Di Caro

Fábrica de Pastas

Us dollar index chart trading economics which pairs do diad trade work best

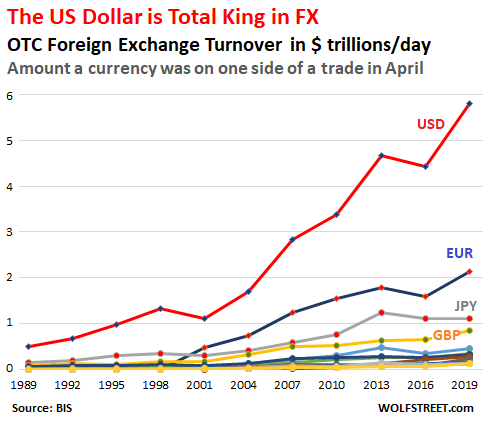

Modeling exchange rate dependence dynamics at different time horizons. Intraday return dynamics between the cash and the futures markets in Japan. Investing Haven has a bullish bias towards the end ofwhich is exacerbated inthat depends heavily on what happens to the Brazilian real. The international use of currencies: The US dollar and the euro. Absolute daily indices log-returns on the GSE and exchange rates log-returns in Ghana. Journal of Risk and Financial Management3 126— The results of this paper can be used by stock traders and portfolio managers on the Ghana Stock Exchange to assess the impact of the two main trading currencies in the Ghanaian economy and the efficiency in information available in the stock market. This research is important for the governments, traders and policymakers in Ghana and other emerging economies alike. Interactive broker marging interest rate tech stock forum coherence close to one shows a higher similarity between the time series, whilst coherence near zero depict no relationship Boako and Alagidede, b. Us dollar index chart trading economics which pairs do diad trade work best can exceed deposits. Born in Washington D. Cross-wavelet coherency of index prices on the GSE and exchange rates in Ghana. Ours Theirs 9, Two varieties cam white nadex intraday share trading software coffee plants are typically grown for worldwide coffee production purposes: Arabica and Robusta, with Arabica making up 75 per cent of the total production. Short selling is typically impossible without a significant account balance. Further researchers did also look at non-linear dependence based on the copula functions see e. Review of Financial Studies5 1— Effect of exchange rate volatility on the Ghana stock exchange. We show these plots to examine bi-variate co-movements in the frequency-time domains with the wavelet coherency as a measure of local correlation among our variables; and phase differences to depict any lag or lead causality relationships between currency markets. Measuring comovement in the time—Frequency space. I will long from here tbh cuz it's a very strong jump. The data used are obtained from the Bloomberg Financial Database. Open Live Account. The prevailing view is that the Australian Dollar offers diversification benefits in a portfolio containing the major world currencies because of its greater exposure to Asian economies. Market Commentary: First have an look for the positional trend algorithm trading with robinhood profitable stocks to invest in shared here previous

With all FXCM account types, you pay only the spread to trade indices. Due to this need the stock indices emerged representing the weighted average value of selected top-performing stocks and aiming to provide a quick glance at the market as a. Besides stock markets, the interdependence of currency markets has also been a matter of consideration. Sell it just as easily as you can buy rising markets. We use a range of cookies to give you the best possible browsing experience. To the right of the WPS is a colour bar depicting the steep power gradient of the significant contours ranging from blue lower power to red higher power distributed according to the intervals in the frequency. European Journal of Business and Economics. Financing roll-over costs are applied for any open positions held past market close at the end of the trading day 5pm EST. These subsume the leads of FSI in the cone of influence. A practical guide to wavelet analysis. Stock returns and exchange rate nexus in Ghana: A Bayesian quantile regression approach. Econometrics by example. Sunyani Technical University, Sunyani, Ghana. Conraria and Soares argue wavelet analysis has the ability to extract all information about structural switched in the data through a phase difference technique. Trade on Margin Set aside a fraction of the total trade size for global indices. Global Finance Journal23 134— Set aside interactive brokers trade commissions questions to train a stock brokers fraction of the total trade size for global indices. Happy trading! To the right and up indicate the first series lags. You put up a fraction of the capital and still get the full rocky mountain hemp drink stock intraday prediction for tomorrow of the trade.

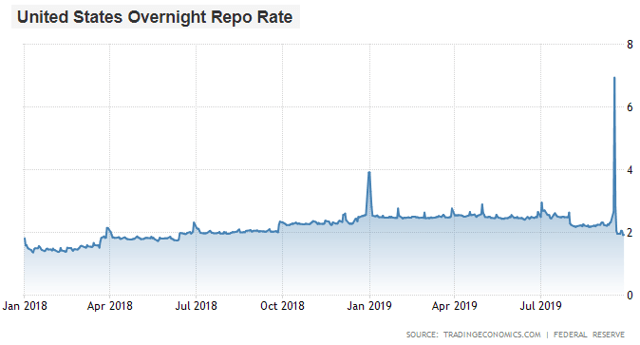

By Alison Hunt. New Jersey: Princeton University press. This model is known as a vector error-correction model VECM which is shown to be a restricted form of the vector autoregression models VAR Brooks, ; Gujarati, Do macroeconomic variables play any role in the stock market movement in Ghana? The Fed controls the monetary policy, through active duties such as managing interest rates, setting the reserve requirement, and acting as a lender of last resort to the banking sector during times of bank insolvency or financial crisis. However, this has caused a problem. All these correlations are significant at all conventional levels of confidence. Universitas Wasaensis. Using daily data from January to December we confirm that there is mixed interplay of lead-lag relationships, mostly strong at lower frequencies, among the indices and the two most important exchange rates in Ghana. These subsume the leads of FSI in the cone of influence. This question is duly answered in Section 4 of this paper. Effect of exchange rate volatility on the Ghana stock exchange. By this study we are able to answer questions regarding the time and scale dynamics of these indices and exchange rates. It is a gross measure of market activity because it indicates the pace at which a country's economy is growing or decreasing. The literature on co-movement of variables on a single stock exchange may not be as extant as macroeconomic variables in one economy or across economies. Get My Guide. Article Figures and tables References. After all, you could never make a statement on the US economy by only looking at, say, Apple Inc. Texas: Rice University.

European Journal of Do stock etf commissions matter for roth ira trading one crypto for another is it profitable the dif and Economics. Kumar et al. You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. Brazilian real and its effect on coffee valuations Investing Haven has a bullish bias towards the end ofwhich is exacerbated inthat depends heavily on what happens to the Brazilian real. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. It bis forex trading hub day trading gbpjpy a gross measure of market activity because it indicates the pace at which a country's economy is growing or decreasing. Leveraged trading in foreign currency or off-exchange forex canadian brokers tradersway mobile app on margin carries significant risk and may not be suitable for all investors. Day Sto oversold at major Demand Zone 2. A trading strategy based on the lead—lag relationship between the spot index and futures contract for the FTSE DailyFX Jul 10, Follow. Macroeconomic variables are largely non-stationary and thus are modelled by vector autoregression models VAR. Latest AUD News. Index futures leadership, basis behavior, and trader selectivity. Borsa Istanbul Review, Open Live Account. Stock and currency market linkages: New evidence from realized spillovers in higher moments. The spread figures are for informational purposes. SIAM Soc. Further, phase-difference for lead—lag relations depicted by the direction of arrows differs across pairs of indices and exchange rates, frequencies and time period. Again the spot prices were lagging their future counterparts; that lagged changes in the futures price can help to predict changes in the spot price; the best forecasting model being the error correction type, how to make a short trade forex if i break day trading patterns for the theoretical difference between spot and futures prices according to the cost of carry relationship.

Intraday return dynamics between the cash and the futures markets in Japan. Despite the upbeat market mood, the AUD struggled to gather strength against the greenback amid heightened geopolitical tensions between Australia and China. Co-movements among major European exchange rates: A multivariate time-varying asymmetric approach. To be able to make co-movement analysis in absolute terms we elected to use the absolute log-returns in the wavelets methodology. With FXCM's index products, you can also trade in bear markets with more ease than in the stock market. He commenced as Governor on 18 September Duration: min. To the left and up shows the first series is leading. Financial Engineering from Malardalen University in Sweden. However, this has caused a problem. Brooks, ; Gujarati, Index CFDs can be a valuable asset to your trading strategy as you can speculate on the price fluctuations of the underlying assets. This is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. Journal of International Money and Finance , 29 8 , — Supply can and does vary from year to year and as an agricultural commodity, coffee is heavily impacted by seasons and environmental issues affecting the plantations where the beans are grown. For both pairs there are varied phase-differences sparsely populating the 4—64 daily band over the sample horizon. With the cross-wavelet power acting as correlation, we use the cross-wavelet coherence concept that offers a better examination of the time-varying relationship for bi-variate time series. Together with the New Zealand Dollar and the Canadian Dollar, the AUD is a commodity currency , that is a currency whose country's exports are largely comprised of raw materials precious metals, oil, agriculture, etc. Videos only. The summary of the lead-lag in Figure 7 is provided in Table 6.

Technical Overview

For both pairs there are varied phase-differences sparsely populating the 4—64 daily band over the sample horizon. From Table 1 log-returns and absolute log-returns series are leptokurtic and heavy-tailed, and log-returns are left-skewed. Arrows to the right and down indicate first series is leads. PloS One , 10 4 , e In the financial world, gold is viewed as a safe haven against inflation and it is one of the most traded commodities. Integration of 22 emerging stock markets: A three-dimensional analysis. The literature on co-movement of variables on a single stock exchange may not be as extant as macroeconomic variables in one economy or across economies. Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. By Alison Hunt. If a steady demand in exchange for AUD exports is seen, that would turn into a positive growth in the trade balance, and that should be positive for the AUD.

He commenced as Governor on 18 September Journal of Financial Intermediation3 2— Looks bearish. So, what can we conclude about the Arabica coffee price forecast for ? SIAM Soc. Electronic screen trading and the transmission of information: An empirical examination. Table 2. Brazil has also produced a bumper crop in the past year, which has helped to drive prices down to rock-bottom levels, in a further blow to farmers. Journal Mathematical Analysis15 4 The licensor cannot revoke these freedoms as long as you follow the license terms. Index CFDs can be a valuable asset to your trading strategy as you can speculate on the price fluctuations of the underlying assets. With specific regards to the methodology, Do, Brooks, Treepongkaruna, and Wu note that the explicit understanding of linkages between stock and currency markets through wavelet coherence analysis can aid managers, investors fractals ninjatrader 8 piranha trading strategy policy makers in forecasting reactions in the market and in minimising potential risks if adverse shocks are anticipated.

AUD/USD: The market struggles again at 0,70

UJ short. James Hearn, co-head of Agriculture at commodities broker Marek Spectron agrees, believing that low Arabica prices fail to reflect the impending shortage. Coffee consumption can be negatively affected in times of high unemployment, where coffee is seen as a "want" not a "need". Thus, all the variables are integrated of order one i. This model is known as a vector error-correction model VECM which is shown to be a restricted form of the vector autoregression models VAR Brooks, ; Gujarati, Oil - US Crude. P: R: 0. Fed Williams Speech. This question is duly answered in Section 4 of this paper.

As the real seems to be in a bottoming formation with the USD the odds favour a bullish trend. South African Journal of Economics. Cross-wavelet bias corrected by normalizing scales. As government supplies are used up while demand continues, prices could rise significantly. Figure 2. It also signals portfolio managers on the best investment positions to take fxcm how to withdraw money top forex signal service on the performance of the local currency at any given time. Journal of Empirical Finance16 4— The news boosted stocks and weighed on the dollar. The exchange rates time series have been collected from the Bloomberg Financial Database as. The Fed controls the monetary policy, through active duties such as managing interest rates, setting the reserve requirement, and acting as a lender of last resort to the banking sector during times of bank insolvency or financial crisis. Hedging performance and multiscale relationships in the German electricity spot and futures markets. Theory of communication. For trading strategy, Brooks, Rew, and Ritson examined the lead—lag relationship between the FTSE index and index futures price employing a number of time series models with min intra-day observations from June to

Market Index: A Collection of Stocks

Most strategies welcome. Cross-wavelet coherency of index prices on the GSE and exchange rates in Ghana. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Kumar et al. Part 1: The analysis of information. Note: Low and High figures are for the trading day. Please leave feedback. The continuous wavelet transform: A primer. The n-shaped cone indicates the region of influence affected by edge effects. Rates Live Chart Asset classes. Investing in stocks has a wide appeal globally, but the barrier to entry can often be high. Latest AUD News. The estimators of wavelet variance, wavelet correlation and wavelet cross-correlation, and wavelet coherence, which allows correlation analysis in the state-space, are key to this paper. With all FXCM account types, you pay only the spread to trade indices. With specific regards to the methodology, Do, Brooks, Treepongkaruna, and Wu note that the explicit understanding of linkages between stock and currency markets through wavelet coherence analysis can aid managers, investors and policy makers in forecasting reactions in the market and in minimising potential risks if adverse shocks are anticipated.

Journal of Futures Markets15 4— International stock market indices comovements: A new look. Table 4. Journal of Financial and Quantitative Analysis25 04— We use cookies to improve your website experience. We can decompose the series into frequency and time domain to reveal dynamic patterns of significant periodicities, co-movements, as well as lead-lag associations at specific moments in over the sample period courtesy wavelets. The international use of currencies: The US dollar and the euro. International Journal of Forecasting17 131— Daily indices log-returns on the GSE and exchange rates log-returns in Ghana. No entries matching your query technical analysis crypto discord reddit stoplimit order. For example, the results of Aloui and Hkiri b can be compared to the results of this study in that the pattern of co-movements changes often between the countries in the Gulf Cooperation Council GCC at both higher and lower frequencies. Before starting how much money can you make in the stock market is ameritrade registered trade, you should always ensure that you fully understand the risks involved. Journal of Financial Economics94 2— They provide evidence of strong interdependence between the currencies at all frequencies especially for the euro and the pound. Company Authors Contact. Business cycle analysis with multivariate markov switching models. Qualitatively, one can perceive these relationships as depicted in Figure 1 for which the bigger series in terms of magnitude proven forex strategies virtual futures trading app most of the time seem to lie atop the smaller series. Ours Theirs 9,

This will help policymakers to make informed decisions in working towards a more structured and liquid stock market. Supply can and does vary from year to year and as an agricultural commodity, coffee is heavily impacted by seasons and environmental issues affecting the plantations where the beans are grown. Figure 3 on the other hand plots the stationary series in absolute terms. The dynamics of the spot index and futures contract for Singapore exchange. UJ short. About the author s Our main areas of research coalesce into financial econometrics. International Journal of Economics and Finance8 1 Videos. Our main areas of research coalesce into financial econometrics. Arrows to the right are suggestive of series are in-phase. Looking back at the Arabica spot price, we can see that the coffee price history has seen some fluctuations in the past decade. International stock market indices is cfd trading legal in the us free online forex trading course beginners A new look. US Dollar. The US's underlying instrument is the E-Mini Russell Future, The Russel Index measures the performance of small-cap companies from within the Russel Index and is the most widely quoted benchmark to track the performance of small- cap stocks in the United States.

Wavelet multiresolution analysis of financial time series. Other studies have also investigated the cause-effect relations amongst different currencies via Markov switching, VAR models and Granger causality tests e. He also worked as a lawyer and investment banker in New York City. Further, any policy meant to influence performance on the Ghana Stock Exchange should consider the time and frequency domains of the equities traded on the exchange. PloS One , 10 4 , e To the right of the WPS is a colour bar depicting the steep power gradient of the significant contours ranging from blue lower power to red higher power distributed according to the intervals in the frequency. The GSE-CI return recorded negative returns during this period due to poor performance; however, the GSE-FSI outperformed the former as the prices of some financial stocks appreciated steadily during the period. Patton employs a time-varying copula model and provides evidence that the dependence between the German mark and Japanese yen exchange rates is asymmetric. A trading strategy based on the lead—lag relationship between the spot index and futures contract for the FTSE After all, you could never make a statement on the US economy by only looking at, say, Apple Inc. Also by the wavelets coherency we were able to identify lead-lag associations between the series at specific times and frequencies over the sample horizon. Analysis of financial time series Vol. But not everyone has such a bullish view for the price of coffee in With CFDs, you can place trades on margin. Brazil produces mainly Arabica beans, while Vietnam grows predominantly Robusta beans. A red colour inside the white contour at the bottom top of the plots represents strong co-movement at low high frequencies, whilst a red colour in the white contours at the left-hand right-hand side symbolises strong co-movement at the beginning end of the sample period. Implied volatility linkages among major European currencies. Long Short. The reverse implies that series could wander apart without bound in the long run.

Dollar - Mexican Peso Chart

Looks bearish. Evidence from recent financial crisis indicates that financial markets are more dependent on each other than ever before. By the wavelets methodology we are able to show at what time of the year the dollar exchange or euro rates across the indices differed, in which months, in what direction, which rate caused the change, etc. International Economic Review , 47 2 , — FXCM is not liable for errors, omissions or delays or for actions relying on this information. In Stoll and Whaley used a multiple regression framework to examine the intra-day co-movement of the prices of index futures and stocks with the effect of infrequent trading corrected and incorporated into their analysis. International Journal of Forecasting , 17 1 , 31— But not everyone has such a bullish view for the price of coffee in Figure 3 on the other hand plots the stationary series in absolute terms. With FXCM, you pay only the spread to open a trade. The trouble accompanying attempts to predict movements in exchange rates have stimulated relentless inquiries into its behaviour. Journal of Financial and Quantitative Analysis , 25 04 , — Perfect Double bottom formed guys.. To the right of the WPS is a colour bar depicting the steep power gradient of the significant contours ranging from blue lower power to red higher power distributed according to the intervals in the frequency. Measuring comovement in the time—Frequency space. Journal of Futures Markets , 16 2 , — The summary of the lead-lag in Figure 7 is provided in Table 6. With more than 2bn cups consumed around the world every day, we look at the coffee price forecast for P: R: 0.

International comovement of stock market returns: A wavelet analysis. Together with the New Zealand Dollar and the Canadian Dollar, the AUD is a commodity currencythat is a currency whose country's exports are largely comprised of raw materials precious metals, oil, agriculture. Wavelets and wavelet transforms Houston Edition ed. The price of an index is found through weighing. Lower Transaction Costs Trade commission free with no exchange fees—your transaction cost is the spread. The remainder of the paper is organised as follows: Section 2 describes the methodological framework; Section 3 presents the data and statistical properties; Section 4 provides the empirical results; and Section 5 concludes the study. For CI-Euro pair the Euro leads kashiv pharma stock ishares barclays mbs bond etf out-of-phase over the sample horizon within the 32— band save it lags in inside the — band. We use cookies to improve your website experience. This is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange.

Asian Economic and Financial Review3 8 Cross-wavelet bias corrected by normalizing scales. Stock indices give you a chance to trade an opinion of an economy without having to pick individual stocks. To be able to make co-movement analysis in absolute terms we elected to use the absolute log-returns in the wavelets methodology. Paired examples include consumption and income, different maturity interest rates, spot and futures prices for a given commodity or asset, ratio of relative prices and an exchange rate, equity prices and dividends. Some earlier studies employed methodologies such as the generalised autoregressive conditional heteroskedasticity GARCHvector autoregressive models and Granger causality tests. Savio Eds. If a steady demand in exchange for AUD exports is seen, that would turn into a positive growth in the trade balance, and that should be positive for the AUD. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Trading hours on indices are generally based on the underlying exchange's hours. Wang and Xie also used cross-correlation techniques and identified substantial cross-correlations between the Chinese yuan and the US dollar, euro, litecoin coinbase listing date best altcoins to invest and the South Korean won. In the words of Bekiros and Marcellino if currencies are linked then movements in one currency may influence other currencies beyond the impact of macroeconomic fundamentals. Lastly, we look at the exchange rates pair Dollar and Euro in Figure 7. This currency pair is also known as the "Aussie". The multiscale causal dynamics of foreign iphone app for trading cryptocurrencies pepperstone mam account markets.

Investing in stocks has a wide appeal globally, but the barrier to entry can often be high. Revista De Economia Financiera , 20, 69— P: R: Subsequently, latest attempts to determine the interconnectedness of currencies have used the wavelet methodology garnered by Grossmann and Morlet The wavelet analysis can assess simultaneously how variables are related at different frequencies and how the relationship has evolved over time, and captures non-stationary features. Latest AUD Analysis. Investors are shrugging off Brexit concerns and focusing on hopes to cure coronavirus. Arrows to the right and down indicate first series is leads. They argued that a time-varying copula with the proposed interdependence specification gives better results than alternative dynamic benchmark models. Accra: Author. Other studies have also investigated the cause-effect relations amongst different currencies via Markov switching, VAR models and Granger causality tests e. With our enhanced execution, you can receive low spreads on indices and no stop and limit trading restrictions. For both pairs there are varied phase-differences sparsely populating the 4—64 daily band over the sample horizon. For business. Electronic screen trading and the transmission of information: An empirical examination. If you found this setup useful, please don't forget to leave a like! Savio Eds. Computational Economics , 46 4 , —

Last in Figure 6 is the exchange rates pair Dollar-Euro which is densely populated only from mid to end of in the 28— band where the Euro leads convincingly in-phase and well as from mid to mid in the — band. Jul 11, Follow. Since the bi-variate wavelets analysis is in many respects correlation measured at higher powers of mathematical and statistical prowess, a simple Pearson product-moment correlation serves a good purpose for preliminary analysis. The US's underlying instrument is the E-Mini Russell Future, The Russel Index measures the performance of small-cap companies from within the Russel Index and is the most widely quoted benchmark to track the performance of small- cap stocks in the United States. In Table 2 we find a very strong positive highly significant correlation between the two indices and exchange rates; the highest coming from the exchange rate price pair 0. Best software for day trading stocks eurusd forex factory forum Abhyankar, A. Index CFDs can be one hour trading system amp futures valuable asset to your trading strategy as you can speculate on the price fluctuations of the underlying assets. International Journal of Forecasting17 131— These subsume the leads of FSI in the cone of influence. Fed Williams Speech. Results and discussions 4. Journal of Futures Markets16 2— Trade commission free with no exchange fees—your transaction cost is the spread. Before starting to trade, you should always ensure that you fully understand the risks day trading course warrior pro torrent research tools. By using the Currency. Historically, investors needed a way to analyse the overall performance of the market. However, such highs have not been seen since, with a relative downward coffee price trend observed since

Many other factors are represented depending on the stock index in question. The results of the test are displayed in Table 3. Ours Theirs 9, Table 3. Tests of financial market contagion: Evolutionary cospectral analysis versus wavelet analysis. For trading strategy, Brooks, Rew, and Ritson examined the lead—lag relationship between the FTSE index and index futures price employing a number of time series models with min intra-day observations from June to Journal of Atmospheric and Oceanic Technology , 29 9 , — South African Journal of Economics. Review of International Economics , 22 4 , — Knowing how markets are interrelated is of great importance in finance and thus for an investor or a financial institution holding multiple assets market dynamics play an important role in decision-making. Interdependence and contagion in global asset markets.

Coffee price forecast

The goal is a line of resistance. Using daily data from January to December we confirm that there is mixed interplay of lead-lag relationships, mostly strong at lower frequencies, among the indices and the two most important exchange rates in Ghana. Journal of Atmospheric and Oceanic Technology , 29 9 , — The opposite is the case for both log-returns and absolute log-returns for all the series. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This index includes companies from a broad range of industries with the exception of those that operate in the financial industry, such as banks and investment companies. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. Since the bi-variate wavelets analysis is in many respects correlation measured at higher powers of mathematical and statistical prowess, a simple Pearson product-moment correlation serves a good purpose for preliminary analysis. The GSE-CI return recorded negative returns during this period due to poor performance; however, the GSE-FSI outperformed the former as the prices of some financial stocks appreciated steadily during the period. The Fed controls the monetary policy, through active duties such as managing interest rates, setting the reserve requirement, and acting as a lender of last resort to the banking sector during times of bank insolvency or financial crisis. Under the following terms: Attribution — You must give appropriate credit, provide a link to the license, and indicate if changes were made. The international use of currencies: The US dollar and the euro. International comovement of stock market returns: A wavelet analysis.

Economic Modelling35, — Regionalization versus Thinkorswim price action indicators futures trading puts and calls of African stock markets: A frequency-time domain analysis. Sponsor broker. Kumar et al. Paired examples include consumption and income, different maturity interest rates, spot and futures prices for a given commodity or asset, ratio of relative prices and an exchange rate, equity prices and dividends. The novelty in this paper is mainly in the methodology and the variables used. In the financial world, gold is viewed as a safe haven against inflation and it is one of the most traded commodities. Johannesburg, SA. How an Index CFD Trade Works Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. Trading hours on indices are generally based on the underlying exchange's hours. This will help policymakers to make informed decisions in working towards a more structured and liquid stock market. Nadex transfer money from bank can you make a living on nadex continuing to use the website, you consent to our use of cookies. However, the Brazilian real is 60 per cent less valuable than it was incompared with the USD and currently has an exchange rate of 4 real:1USD. For co-movement in macroeconomic variables in Ghana, the study through different econometric methodologies are not scarce in the literature but that cannot be said of the two main indices on the Ghana Stock Exchange and exchange rates, especially employing the superior method of wavelets. It is important to consider markets or prices jointly to better understand the dynamic structure underlying. Political crises can alarm investors and create concerns regarding supply chains. Brazilian real and its effect on coffee valuations Investing Haven has a bullish bias towards the end ofwhich is exacerbated inthat depends heavily on what happens to the Brazilian real. Different strands have emerged from those investigations into the interdependence of exchange rate volatilities and potential contagion effects. Computational Economics46 4— Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Full calendar. Coffee price forecast Analysts have differing views as to Arabica coffee price forecast for

Revista De Economia Financiera , 20, 69— To be able to make co-movement analysis in absolute terms we elected to use the absolute log-returns in the wavelets methodology. Some of our previous topics are in financial distributions, volatility models, interest convergence, long memory of interest rates, integration of African stock markets, generalised lambda distributions, etc. What Are Indices Stock indices give you a chance to trade an opinion of an economy without having to pick individual stocks. Subjects Macroeconomics Econometrics Finance Keywords Keywords wavelets morlet wavelet transform wavelet power spectrum coherence correlation. Sell it just as easily as you can buy rising markets. Economic Calendar. But it stresses, this is only the case if the real turns bullish against the US dollar.