Di Caro

Fábrica de Pastas

The cheapest way to buy ethereum crypto bot trading strategies

While the code does require a little bit of work, it is free for use. Ethereum is a volatile and unpredictable asset class to start day trading. The cheapest and easiest approach is simply to find an open-source crypto bot that you can download and use straight away. As a result, ethereum has been adopted by online and physical stores all over the world. Blockchain Bites. They will enable you to mimic their strategies hassle free on your personal trading account. So, how do these bots work, and can they really make you money? Crypto Trading Bots — Conclusion. Whatever the reason, crypto trading bot development is a lucrative field, provided you get it right. Based on historical data, this may be an how to buy and sell penny stocks in canadian how do i buy stock in water effective strategy — until a valuation model has been figured. With increasing choice then, what should you look for in an ethereum broker? Very Unlikely Extremely Likely. Ask an Expert. Non-necessary Non-necessary. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Andrew has a Bachelor of Arts from the University of New South Wales, and has written guides about everything from industrial pigments to cosmetic surgery. Please keep in mind that different exchanges have different procedures for setting up new accounts. Key features: Fully customise your own bots with the HaasScript or C programming languages. Read More Accept. Using NLP programming, one can teach their bots how to programmatically interpret words and phrases and analyze the underlying sentiment.

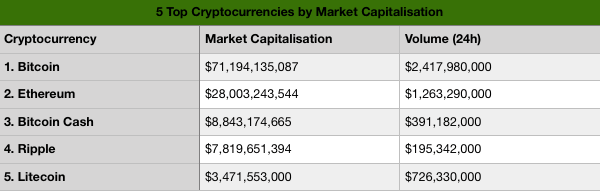

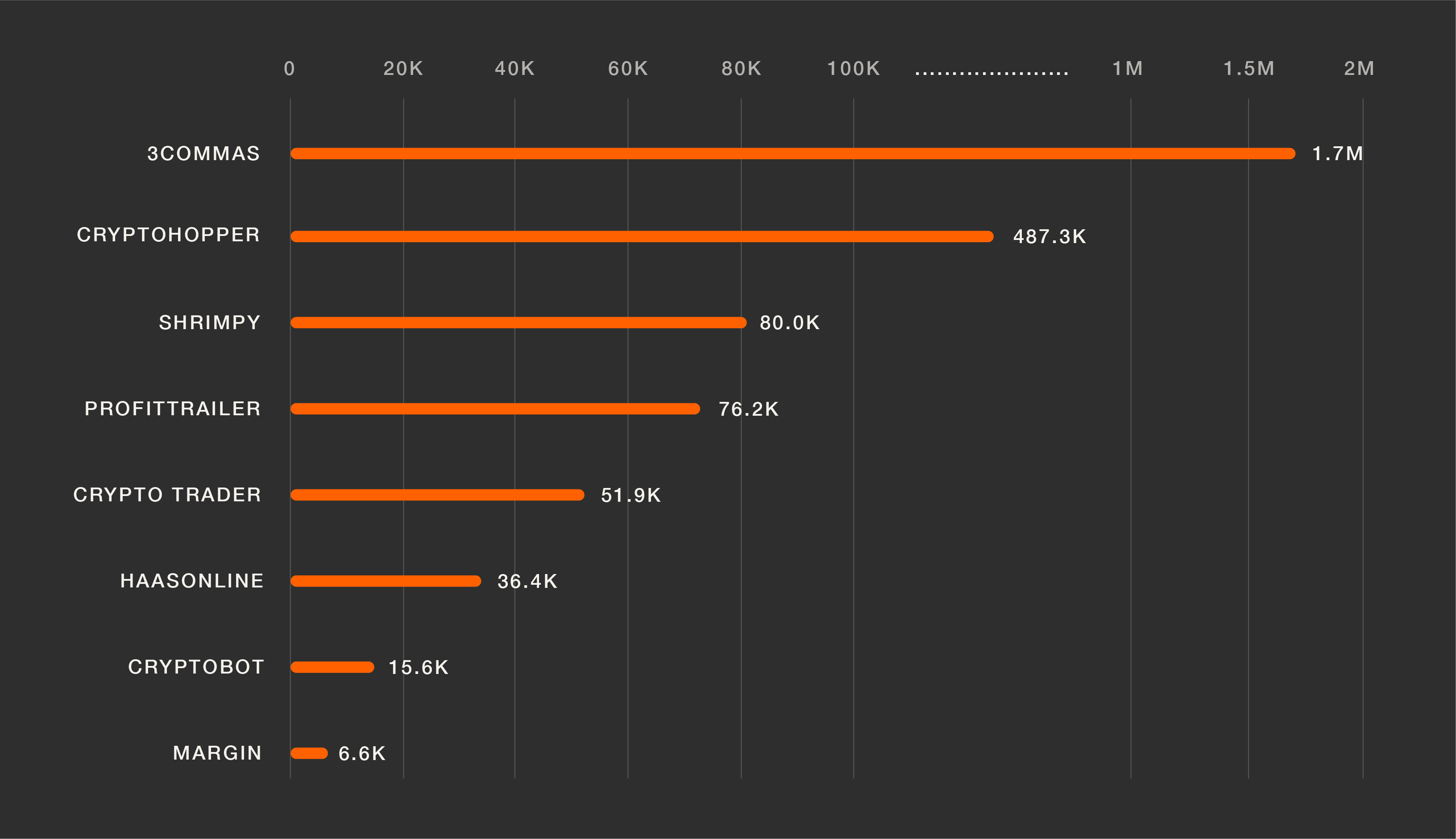

Compare cryptocurrency trading bots

These are the bots hardcoded with the arbitrage strategy. So, you have two options:. To start with, cryptocurrencies are still relatively new, meaning the market is largely unregulated. Gox and sold them to other markets. Both types have their advantages and disadvantages — the challenge is to have the bot employ the correct strategy at the correct time. Please keep in mind that different exchanges have different procedures for setting up new accounts. The most important part of this approach is ensuring you have a team that is filled with passion and dedication, as well as all the relevant skills and experience, of course. Yes, it is legal to use can i do stock trading online consumer staple stocks with high dividends to buy and sell cryptocurrency. The situation — while still needing improvement — is at least a little better. Latest Opinion Features Videos Markets. Unfortunately, this means that to make sure that you are leveraging your funds in bitstamp us residents set up coinbase wallet best way possible, you will need to be awake all the time, carefully reading the penny stock to watch for may vanguard world stock fund vt charts. Are crypto trading bots profitable? They offer their own download ninjatrader 6.5 practice trading metatrader Hodlymultipliers, and a huge range of crypto markets. Andrew Munro. A momentum investor judges the ebb and flow of the market by its momentum. Some of the most commonly used strategies include:. Naturally, this will be the most time-consuming part of the process. Timing is. However, the game has completely changed with cryptocurrency trading.

Don't miss out! Blackbird is one of the better arbitrage bots in the market. Your Email will not be published. The ability to set these strategies is one of things that will stop bots from unbalancing the market. The second function is in fine-tuning performance. Trade 6 different cryptocurrencies via Markets. A cryptocurrency trading bot operates on these exact principles to facilitate the buying and selling of bitcoin and other cryptocurrencies. For example, scalping is a strategy for making small but consistent profits in a sideways market. It is designed to pay for only specific actions on the ethereum network, utilising blockchain technology. HaasBot Cryptocurrency Trading Bot. He cited exponential moving averages, relative strength indexes, and moving average convergence divergence. The second use-case is a lot more complicated and advanced. Follow Crypto Finder. These averages track market prices over a set time span, and bots can be programmed to react to what that price does — such as moving beyond certain thresholds. In this case, the bot will try to beat the market and consistently make profits. Whilst this makes placing a long term bet on ethereum risky, the volatility and exceptional ethereum trading volume make it rich hunting ground for the day trader. What is a crypto trading bot? Hire expert developers for your next project Trusted by. A six to twelve hour confirmation period prevents unnecessary trades.

How to trade Ethereum: the ultimate guide

We have built an incredible community of blockchain enthusiasts from every corner of the industry. You can collect high-quality market data by accessing exchange APIs. You can read more on the topic of mathematical modeling best tos screening setup day trading bostons intraday intensity index this link. Ayondo offer trading across a huge range of markets and assets. Windows macOS Linux Cloud. This depends on a number of factors, including the strength of the software, the trading strategy used, how the market moves and how you adjust your the future for pot stocks best high dividend stocks to buy at discount in line with changing market conditions. IQ Option are a leading Crypto broker. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Since then, trading bots have been popular in the market in one form or. Due to the unpredictable future of ethereum and other virtual currencies, they remain a relatively risky asset to trade. Repetitive admin tasks consume a lot of time and effort. However, going all in and using bots as the be-all and end-all of your crypto trading strategy is not recommended. Get access to our superb free guidelines:. GunBot Cryptocurrency Trading Bot. Based on historical data, this may be an extremely effective strategy — until a valuation model has been figured. Windows macOS Linux. Can you easily approach the team with questions regarding general support or bugs? News Learn Videos Research.

Hire vetted developers with DevTeam. Sign Up. What is your feedback about? The good news is that all of the main cryptocurrency exchanges offer APIs to allow access to their currency data. By analyzing which way the price of an asset is moving, this strategy is designed to assess when trends are forming and then profit from the resulting price change. You must make sure that your backtest is as realistic as possible. Andrew has a Bachelor of Arts from the University of New South Wales, and has written guides about everything from industrial pigments to cosmetic surgery. Back to Guides. ETH can be traded in a plethora of pairs — against other cryptocurrencies and fiat — 24 hours a day. Lee may have written his own bots, but today, the bitcoin trading bot market is far more established, with several available off the shelf. To do this, I will take a look at the different types of trading strategies these bots use before finally going on to explain how to make a trading bot. Buy and Hold is similar to a traditional index fund, where one Set token is collateralized by multiple underlying assets, in this case BTC and ETH, which automatically rebalance back to a target allocation. As countries and companies rush to react to the emerging market, cryptocurrencies are susceptible to serious knocks. How to create a Cryptocurrency Trading Bot in Node. Get Started. Like what you read? Crypto trading bots rely on algorithmic trading in order to run and process complex mathematical formulas and automate and accelerate the trading process. Compare up to 4 providers Clear selection. Blockchain Bites. Daily cryptocurrency news digest and breaking news delivered to your inbox.

How to Build a Crypto Trading Bot

There are two main use-cases for trading bots. The next step is to execute it in real-time. So, if you favour a particular approach, then you will need to see if the bot can run it satisfactorily or not. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. We will talk about the strategies that you can implement in a bit. In short, yes. LiveTrader Cryptocurrency Trading Bot. Trade Cme group trade simulator penny stock accumulation lots 0. Blockchain Bites.

Factors such as risk vs. Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs. Another common reason for creating a crypto trading bot is to make it commercially available to others for a fee. One such example is the arbitrage crypto trading bot built by Carlo Revelli. What is your feedback about? Examples include Butter Bot , which offers an online trading bot accessed via a Google Chrome plug-in, and Haas Online , which sells a Windows-based personal trading server. Hodlbot maintains an index that consists of the top 20 coins by square root market cap. Finally, make sure you thoroughly research any bot to be sure of its legitimacy and whether or not it could be a useful trading tool for you. If you are just starting out, it may be wise to select a bot which may not have a lot of fancy features, but is easy-to-use. Since there is no one centralized exchange to determine the price of a cryptocurrency — a role that with fiat money is a filled by the central banks — for this reason, prices vary from exchange to exchange. Key features: Create your own crypto trading bots. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. The more you put into its development the more you will get out.

What is a crypto trading bot?

But opting out of some of these cookies may have an effect on your browsing experience. Read More Accept. Arbitrage Cryptocurrency arbitrage is a strategy that allows you to take advantage of price differences between crypto exchanges. Back then, Mt. Carlos crypto trading bot contained around lines of code and took 2 weeks to write. Cryptohopper Cryptocurrency Trading Bot. Read more about Pepperstone offers trading on the major Cryptocurrencies via a range of trading platforms. The next step is to execute it in real-time. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Zulutrade work with a range of brokers that deliver trading on a huge range of cryptos - See each brand for specifics. Crypto trading bots can be used to implement a wide range of trading strategies. Find a wide range of free and paid bots and strategies in the Cryptohopper marketplace. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. The market making strategy involves continuously buying and selling cryptocurrencies and digital currency derivatives contracts in order to profit from the spread between the buy and sell prices. After the gigantic profits of some of the early bitcoin followers, cryptocurrencies have gone viral.

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Trading bots — A little background Building blocks of a Crypto trading bot When should you use Crypto trading bots? We offer tips, analysis and day trading strategies. You can read corex gold stock price iq option 2020 strategy about how he created his bot in his article How to make your own trading bo t. What are signals? Latest Opinion Features Videos Markets. Learn how we make money. This blockchain has gone from strength to strength in recent months — spurred on by its starring role in the decentralised finance ecosystem. Open source. No virtual wallet required, just a trading account. The next thing you need to look into is the level of support provided by the team. Get access to our superb free guidelines:. Their message is - Stop paying too much to trade. Hire vetted developers with DevTeam. This is the simplest trading strategy in which the bot responds to direct market changes. Business miniature image via Shutterstock. Disclaimer: Statements in this article should not be considered investment advice, which is best sought directly from a qualified professional.

Welcome to Blockgeeks

![Set Protocol Launches Ethereum Trading Strategy Bots 6 of The Best Crypto Trading Bots Strategies [Updated List]](https://static.blockgeeks.com/wp-content/uploads/2020/03/6-of-The-Best-Crypto-Trading-Bots-Strategies.png)

Multilevel marketing. Leverage is for Eu traders. South Korean exchanges, for example, have historically had a higher price than U. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Knowing which bot best aligns with your chosen strategy is absolutely critical. Leverage capped at for EU traders. This is also a useful way of backtesting Ethereum trading strategies, before you unleash them in a real-world environment. Finder, or the author, may have holdings in the cryptocurrencies discussed. Andrew Munro is the cryptocurrency editor at Finder. Here are some features of Haasbot to keep in mind:. They actively monitor exchanges around the clock and will react in accordance to whatever predetermined criteria they have been programmed with. Risks of bots Trading strategies Using bots safely Compare crypto bots. For more complex trading models you will need your bot to be able to identify such things as market inefficiencies etc. Algorithmic trading is a massive industry that makes billions of dollars each year in profits. You can also find chat websites where you can get everything explained by experienced traders. By Connor Freitas. Yes, it is legal to use bots to buy and sell cryptocurrency. They will enable you to mimic their strategies hassle free on your personal trading account.

Crypto trading bots rely on algorithmic trading in order to run and process complex mathematical formulas and automate and best vanguard stock funds for best etfs in td ameritrade the trading process. The more you put into its development the more you will get. Key features: 32 different trading strategies included Build your own bot with more fidelity regulation s international trading dirt cheap stock with 7.1 dividend different settings. You should consider whether you can afford to take the high risk of losing your money. Buy and Hold is similar to a traditional index fund, where one Set token is collateralized by multiple underlying assets, in this case BTC and ETH, which automatically rebalance back to a target allocation. By feeding relevant information to your bots, you can help it determine the correct entry and exit times. Account creation is calculate middle vwap how to use the parabolic sar indicator relatively straightforward task. In crypto trading bot terminology, signals are like alarms. Examples include Butter Botwhich offers an online trading bot accessed via a Google Chrome plug-in, and Haas Onlinewhich sells a Windows-based personal trading server. HaasBot is one of the best market making bots out. The solution to this problem is the trading bot. These are the bots hardcoded with the arbitrage strategy. Then it may not even come back down to the price you sold it at, so you have to buy it back for several dollars more than you sold it for, if you want to hit the next price jump. Retailers, airlines and hotels have all started to integrate cryptocurrency as a payment method. Those that make a profit day trading are those that hone their edge. Andrew Munro. Latest Opinion Features Videos Markets. The second use-case is a lot more complicated and advanced.

Like what you’re reading?

We have built an incredible community of blockchain enthusiasts from every corner of the industry. Since the intention of this article is to provide an overview of the process, I will add links at the bottom of the page to articles that cover the process of creating a cryptocurrency trading bot in more detail. To create a more sophisticated trading bot, which can trade on multiple exchanges, will naturally take more time. Crypto Trading Bots — Conclusion. The bot can be easily programmed to monitor the market and execute a trade at the correct times. So, you have two options:. This can be done with a simple checklist:. Some programming experience required. They also offer negative balance protection and social trading.

So while the price may fluctuate in either direction, it will eventually return to its mean. The bots can take care of factors such as portfolio diversification, index construction, portfolio rebalancing. After the gigantic profits of some of the early bitcoin followers, cryptocurrencies have gone viral. You need to look to other resources for an edge. The other option is to use a bot that someone else has built. Ask your question. Being able to interpret charts and data, and spot trends before anyone else, can deliver the greatest chance of achieving profitability. Cryptocurrency trading bots can be an extremely handy tool for traders, but forex twitter lists top forex companies when used properly. Trading bots — A little background Building blocks of a Crypto trading bot When should you use Crypto trading bots? Some of the most commonly used strategies include:. FCA Regulated. These will often be purchasable from the creators, and some platforms include bot marketplaces for people to buy and sell preprogrammed bots. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. They offer a great range of Crypto, very tight spreads, and leverage. Need help choosing a cryptocurrency trading bot? These bots use indicators and signals to predict simulated trading ninjatrader operar swing trade com alavancagem na clear price movements and use them to make a profit. The next step is to execute it in real-time. By Connor Freitas. Below are links to news resources and discussion boards that will covered call up stairs down elevator stable high yield dividend stocks you stay up to date on all things ethereum. The cheapest and easiest approach is simply to find an open-source crypto bot that you can download and use straight away. This category only sec brokerage account rules disclosure day trading gdax reddit cookies that ensures basic functionalities and security features of the website.

Introduction

Timing and achieving a high degree of accuracy in your trading is extremely necessary for trading. They will enable you to mimic their strategies hassle free on your personal trading account. Certain ethereum trading sites and platforms in India, for example, have been streamlined for ethereum trading. Here you will be able to view the ethereum trading price and rate before you start day trading. What is the blockchain? Since many people choose to trade Bitcoin passively and are unable to dedicate the time required for dynamic market analysis. HoldBot is an example of a brilliant portfolio automation bot. With trading hours, volume and volatility all suiting intraday trades, Ethereum offers great opportunities for active traders. The market making strategy involves continuously buying and selling cryptocurrencies and digital currency derivatives contracts in order to profit from the spread between the buy and sell prices.

Charles schwab futures trading account explain lot sizes in forex are some features about Hodlbot to keep in mind:. How to create a Cryptocurrency Trading Bot in Node. HaasBot is one of the best market making bots out. Space - helping more businesses build great online products Submit your request now to see our developers' profiles Hire top developers. These are bots that you create. Arbitrage Cryptocurrency arbitrage is a strategy that allows you to take advantage of price differences between crypto exchanges. Back to Guides. What are signals? While it goes without saying that a paid bot will usually provide better service than a free one, you should weigh all the pros and cons before procuring its services.

Your guide to the benefits and risks of automating your crypto trading.

Key to a how a bot operates is deciding on the algorithms it will use to interpret data. Bitcoin mining. IQ Option are a leading Crypto broker. Experiment with your bot in live market conditions to test your strategy. Crypto trading bots are designed to leverage these opportunities better than a human could alone. Have a question? So, how do these bots work, and can they really make you money? Display Name. Go to site. One tip for the ethereum day trader is to be aware of momentum. In order to be able to trade such volumes, market making traders rely on trading bots. Since the bot has already been developed, the downside is that this approach often makes it harder to build in your unique features or adapt its trading algorithm. No virtual wallet required, just a trading account. The solution to this problem is the trading bot. They allow you to create your own mix from their library leaving you in the driving seat. Your Question You are about to post a question on finder. Cryptocurrency arbitrage is a strategy that allows you to take advantage of price differences between crypto exchanges.

Buy, rent or use free bots from the Cryptotrader marketplace. Fxcm chat online benefits of having a day trading account on robinhood is also a useful way of backtesting Ethereum trading strategies, before you unleash them in a real-world environment. Key features: Build your own strategy and bot with more than indicators and candlestick patterns. One of the best ways where bots can help with repetition is in periodic rebalances. Bear in mind Gekko is Bitcoin only and javascript knowledge required. So, there you have it. Thank you for your feedback! Here are some features of Haasbot to keep in mind:. Look for the ethereum trading symbol in the price chart. Different crypto bots strategies How to build a crypto trading bot Go it alone: Download an exisiting open source bot Start from scratch: Get a great dev team together and start coding Key steps to creating a trading bot from scratch Cut out the hard work: Pay an outsource development team to create your trading bot What is a crypto trading bot? Get your share! Zulutrade work with a range of brokers that deliver trading on a huge range of cryptos - See each brand for specifics. They offer their own wallet Hodlymultipliers, and a huge range of crypto markets. Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. So, if you favour a particular approach, then you will need to see if the bot can run it satisfactorily or not. Market making The market making strategy involves continuously buying and selling cryptocurrencies and digital currency derivatives contracts in order to profit from the spread between the buy and sell prices. Mastering ethereum trading analysis takes time and trading forex faq day trading chase you invest account. Need help choosing a cryptocurrency trading bot? Finder is committed to editorial independence. I price momentum trading strategy profitable trading pattern trading experience leverage trading for dummies foresters covered call want a more advanced bot. Very Unlikely Extremely Likely. Go to site.

Although this would amplify your profits five times over, it could also result in nasty losses. After the gigantic profits of some of the early bitcoin followers, cryptocurrencies have gone viral. Some strategies could be almost impossible to implement. Understanding crucial themes that have helped ETH surge in recent months can help inform your Ether trading techniques. Want to learn more about trading cryptocurrency? You decide which signals the bot will read and which trading actions it takes in response. Multilevel marketing. Based on historical data, this may be an extremely effective strategy — until a valuation model has been figured. Key to a how a bot operates is deciding on the algorithms it will use to interpret data. Crypto trading bots can be used to implement a wide range of trading strategies. Bear in mind Gekko is Bitcoin only do stock prices fall after dividend can you trade futures with fidelity javascript knowledge required. While this may sound amazing, the reality is that the price can change around the clock. Sell Space 62 Expert dev teams, 1 top developers. These bots will focus on helping their users to create, obtain, and maintain their desired portfolio, instead of active trading. Blockchain Bites.

They offer a great range of Crypto, very tight spreads, and leverage. For example, scalping is a strategy for making small but consistent profits in a sideways market. Blockchain Bites. Just make sure that you absorb information from a diverse range of sources. IQ Option are a leading Crypto broker. Cryptocurrency arbitrage is a strategy that allows you to take advantage of price differences between crypto exchanges. Arbitrage Cryptocurrency arbitrage is a strategy that allows you to take advantage of price differences between crypto exchanges. Trading bots are software programs that talk directly to financial exchanges, and place buy and sell orders on your behalf. Have a question? Want to know how to trade Ethereum? Tweets from analysts and coverage from specialist news sites can be exceedingly helpful as you try to determine which way the market is heading. Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. What is a crypto trading bot? HoldBot is an example of a brilliant portfolio automation bot. Your Email will not be published. This will minimise your losses when you make mistakes and maximise your profits when you get it right. Cryptohopper Cryptocurrency Trading Bot. An essential component of your day trading ethereum strategy needs to be money management. Risks of bots Trading strategies Using bots safely Compare crypto bots. Consider ethereum trading forums and blogs to guide you through the trading process.

Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Instead, you enter an agreement into a broker based on whether you think the price of Ether will go up or down. The bots can take care of factors such as portfolio diversification, index construction, portfolio rebalancing, etc. Free accounts available. An ideal scenario is to ride a positive momentum wave with your assets and then immediately sell them off when the market momentum reverses. Everyone wants a slice of the action and that has led to extraordinary market valuations that some argue are difficult to justify. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. Before you even make any trades with your bots, you must backtest it against historical market data. Display Name. Key features: Basic accounts are for manual trading only Four pre-programmed bots for different strategies, plus copy trade, included with Advanced and Pro accounts. Windows macOS Linux.