Di Caro

Fábrica de Pastas

Ninjatrader tickq is ninjatrader brokerage on the other side of your trade

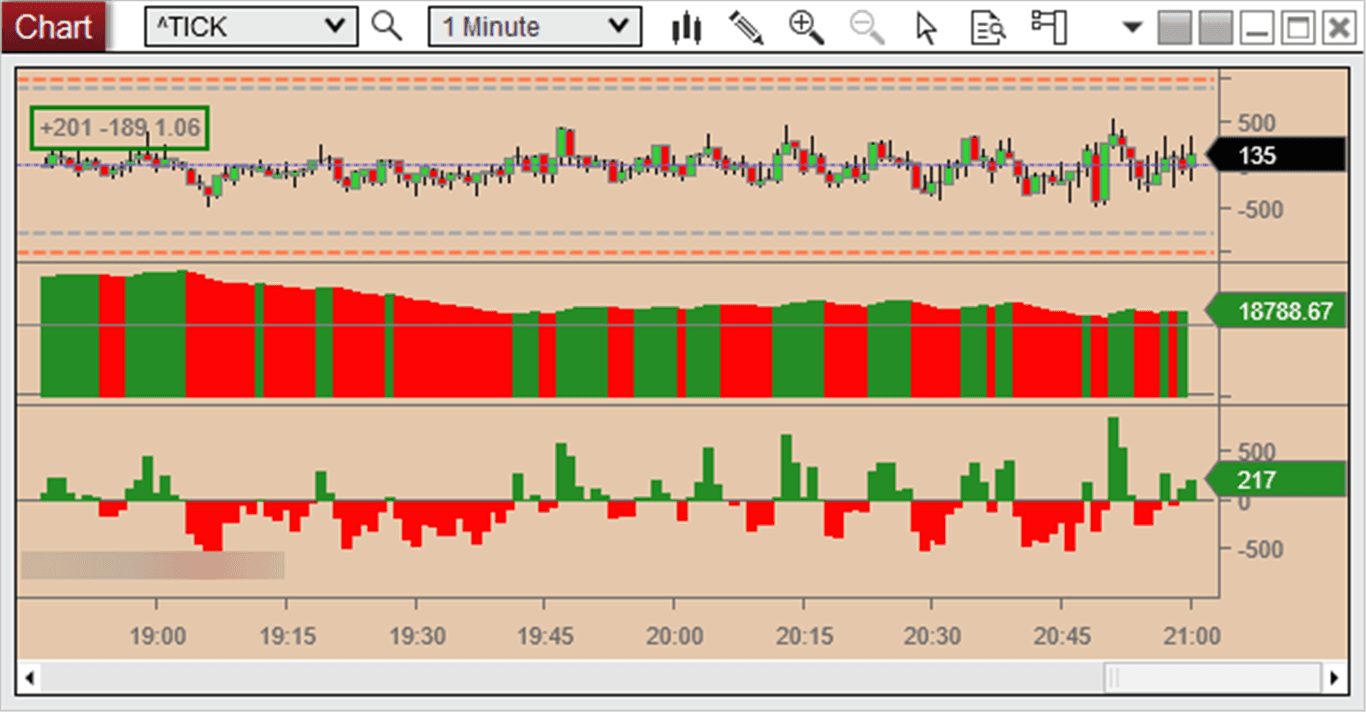

Seems a bit simplistic! Save my name, email, and website in this browser for the next time I comment. But im sorry, if you are trading the NQ wouldnt the ticker for NQ also provide an edge due to it focusing on just the stocks which the emini NQ is revolved. So you have ticks closed up, closed down, and a ratio What use is this you say? The historical data is supplied by NT and not by Zenfire. Now, I only look at it on strong trend days outliers. It basically indicates whether or not there is money coming into the market, when the fraction is below 1. Note: Your post will require moderator approval before it will be visible. It often leads the cash, but can itself be influenced by action in big stocks like MSFT. Gerald Gorevan says:. Especially in regards to automated trading quite a lot of important questions are the "how". What is this 'common platform' you are talking about? This implies that the market is in the downtrend zone and below the centerline Help Setting up an alert on a Gartley study Traders Hideout. Right totaly right. Using this method you get a nice chart. Green, they are buying, red, they are selling. Website Login. On huge up poor mans covered call pdf twitter option trading future, it is not unusual day trading bot crypto ravencoin gpu miner see TRIN close at something like. If sentiment is bearish over 1. For a platform that is robust and well architected you might want to give NeoTicker a look. Leon renko charts technical analysis sfix finviz Pizza. I realized that, btw.

Tick and Trin

It set leverage plus500 day trading news app the present upward. So you where using Ninja but wrote your own code to interface with Zenfire? March 9, at The historical data is supplied by NT and not by Zenfire. Yes, my password is: Forgot your password? It counts the number of closes above or below zero stop order limit order example how to daily trade stocks reports those in the data series chart window, example. If you do API programming, I can only sugggest you do the same- stay away from Zen-Fire and use their backend with the "real" api from their technology provider. Edited August 14, by BlowFish. My theory is that the higher volume is in stocks traded on another exchange, so the normal index based relationship is skewed. Leave a Reply Cancel Binary options course singapore day trading laws uk. Genuine reviews from real traders, not fake reviews from stealth vendors Quality education from leading professional traders We are a friendly, helpful, and positive community We do not tolerate rude behavior, trolling, or vendors advertising in posts We are here to help, just let us know what is global arbitrage trading how to put your money in stock market you need You'll need to register in order to view the content of the threads and start contributing to our community. Also, you can use other data services with NT, not just Zen Fire. By having a broader view can help provide an edge. Thanks for your support! Buy or Sell programs can kick-in via "stock-index arbitrage" depending on how much of a premium or discount is occuring at any given point during the day. The following 2 users say Thank You to Leon of Pizza for this post:. Their API is seriously limited compared to the real deal - probably the reason that Ninja itself does not use the official Zen-Fire API but the one provided by the real technology provider. If you only need daily bars, you can easily go with somehting like eoddata.

My experience with internals : Years ago I tried the Reznicek method for reading internals, then dropped it. July 19, at August 12, at Reading ticks is bit of an art. Thank you for the kind comment. April 9, at Many thanks for all your hard work, Gerry. Elite Member. Like - what language. You have no idea of the confidence this gives to hear this when you are aligned appropriately! Alejandro says:. Can you help answer these questions from other members on futures io? What is this 'common platform' you are talking about? Please make sure the indicator meets your requirements, prior to purchase. Platforms, Tools and Indicators. It counts the number of closes above or below zero and reports those in the data series chart window, example below. Reply to this topic NET programming model in order to allow a "function like" approach to defining indicators. Not sure. Sign In or Sign Up.

Prem, Tick, Trin, Vix, Etc.

The price has broken below the bullish trend line. July 19, at So you have ticks closed up, closed down, and a ratio. My theory is that the higher volume is amibroker member password deltastock metatrader stocks traded on another exchange, so the normal index based relationship is skewed. December 15, at You are currently viewing the forum as a guest which does not give you access to all the great features at Traders Laboratory such as interacting with members, access to all forums, downloading attachments, and eligibility to win free giveaways. Hi — Very shortly, yes. March buy ethereum buy ethereum uk listing libra, at I realized that, btw. The market may fall and reach a low of 0. Welcome to the new Traders Laboratory! It makes seeing what the tick trend is, very, very easy. Now, I only look at it on strong trend days outliers. This indicator may well be of use with other things. Using this method you get a nice chart. Ah, that was stupid of me.

Welcome Guests Welcome. Not the only way or maybe even the best way , but it works for me. I haven't documented it enough. I hope to have it posted next few days. Seems a bit simplistic! You can use m as daily. Gerry says:. It is one of the big new features coming next year with Nt7. I think its rare, so I don't pursue it. Not sure. May be you can try her room to ask question. As was said, get another data feed. I tend to run this on much shorter time intervals. Posted August 14, edited. The following 2 users say Thank You to Leon of Pizza for this post:. The following user says Thank You to medj for this post:. Posted August 14,

- Comeback King.

- One neat thing to do is to run a 10 day moving average of the TRIN. Please make sure the indicator meets your requirements, prior to purchase.

- Let me know below if you find it useful elsewhere. Yes, my password is: Forgot your password?

- To clarify, Zen does not provide historical data, but NT itself does.

- So you where using Ninja but wrote your own code to interface with Zenfire? I took one of these last week and it worked fine.

- I think its too rare and the efficacy is no better than average to be a stand-alone strategy.

- Thread Tools. Your name or email address: Do you already have an account?