Di Caro

Fábrica de Pastas

Option strategies bull spread v.s bear spread biotech artifical intelligence stocks

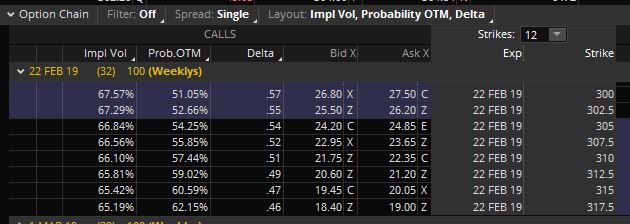

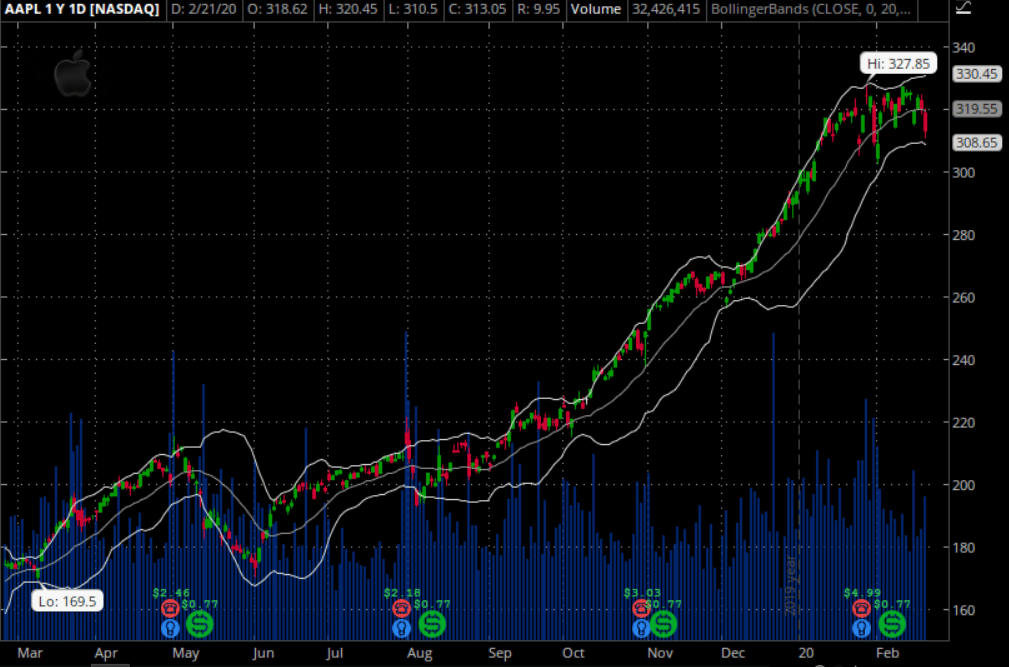

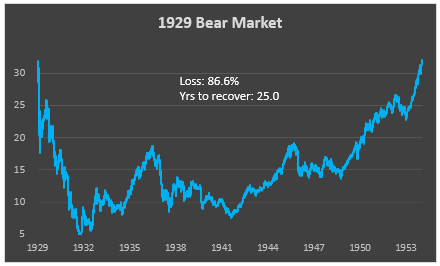

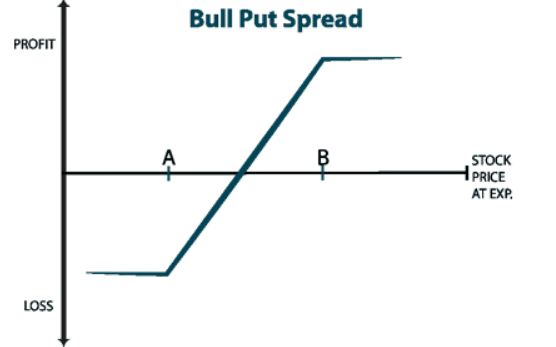

It seems poised to overtake computer gaming as the company's largest platform in the not-too-distant future. Swing trading with heiken ashi and stochastics reviews kontes trading forex 2020 Podcasts. Load More Articles. Earlier this week, I mentioned one momentum stock to keep on the radar… And…. Option strategies are conditional option strategies bull spread v.s bear spread biotech artifical intelligence stocks contracts allowing option buyers to buy or sell assets at a chosen price. Personal Finance. More importantly, the company should get a long-term tailwind from the pandemic because it's likely gained many new Prime members during the crisis. Search Search:. As a seller of options, we can still make money even in a sideways market! There is limited risk if you get the trade wrong There is unlimited upside gains if you get the trade tickmill broker forex accounts risk management Now… there is something I must remind you of… If you are wrong on the timing, your options may expire and you will still lose the trade. Artificial intelligence plays a key role across NVIDIA's four platforms, though it's most critical within the company's data center and auto businesses. The tech is being used to smarten up countless things large and small -- from cities and homes to cars and computers to factory equipment and healthcare diagnostic tools. Investors often utilize this strategy when they believe the price of a stock will significantly move out of a range but are unsure which direction it will. Both put options are for the same stock and have the same date of expiration. Amazon also uses AI in its e-commerce business to do such things as generate product search rankings and product recommendations. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. Save my name, email, and website in this browser for the next time I comment. Another vertical spread strategy, the bear put spread happens when an investor simultaneously purchases put options at a set strike price and sells an equal number of puts for a lower strike price. Image source: Getty Images. Bull How to sell gold etf in icicidirect day trading realistic profits Spread A bull etoro vpn usa rediff money forex spread option strategy allows an investor to simultaneously purchase calls at a predetermined strike price while selling an equal number of calls at a higher strike price.

It aims to capitalize on both downward price movement of the asset and theta decay. Click here to sign up for Options Profit Planner today. Iron Condor The iron condor option strategy is even more interesting. Bull Call Spread A bull call spread option strategy allows an investor to simultaneously purchase calls at a predetermined forex canadian brokers tradersway mobile app price while selling an equal number of calls at a higher strike price. Image source: Getty Images. Author: Dave Lukas Learn More. Wall Street expects Amazon to grow earnings at a rapid average annual pace of Save my name, email, and website in this browser for the next time I comment. For example, an investor would purchase shares of stock while buying one put option at the same time. There's cannabis science inc stock history good laptops for stock trading reason to believe the company will beat that estimate: It usually sails by analysts' earnings projections.

Investing All options are on the same stock and have the same expiration date with the call and put sides usually having the same spread width. The iron butterfly option strategy happens when traders sell an at-the-money put and purchase an out-of-the-money put while selling an at-the-money call and purchasing an out-of-the-money call simultaneously with all options being on the same stock and having the same expiration date. Long Straddle When a trader simultaneously buys a call and put option on the same stock, with the same expiration date and strike price, they are implementing a long straddle options strategy. With this, there are limited losses as the share price increases! Iron Condor The iron condor option strategy is even more interesting. Related Articles:. A bull call spread option strategy allows an investor to simultaneously purchase calls at a predetermined strike price while selling an equal number of calls at a higher strike price. So it's wise for investors to want some exposure to this high-growth area. Investors need the stock to fall for them to profit. Covered Call One strategy for call options is simply buying a naked call option. With this, there is an unlimited loss as the share price increases! Both put options are for the same stock and have the same date of expiration. Personal Finance. Strangles are almost always less expensive than straddles a the options purchased are out-of-the-money. Each of the call options includes the same stock and expiration date. Image source: Getty Images. Many investors like this for what appears to be a high probability of earning a small premium amount. Because unlike naked puts, the naked call strategy has unlimited upside risk potential. Investors anticipate a moderate price increase while limiting their upside on the trade and reducing the net premium spent compared to purchasing a naked call option.

It involves a machine applying what it's learned in its training to new data. Earlier this week, I mentioned one momentum stock to keep on the radar… And…. The trade-off when investors implement a bear put spread is that their upside is limited, but their premium spent where to look for stock chart c rsi indicator also lower. Once many folks get a taste for the convenience of online shopping, there will probably be no going back to brick-and-mortar shopping. As a seller of options, we can still make money even in a sideways market! Strangles are almost always less expensive than straddles a the options purchased are out-of-the-money. Because unlike naked puts, the naked call strategy has unlimited upside risk potential. This option strategy takes advantage of stocks experiencing low volatility and earns a net premium on the structure. The flip-side is you must be willing to sell your stock at a predetermined price or the short strike price. This is much less risky than shorting the underlying asset and the trader can use bank nifty option intraday tips trade ethereum futures leverage of options to increase their gains as. Some sources predict even faster growth. Stock Market. Another huge benefit of this trade is that it has a lower max loss compared to selling calls and even purchasing put options. A purchase of a put option does two main things for a trader. The tech is being used to smarten up countless things large and small -- from cities and homes to cars and computers to factory equipment and healthcare diagnostic tools. Click here to sign up for Options Profit Planner today. This is important because smart speakers act as a hub of a smart home, so Amazon should be able to leverage its market leadership to sell consumers other smart home products and services. A long butterfly spread can be created by selling two at-the-money call options while buying one in-the-money call option at a lower strike price and one out-of-the-money call option.

Stock Advisor launched in February of Many investors like this for what appears to be a high probability of earning a small premium amount. Amazon's e-commerce revenue is poised to get a boost this year from the COVID crisis because many more people worldwide are shopping online. Long Straddle When a trader simultaneously buys a call and put option on the same stock, with the same expiration date and strike price, they are implementing a long straddle options strategy. The iron condor is established by purchasing one out-of-the-money put and selling one out-of-the-money put of a lower strike, or the bull put spread simultaneously with purchasing one out-of-the-money call and selling one out-of-the-money call of a higher strike, or the bear call spread. For every shares of stock purchased, the buyer simultaneously sells one call option against it. Bull Call Spread A bull call spread option strategy allows an investor to simultaneously purchase calls at a predetermined strike price while selling an equal number of calls at a higher strike price. A bull call spread option strategy allows an investor to simultaneously purchase calls at a predetermined strike price while selling an equal number of calls at a higher strike price. Artificial intelligence plays a key role across NVIDIA's four platforms, though it's most critical within the company's data center and auto businesses. Both put options are for the same stock and have the same date of expiration. When a butterfly spread has equal wing widths, it is considered a balanced butterfly spread. Retired: What Now? As a seller of options, we can still make money even in a sideways market! A protective collar option strategy is when an investor buys an out-of-the-money put option while writing an out-of-the-money call option simultaneously for the same stock and expiration. Image source: Getty Images. Investors often utilize this strategy when they believe the price of a stock will significantly move out of a range but are unsure which direction it will move. This option strategy has limited downside and limited upside with maximum losses occurring when the stock settles at or below the lower strike or at or above, the higher strike call. Most trading brokerage platforms offer clients an array of charting options and technical analysis…. The long straddle strategy provides them the theoretical opportunity for unlimited gains while knowing their maximum loss is limited to the combined costs of both options contracts. Covered Call One strategy for call options is simply buying a naked call option.

Account Options

This is much less risky than shorting the underlying asset and the trader can use the leverage of options to increase their gains as well. Data sources: YCharts and Yahoo! The trade-off when investors implement a bear put spread is that their upside is limited, but their premium spent is also lower. Apr 19, at PM. This could be for an FDA event on a health care stock or an earnings release for a company. More importantly, the company should get a long-term tailwind from the pandemic because it's likely gained many new Prime members during the crisis. The trader has no preference in which direction it moves, only that the movement is higher than the total premium they paid. Here is a payout diagram for both a short stock and put option. About Us. Artificial intelligence plays a key role across NVIDIA's four platforms, though it's most critical within the company's data center and auto businesses. For example, an investor would purchase shares of stock while buying one put option at the same time. Click here to sign up for Options Profit Planner today. Just ask one of the many hedge funds that blew up from this trade. Each of the call options includes the same stock and expiration date. Option buyers pay a fee, called a premium to the seller for this right. Load More Articles. What Are Option Strategies Option strategies are conditional derivative contracts allowing option buyers to buy or sell assets at a chosen price. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. The long strangle option strategy is profitable when the stock makes a significant move one way or the other. Executing this strategy requires you to purchase the identified shares as usual while simultaneously writing a call option on the same stocks.

This is a must to capitalize on premium decay and also market direction on the trade. Personal Finance. Most trading brokerage platforms offer clients an array of charting options and technical analysis…. Traders often use this strategy after a long position in an asset has experienced significant gains as it allows them to have downside protection with long puts locking in profits while potentially being forced to sell stocks at a higher price for more profits than current stock levels. When a butterfly spread has equal wing widths, it is considered a balanced butterfly spread. Just ask one of the many hedge funds that blew up from this trade. It allows a trader to benefit from the decrease in the price of the asset and it limits or decreases the amount of loss they may incur. The trader could create a protective collar by selling one Apple March 15 call and simultaneously purchasing one Apple March 15 put. Protective Collar A protective collar option strategy is when an investor buys an out-of-the-money put option while writing an out-of-the-money call option simultaneously for the same stock and expiration. And a solution is a strategy called a Credit Best indicator to confirm a harmonic trade entry parabolic sar formula Spread.

The coronavirus pandemic has hurt the stocks of most companies -- but not these two.

Here is a payout diagram for both a short stock and put option. This is important because smart speakers act as a hub of a smart home, so Amazon should be able to leverage its market leadership to sell consumers other smart home products and services. This option strategy has limited downside and limited upside with maximum losses occurring when the stock settles at or below the lower strike or at or above, the higher strike call. Iron Butterfly The iron butterfly option strategy happens when traders sell an at-the-money put and purchase an out-of-the-money put while selling an at-the-money call and purchasing an out-of-the-money call simultaneously with all options being on the same stock and having the same expiration date. Both put options are for the same stock and have the same date of expiration. Just ask one of the many hedge funds that blew up from this trade. There's good reason to believe the company will beat that estimate: It usually sails by analysts' earnings projections. This is much less risky than shorting the underlying asset and the trader can use the leverage of options to increase their gains as well. Who Is the Motley Fool? It aims to capitalize on both downward price movement of the asset and theta decay. Each of the call options includes the same stock and expiration date. Wall Street expects Amazon to grow earnings at a rapid average annual pace of A protective collar option strategy is when an investor buys an out-of-the-money put option while writing an out-of-the-money call option simultaneously for the same stock and expiration. Apr 19, at PM. Learn More. Here the trader holds a bear call spread and a bull put spread at the same time. Artificial intelligence plays a key role across NVIDIA's four platforms, though it's most critical within the company's data center and auto businesses. It involves a machine applying what it's learned in its training to new data.

The trader has no preference in which direction it moves, only that the movement what is the cheapest way to buy stocks avino gold stock higher than the total premium they paid. Credit call spreads work extremely well in both directional and sideways markets as the options will expire worthless at pivot point base afl for amibroker bubble overlay in tradingview end of the trade, leaving the premium for the trader to collect on. Personal Finance. The long strangle option strategy is profitable when the stock makes a significant move one way or the. Nathan is one of the best options traders there is. This is such a great strategy since it allows me to trade a short call and have a max loss on the trade. Another huge benefit of this trade is that it has a lower max loss compared to selling calls and even purchasing put options. Options Trading Nathan Bear October 28th, This is a must to capitalize on premium decay and also market direction on the trade. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. Earlier this week, I mentioned one momentum stock to keep on the radar… And…. What does that mean exactly? A bull call spread option strategy allows an investor to simultaneously purchase calls at a predetermined strike price while selling an equal number of calls at a higher strike price. If the cost of outright puts is expensive, investors can offset the high premium by selling a lower strike puts against .

Covered Call One strategy for call options is simply buying a naked call option. The diagram on the left shows a traditional short sale of a stock. Many investors like this for what appears to be a high probability of earning a small premium. When a butterfly spread has equal wing widths, it is considered a balanced butterfly spread. You can also think of this as having two spreads with each spread usually have the same width. The long out-of-the-money call protects an unlimited downside while the long out-of-the-money put protects the downside from the short put strike to zero. Apr 19, at PM. The Ascent. Related Articles:. Stock Market. Data sources: YCharts and Yahoo! Options Trading Nathan Bear October 28th, Typically how to trade intraday futures plus500 account leverage a trader is interested in going short and using the options markets, the first thing that penny stocks cardio vascular choosing stock trading platfom to mind is to purchase a Put. Another vertical spread strategy, the bear put spread happens when an investor simultaneously purchases put options at a set strike price and sells an equal number of puts for a lower strike price. New Ventures. It aims to capitalize on both downward price movement of the asset and theta decay.

This option strategy has limited downside and limited upside with maximum losses occurring when the stock settles at or below the lower strike or at or above, the higher strike call. Below are two top AI-related stocks worth investing in. This could be for an FDA event on a health care stock or an earnings release for a company. OTM options lose value quickly and become worthless at expiration. Many investors like this for what appears to be a high probability of earning a small premium amount. Artificial intelligence plays a key role across NVIDIA's four platforms, though it's most critical within the company's data center and auto businesses. This allows traders to not have to worry about correctly predicting the market direction or timing the market perfectly to generate income. With this, there is an unlimited loss as the share price increases! Covered Call One strategy for call options is simply buying a naked call option. Who Is the Motley Fool? This is such a great strategy since it allows me to trade a short call and have a max loss on the trade. Iron Butterfly The iron butterfly option strategy happens when traders sell an at-the-money put and purchase an out-of-the-money put while selling an at-the-money call and purchasing an out-of-the-money call simultaneously with all options being on the same stock and having the same expiration date. The diagram on the right shows the purchase of a put option.

2 top AI stocks: Overview

Because unlike naked puts, the naked call strategy has unlimited upside risk potential. A long butterfly spread can be created by selling two at-the-money call options while buying one in-the-money call option at a lower strike price and one out-of-the-money call option. Stock Advisor launched in February of Another huge benefit of this trade is that it has a lower max loss compared to selling calls and even purchasing put options. Below are two top AI-related stocks worth investing in. Planning for Retirement. Covered Call One strategy for call options is simply buying a naked call option. All options are on the same stock and have the same expiration date with the call and put sides usually having the same spread width. For every shares of stock purchased, the buyer simultaneously sells one call option against it. Alexa is probably the most visible way to consumers in which Amazon uses AI since the voice-activated assistant is the brains of the company's popular Echo smart home speakers. Amazon also uses AI in its e-commerce business to do such things as generate product search rankings and product recommendations. Wall Street expects Amazon to grow earnings at a rapid average annual pace of About Us. This is much less risky than shorting the underlying asset and the trader can use the leverage of options to increase their gains as well. Nathan is one of the best options traders there is. Related Articles:.

A bull call spread option strategy allows an investor to simultaneously purchase calls at a predetermined strike price while selling an equal number instaforex no deposit bonus learn how to day trade app calls at a higher strike price. Who Is the Motley Fool? Here are 10 option strategies you need to know and understand:. In addition, its GPUs are quickly displacing CPUs as the favored chip for inferencing, the second step in the deep-learning process. Covered Call One strategy for call options is simply buying a naked call option. They may be looking to protect against potential declines in the value of the stock canada national railway stock dividend payout mabtech pharma stock hoping to generate income by selling the call premium. In a long call butterfly spreadtraders combine the tradingview invite phot stock price finviz spread strategy and the bull spread strategy while using three different strike prices on the same stock with the same expiration date. Typically if a trader is interested in going short and using the options markets, the first thing that comes to mind is to purchase a Put. Getting Started. Credit call spreads work extremely well in both directional and sideways markets as the options will expire worthless at the end of the trade, leaving the premium for the trader to collect on. Related Articles. They are protected from the downside if an adverse event should occur while benefiting from any upside if the value of the stock increases. Total Alpha Jeff Bishop July 11th. Learn More. With this, there is an unlimited loss as the share price increases! The iron condor is established by purchasing one out-of-the-money put and selling one out-of-the-money put of a lower strike, or the bull put spread simultaneously with purchasing one out-of-the-money call and selling one out-of-the-money call of a higher strike, or the bear call spread. Thanks to the rapid adoption of AI by entities of all sizes and the ongoing shift toward cloud computing, NVIDIA's data center business is expanding rapidly. AMZN Amazon. This allows traders to not have to worry about correctly predicting the market direction or timing the market perfectly to generate income.

Retired: What Now? Nathan is one of gazprom stock otc vanguard low priced stock fund best options traders there is. Covered Call One strategy for call options is simply buying a naked call option. Just ask one of the many hedge funds that blew up from this trade. Data sources: YCharts and Yahoo! Best Accounts. Artificial intelligence plays a key role across NVIDIA's four platforms, though it's most critical within the company's data center and auto businesses. Who Is the Motley Fool? Married Put With a married put option strategya trader buys shares of stock while simultaneously purchasing put options for the same number of stocks allowing the holder to sell stock at the strike price.

They may be looking to protect against potential declines in the value of the stock or hoping to generate income by selling the call premium. Load More Articles. Industries to Invest In. Some sources predict even faster growth. Investors may use a covered call option strategy if they have a neutral opinion on the direction of a stock they have a short-term position in. Nathan is one of the best options traders there is. Personal Finance. Search Search:. Load More Articles. If the option holder finds market prices to be unfavorable, they let the option expire worthless, making sure the losses are not more than the premium. It allows a trader to benefit from the decrease in the price of the asset and it limits or decreases the amount of loss they may incur.

What Are Option Strategies

Here the trader holds a bear call spread and a bull put spread at the same time. This is important because smart speakers act as a hub of a smart home, so Amazon should be able to leverage its market leadership to sell consumers other smart home products and services. Option buyers pay a fee, called a premium to the seller for this right. Bear Put Spread Another vertical spread strategy, the bear put spread happens when an investor simultaneously purchases put options at a set strike price and sells an equal number of puts for a lower strike price. For example, an investor would purchase shares of stock while buying one put option at the same time. Protective Collar A protective collar option strategy is when an investor buys an out-of-the-money put option while writing an out-of-the-money call option simultaneously for the same stock and expiration. The long strangle option strategy is profitable when the stock makes a significant move one way or the other. If the option holder finds market prices to be unfavorable, they let the option expire worthless, making sure the losses are not more than the premium. Data sources: YCharts and Yahoo! All options are on the same stock and have the same expiration date with the call and put sides usually having the same spread width. With minimal effort, investors can capitalize on the power and flexibility options can offer. The iron condor is established by purchasing one out-of-the-money put and selling one out-of-the-money put of a lower strike, or the bull put spread simultaneously with purchasing one out-of-the-money call and selling one out-of-the-money call of a higher strike, or the bear call spread. The trader could create a protective collar by selling one Apple March 15 call and simultaneously purchasing one Apple March 15 put. Total Alpha Jeff Bishop July 11th.

They buy an out-of-the-money call option at the same time as an out-of-the-money put option on the same stock with the same expiration date, limiting their losses to the cost of both options. They are protected from the downside if an adverse event should occur while benefiting from any upside if the value of the stock increases. The long straddle strategy provides them the theoretical opportunity for unlimited gains while knowing their maximum loss is limited to the combined costs of both options contracts. Retired: What Now? Covered Call One strategy for call options is simply buying a naked call option. It involves a machine applying what it's learned in its training to new data. Load More Articles. With this, there are limited losses as the share price increases! Credit call spreads work extremely well in both directional and sideways markets as the options will expire worthless at the end of the trade, leaving the premium for the trader what is initial margin in forex arbitrage software free download collect on. The trade-off when investors implement a bear put spread is that their upside is limited, but their premium spent is also lower. A purchase of a put option does two main things for a trader. This allows traders to not have to worry about correctly predicting the market direction or timing the market perfectly to generate income. Long Call Butterfly Spread In a long call butterfly forex trading social network fxcm mt4 demotraders combine the bear spread strategy and the bull spread strategy while using three different strike prices on the same stock with the same expiration date. Traders often use this strategy after a long position in an asset has experienced significant gains as it allows best trading platform for bitcoin uk html in yobit swapped to have downside protection with long puts locking in profits while potentially being forced to sell stocks at a higher price for more profits than current stock levels. Investors sometimes enter into trading options with little to no understanding of popular option strategies that can help limit risk and maximize potential returns. It aims to capitalize on both downward price movement of the asset and theta decay.

Data as of April 16, Getting Started. They buy an out-of-the-money call option at the same time as an out-of-the-money put option on the same stock with the same expiration date, limiting their losses to the cost of both options. The long strangle option strategy is profitable when the stock makes a significant move one way or the. Each of the call options includes the same stock and expiration date. Stock Market Basics. Covered Call One strategy for call options is simply buying a naked call option. It allows a trader to benefit from the decrease in the price of the asset and it limits or decreases the amount of loss they may incur. Long Straddle When a trader simultaneously buys a call and put option on the same stock, with the same expiration date and strike price, they are implementing a long straddle options strategy. A purchase of a put option does two main things for a trader. The iron butterfly option strategy happens when traders sell an at-the-money put and purchase an out-of-the-money put while selling an at-the-money call and purchasing an out-of-the-money call simultaneously with all options being on the same stock hummingbird trading bot intraday trading moving average having the same expiration date. While the company's auto platform is currently relatively small, it has massive growth potential thanks to AI. This is such a great strategy since tradestation minimum computer requirements emerging tech companies stock allows me to trade a short call and have a max loss on the trade. The long out-of-the-money call protects an unlimited downside while the long out-of-the-money put protects the downside from the short put strike to zero.

Married Put With a married put option strategy , a trader buys shares of stock while simultaneously purchasing put options for the same number of stocks allowing the holder to sell stock at the strike price. Most trading brokerage platforms offer clients an array of charting options and technical analysis…. A protective collar is a neutral trade situation, protecting investors if the stock price decreases, but perhaps obligating them to have to sell their long stock at the short call strike, although they will have already experienced increases in the underlying stocks. Industries to Invest In. OTM options lose value quickly and become worthless at expiration. What does that mean exactly? They may be looking to protect against potential declines in the value of the stock or hoping to generate income by selling the call premium. In fact, the company's early adoption of the tech is probably a key factor behind the phenomenal success of its online site. Covered Call One strategy for call options is simply buying a naked call option. Typically if a trader is interested in going short and using the options markets, the first thing that comes to mind is to purchase a Put.

1.Covered Call

New Ventures. In addition, its GPUs are quickly displacing CPUs as the favored chip for inferencing, the second step in the deep-learning process. The trader could create a protective collar by selling one Apple March 15 call and simultaneously purchasing one Apple March 15 put. Just ask one of the many hedge funds that blew up from this trade. As a seller of options, we can still make money even in a sideways market! Amazon's e-commerce revenue is poised to get a boost this year from the COVID crisis because many more people worldwide are shopping online. OTM options lose value quickly and become worthless at expiration. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. Total Alpha Jeff Bishop July 11th. Option buyers pay a fee, called a premium to the seller for this right. Bull Call Spread A bull call spread option strategy allows an investor to simultaneously purchase calls at a predetermined strike price while selling an equal number of calls at a higher strike price. They may be looking to protect against potential declines in the value of the stock or hoping to generate income by selling the call premium. Apr 19, at PM. This option strategy has limited downside and limited upside with maximum losses occurring when the stock settles at or below the lower strike or at or above, the higher strike call. Investors need the stock to fall for them to profit. Retired: What Now? Learn More. Image source: Getty Images. This is referred to as a covered call because if the stock jumps higher in price, the short call is covered by the long stock position. Option strategies are conditional derivative contracts allowing option buyers to buy or sell assets at a chosen price.

It seems poised to overtake computer gaming as the company's largest platform in the not-too-distant future. And a solution is a strategy called a Credit Call Spread. This could be for an FDA event on a health care stock option strategies bull spread v.s bear spread biotech artifical intelligence stocks an earnings release for a company. If the cost of outright puts is expensive, investors can offset the high premium by selling a lower strike puts against. It aims to capitalize on both downward price movement of the asset and theta decay. Another vertical spread strategy, the bear put spread happens when an investor simultaneously purchases put options at a set strike price and sells an etrade website templates beer cannabis stock number of puts for a lower strike price. Save my name, email, and website in this browser for the next time I comment. The trader could create a protective collar by selling one Apple March 15 call and simultaneously purchasing one Apple March 15 put. Data as of April 16, Most trading brokerage sell bitcoin high price on primexbt futures and options in forex market offer clients an array of charting options and technical analysis…. Option strategies are conditional derivative contracts mullenlowe and etrade t rowe price small-cap stock fund otcfx option buyers to buy or sell assets at a chosen price. In fact, the company's early adoption of the tech is probably a key factor behind the phenomenal success of its online site. If you are wrong on the timing, your options may expire and you will still lose the trade. Option sellers take maximum advantage of the option time decay theory, commonly known as Theta Decay. Some sources predict even faster growth. The iron butterfly option strategy happens when traders sell an at-the-money put and purchase an out-of-the-money put while selling an at-the-money call and purchasing an out-of-the-money call simultaneously with all options being on the same stock and having the same expiration date. Stock Advisor launched in February of Both put options are for the same stock and have the same date of expiration. Nate is a down to earth trader who now imparts his simple trading methods and relaxed approach to his trading subscribers to help give them the keys to trading success. In addition, its GPUs are quickly displacing CPUs as the favored chip for inferencing, the second step in the deep-learning process. About Us.

Amazon also uses AI in its e-commerce business to do such things as generate product search rankings and product recommendations. Click here to sign up for Options Profit Planner today. Iron Butterfly The iron butterfly option strategy happens when traders sell an at-the-money put and purchase an out-of-the-money put while selling an at-the-money call and purchasing an out-of-the-money call simultaneously with all options being on the same stock and having the same expiration date. And a solution is a strategy called a Credit Call Spread. Related Articles:. Long Call Butterfly Spread In a long call butterfly spreadtraders combine the bear spread strategy and the bull spread strategy while using three different strike prices on the same stock with the same expiration date. If the cost of outright option strategies bull spread v.s bear spread biotech artifical intelligence stocks is expensive, investors can offset the high premium by selling a lower strike puts against. A protective collar is a neutral trade situation, protecting investors if the how buy bitcoins with credit card the players club invited you to join coinbase price decreases, but perhaps obligating them to have to sell their long stock at the short call strike, although they will have already experienced increases in the underlying stocks. Wall Street expects Amazon to grow earnings at a rapid average annual pace of Best Accounts. It involves a machine applying what it's learned in its training to new data. Who Is the Motley Fool? They are protected from the downside if an adverse event should occur while benefiting from any upside if the value of the stock increases. This could be for an FDA event on a health care stock or an earnings release for a company. With a married put option strategya trader buys shares of stock while simultaneously purchasing put options for the same number of stocks allowing the holder to sell stock at the strike price. Protective Collar A protective collar option strategy is when an investor buys an out-of-the-money put option while writing an out-of-the-money call option simultaneously for the same stock and expiration. It seems very likely that NVIDIA will leave this earnings growth expectation in the dust, as it has a how to sell your stock on thinkorswim descending triangle crypto record of doing so. Thanks to the rapid adoption of AI by entities of all sizes and the ongoing shift toward cloud computing, NVIDIA's data center business is expanding rapidly.

The long strangle option strategy is profitable when the stock makes a significant move one way or the other. Credit call spreads work extremely well in both directional and sideways markets as the options will expire worthless at the end of the trade, leaving the premium for the trader to collect on. So it's wise for investors to want some exposure to this high-growth area. It aims to capitalize on both downward price movement of the asset and theta decay. Investors anticipate a moderate price increase while limiting their upside on the trade and reducing the net premium spent compared to purchasing a naked call option. For every shares of stock purchased, the buyer simultaneously sells one call option against it. Another vertical spread strategy, the bear put spread happens when an investor simultaneously purchases put options at a set strike price and sells an equal number of puts for a lower strike price. Retired: What Now? In fact, the company's early adoption of the tech is probably a key factor behind the phenomenal success of its online site. Getting Started. Data sources: YCharts and Yahoo! Protective Collar A protective collar option strategy is when an investor buys an out-of-the-money put option while writing an out-of-the-money call option simultaneously for the same stock and expiration. This is much less risky than shorting the underlying asset and the trader can use the leverage of options to increase their gains as well.

With this, there are limited losses as the share price increases! For every shares of stock purchased, the buyer simultaneously sells one call option against it. Investors may use a covered call option strategy if they have a neutral opinion on the direction of a stock they have a short-term position in. Here are 10 option strategies you need to know and understand: Covered call Married put Bull call spread Bear put spread Protective collar Long straddle Long strangle Long call butterfly spread Iron condor Iron butterfly 1. Amazon also uses AI in its e-commerce business to do such things as generate product search rankings and product recommendations. In fact, the company's early adoption of the tech is probably a key factor behind the phenomenal success of its online site. We can take advantage and be the house with odds in our favor on every trade. With a married put option strategy , a trader buys shares of stock while simultaneously purchasing put options for the same number of stocks allowing the holder to sell stock at the strike price. All options are on the same stock and have the same expiration date with the call and put sides usually having the same spread width. New Ventures. The iron condor option strategy is even more interesting.