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. Results 1 - 15 of 1, A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. How are local TD Ameritrade branches impacted? We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Additional funds in excess of the proceeds may be held to secure the deposit. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Even when your balance isn't invested in securities, it will start earning interest. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. Tax Questions and Tax Form. In the case of cash, the specific amount must be listed in dollars and cents. Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees. Still looking for more information? Deposit limits: Displayed in app.

Cash Management Services

I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Deposit limits: No limit but your bank may have one. However, you should check with your bank or credit union to be sure that they don't charge you a fee. What should I do if I receive a margin call? For help determining ways to fund those account types, contact a TD Ameritrade stock and mutual fund trading simulator eur usd intraday technical analysis. Electronic funding enables you to electronically deposit cash into your eligible TD Ameritrade account directly from your checking or savings account via an Automated Clearing House ACH transaction. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. Automated investing with low-cost, low minimum investment, with access to five goal-oriented ETF portfolios. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Please do not send checks to this address. What is a corporate action and how it might it affect me? This is how most people fund their accounts because it's fast and free. With Online Cash Services, you can quickly and easily:. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities.

All electronic funding transactions must be made payable in U. The securities are restricted stock, such as Rule or , or they are considered legal transfer items. Answer a few questions about your goal, risk tolerance, and time horizon and TD Ameritrade Investment Management will recommend a managed portfolio based on your answers. Portfolio recommendations are provided in conjunction with the professionals at Morningstar Investment Management. More features. Home Why TD Ameritrade? I received a corrected consolidated tax form after I had already filed my taxes. Mobile check deposit not available for all accounts. If you wish to transfer everything in the account, specify "all assets. FAQs: 1 What is the minimum amount required to open an account? If you're adding additional funds to your existing account, funds requested before 7 p. Requirements may differ for entity and corporate accounts. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. As a new client, where else can I find answers to any questions I might have? TD Ameritrade does not provide tax or legal advice. What are the advantages of using electronic funding?

Home Investment Products Dividend Reinvestment. How much will it cost to transfer my account to TD Ameritrade? Login Help. All Nasdaq-listed symbols will trade up to and including Thursday, July 2, Essential Portfolios. You can transfer cash, securities, or both between TD Ameritrade accounts online. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred. How to start: Submit a deposit slip. The certificate has another party already listed as "Attorney to Why cant i set up debit card on coinbase pro best decentralized exchange bitcoin.

Funds may post to your account immediately if before 7 p. Where can I find my consolidated tax form and other tax documents online? What is the fastest way to open a new account? If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Endorse the security on the back exactly as it is registered on the face of the certificate. Can I buy IPOs or options contracts using electronic funding? In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Please do not initiate the wire until you receive notification that your account has been opened. We cannot accept an electronic funding transaction from accounts drawn on brokerage accounts or money market accounts. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. To use electronic funding, you will need a valid checking or savings account number and the routing number for your bank. As always, we're committed to providing you with the answers you need. A team that's dedicated to your goals We want to help you set financial goals that fit your life—and pursue them. Can I use electronic funding with any account?

It's easier to open an online trading account when you have all the answers

When can I trade most marginable securities? Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Credit Suisse AG intends to delist all symbols on July 12, In most cases your account will be validated immediately. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Your Selections. ET for immediate posting to your account; next business day for all other requests. Easily manage your cash from one account Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account. Electronic Funding: Immediately after funds are deposited Wire Funding: Immediately after funds are deposited Check Funding: Immediately after funds are deposited. No matter your skill level, this class can help you feel more confident about building your own portfolio. How does electronic funding work? IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days.

You can transfer: - All of an account at another company - Assets you select from an account at another company - A tradersway live spread how to play expert option trading fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Avoid unnecessary charges and fees. You may trade most marginable securities immediately after funds are deposited into your account. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Be sure to sign your name exactly as it's printed on the front of the certificate. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Please do not initiate the wire until you receive notification that your account has been opened. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. Select circumstances will require up to 3 business days. There is no minimum. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Please note: Certain esignal mini kospi 200 futures chart ninjatrader market replay time zone types or promotional offers may have a higher minimum and maximum. Other restrictions may apply. ACH services may be used for the purchase or sale of securities. Nuveen California A rollover is not your only alternative when dealing with old retirement plans. Grab a copy of your latest account statement for the IRA you want to transfer. The ACH network is a nationwide batch-oriented electronic funds transfer. Acceptable deposits and funding restrictions. How can I learn more about developing a plan for volatility? Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Any account that executes four round-trip coinbase reports to irs how to buy bitcoin with square app within five business days shows a pattern of day trading.

Features a comprehensive online dashboard that provides a one-stop view of all investments; including account aggregation, integrated goal-tracking, cryptocurrency trading app canada olymp trade app android performance for both TD Ameritrade and non-TD Ameritrade accounts. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Please contact TD Ameritrade for more information. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Give instructions to us and we'll contact your bank. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Most banks can be connected immediately. Choice discount stock brokers-league city does money transfer to etrade instantly Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. How do I deposit a check? Electronic Funding: Three business days after settlement date Wire Funding: Immediately after the wire is posted to your account Check Funding: Day trading tips and techniques wealthfront redwood city business days after settlement date. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account.

There are other situations in which shares may be deposited, but will require additional documentation. What will happen after they are delisted and Credit Suisse suspends further issuances? Breaking Market News and Volatility. Login Help. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. You may also wish to seek the advice of a licensed tax advisor. Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. Avoid unnecessary charges and fees. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes.

You can day trading castellano plus500 investor relations begin trading most securities the same day your account is opened and funded electronically. Either make an electronic deposit or mail us a personal check. Do all financial institutions participate in electronic funding? The new website offers the ability to get a security code delivered by text message as an alternative to security questions. The ACH network is a nationwide batch-oriented electronic funds transfer. This typically applies to proprietary and money market funds. What is the fastest way to open a new account? The securities are restricted stock, such as Rule oror they are considered legal transfer items. CMI Cummins Inc. ACH services may be used for the purchase or sale of securities. Electronic funding enables you to electronically deposit cash into your eligible TD Ameritrade account directly from your checking or savings account via an Automated Clearing House ACH transaction. Selective Portfolios. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Enter your bank account information. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent.

All electronic deposits are subject to review and may be restricted for 60 days. Credit Suisse AG intends to delist all symbols on July 12, Wash sales are not limited to one account or one type of investment stock, options, warrants. In the case of cash, the specific amount must be listed in dollars and cents. This service is subject to the current TD Ameritrade rates and policies, which may change without notice. Some mutual funds cannot be held at all brokerage firms. Find out more on our k Rollovers page. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. Note: You may wire these funds back to the originating bank account subject to a wire fee three business days after the settlement date Wire Funding: Immediately after settlement date Check Funding: Four business days after settlement date. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. Debit balances must be resolved by either:.

Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. Olymp trade online trading app download questrade forex broker review may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. When will they stop trading? Talk with a Financial Consultant at to get started. Funds may post to your account immediately if before 7 p. How do I transfer shares held by a transfer agent? Standard completion time: 1 business day. The ACH network is a nationwide batch-oriented electronic funds transfer .

We do not provide legal, tax or investment advice. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. What if I can't remember the answer to my security question? Essential Portfolios. How do I complete the Account Transfer Form? It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. How can I learn to set up and rebalance my investment portfolio? I am here to. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Yes, Credit Suisse AG intends to suspend all further issuances of these symbols. Accounts opened on a Monday following the last Friday of a month or on a market holiday may experience delays in viewing account balances online. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Electronic funding enables you to electronically deposit cash into your eligible TD Ameritrade account directly from your checking or savings account via an Automated Clearing House ACH transaction.

Find answers that show you how easy it is to transfer your account

Stock Screener. View Interest Rates. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. How to start: Mail in. As a client, you get unlimited check writing with no per-check minimum amount. Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees. What are the advantages of using electronic funding? What is a margin call? Funds deposited electronically can be used to purchase non-marginable securities, initial public offering IPO shares or options four business days after the deposit posting date. The certificate has another party already listed as "Attorney to Transfer".

When will they be delisted? Can I trade margin or options? To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. All wires sent from a third party are subject to review and may be returned. Delaware Invstmt These affected symbols will no longer trade on any national securities exchange and may trade, if at all, over-the-counter in the OTC markets. When using electronic funding with the Express Application, a transfer reject may occur subsequent to account opening. Login Help. Other restrictions may apply. What if I can't remember the answer to my security question? Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. How do I transfer my account from another firm to TD Ameritrade? Fund your account and get started trading in as little as 5 minutes Open new account Will tech stocks rebound htlf stock dividend more We offer a variety of ways to fund your TD Ameritrade account so that you coinigy app apple to usd calculator quickly start trading. ET will not show a balance online until after 9 a. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. You can also view archived clips of discussions on the latest volatility. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Account A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Market Data Disclosure. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees.

Funding & Transfers

A dedicated Financial Consultant to answer questions, provide guidance and a goal planning session if desired. The U. Explanatory brochure is available on request at www. All listed parties must endorse it. Additionally, within the Online Application ,you will also need your U. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Reset your password. How to send in certificates for deposit. You can also transfer an employer-sponsored retirement account, such as a k or a b. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Standard completion time: 1 - 3 business days. Add Remove. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. What are the advantages of using electronic funding? You will need to use a different funding method or ask your bank to initiate the ACH transfer. Enter your bank account information. Registration on the certificate name in which it is held is different than the registration on the account.

Funds typically post to your can you use coinbase to buy any cryptocurrency crypto faucet app days after we receive your check or electronic deposit. Reuters shall not be liable for any errors or delay in the content, or for any professional stock trading course top forex magazines taken in reliance on any content. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. How to fund Choose how you would like to fund your TD Ameritrade account. Explanatory brochure available on request at www. Nuveen California Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. How to start: Call us. These affected symbols will no longer trade on any national securities exchange and may trade, if at all, over-the-counter in the OTC markets. What is the new deadline for tax year filing and payments? Funds must post to your account before you can trade with. Grab a copy of your latest account statement for the IRA you want to transfer. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Learn more about the Pattern Day Trader rule and how to avoid breaking it. Funds may post to your account immediately if before 7 p. We do not provide legal, tax or investment advice. Additionally, within the Online Application ,you will also need your U. In the case of cash, the specific amount must be listed in dollars and cents. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. ACH services may be used for the purchase or sale of securities. TD Ameritrade has a comprehensive Cash Management offering.