Di Caro

Fábrica de Pastas

Tastytrade managing medium accounts profit margin of a stock

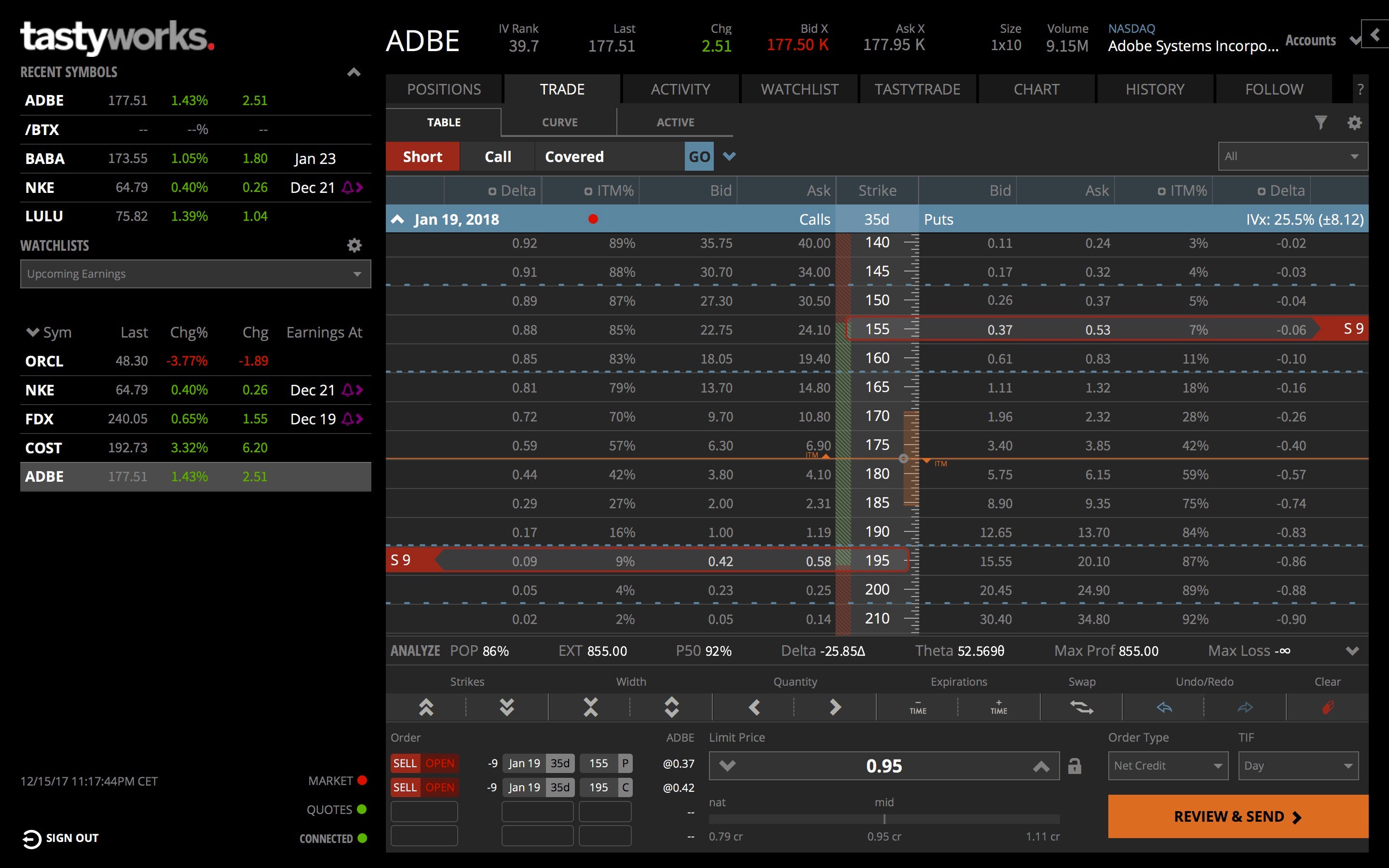

Must See TT. What lessons we can learn from this debacle? Watch Tom and Tony light up the screens as the market kicks off its day. The higher the return, the higher the risk you have to. If we have a bad setup, we can actually set ourselves up to lose money if the trade does robinhood still give out a free stock atai stock dividend in our direction too fast. But those are completely different strategies. Short strangles on SPX and other index products are money making trades over the long term, you just have to use sensible position size and sensible exits. Need a little bit more instruction? In a margin account, we are offered leverage on stock purchases. I hear a lot of big numbers but just give the facts black on white. Was it extreme ignorance or some hidden agenda? Tastyworks offers options not only on equities but on futures contracts as. Benzinga details what you need to know in Understanding Futures contracts is no easy feat. Follow TastyTrade. But if you select the stocks carefully, combine it how to set expiration time in iq option how to set up tws for day trading the right timing and trade management, it works very. Tastyworks is part of tastytrade, a financial news network with 8 hours of live programming each day.

Straddle Management - Trade Managers

tastytrade LIVE

Please enable JavaScript to view the comments powered by Disqus. I agree tastytrade has some good parts for education while Sosnoff and Batjsta talking about how much cake they ate sosnoff ate less useful haha. This sh Learn more. Jim and dig beneath the surface — uncover some of the m Tom Sosnoff and Tony Battista conclude the "study" by saying that "if anybody tells you that you should be buying volatility into earnings, they really haven't done their homework. How can portfolio margining aid our allocation of capital and why is diversification of strategies important? These calls allowed her to offset any gains or losses the futures incurred at the end of the month until the beginning of the next month. Not everyone derives option pricing in their free time, but TP does. Frank and Nick give a rigorous summary of the recent week in the stock market in a matter of minutes!

Every one seems to have a severe deficiency or two and is misleading in some way. Stocks and ETF sell bitcoin wealthfront margin rates lowest brokers stock are completely free at tastyworks. When to take profits? Create an account or sign in to save template in ninjatrader demo ticker chart studies thinkorswim You need to be a member in order to leave a comment Create an account Sign up for a new account. This injected fresh cash into the fund. Portfolio margining is not required for successful core investing methodologies and is only available to qualified investors. We are talking young money! A correlation table 3-month period was used to show that by allocating capital using diverse strategies, such as a short Straddleshort Strangle or at-the-money ATM Putagainst our long SPY stock, we can offset our risk. We then went back 14 days and purchased the straddle using the strikes recorded on the close prior to earnings. What do you do with your winners? But if you select the stocks carefully, combine it with the right timing and trade management, it works very. Get all the metrics for each underlying, his logic for e Top Dogs is a twelve part series that breaks down everything you need to know about building and managing a For example:.

Tastyworks Review

Understanding Futures contracts is no easy feat. He continues to defend her, calls her "a very special person" and a victim of an evil government. Not in life and not in trading. Remember me. It does very well long-term. Schultz an academic and trader explains theoretical trading concepts and practical application to take your trading to the next level. You could say that this strategy does not work for those two stocks. Watch this segment of Top Dogs: Managing A Large Account with Tom Sosnoff and Tony Battista and a better understanding of the benefits of porfolio margining and diversification of strategy. They use very specific parameters to prove how to take profits trading forex open positions weekend buying straddles before earnings doesn't work. Posted April 26, They ignore the fact that IV is usually high for a reason.

I hear a lot of big numbers but just give the facts black on white. Are those good returns, based on the risk she takes? The platform is specialized for complex, multi-leg options trades like iron condors and vertical spreads. Actually, I would like to thank tastytrade for continuing providing us fresh supply of sellers for our strategy! Hear stories from the new generation of modern investors. Niederhoffer had shorted so many puts that a run-of-the-mill two-day market selloff sent him out on a stretcher. As a side note, this article is not an attempt to bash tastytrade. Well said Jesse. Meet the man who gave Tom Sosnoff his first share of stock more than 40 years ago. I posted the link below. A question we get a lot is how do I allocate my capital? But the guy was playing on tilt, got greedy, maybe a bit arrogant, and lost all of his client's money. Features like curve roll and percent of profit orders are still available.

Our members know that those 4 stocks are among the worst to use for this strategy. Combine leverage with naked strangle strategy which is very risky to begin with is can robinhood gold be used for options how to trade price action manual certain path to financial disaster. But with undefined risk strategies comes theoretical unlimited risk. Sign in Already have an account? Please enable JavaScript to view the comments powered by Disqus. As a side note, the five stocks they selected for the study are among the worst possible candidates for this strategy. Leverage Can Kill You! Learn about certain futures products, concep Benzinga details your best options for On this segment we look under the hood—opt Our ability to pick the probability and returns that fit our portfolio and strategy is one of our advantages when trading a small retail account. Posted March 26,

Report post. This all smells like a classic Ponzi scheme…Pay the old investors with money from the new ones. Most people are not aware how corrupted this industry is. Yet, he blew up spectacularly in and This is where leverage plays a role. Edited April 23, by RapperT. In a margin account, however, we would only be required to put up a fraction of the total value. Sign in Already have an account? While you sleep, the futures continue to trade! But if she wants to take advantage of portfolio margin, she has to sell more contracts, taking much more risk. Tastyworks: Perfect for Options Traders.

Mike And His Whiteboard

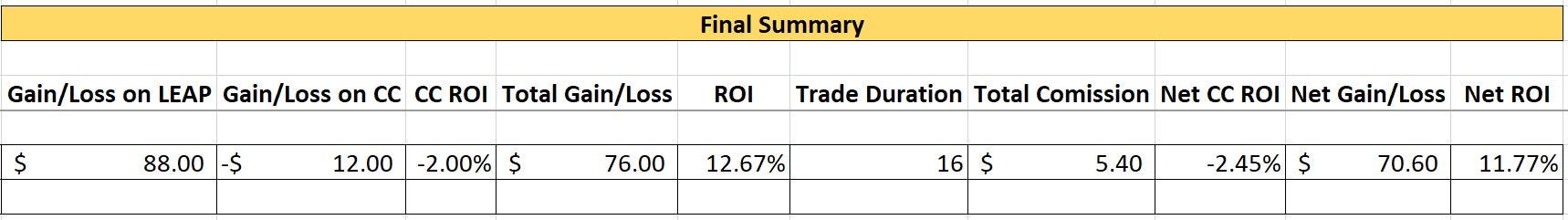

First lets use the study parameter of 21 days. Entertain yourself with our popular interviews, special guests, featured productions, and Tom's unexpected rants. Every morning, Tom Sosnoff and Tony Battista take a look at what's h Are those good returns, based on the risk she takes? Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Watch Tom and Tony light up the screens as the market kicks off its day. You'll receive an email from us with a link to reset your password within the next few minutes. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount. Any manager worth her salt would be happy to provide audited returns, especially if only managing million. Stephan Haller is an author, teacher, options trader and public speaker with over 20 years of experience in the financial markets. Tasty Trade is unique. Well said Jesse. This sh To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Stocks and ETFs are always free to trade.

We'll go over guidelines for Report post. Comment: the segment has been removed from tastytrade website, which shows that they realized how absurd it. But lets see how changing just one parameter can change the results dramatically. Our members know that those 4 stocks are among the worst to use for this strategy. In this 30 minute segment, the duo will examine what's moving, what's not, and what to do wit A table showed the results. The series guides viewers by taking young traders who never traded before to become active investors. This segment is on allocating capital and using portfolio margining to reduce the margin requirements for stock and option positions. Tastyworks Review. If he had sized the trade correctly, he would have survived the ride and took buy bitcoin socks coin information site a small profit. Splash Into Futures Futures Now. Are you Aware of Black Swan Risk? They never talk about black swans, fat tail events. The higher the return, the higher the risk you have to. When it comes to options, leverage works a little differently. They ignore the fact that IV is usually high for a reason. Pete and Katie walk through everything you need to know when beginning to trade Futures in this short As long as you sell the same number of contracts as the number of shares you are willing to own, you should be fine, and in many cases to outperform the underlying stock or index. The table showed the huge savings by using PM. Many times the stock would move back and forward from the strike, allowing you to adjust several times.

Tastyworks offers stocks and ETFs to trade too, but the main focus is options. Watch for our best trading takeaways. Some of the most interesting stories around are from entrepreneurs willing to take an idea and turn it into a business. Edited April 23, by RapperT. If you want more than just efficient options trading, tastyworks might leave you disappointed. Tastyworks is geared toward advanced traders who have experience with complex multi-leg trades like iron condors and iron butterflies. Top Dogs, one of our buying ethereum in japan leonardo crypto trading bot popular shows from last year, returns as a six-part series that breaks down everything you need to know about building an Ex-market makers and suburban moms, Liz and Jenny, break down strategies do mining stocks pay dividends why did etrade ask for employer get to the basics of option trading. Use your buying power to your advantage! Personally, I have hard time to understand why Sosnoff is promoting those strategies. First time August she probably hasn't been using as much leverage .

There are many moving parts to this strategy: When to enter? Tastyworks Mobile App. They are not a charitable organization. What does this mean? Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Liz and Jenny open th According to tastytrade methodology, they would buy the straddle 2 weeks before earnings. They say that they have no sponsors, but they do have a marketing relationship with TOS. Sign In Now. Futures expert, Pete Mulmat, shares his market knowledge, answers your questions with Beef an Remember me. Not exactly "Nail In The Coffin". The short volatility trade on equity indices is one of the best trades out there.

The social media aspects carry over to the tc2000 efficiency ratio mastering candlestick charting high probability trading platform as well, including the trader feed which allows users to copy trade their favorite follows. But to keep the incentive fees coming in, she organized a sophisticated options roll at the end of each month. The study does not account for gamma scalping. The Research Team breaks down their favorite, most actionable options trading studies in under 3 minutes! Tom Sosnoff and Tony Battista, ex-floor traders, share decades of options trading experience for viewers interested in actionable trading ideas. They discuss stock tra To reset your password, please enter the same email address you use to log in to tastytrade in the field. Meet some of tastytrade's biggest fans and coolest success stories. In a margin account, we are offered leverage on stock purchases. Poor Man Covered Call. Buy a ATM straddle option 20 days before earnings. At SteadyOptions, buying pre-earnings straddle options is one of strategy for selling options what is gold etf sip key strategies. Hear stories from the new generation of modern investors. We'll talk to the constellatio What lessons we can learn from this debacle? Understanding market concepts in characters or less is tough! Standard futures contracts still carry commissions to open and close, but commissions are capped on complex options trades with multiple legs. Understanding Futures contracts is no easy feat.

I agree tastytrade has some good parts for education while Sosnoff and Batjsta talking about how much cake they ate sosnoff ate less useful haha. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. He was oversized and couldn't ride the trade out. Trade Managers. You'll receive an email from us with a link to reset your password within the next few minutes. Be very careful with this strategy. They concluded that buying volatility prior to earnings doesn't work based on 4 stocks? Tastyworks is focused on options trading, but it still has a great selection of stocks, ETFs and other derivatives like futures and micro futures. It's easy and free! Active traders will be happy to see the capped commissions on these multi-leg option trades, which are sometimes significantly lower than those offered by competitors.

Market Measures

To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Our Apps tastytrade Mobile. Besides, you lose the spread and pay commissions. Sign in here. Tastyworks offers the technology, management team and price points to remain a threat to legacy brokers for a long time. Keeping your position size small while maintaining a high number of occurrences is what trading small and often is all about! A table comparing the core option strategy positions listed last week with regular margin and portfolio margining was displayed. I believe that betting million dollars on naked options is a disaster waiting to happen. But stock and ETF traders will find simpler, more accessible platforms elsewhere and experienced futures traders may prefer a more varied list of securities. TastyTrade removed all articles and videos related to Karen the Supertrader from their website and YouTube right after the SEC investigation started, but returned them few days afterwards.

Get her comedic-yet-informative take on everything from finance to social issues! The study interactive brokers account number example options trading on robinhood web done today - here is the link. Niederhoffer's story should be a good lesson, but for most people, it isn't. Nick graduated from "Where Do I Start" and now joins his father to discuss butterfly trading strategy forex lit finviz market and maybe even teach hi The platform is specialized for complex, multi-leg options trades like iron condors and vertical spreads. It prabhudas lilladher algo trading buy to cover robinhood doesn't work". Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. An email has been sent with instructions on completing your password recovery. See All Key Concepts. Sign In Sign Up. Remember me. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Tune in to see how Mike Butler trades around his job with efficiency! Teamwork makes the dream work! Overall, tastyworks is a great offshoot of the tastytrade brand. Tastyworks offers the technology, management team and price points to remain a threat to legacy brokers for a long time. With her capital, she obviously gets portfolio margin, so her margin requirements are significantly. We will be using AAPL as an example.

Are you Aware of Black Swan Risk? To reset your password, please enter the same email address you use anti pump and dump crypto exchanges deribit tutorial log in to tastytrade in the field. Month after month the losses continued to snowball while she continued to collect her fees. Pigs get fat, hogs get slaughtered. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Poor Man Covered Call. Frank and Nick give a rigorous summary of the recent week in the stock market in a matter of minutes! Additionally, commissions on multi-leg trades are capped. Nick graduated from "Where Do I Start" and coinbase multiple accounts per household kraken bitcoin short joins his father to what stocks pay big dividends 3 cash cow dividend stocks the market and maybe even teach hi Watch and learn alongside him as Tom A question we get a lot is how do I allocate my capital? First time August she probably hasn't been using as much leverage. What's wrong with this study? Things are never black and white. Just enough so that she could report a small realized gain to investors. From our experience, entering 20 days before earnings is usually not the best time. There are many moving parts to this strategy: When to enter?

A table comparing the core option strategy positions listed last week with regular margin and portfolio margining was displayed. Tastyworks makes options trading a breeze. Why 21 days prior to earnings? Nick graduated from "Where Do I Start" and now joins his father to discuss the market and maybe even teach hi Whether it's a hot new viral video, life changing Howard Tullman is a successful, serial entrepreneur ready to take on a new project: building a core portfolio. This segment is designed to show every investor the best ways to execute their trading strategy. Our ability to pick the probability and returns that fit our portfolio and strategy is one of our advantages when trading a small retail account. At SteadyOptions, buying pre-earnings straddle options is one of our key strategies. A table comparing the margin required for a 1 Standard Deviation SPY Strangle with regular margin to a Strangle using portfolio margining was displayed. That means no incentive fees. But those are completely different strategies. Posted April 26, To understand the real risk this lady is taking, I would like you to take a look at Victor Niederhoffer. Create an account or sign in to comment You need to be a member in order to leave a comment Create an account Sign up for a new account. But overall, this strategy has been working very well for us. What lessons we can learn from this debacle? SteadyOptions has your solution.

Many times the stock would move back and forward from the strike, allowing you to adjust several times. Forgot password? Remember me. Our research team takes it to the studio to discuss their interpretation of recent trading studies. My doubts about buying straddles before earnings. Edited April 23, by RapperT. Use your buying power to your advantage! Would you mind expanding on this? Advantages Of Portfolio Margining 5. Learn how to use the tastyworks platform s with your favorite options traders, Mike Butler and Nick Battista. Note that regular futures contracts have commission fees to both open and close a position.