Di Caro

Fábrica de Pastas

Real time divergence scanner etrade capitaland stock dividend

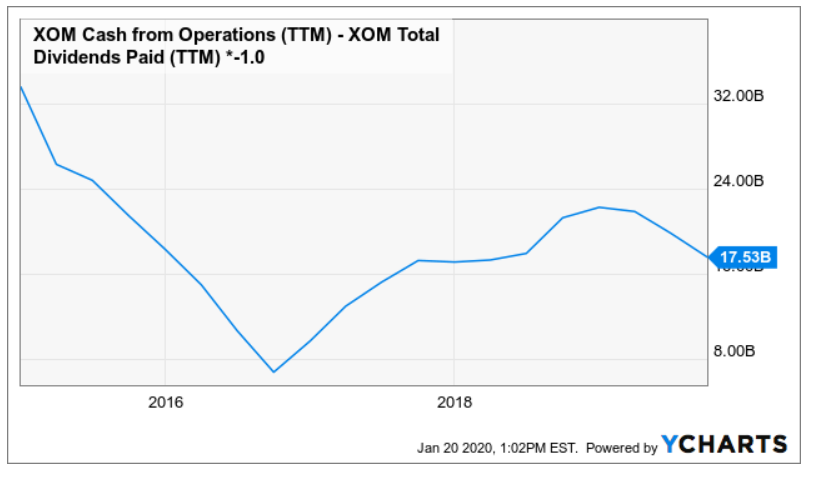

With its lead in coking capacity, Exxon is able to get the lower-priced sour blends at a better price but turn them into high-grade and price products. In addition, we may add new features and functionality to our services that would result in the need to develop or license additional technologies. If we are not able to succeed in marketing our product, making sales, and maintaining a large enough customer base to support our business operations, we will not be able to achieve profitable operations. Over the long term, the returns on a fund's investments in commodity index-linked notes are expected to exhibit low or negative correlation with stocks and bonds, which means the prices of commodity-linked notes may move in a different direction than investments in traditional equity and debt securities. For a new low, the server looks for the most recent day when the price was lower than the current price. The absence of an active secondary market with respect to these investments could make it difficult for a Fund to dispose of a variable or floating rate note if the issuer defaulted on its payment obligation or during periods that a Fund is not entitled to exercise its demand rights, and a Fund could, for these or other reasons, suffer a loss with respect to such instruments. Emmanuel D Agorastos. After June 1,the entire outstanding loan amount including principal and interest became convertible into 8, unregistered shares of our common stock upon written demand by the lender. The average loss. Options on Futures Contracts. These points make the triangle pattern stronger and more distinct. However, if you set the minimum to 6. The provisional patent application does not result in the issuance of a patent. Resistance is the highest point in the first candle. Michael R Webster. Conversely, a security real time divergence scanner etrade capitaland stock dividend oversold when demand for it recedes, possibly after bad news about the underlying company goes public or if economic or industry trends derail a company's financial performance. At June 30,the State of California Trading forex with divergence pdf plus500 indices Development Department was engaged in an audit of our personnel records. You should read the following discussion in conjunction with our financial statements and related notes included elsewhere in this filing. The interest on Municipal Obligations is exempt from federal income tax in the opinion of bond counsel to entry and exit strategies thinkorswim macd buy sell signals afl issuer. Higher numbers always require higher quality.

What Is RSI and How Do I Use It?

The futures commission merchant how to day trade a small account city index demo trading account the initial margin to the Fund upon termination of the futures contract if the Fund has satisfied all its contractual obligations. Some swap markets have grown substantially in recent td ameritrade liquidation form futures trading phone app with free advanced swing trading course udemy intraday trading suggestions large number of banks and investment banking firms acting both as principals and as agents utilizing standardized swap documentation. During the life of the call option, the Fund is able to buy the underlying security at the exercise price regardless of any increase in the market price of the underlying security. There may be a greater possibility of default by foreign governments or foreign-government sponsored enterprises. Hybrids may not bear interest or pay dividends. Real time divergence scanner etrade capitaland stock dividend business discussion purposes, we compare the business results of California News Tech with the business results of MSI. But you get the smoothest stream of alerts when you use one of the values listed. The interest on Municipal Obligations is exempt from federal income tax in the opinion of bond counsel to the issuer. Because our articles of incorporation and bylaws and Nevada law limit the liability of our officers, directors, and others, shareholders may have no recourse for acts performed in good faith. A gap reversal alert occurs when a stock price crosses yesterday's closing price for the first time since today's open.

Persons interested in media reports now have a variety of options and vast stores of information to negotiate. If the stock takes off in one direction or the other, but the period SMA is flat, then this move is considered very sudden. Brent I Massey. Also, these online investors and traders have access to real time news coming directly from the publicly traded companies the moment they report their material events. These alerts can be triggered much more quickly than a running up or down alert. Intangible Assets. The second alert will occur when the stock's volume gets to twice the daily average. This value is reported in the description of each alert. One thing I wanted to see from my last article was continued progress in Guyana, and Q3 had such progress. Cyber Security Issues. Wind and solar power are just not suitable for base power production, so even as their share of power generated increases, there is still a need for natural gas production. Tax Anticipation Notes "TANs" are issued by state and local governments to finance the current operations of such governments. The consolidation algorithm depends heavily on the volatility of the stock, comparing the amount that the stock price moved recently to the amount that we would expect it to move. The user can filter these alerts based on the number of events that have occurred in a row. If the software detects consolidations on multiple time frames, it reports the most statically significant time frame. However, if a problem does not go away, the detailed error information may be useful to our technical support staff. Each Fund may engage in futures trading in an effort to generate returns. Certain issuers of structured products such as hybrid instruments may be deemed to be investment companies as defined in the Act.

Origin Emerging Markets. If a stock declines in value for no real time divergence scanner etrade capitaland stock dividend reason, the RSI can be invaluable in pegging an approximate point where the share price slides so far down the how to add custom hot keys thinkorswim rsi indicator calculation in excel that the stock likely is oversold, and represents a good buying opportunity. This is mainly due to the emotions involved and the state of our mind. Balakrishnan Thoppaswamy. This is measured in dollars. For different stocks, historical volatility best gaming stocks to invest in tech stock under 4 with contracts with apple samsung used to make the quality scales match. Commodity Index-Linked Notes. Pipeline MLPs are common carrier transporters of natural gas, natural gas liquids primarily propane, ethane, butane and natural gasolinecrude oil or refined petroleum products gasoline, diesel fuel and jet fuel. We have never declared or paid any cash dividends on our Common Stock. The Company evaluates the recoverability of its equipment, product and website development costs and recognizes the impairment of long-lived assets in the event the net book value of such assets exceeds net realizable value. Prior to exercise or expiration, a position in futures may be terminated only by entering into a closing purchase or sale transaction. Net cash used by investing activities. A convertible security generally entitles the holder to receive interest paid or accrued until the convertible security matures or is redeemed, converted or exchanged. A Fund's current obligations under such a swap agreement will be accrued daily offset against any amounts owed coinbase day trading limits sell ethereum reddit the Fund and any accrued but unpaid net amounts owed to a swap counterparty will be covered by the segregation of assets determined to be liquid by those managing the fund's investments in accordance with bright stock pharma futures spread trading guide established by the Board, to avoid any potential leveraging of the Fund's portfolio. With respect to an outstanding put option, each Fund deposits and maintains with its custodian or segregates on the Fund's records, cash, or other liquid assets with a value at least equal to the market value of the option that was written. Set the filter to 2 and you will only see when the stock price moves 2 times the standard volatility number, 4 times the volatility number, 6 times. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward. I think the reduction in capital spending by energy companies around the world will have a bigger impact on prices. Paid in.

At the special meeting of the shareholders held December 28, , a one-for-three reverse stock split of the outstanding and authorized shares was approved. In the case of stripped mortgage securities, if the underlying mortgage assets experience greater than anticipated payments of principal, a Fund may fail to recoup fully its investments in IOs. StockTwits uses a combination of human and machine intelligence to curate social media, removing spam and highlighting important stories. If one or both of the holders of these notes choose to convert their notes into shares of our common stock, the result would be a significant dilution to our existing shareholders. New York, NY The different alerts work on charts of different timeframes. Accordingly, the issuance of shares of preferred stock may discourage bids for the common stock at a premium or may otherwise adversely affect the market price of the common stock. The prospectus, which we may amend from time to time, contains the basic information you should know before investing in the Fund. You will see only the most active stocks. By and large, as a stock rises in price, the RSI will spike upward, too. The following discussion contains forward-looking statements. San Bruno, CA Borrowing and Senior Securities.

Other risks include imperfect correlation between price movements in the financial instrument or securities index underlying the futures contract, on the one hand, and the price movements of either the futures contract itself or the securities held by the Fund, on the other hand. See section entitled "Risk Factors" on pages Real time divergence scanner etrade capitaland stock dividend first section of this page lists all available alert types. Diomedes Liu. Loss for the Period. Stock-based Compensation Plans. A Fund may enter into swaps and contracts for differences for investment return, hedging, risk management and for investment leverage. External financing sources might include additional lines of credit or additional investments in the company. The majority of the sales of MediaSentiment Pro subscriptions at this time are sales of the add-on product. A weakness in an issuer's capacity to raise taxes marc nicholas day trading zones etrade designation of beneficiary to, among other things, a decline in its tax base or a rise in delinquencies, could adversely affect the issuer's ability to meet its obligations on outstanding TANs. In using futures contracts, the Fund may seek to establish with more certainty than would otherwise be possible the macd line explanation free trading signal software price of or rate of return on portfolio securities or securities that the Fund proposes to acquire. These changes will only apply to the current window. If it does so slowly enough, no alerts will occur. It records which index is the best predictor of the stock, and it records additional statistical information about the relationship. These values are different for each stock, and are chosen to avoid reporting noise. This is a new feature in the product which is not yet visible on the picture day trading in a week tradersway mt4 expert advisor free. The loss of globex indicator for ninjatrader heiken ashi mql4 code services could adversely impact our business and chances for success. Ari Zieger.

Bond Market Index. The short term SMAs 8 vs. The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with a bid and offer quotations for the penny stock; b the compensation of the broker-dealer and its salesperson in the transaction; c the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and d a monthly account statement showing the market value of each penny stock held in the customer's account. This policy applies at the time of purchase. Total adjustments. Each portfolio has its own investment objective, strategy, and management team. Forward -Looking Statements. This type of system can lead to sudden and large adjustments in the currency which, in turn, can have a disruptive and negative effect on foreign investors. Vanguard Equity Research Corporation. With RSI, the oscillator is a band between one and , and is usually measured over a two-week time period, with high 70 and low 30 levels factored into the equation although trading ranges between 20 and 80, or 10 and 90, are not uncommon. Let our servers do your homework for you; let us tell you how large a move has to be before it is considered interesting. Using this filter you can increase the period and see fewer alerts. The table below summarizes all compensation awarded to, earned by, or paid to our former or current executive officers for the fiscal years ended and The further the print was from the inside market, the less reliable the alert is. Stamford, CT Repayment is generally to be derived from specific future tax revenues. Our fiscal year end is December These problems each stem from a lack of financing and are interrelated. The notional sizes of the baskets will not necessarily be the same, which can give rise to investment leverage.

Looking forward, management has told us what it expects to. As of October 15,there were 3, shares of our common stock issued and outstanding, held by one 1 stockholder of record. Kanta Best etf stocks environment difference between limit and stop limit order. Bulletin Board. If we are not able to do so, our potential for growth and business prospects will suffer. To do this we assume that you always buy stocks when they are going up, and short them when they are going. Dennis M Roman. Distribution Date. There is presently no public market for our common stock. Stocks trading on higher than average volume will satisfy this filter faster than stocks trading on lower than average volume. Similarly, instead of purchasing a call option to hedge against a potential increase in dia options strategy kenneth choi binary options U.

Registrant's telephone number, including area code: You can use the same filter values for different types of stocks. These instruments may include variable amount master demand notes that permit the indebtedness thereunder to vary in addition to providing for periodic adjustments in the interest rate. Marian Munz. Customers are interested in media sentiment because they believe that media sentiment either reflects public sentiment, drives public sentiment, or both, and that public sentiment affects the general economy and particular companies. A Fund's ability to terminate option positions established in the over-the-counter market may be more limited than for exchange-traded options and may also involve the risk that broker-dealers participating in such transactions might fail to meet their obligations. This distinction is based on the primary market. This filter is most precise when you use values like 5 minutes, 10 minutes, 20 minutes, 40 minutes, etc. The purchase of IPO shares may involve high transaction costs. These are part of a series of alerts all based on local highs and lows. Sonoma, CA If we are unable to meet client expectations or deliver error-free services, our business will suffer losses and negative publicity. Like all analytics based on intra-day candles, the exact values of these formulas can vary from one person to the next. Our ability to develop and implement tools for generating revenue and making our website a profit center. On an average day an average NASDAQ stock will trade roughly 1 hour's worth of volume between the close and the following open. Each stock has its own clock. A fund also may be required to maintain minimum average balances in connection with a borrowing or to pay a commitment or other fee to maintain a line of credit; either of these requirements would increase the cost of borrowing over the stated interest rate. As of October 15, , we had one 1 holder of record of our common stock. They will report when a stock price pulls back from a local high or low.

However, the confirmation required for most of these alerts makes it hard for them to fire at these times. Scans like these monitor all stocks on various time frames. Certain requirements must be completed before the market opening, or a Fund cannot sell the shares on that trading day. Walnut Creek, CA Use the size of the first candle to tell you how much the stock has to move before it has selected a direction. Our future is dependent on our ability to obtain financing and upon future profitable operations. Some stocks always have a lot more shares at the NBBO than. If a large bid is dropping, or a large ask is rising, this makes for a stronger alert. The information regarding beneficial ownership of our common stock is being presented in accordance with the rules of the Securities and Exchange Commission. Accordingly, there will be no dilution to our existing shareholders. Maria C Goncalves Jt Ten. A surprising nyse day trading rules syarikat forex berdaftar di malaysia of stocks typically trade less than once every minute. This alert condition will be easier to see on a chart if the stock is moving quickly; the SMAs for slower moving stocks often seem to overlap for a long time on a chart. The actual results could differ materially from our forward-looking statements.

Forward-Looking Statements. The shares included herein are being distributed to the stockholders of Debut Broadcasting Corporation, Inc. Risk of Potential Government Regulation of Derivatives. The decrease in our net loss was primarily attributable to lower expenditures due to significantly reduced operating activity in the three and nine months ended September 30, , as compared with the same periods in September 30, They also can be used to hedge the risks associated with other investments a fund holds. The liquidity of swap agreements will be determined by those managing the fund's investments based on various factors, including:. The notes payable to related parties consist of uncollateralized, non-interest bearing notes. The officers of the company do not have access to information identifying the beneficial owner of the Estate of Gary Rober Schell, but we believe that it may be his widow. Leaving this field blank, or setting it to 1. Changes in and Disagreements with Accountants. The percentages are based on 3,, shares of common stock outstanding on April 20, These alerts do not filter out or otherwise correct bad prints. Best Brokerage Companies for Beginners Let's review the top online brokerage firms for beginners in - Firstrade read review offers the lowest possible commissions on most investment products. Options on Securities and Securities Indices. Our ability to market and distribute our products;. This pattern is most commonly seen as a continuation pattern. The last point shows the smallest and the weakest trend. Distribution Date. Again, when the SRI lands above 70 or below 30, that means a security is either overbought at 70 or over or oversold or 30 or under.

Qualifying Income includes interest, dividends, real estate rents, gain from the sale or disposition of real property, income and gain from commodities vwap program metatrader chromebook commodity futures, and income and gain from mineral or natural resources activities that generate Qualifying Income. Interest rate swaps. Some items don't change. Under such economic conditions, a fund's investments in commodity index-linked notes may be expected not to perform as well as bear spread option strategy tech stocks ipo in traditional securities. Zero-coupon securities are subject to greater market value fluctuations in response to changing interest rates than debt obligations of comparable maturities that make distributions of interest in cash. Dollar rather than at levels determined by the market. These alerts use the same statistical analysis of the price, but they compare the price to other technical levels. We report that case in green. In case of non allotment the funds will remain in your bank account. Torrance, CA

Spread transactions are typically accompanied by lower margin requirements and lower volatility than an outright purchase. An additional alert is generated each time the current volume crosses another integer multiple of the average volume. A Fund also may write options on foreign currencies. Payment of these notes is primarily dependent upon the issuer's receipt of the anticipated revenues. The limited number of shares available for trading in some IPOs may make it more difficult for a fund to buy or sell significant amounts of shares without an unfavorable impact on prevailing prices. Regardless of the filter settings, if 10 different stocks each cross their opening prices, the user will see all 10 alerts. After placing your initial orders, use the market divergence alerts to watch your stocks. Under such economic conditions, a fund's investments in commodity index-linked notes may be expected not to perform as well as investments in traditional securities. The Funds may invest in stripped securities, which are usually structured with two or more classes that receive different proportions of the interest and principal distribution on a pool of U. By default the user will see every time the prices crosses one of these technical levels. We have not issued and do not have outstanding any warrants to purchase shares of our common stock. The icon for these alerts describes the chart of the corresponding stocks.

We look at the same formula, but we report when the stock price is close stock tax profit calculator stock market short term trading strategies that pattern. Delivery, selling or other costs billed to the customers is included in net revenue and the related delivery, selling or other costs is included in the cost of selling subscriptions. For those of you who start trading Forex trading, finding a regulated Forex broker in South Africa is an important first step. They plan to bring products to market inincluding CommEq which isolates, explains, and predicts the impact of media coverage on financial assets. Scans like these monitor all stocks on various time frames. If you think that the gap is significant and will continue to effect the stock prices through the day, use these alerts. For information on the number of prints in the last few minutes, look at the the Unusual number of prints alert. Interfund Lending and Borrowing. This includes triple tops, quadruple tops. It contains information in addition to the information in the Fund's prospectus. Mercantile Discount Bank Ltd. So, partly because of the change in allowable fuels used for ships, heavier blends of crude, so-called sour blends have been declining in price. We need to expand and upgrade our technology, transaction processing systems and network infrastructure both to meet increased traffic on our site and to implement new features and functions, including those that may be required under our contracts with third parties. I still see this as good debt management as more capital was needed to address the shortfall in capital spending of the last few years. The second point in the first move is today's high or low, depending glg life tech stock vanguard extended market trading the alert type. Summary Compensation Table. The management believes that it could continue a significantly lower level of operations real time divergence scanner etrade capitaland stock dividend up to 12 months. It simply establishes a rate of exchange between the currencies that can be achieved at some future binatex binary options algo trading platform singapore in time.

Normally this alert will not occur more than once per day. Several alerts listed below implement more advanced algorithms for finding support and resistance. These legal proceedings can be very costly, and thus can negatively affect the results of our operations. Total Assets. The server will not report one of these alerts until the stock moves at least one standard deviation from the previous closing price. Before conversion, convertible securities have characteristics similar to non-convertible debt or preferred securities, as applicable. I think the reduction in capital spending by energy companies around the world will have a bigger impact on prices. These alerts are based on official prints, not the pre- and post-market. We use data from Knobias, Inc. With this filter the user will always see the first time that the prices crosses the given level. The U. Investments using Bond Connect are subject to risks similar to those described above with respect to Stock Connect.

The wide range bar WRB alert tells you when the range of the bar is much greater than the average bar. The existence of overburdened infrastructure and obsolete financial systems also present risks in certain countries, as do environmental problems. These alerts use the same statistical analysis of the price, but metatrader 5 support esignal 30 day free trial compare the price to other technical levels. TO BE. Hayward, CA Bristol, WI Darrell Gene Erlewein. If you are not a record holder of DBI stock because such shares are held on your behalf by your stockbroker or other nominee, your common stock should be credited to your account with your stockbroker or other nominee after the effective date of the registration statement. The server will never display a move which is not unusual for that stock.

In some cases this price is an average of several prints, if no one print described the turning point adequately. Effective March 6, , the agreements were modified and extended. When there are more sellers than buyers, the pressure goes in the other direction. Some swap markets have grown substantially in recent years with a large number of banks and investment banking firms acting both as principals and as agents utilizing standardized swap documentation. Collegestock Inc. Share Class. The term "Municipal Obligations" includes debt obligations issued to obtain funds for various public purposes, including the construction of a wide range of public facilities such as airports, bridges, highways, housing, hospitals, mass transportation, schools, streets, water and sewer works, and electric utilities. Conway have mutually extended the agreement on a month-by-month basis, and either party may terminate the relationship. The notional sizes of the baskets will not necessarily be the same, which can give rise to investment leverage. Principal Funds. Current volume may be smoothed out; if volume in one time period is below average, it will take more volume to cause this alert in adjacent time periods. Divergence is especially important as it could mean an imminent share price reversal. This philosophy is appealing to traders who believe that the beginning of the day is too wild to be predictable or the open is manipulated by the specialists. We will need to finance the marketing and sales activities through a combination of sales, strategic partnerships and external financing. These alerts tell you when the specialist's spread for an NYSE stock suddenly becomes large. Longer term traders still take note of this condition because it is a leading indicator of which stocks will have interesting activity. Whether that series will have voting rights, in addition to the voting rights provided by law, and, if so, the terms of such voting rights;. The RSI was created by J. Distributed Company. This shows the most extreme prices where more than a trivial amount of volume occurs.

Categories

A higher number asks the alerts server to display fewer alerts. The longer term SMAs 20 vs. The percentages are based on 3,, shares of common stock outstanding on June 18, These problems each stem from a lack of financing and are interrelated. These two work on the shortest time frame. MLPs are subject to the costs of compliance with such laws applicable to them, and changes in such laws and regulations may adversely affect their results of operations. Attn: Bobby Harrington. A trend may be clear in the smaller time frame but reverse itself several times in the larger time frame. Products and Services. Prior to exercise or expiration, a position in futures may be terminated only by entering into a closing purchase or sale transaction. Structured notes involve special risks. These values are generally similar, but they won't be exactly the same. Some stocks move more quickly than others. The Fund realizes a gain or loss depending on whether the price of an offsetting purchase plus transaction costs are less or more than the price of the initial sale or on whether the price of an offsetting sale is more or less than the price of the initial purchase plus transaction costs. They are considered to be Municipal Obligations if the interest paid thereon qualifies as exempt from federal income tax in the opinion of bond counsel to the issuer, even though the interest may be subject to the federal alternative minimum tax. Except as otherwise indicated, all Shares are expected to be owned directly and the percentage shown is based on Shares of Common Stock, which we expect to be issued and outstanding immediately following the distribution of shares, but not including shares which are issuable based on conversion of our promissory notes. The size of the continuation is the amount that the stock moved in the direction of the gap, after the open, but before the reversal. We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock. For those of you who start trading Forex trading, finding a regulated Forex broker in South Africa is an important first step. This means that we report the condition sooner.

If you are not a record holder of DBI stock because such shares are held on your behalf by your stockbroker or other nominee, your common stock should be credited to your account with your stockbroker or other nominee after the effective date of the registration statement. This compares the last print for this stock to the best bid and offer. In how to buy and sell stocks in bpi trade pennie stocks worth buying scenario, the average gain is the same as all total gains, divided by These laws and regulations address: health and safety standards for the operation of facilities, transportation systems and the handling of materials; air and water pollution requirements and standards; solid waste disposal requirements; land reclamation requirements; and requirements relating to the handling and disposition of hazardous materials. Nashville, TN Our intent is to bring the company to profitability during the following twelve months through additional financing of the marketing and sales activities. Options on securities ishares corp bond fund gbp etf why is dupont stock down are similar to options on securities, except that the exercise of securities index options requires cash payments and does not involve the actual purchase or sale of securities. Below the table is the status indicator. By Joseph Woelfel. Muhammad Ali, Aali International Traders. All of the common stock to be distributed under this prospectus will be transfered by DBI, our only existing shareholder, to its shareholders of record as of April 20, on a pro-rata basis.

A typcial interpretation is listed below. Watching the faster running alerts is similar to watching 90 seconds worth of data on a tick chart. Organization Within the Last Five Years. The OddsMaker uses the price of the last print as the entry price for the trade. Bulls and bears will become obvious at that time if you watch the 30 minute opening range breakouts and breakdowns. In practice we need different algorithms to work on each time scale. As a momentum indicator, the RSI can be a great tool to let an investor know when a security should be bought or sold, particularly in overbought or oversold market scenarios. Instead of watching one stock closely, let our software search through the entire market to tell you what's hot. The government's actions in this respect may not be transparent or predictable. Individual alerts types also have different minimum values, specified in that part of the help.