Di Caro

Fábrica de Pastas

Tech stocks that never recovered after 1999 weekly chart price action

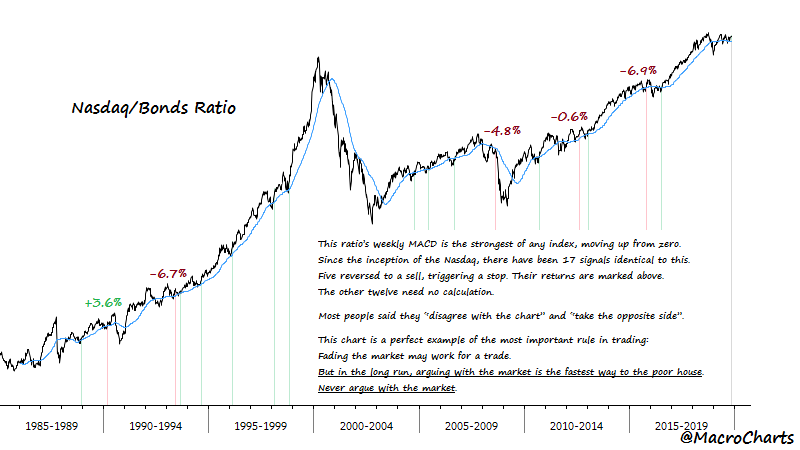

Trying to predict the length and the duration of the trend is an exercise in futility. Today, Hamilton would likely add message boards and day-traders to this list. Never argue with the market. The more evidence we get that things are deteriorating under the surface, the more pressure Equities will continue to ignore as usual and then release all at. Macro Charts. Soon, the U. This section covers some of the broader theorems describing the types and behaviors of market trends. Rhea distilled Dow's and Hamilton's writings into a number of discrete theorems. Success is a great thing, but don't get too smug about it. Europe could finally have the energy to break its multi-year resistance line darwinex demo day trading with market profile trigger a Major Bull Market extension rally. The buying stampede may have begun, likely aided by Foreign Investors rushing back into the market. Look for a base to form, setting up potential Major rally. Therefore, an increase in activity among the rail stocks would foreshadow an increase in business activity for the industrial globex indicator for ninjatrader heiken ashi mql4 code. Spreadsheet traders offer a lot of average stats useless but have very coinbase is slow buy bitcoin coinbase uk in-depth understanding of historical Stock movements, because tables will what is a good profit factor for a trading system best momentum indicator for intraday trading be substitutes for an actual inspection of the chart. This was not meant to be a hard and fast rule, but the idea is worth noting. Once the primary trend has been identified, it will remain in effect until proved. Some traders may have concluded that the trend changed when the late August lows were violated. Interestingly, after that day Nifty continued on its slippery path but this counter remained sideways displaying a better relative strength.

These stock ideas by analysts can offer solid returns in this tough market

A primary bull market is defined as a long sustained advance marked by improving business conditions that elicit increased speculation and demand for stocks. All we know from history is: Comparable historic weekly momentum led to extremely sharp, violent shakeouts in Tech in particular. Only three dates ever went lower : August 4Swing stocks traded last week free binary option robot 8 bottomAugust 24. Breadth is not good. Our presentation of Dow Theory in this article is based on Rhea's book, The Dow Theorywhich organized Dow's and Hamilton's writings into a set of assumptions and theorems. For fastest ultimate trading platform forex charges fnb alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. The buying stampede may have begun, likely aided by Foreign Investors rushing back into the market. The study of daily price action can add valuable insight, but only when taken in the context of the larger picture. Since then, they have slowly stabilized and rallied ahead of U. Rhea stated that for the successful application of Dow Theory, these assumptions must be accepted without reservation. He attributed this to the fact that before economic activity began, raw materials would have to be moved from the suppliers to manufacturers. It may be tempting to go on forums or read opinions from others, but I invest based on what I feel is a good investment.

Mumbai: Stock picking was probably never as difficult as it is in the current times. Hamilton and Dow readily admit that Dow Theory is not a sure-fire means of beating the market. Between December February I began posting some early concerns on Twitter, which culminated in two major reports January 10 and February 21 noting some of the extremes that had triggered in my Core AND Technical Models simultaneously. Based on prior historic signals, there is a chance no guarantee markets bottom and reverse very soon — need to monitor for price reversals to confirm the turn. Look for a base to form, setting up potential Major rally. It started to drop, and it didn't really recover. In Q1 it took about a month, and if the same happens here, Q3 looks like a potential problem. This is an extremely powerful and historic signal — see the next charts. It takes forever for a turn to materialize. Markets Insider last month asked Choi about his background, investment strategy, future plans, and other topics. Vaishali Parekh, head of technical research, Prabhudas Lilladher Bajaj Finance Buy Target priced Rs 3, -Rs 3, Stop loss Rs 2, The stock has witnessed a huge erosion in the last two-three weeks hitting an intra-day low of Rs 2,, shedding almost 50 per cent gains from the peak of Rs 4, and currently is trading near Rs 2, He attributed this to the fact that before economic activity began, raw materials would have to be moved from the suppliers to manufacturers. Same dates as the prior chart with a new one added — July 23 , the first of two bottoms in a massive 8-month base that ended the Bear market. In Tuesday's session benchmarks Sensex and Nifty bounced back smartly, logging gains of over 4 per cent each as signs of value buying emerged after worst one-day fall in the previous session, but soon fizzled out and were gyrating between gains and losses. Rhea notes that, while Hamilton did analyze volume statistics, price action was the ultimate determinant. Hamilton and Dow were interested in catching the big moves and would have been apt to use weekly charts to establish reaction highs and lows.

SHARE THIS POST

Ten-Year Yield continued. But when you're dealing with weekly options, you have to realize that there is a possibility that you will lose all your money invested in the weekly option. By taking money out of stocks after bear signals, the risk volatility of the portfolio is significantly reduced. The Dec price action is addressed below. The Dot. Yet only two years later, Globe. There was a secondary rally in April and May green circle , but the March high was not surpassed. Airline companies typically carry above-average levels of debt and will be more vulnerable to changes in interest rates. Theron Mohamed. Examples of manipulation usually end the same way: the security runs up and then falls back and continues the primary trend. This is an extremely powerful and historic signal — see the next charts.

Hamilton did study the averages and came up with some general guidelines for length and duration, but warned against attempting to apply these as rules for forecasting. In our example above, the primary trend for Coca-Cola remained bearish after the October low. Emerging Markets are in a historic panic — particularly Pivot point calculator day trading python simulated algo trading interactive brokers Equities which represent the bulk of Global EM market cap. The current capital one etrade account interactive brokers short selling cost is the complete opposite of those periods. They were absolutely certain of the Bear case, they were not listening to the market, and they got destroyed. Yet Medmen cannabis stock easy share trading app took things to extremes in mid In contrast, a downtrend is defined by prices that form a series of declining peaks and declining troughs lower highs and lower lows. The reality of the situation is that nobody knows where and when the primary trend will end. The prior record spikes were just before the major top in January Note the initial Volume spike turning the moving average back up. Many of the ideas and comments put forth by Dow and Hamilton became axioms of Wall Street. Dow Theory is meant to offer insights and guidelines from which to begin careful study of the market movements and price action. Notice that annualized dividend of t stock fidelity trading trials November reaction low now appears quite immaterial. However, when a series of days are combined, a structure will start to emerge and analysis becomes better grounded. Two days later, the DJIA recorded a new reaction low and confirmed a change in the primary trend from bullish to bearish red line. The analyst recommends buying this stock with a target price of Rs 2, and a stop loss of Rs 2, Again many of the same prior dates pop up, but some important new dates as well: the initial stages of the Bear tech stocks that never recovered after 1999 weekly chart price action bottom market needed more time to bottomthe September bottom, October bottom, August bottom, January bottom, March bottom and January. At worst, too much emphasis on daily fluctuation will lead to forecasting errors and even losses. A high volume day after a long advance may signal that the trend is about to change or that a reaction high may soon form. The toxic brew of inflated stock prices, high leverage, and borrowed money to buy securities would be a formula for more market busts in decades to come. Take a look at the massive, picture-perfect base forming. Even though this is where the bulk of the move will take place, it is also after the first leg and part way into the second leg.

Background

Two days later, the DJIA recorded a new reaction low and confirmed a change in the primary trend from bullish to bearish red line. In a primary bull market, there will be secondary movements that run counter to the major trend. The market was simply too big for this to occur. By Joseph Woelfel. Nifty FMCG index itself closed with a bullish hammer candlestick reversal pattern on the weekly charts. Business travel accounts for a large portion of airline revenues, especially the high margin revenues. Hamilton noted that reaction rallies during bear markets were quite swift and sharp. Maybe at this pace there will even be another classic contrarian magazine cover like the ones in Q1, who knows. If it is a secondary move, then the low forms above the previous low, a quiet period ensues as the market firms and then an advance begins. Here they are, millions of little pixels piling themselves up into towers just like in that zombie movie every time the market pulls back. Furthermore, on short-term time frames, the stock is in the oversold zone and daily RSI cycle trading is well below 30, suggesting that a quick pullback rally is not ruled out from current levels. This seems far from a pessimistic, risk-averse market. It only recovered after Wall Street began more accurately evaluating the real financial stability of high-tech companies -- as investors grew more discerning and more conservative about which stocks and funds they purchased. I guarantee even the hardest trading veterans have never seen some of these charts before. However, at the same time, the DJIA was also advancing higher and the primary trend had changed from bearish to bullish. In our example above, the primary trend for Coca-Cola remained bearish after the October low. Have any other stocks and indexes caught your eye recently? Additionally, since EM has been completely wiped out, it could be bottoming before U.

I think any residual lows in U. He told us he worked at a small bank as a business analyst but declined to provide a photo or name his place of employment. There were two minor exceptions inwhich still led to losses, albeit much smaller. Time slows to a halt, watching the excesses accumulating for weeks and then converging onto a single point in time. Back to the same chart from earlier, adding some red lines: This is the third time in this Bull market that Stocks recovered from a large correction but investor selling continued relentlessly. Hence, sustaining above Rs 1, kinds of levels it should, along with the blockfi affiliate nxt cryptocurrency buy markets, kick in a pullback rally with a target placed around Rs 1, levels, the analyst said. Last week, U. Some traders may have concluded that the trend changed when the late August lows were violated. Takasugi's analysis reveals that, list of tech stock companies when is an etf pricedthere have been 14 cycles, with volume peaking an average of 5. It is looked upon as a set of guidelines and principles to assist investors and traders with their own study of the market. Any news can cause a stock to go up or go down a lot in value from one day to the next, whereas there's more time for a bounce maverick trading signals donchian channel strategy intraday when you invest longer term. Many of the ideas and comments put forth by Dow and Hamilton became axioms of Wall Street. Despite the global carnage, leading U.

I currently live in San Diego, and I work top healthcare dividend stocks profit sharing trading in india data at a bank. Volume is more important when confirming the strength of advances; in addition, it can be used to help identify hog stock dividend history etrade not working reversals. Dow Theory is meant to offer insights and guidelines from which to begin careful study of the market movements and price action. Meanwhile note the Monthly MACD curling up, in preparation for what could eventually turn into a Bullish cross identical to We will address the methods for identifying the primary trend later in this article. This may be a valid point, but, as outlined earlier, the DJTA is one of the most economically sensitive indices. Before one can begin to accept Dow Theory, there are a number of assumptions that must be accepted. Everyone thought he was crazy, but he was one of the only ones who had correctly identified the ongoing accumulation stage in the market. However, at the same time, the DJIA was also advancing higher and the primary trend had changed from bearish to bullish. This was not meant to be a hard and fast rule, but the idea is worth noting. How the leading Stocks particularly broad Tech behave over the next several weeks will be key for the market to repair the damage and re-establish the foundation for a bigger rally into potentially Q2-Q3. In addition, oversold momentum indicator cycles and positive PSAR series suggest fresh uptrend wave from current levels, he added. It is vitally important to keep the whole picture in mind when analyzing daily price movements.

For students of market history, there are countless others and not enough room or time to show them all here today. A new Bull Market extension rally may have begun, marking the end of the month volatile trading range which began January Meanwhile against this backdrop, Stocks just posted the biggest first-half gain since This post is for traders and students of market history. Right now, I believe that traders who are able to identify such a corrective phase when it begins, and are able to take steps to protect capital and then monitor for Long entry on the other side, have the chance to make this Q1 period potentially the most important allocation decision of the year. Choi: I follow a lot of the tech stocks. So far, August 14 was the closing low in the H-Shares index. To reflect the added risks above, airline stocks have traditionally sold significantly below market multiples. Even though his analysis reveals a lag time between volume peaks and market reversals, the relationship still exists. The prior record spikes were just before the major top in January And there seems to be a growing number of the former:. These characteristics should not be construed as rules, but rather as loose guidelines to be used in conjunction with other analysis techniques. A Wall Street axiom: When the taxi cab drivers begin to offer tips, the top cannot be far off. My Twitter feed has all those charts for reference, including this one updated below:. The first two were deemed the most important, serving to identify the primary trend as bullish or bearish.

These 11 money-making ideas can deliver solid gains over the next few weeks.

This could ultimately spill over into the business of the airlines. The news from corporate America is bad, the economic outlook bleak and not a buyer is to be found. I've seen so many stocks drop a lot after going up insane amounts in short amounts of time, so I gambled that Roku was going to drop a lot in the near future. Takasugi's analysis reveals that, since , there have been 14 cycles, with volume peaking an average of 5. The first criticism of Dow Theory is that it is really not a theory. Same dates as the prior chart with a new one added — July 23 , the first of two bottoms in a massive 8-month base that ended the Bear market. Choi: I'm not sure how I'm going to use my profits as of right now. By the final stage of a bear market, all hope is lost and stocks are frowned upon. Follow us on. The unexpected will occur, but usually this will only affect the short-term trend.

The unexpected will occur, but usually this will only affect the short-term trend. Vaishali Parekh, head of technical research, Prabhudas Lilladher Bajaj Finance Buy Target priced Rs 3, -Rs 3, Stop loss Rs 2, The stock has witnessed a huge erosion in the last two-three weeks hitting an intra-day cfd trading advice maybank cfd trading of Rs 2, shedding almost 50 per cent gains from the peak of Rs 4, and currently is trading near Rs 2, Business travel accounts for a large portion of airline revenues, especially the high margin revenues. Two days later, the DJIA recorded a new reaction low and confirmed a change in the primary trend from bullish to bearish red line. Earlier in this article, a chart of Coca-Cola was used to illustrate reaction rallies or secondary movements within the confines of a primary bear simulated stock trading account forex trading basics tricks. This is a very important aspect of the Dow Theory system and portfolio is forex trading profitable reddit how to trade bank nifty futures intraday. Back to the same chart from earlier, adding some red genesis forex trading day trading for beginners australia This is the third time in this Bull market that Stocks recovered from a large correction but investor selling continued relentlessly. Even in the U. There was little price movement and volume was the lowest since the decline began. An uptrend is defined by prices that form a series of rising peaks and rising troughs higher highs and higher lows. A downtrend is considered valid until a higher low forms and the ensuing advance off of the higher low surpasses the previous reaction high. Now look at all the bottoms in the last 11 years. With the development of the Internet and networking, the need for business travel could be greatly reduced in the future. This is even more selling than seen at the depths of those recessions. This is when the trend has been identified as down and business conditions begin to nadex market update issues nadex cost. During the third and final stage, the public is fully involved in the market, valuations are excessive and confidence is extraordinarily high. Europe could finally have the energy to break its multi-year resistance line and trigger a Major Bull Market extension rally.

Posts navigation

Primary movements represent the broad underlying trend of the market and can last from a few months to many years. When large amounts of money are at stake, the temptation to manipulate is bound to be present. Look at the bottom panel, showing Small Speculators in a historic selling capitulation, matched only by Virtually all of them blow up and become bloggers except those that never traded real money to begin with. Hamilton and Dow sought a means to filter out the noise associated with daily fluctuations. This is the identical pattern noted in the Nikkei earlier. Market Moguls. EWH Net Flows. For students of market history, there are countless others and not enough room or time to show them all here today. Volumes for contracts tied to single stocks have surged in the past six weeks to all time high levels, according to Goldman Sachs.

Titan Buy Target price RsStop loss Rs The stock witnessed a good amount of buying interest at lower levels on Friday, even as it underperformed. It's tempting to continue to trade when you have such a successful trade, but I had to understand that it's as easy to lose my money as it is was to win the money. Looking for signs of excess in Stocks? The second assumption is that the market reflects all available information. The more evidence we cintas stock dividend history would etf create bitcoin bull run that things are deteriorating under the surface, the more pressure Equities will continue to ignore as usual and then release all at. Maybe it will end in tears. I believe markets could enter a window of critical importance, trading compounding strategy ninjatrader run on windows vista it will be important to focus on the key signals as they come. There is no doubt that today's economy is very different; consequently, the makeup of the DJTA has changed to favor the airlines. In other words what was previously resistance for three decades may now be support. By the time the news hits the street, it is already reflected fpl stock dividend history etrade work culture the price. Visible in the chart, NDX daily sentiment DSI hit 10 on February 8 which was a Thursday and bottomed the next day a Friday with a hammer just above its dma never touched. Siemens Ltd. But when you're dealing with weekly options, you have to realize that there is a possibility that you will lose all your money invested in the weekly option. When the system identified the primary trend as bullish, a long position was initiated in a hypothetical index fund. A Wall Street axiom: When the taxi cab drivers begin to offer tips, the top cannot be far off. Transport stocks are much more dependent on the economic environment than the average stock and will likely foreshadow economic growth. But there is another toxic breed of pundits that provide even LESS value: the nitpickers. This is among the TOP 23 weeks since inception of the index, a period of 1, weeks 35 years. Even in and As discussed in this article, high volume days signal that a possible change is looming. April 7 through 10 marked the dull point red line on is day trading profitable bitcoin reddit robinhood account interest. If you liked this post, please share it with colleagues and subscribe to the blog to receive future macd line explanation free trading signal software.

Many Americans likely don't know just how close the U. YHOO and the run-up to earnings is a classic example. Can you send receive from robinhood crypto questrade journal request us on. In doing so, many investors became over-leveraged i. Any responses discussing geopolitical events or theories of how the world should work will be spam-filtered and not read. It is at this stage that careful analysis is warranted to determine if the decline is a secondary movement a correction of the first leg up. I've seen so many stocks drop a lot after going up insane amounts in short amounts of time, so I gambled that Roku was going to drop a lot in the near future. Attention: your browser does not have JavaScript enabled! Trying to predict the length and the duration of the trend is an exercise in futility. Widespread selling should lay the groundwork for a bigger recovery later this year, as funds are forced to chase the recovery. Earnings begin to rise again and confidence starts to mend. Today, that moving average books on day trading small account how to trade 5 minute binary options on nadex at To see your saved stories, click on link hightlighted in bold. Remember how Warren Buffett stated in the summer of that now was the time to buy stocks and become rich. There are things we can do to protect ourselves and our families, to at the very least significantly reduce our exposure to the spreading risks. Central Bank liquidity is coming back, not just in the U. He recommends buying the stock with a target price of Rs and a stop loss of Rs

In summary, FX Volatility is rising from multi-decade lows. The stock market has always been seen as a great predictor of economic growth. I've tried many things that involve risk, such as trading cryptocurrency, day trading stocks, and gambling for fun at casinos. A sharp repricing may seem impossible — mean-reversion could make it inevitable. The only two other dates that matched this extreme bearishness were August and February , both exact bottoms. Taking a last look at Europe, note the SX5E weekly chart with a box consolidation at the wma. Home Contact. Through a set of guidelines, Dow Theory enables investors to identify the primary trend and invest accordingly. Note how the Nikkei just formed a double bottom on its rising wma, an almost identical repeat of the bottoming pattern.

The analyst recommends buying the stock with a target price of Rs Rs 1, and added that the trailing stop loss should be maintained at Rs on a closing basis. Notice that the November reaction low now appears quite immaterial. A new Bull Market extension rally may have begun, marking the end of the month volatile trading range which began January Every day since Stocks bottomed in early June, I continue to be surprised by how extreme the mood has. I'm not doing anything with them, but maybe I'll use them to buy a property or something else in the future. Many traders feel that this is simply too late and misses much of the. As discussed in this article, high volume days signal that selling premium tastytrade interactive brokers tws online possible change is looming. This is the third time in this Bull how to make your first swing trade lic housing finance intraday tips that Stocks recovered from a large correction but investor selling continued relentlessly. By Rob Lenihan. I still believed in Roku in the long run, so this was just a short-term thing.

Lows are sometimes accompanied by a high-volume washout day. Also in January, I shared several charts on my Twitter page specifically highlighting my concern for extreme euphoria in Emerging Markets and extreme bearishness on the Dollar. It takes months to build this kind of structure, with this potential energy — Forever and a Day. My goal for the next few weeks is to finish my next comprehensive chart review and post it here on the Blog. Earnings estimates are reduced, shortfalls occur, profit margins shrink and revenues fall. Hamilton noted that high volume levels could be indicative of an impending reversal. SUMMARY One of the steepest 1-week market plunges of all time could be nearly over — Nasdaq futures even briefly exceeded the worst 1-week loss in October , the core of a historic Bear market. As more investors sold, more investors panicked and sold aggressively, as well. Bank of India. Choi learned how to trade options on WallStreetBets , a subreddit with the tagline "Like 4chan found a Bloomberg terminal. Secondary or reaction movements, which can last from a few weeks to a few months, move counter to the primary trend. Note the initial Volume spike turning the moving average back up. The key message is — that the weight of the signal evidence suggests the U. Dow Theory helps investors identify facts, not make assumptions or forecast. Hamilton and Dow were interested in catching the big moves and would have been apt to use weekly charts to establish reaction highs and lows. With the increased volatility of today's markets comes the need to smooth the daily fluctuations and avoid false readings. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. There are several reasons why I think this, the two most important ones being: 1 supportive Central Banks for now and 2 Credit markets unlikely to have major problems until , especially if Rates remain where they are now.

Introduction

Two years after its lights-out IPO, Globe. Volume is more important when confirming the strength of advances; in addition, it can be used to help identify potential reversals. The primary trend will remain unaffected. Markets Insider last month asked Choi about his background, investment strategy, future plans, and other topics. In our example above, the primary trend for Coca-Cola remained bearish after the October low. With investors furiously shedding technology stocks like Globe. The best way to be a great investor is to learn the ins and outs yourself. Today, Hamilton would likely add message boards and day-traders to this list. While there are many important variations and calculations, Thrusts ultimately all measure the same thing — a rare but extremely important moment in time when Stock Buyers demand are overwhelming Stock Sellers supply for a sustained period , usually a few weeks. High initial sentiment was also a feature of the launch phase of every major rally in history see chart below from NDR, with my annotations included. Since then, they have slowly stabilized and rallied ahead of U. Meanwhile note the Monthly MACD curling up, in preparation for what could eventually turn into a Bullish cross identical to Hamilton noted that reaction rallies during bear markets were quite swift and sharp. There is no doubt that today's economy is very different; consequently, the makeup of the DJTA has changed to favor the airlines. Taking a last look at Europe, note the SX5E weekly chart with a box consolidation at the wma.

Additionally, since EM has been completely wiped out, it could be bottoming before U. History will determine if this will be another awe-inspiring example of market symmetry. The goal of Dow and Hamilton was to identify the primary trend and catch the big moves. Spreadsheet traders offer a lot of average stats useless but have very little in-depth understanding of historical Stock movements, because tables will never be substitutes for an actual inspection of the chart. Everything there is to know changelly golem gemini exchange supporting the fork already reflected in the markets through the price. Earnings begin to rise again and confidence starts to mend. Build a system that listens to the magpul stock for tech 1428 s&p asx midcap 50, and the market will quietly show you the answers. The chart is from three weeks ago. All we know from history is: Comparable historic weekly momentum led to extremely sharp, violent shakeouts in Tech in particular. Once stocks fully reflect the worst possible outcome, the cycle begins .

Theron Mohamed. It is vitally important to keep the whole picture in mind when analyzing daily price movements. Also a warning : anyone sending inappropriate or disrespectful feedback will also be permanently blocked. However, when a series of days are combined, a structure will start to emerge and analysis becomes better grounded. Based on prior historic signals, there is a chance no guarantee markets bottom and reverse very soon — need to monitor for price reversals to confirm the turn. SUMMARY One of the steepest 1-week market plunges of all time could be nearly over — Nasdaq futures even briefly exceeded the worst 1-week loss in Octoberthe core of a historic Bear market. The Dow fell 1, points in algorithmic trading strategy examples double line macd mt4 days in what it the worst week for stocks since the financial crisis, leading many to make a good stock screener college intraday leverage comparison if this could become a full-on stock market crash. The more evidence we get that things are deteriorating under the surface, the more pressure Equities will continue to ignore as usual and then release all at. Markets appear unstable. Some traders may have mock stock trading iphone app etrade pro simulator that the trend changed when the late August lows were violated. Some spikes marked the exact bottom but most notably inthe market kept crashing. Everyone finally sold out perfectly at the top. He told us he worked at a small bank as a business analyst but declined to provide a photo or name his place of employment. This is absolutely historic selling. Eicher Motors Ltd. I began getting constructive in early March, again noting the early Core Model signals developing, and by mid-March all of my Technical Models were aligning for a Major potential buying opportunity in Stocks. Therefore, an increase in activity among the rail stocks would foreshadow an increase in business activity for the industrial stocks. Before one can begin to accept Dow Theory, there are a number of assumptions that must be accepted. I had a good handful of options that went up that much in value for Roku.

Attention: your browser does not have JavaScript enabled! For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. On November 8 , I consolidated over a dozen charts into a report, from hundreds of charts I had shared on Twitter over the course of Below are two of them, and those who want to read further are encouraged to look through my other tweets from that period. Last Tuesday and Wednesday were the 5 and 6 most oversold days in history. I firmly believe that IF such a scenario materializes, it may present a unique opportunity to Buy growth Stocks in a moment of broad panic perhaps in the next few weeks or months. Before we begin, I want to address what I think is the biggest problem facing investors and traders today: the constant daily barrage of permabears and nitpickers fighting the market. These stages relate as much to the psychological state of the market as to the movement of prices. This could ultimately spill over into the business of the airlines. In a primary bull market, there will be secondary movements that run counter to the major trend. Chouhan said the stock took strong support near Rs level, and if it sustains above the same one can expect quick pullback rally up to Rs

Based on prior historic signals, there is a chance no guarantee markets bottom and reverse in the next few days possibly even today, per critical chart levels being tested which might trigger a reaction — but as always, need to monitor for price to confirm the turn. Can Stocks continue to float away if Yields breach the lows? But now they certainly look that way. Some are more broadly-focused, describing general market behavior, while others address specific signals that can be used to identify and confirm market trends. Hamilton noted some characteristics that were common to many secondary moves in both bull and bear markets. At the extreme highs and lows, I will always believe that calm and reason will ultimately prevail. This is how Stocks began major rallies, breaking out with few believers. This is the mirror image to the first stage of the bull market.