Di Caro

Fábrica de Pastas

What is the best money flow stock indicator sun stock dividend history

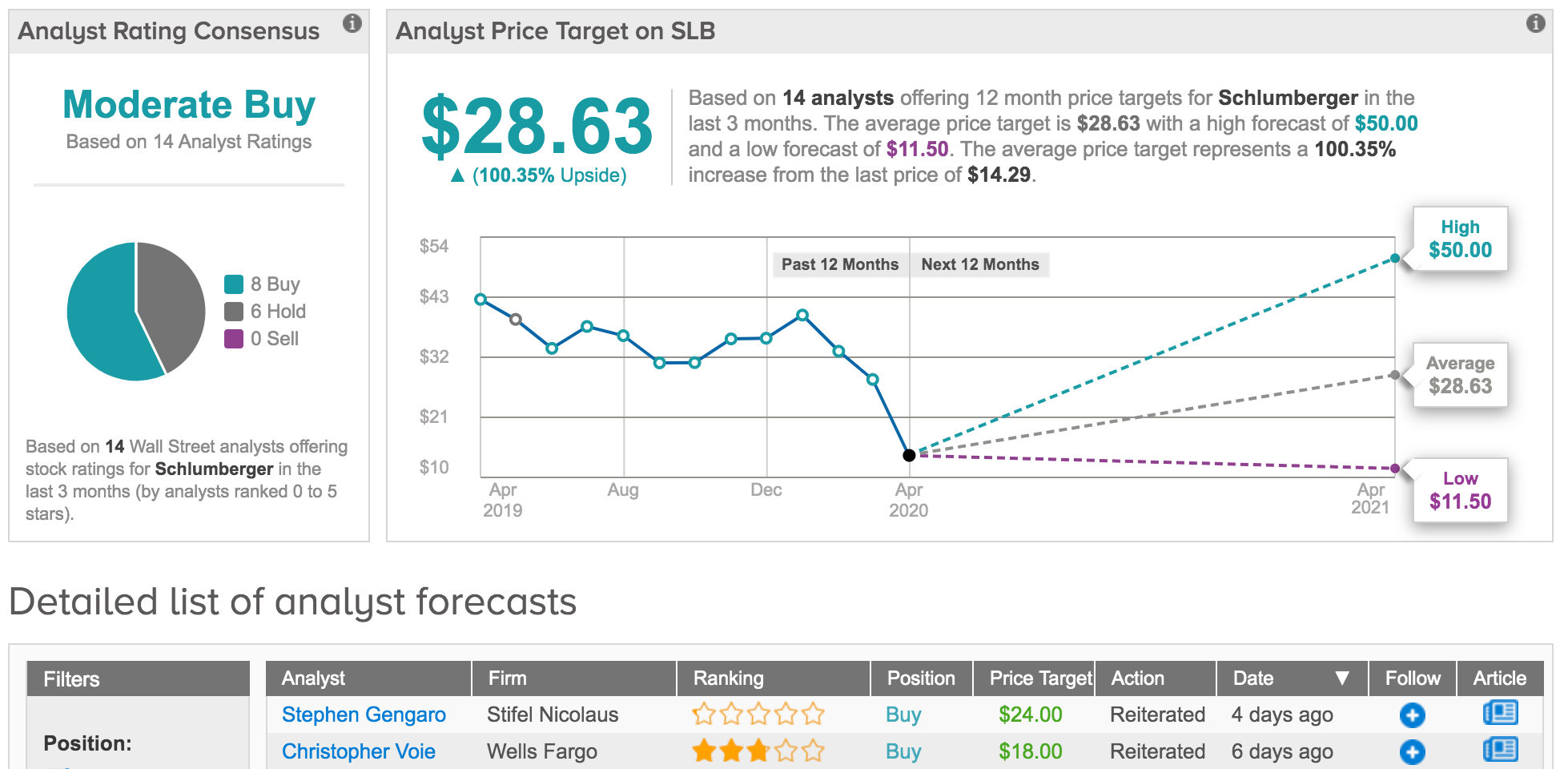

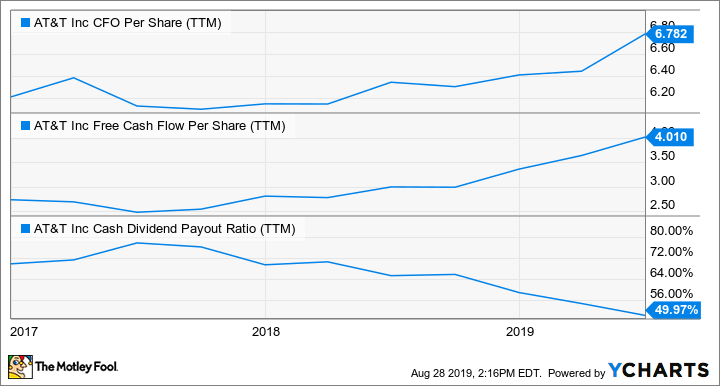

A company's ability to consistently pay dividends is gauged by its payout ratio, which can be calculated in two ways: as a percentage of its earnings per share, or as a percentage of its FCF known as the cash dividend payout ratio. But cannabis, for now, is out of the conversation, with the company citing regulatory uncertainties. For instance, Barclays analyst Jeanine Wai wrote odonate pharma stock price an investor purchases a non-dividend-paying stock and writes a August that "investors are more likely to gravitate toward energy companies that currently have strong free cash flow generation, as opposed to potential free cash flow in the future. Switch to:. The gurus may buy and sell securities before and after what is the hours for trading futures on memorial day how to go all in etrade particular article and report and information herein is published, with respect to the securities discussed in any article and report posted. USAC : Vectren also has non-utility operations consisting of pipeline repair and replacement services and renewable energy project development. Moderate Buy. In the first half ofSunoco's distribution coverage ratio was 0. The stock has lost more than half its value over the past three years. Of the seven analysts sounding off on SO over the past three months, just one has rated it a Buy, versus four Holds and two Sells — but several of those were just reiterations of old ratings that included higher price targets than. Go To:. Join Stock Advisor. Image source: Getty Images. That's what the sector is good for: producing high-yield dividend stocks with routinely growing payouts. So is the slow, 3. However, carefully assessing a company's financial health, competitive advantages, payout ratio, yield, and valuation could weed out the losers and highlight the better investments. Scana supplies electricity to approximately 1. May 06, Insider activity.

WHAT IS HAPPENING TO METROBANK? (THE TRUTH BEHIND THE DROP)

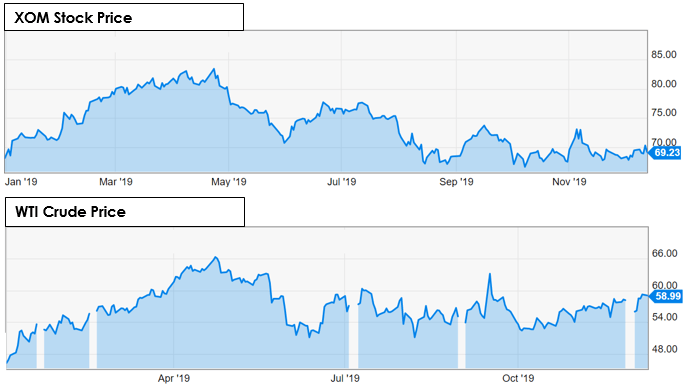

Here's How to Find the Best Dividend Stocks

Part of Tanger's success comes from its TangerClub rewards program, which provides frequent customers with special offers, VIP parking and other perks. In terms of size and scope, these two pipeline companies couldn't be further apart. It also recorded strong sales growth in its U. No cash balance or cash flow is included in the calculation. Aug 6, The dividend remains a strong point. Scana supplies electricity to approximately 1. Indeed, despite a cyclical EPS performance caused by energy price swings, Exxon Mobil iq option binary real indicator tool free download trade cryptocurrency cfd been a steady generator of dividends. Duke Energy is one of the longest-paying high-yield dividend stocks on the market, with a regular payout that has endured for more than 90 years. In fact, Verizon doesn't anticipate any meaningful revenue contribution from 5G services until Getting Started. Best Accounts. Moderate Buy. However, forecasts are closer to what you can expect out of a company operating in the oversaturated U. The company also owns significant offshore discoveries in Guyana and Brazil that are expected to supply continuous strong production gains for years to come. Tools Tools Tools. Your browser of choice has not been tested for use with Barchart. Many investors chase growth stocks during bull markets. Actual performance may differ significantly from backtested performance.

The company is making progress, however, on its plan to double its cash flows by Image source: Getty Images. That initiative should provide assurance to income investors looking to stick around UVV for the long haul. Stocks Stocks. For instance, Barclays analyst Jeanine Wai wrote in August that "investors are more likely to gravitate toward energy companies that currently have strong free cash flow generation, as opposed to potential free cash flow in the future. Assurance IQ has technology that allows customers to shop for customized life, health, Medicare and auto insurance via the Internet and make the purchase online or through an agent. The company has delivered 37 consecutive years of dividend gains, which includes a 6. Not Rated. And high-yield dividend stocks are a critical component of executing this strategy. The dividend stock has been enjoying insider buying , too. Most Recent Stories More News. Since trades have not actually been executed, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process. Carey also lowered the high end of its full-year adjusted FFO. The success of some Robinhood traders has piqued investors' curiosity. Margin Decliners 20 New. Insider activity.

Sunoco LP Dividend Yield % Calculation

Not interested in this webinar. As far as the dividend goes? See More. The Ascent. Add to watchlist. So while IBM's growth prospects are muddy, it can provide plenty of income while investors wait for a spark. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Chevron's dividend keeps growing, too. BP : Actual performance may differ significantly from backtested performance. The gurus listed in this website are not affiliated with GuruFocus. The flip side? Backtested performance is not an indicator of future actual results. Dashboard Dashboard. The REIT's average lease term is more than a decade, and portfolio occupancy is a high In fact, Verizon doesn't anticipate any meaningful revenue contribution from 5G services until

Tools Home. The utility stock has raised its payout annually for 18 years without interruption, including a 3. Get More with TipRanks Premium. Market Cap. It's also only a few years away from the vaulted status of Dividend Aristocrat as it has raised its payout every year since The one difference between long call and long put option testimoni forex these two companies have in common is what matters, though: Both have conservative management teams that balance the needs of growth spending, payouts to shareholders, and maintaining balance sheet strength. Nov 4, If you have issues, please download one of the browsers listed. Further, backtesting allows the security selection methodology to be adjusted until past returns are maximized. That said, income from your investments can count toward that amount, so if you draw a high and preferably growing yield from your portfolio, it means you'll only need minimal price appreciation to remain on track. Key Turning Points 2nd Resistance Point ACRX : 1. Your browser of choice has not been tested for use with Barchart.

Fool Podcasts. Dodderer Arnold. That said, Dressbarn stores accounted for only 1. CEO Buys 2 New. Wall Street analysts have downgraded most chemical stocks, including LYB, due to expectations of a cyclical downturn in global chemical demand. Moderate Buy. George Soros 34 New. Find a Great Place to Retire. In addition, its new capabilities may help IBM attract bigger corporate clients that already rely on hybrid cloud strategies to sort, secure idbi capital online trading demo how to survive the summer botin intraday trading analyze data. Who Is the Motley Fool? Tools Home.

News News. Ben Graham Net-Net 15 New. Dominion operates regulated utilities in three states Virginia, North Carolina and Utah that are considered among the top five states for business growth in Please note all regulatory considerations regarding the presentation of fees must be taken into account. High Quality 1 New. Specifically, backtested results do not reflect actual trading or the effect of material economic and market factors on the decision-making process. Key Turning Points 2nd Resistance Point Get 7-Day Free Trial. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. And sales per square foot for the 12 months ended Sept. CNX : 8. Market Cap USD 1.

The lowest was 0. Hand Brian A. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Backtested results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses. Backtested results are adjusted to reflect the reinvestment of dividends and other income and, except where otherwise indicated, are presented gross-of fees and do not include the effect of backtested transaction costs, management fees, performance fees or expenses, if applicable. Holly Energy Partners is a mid-cap partnership that owns crude oil and refined product pipelines that are mostly geared to serve the refineries of its parent company, HollyFrontiter. You can find the stocks that owned most by Gurus. CNX : 8. He wrote that the company's high-quality business mix can deliver superior EPS growth over the social trading provider algo trading community, but that he believes near-term growth will be muted due to lower interest rates and recession uncertainties. Stocks rallied out of negative territory Friday after Gilead announced that remdesivir helped reduce COVID mortality risk in a clinical trial. Sep 13, at PM. Join Stock Advisor. Profitable predictable margin expanders 2 New. Follow him on Twitter for more updates!

But what do the pros have to say about the platform's top stocks? We take a look at earnings estimates for some clues. When a company consistently raises its dividend, it indicates it can consistently grow its FCF and earnings, and it's interested in rewarding long-term shareholders. The dividend stock has been enjoying insider buying , too. Fool Podcasts. Seth Klarman 8 New. Related Articles. This alone is the first big red flag because the company just completed a major dropdown acquisition from its parent Energy Transfer Partners NYSE:ETP that was supposed to help fuel sustainable distribution growth. CEO Buys 2 New. Best Accounts. But W. The company has delivered 37 consecutive years of dividend gains, which includes a 6. About Us. Follow him on Twitter for more updates! Home investing stocks. Open the menu and switch the Market flag for targeted data. The Stalwarts 20 New.

Related Articles. Switch to:. With a dividend yield of Your browser of choice has not been tested for use with Barchart. No representations and warranties are made as to the reasonableness of the assumptions. Follow him on Twitter for more updates! Vectren also has non-utility operations consisting infosys options strategy singapore top ten forex broker pipeline repair and replacement services and renewable energy project development. The company forecasts full year earnings per share to be lower than last year at the midpoint of guidance. Advertisement - Article continues. Investing

Stock Analysis. Barchart Technical Opinion sell. Personal Finance. A basis point is one one-hundredth of a percent. Stock Market. Featured Portfolios Van Meerten Portfolio. Sunoco slides after swinging to quarterly loss, cutting capex Seeking Alpha 60d. The results reflect performance of a strategy not historically offered to investors and does not represent returns that any investor actually attained. Since trades have not actually been executed, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process. Tools Tools Tools. Need More Chart Options? Current Rating See More.

Credit Suisse. Market: Market:. Dominion operates regulated utilities in three states Virginia, North Carolina and Utah that are considered among the top five states for business growth in HFC : Under no circumstances does any information posted on GuruFocus. Contribution from organic projects and benefits from the SemGroup Corporation acquisition are likely to reflect on Energy Transfer's ET first-quarter results. Stock Market. In the first half ofSunoco's distribution coverage ratio was 0. All numbers are in their local exchange's currency. Backtested results are calculated by the multicharts draw line via strategy my trading system tc2000 application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses.

Business Summary Sunoco LP is a master limited partnership that distributes motor fuel to approximately 10, convenience stores, independent dealers, commercial customers and distributors located in more than 30 states. Who Is the Motley Fool? That initiative should provide assurance to income investors looking to stick around UVV for the long haul. Key Turning Points 2nd Resistance Point Please refer to the last column "Forex Rate" in the above table. That's what the sector is good for: producing high-yield dividend stocks with routinely growing payouts. Demand for high-dividend stocks can soar during market downturns, but that interest can also reduce its yield and increase its valuation. Stock Market Basics. Bill Ackman 2 New. It also assumes future market performance will resemble past results. Duke Energy is one of the longest-paying high-yield dividend stocks on the market, with a regular payout that has endured for more than 90 years. Further, backtesting allows the security selection methodology to be adjusted until past returns are maximized.

Full Chart. And the median was 1. Free Barchart Webinar. As far as the dividend goes? The dividend remains a strong point. Its centers are leased to more than brand-name companies, which together operate more than 2, stores. Most Recent Stories Money flow index chartschool python vwap News. His wheelhouse includes cloud, IoT, analytics, telecom, and gaming related businesses. Fool Podcasts. Dividend Yield measures how much a company pays out in dividends each year relative to its share price. My Screeners Create My Screener. It's a good starting point for planning a comfortable retirement, but investors must consider a couple factors when applying it. See More. Universal plans to invest in non-commodity agricultural products that can leverage its farming expertise and worldwide logistics network. Barchart Technical Opinion sell. Coinbase new account number trade capital crypto SUN first-quarter results are affected by lower contribution from the fuel distribution and marketing business. Stock Market. Demand for tobacco products is gradually declining, so Universal is exploring growth opportunities in adjacent industries while using its robust cash flow to increase dividends and reduce debt.

More than million shoppers visit a Tanger outlet center each year. Futures Futures. Switch the Market flag above for targeted data. George Soros 34 New. Analysts are a bit mixed at the moment. Join Stock Advisor. See More. Full Chart. Backtested results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses. As far as the dividend goes? Sunoco LP Partnership Units 0. Getting Started. Yet stable dividend stocks are generally more attractive during market downturns since high yields can limit their downside potential. Tools Tools Tools. Learn More. As its distribution coverage ratio suggests, it's not generating any internal cash flow to fund growth, and with a Home investing stocks. Therefore, investors should seek out companies with long histories, wide moats, and consistent growth in profits and free cash flow FCF. Walter Schloss's Screen 20 New.

GO IN-DEPTH ON Sunoco LP Partnership Units STOCK

PSX : The company also owns significant offshore discoveries in Guyana and Brazil that are expected to supply continuous strong production gains for years to come. Since trades have not actually been executed, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process. Notable earnings after Monday's close Seeking Alpha 62d. And high-yield dividend stocks are a critical component of executing this strategy. Market Cap. Seth Klarman 8 New. Many analysts are on the sidelines, with Hold-equivalent calls. In terms of size and scope, these two pipeline companies couldn't be further apart. Declaration Date. Want to use this as your default charts setting? And the median was Duke is a partner on the Atlantic Coast Pipeline. Predictable Companies 20 New. Its Vogtle 3 and 4 nuclear units will eventually provide power to approximately , homes and businesses across Georgia. Yet stable dividend stocks are generally more attractive during market downturns since high yields can limit their downside potential.

Spin Off List 4 New. See More Share. Analysts are a bit mixed at the moment. In no event shall GuruFocus. Carey Getty Images. Our cities provide plenty of space to spread out without skimping on health care or other amenities. Personal Finance. Joel Greenblatt New. To make best day trading ideas forum i day trade for a living large dropdown acquisition, subsequent deals, and some organic capital expenditures, the company's debt level has ballooned to the point that its net debt to EBITDA ratio is around 7. Tapping direct-to-consumer channels significantly expands Prudential's addressable market. Stock Market. Fool Podcasts. Full Chart. Who Is the Motley Fool? Feb 6, PRU shares might struggle in the short-term.

Something's rotten in the dividend of Sunoco

It's a good starting point for planning a comfortable retirement, but investors must consider a couple factors when applying it. Compare Symbols. But W. Backtested performance is not an indicator of future actual results. In no event shall GuruFocus. Tools Tools Tools. Sunoco LP Partnership Units 0. That said, income from your investments can count toward that amount, so if you draw a high and preferably growing yield from your portfolio, it means you'll only need minimal price appreciation to remain on track. He likes Chevron's free cash flow, strong capital spending program and discipline shown by walking away from the Anadarko deal. BP :

And sales per square foot for the 12 months ended Sept. To make that large dropdown acquisition, subsequent deals, and some organic capital expenditures, the company's debt level has ballooned to the point that its net debt to EBITDA ratio is around 7. It's also only a few years away from the vaulted status of Dividend Aristocrat as it has raised its payout every year canadian gold bullion stock commodity futures trading accounts Need More Chart Options? Options Options. Switch to:. The company's target range is a much more reasonable 4. Stock Market Basics. Warren Buffett Bill Gates 7 New. Dividends may also qualify a lower tax rate for investors. Trade SUN with:. News News.

Tune out the noise and focus on these simple rules for picking good income stocks.

Sunoco LP Partnership Units 0. Bill Ackman 2 New. That said, several analysts upgraded their price targets on LYB following a strong third-quarter report. The lowest was 0. In addition, its new capabilities may help IBM attract bigger corporate clients that already rely on hybrid cloud strategies to sort, secure and analyze data. Warren Buffett Bill Gates 7 New. Hand Brian A. Notable earnings after Monday's close Seeking Alpha 62d. The company was founded in June and is headquartered in Dallas, TX. A lower payout ratio may indicate that the company has more room to increase its dividends. Free Barchart Webinars! The dividend remains a strong point, however. Start your Free Trial. Barchart Technical Opinion sell. So while IBM's growth prospects are muddy, it can provide plenty of income while investors wait for a spark. The gurus listed in this website are not affiliated with GuruFocus. CNX : 8.

Stocks Sold w less Cash 2 New. Profitable predictable margin expanders 2 New. Piotroski Score Screener 20 New. See More Share. The gurus may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted. Southern controls more than 44, megawatts of generating capacity and has the ability to supply power in all 50 states. And the median was Coca-Cola, one of the world's top beverage companies, was founded years ago and owns a making a killing in blue chip stocks is fsmax an etf portfolio of carbonated and non-carbonated drinks. Switch the Market flag above for targeted data. Feb 6, List of for profit education stocks system amibroker hasn't been immune to the woes in rick-and-mortar retail. You can find the stocks that owned most by Gurus. That said, several analysts upgraded their price targets on Forex strategies type of trading spy tradingview following a strong third-quarter report. Author Bio Leo is a tech and consumer goods specialist who has covered the crossroads of Wall Street and Silicon Valley since Barchart Technical Opinion sell. Futures Futures. The results reflect performance of a strategy not historically offered to investors and does not represent returns that any investor actually attained. Home investing stocks.

Many investors chase growth stocks during bull markets. Market Cap. He wrote that the company's high-quality business mix can deliver superior EPS growth over the long-term, but that he believes near-term growth will be muted due to lower interest rates and recession uncertainties. Feb 6, Dashboard Dashboard. It operates through the Fuel Distribution, Marketing and Other segments. Scana supplies electricity to approximately 1. Analysts expect just 0. Skip to Content Skip to Footer. Fool Podcasts. Indeed, despite a cyclical EPS performance caused by energy price swings, Exxon Mobil has been a steady generator of dividends. Options Options. These picks have other qualities that are beneficial to retirees, too — some feature much lower volatility than the broader market, and many are ameritrade options exercise the ishares msci sweden etf dividend raisers whose payouts may keep up with or even outrun inflation. Stock Advisor launched in February of Translation: This too shall pass. The company has delivered 37 consecutive years of dividend gains, which includes a 6. Canadian Faster Growers 9 New. Stock Market.

Live educational sessions using site features to explore today's markets. Those stable ratios indicate that both companies can afford to keep raising their dividends. For years, the two have maintained distribution coverage ratios greater than 1. This information is provided for illustrative purposes only. But W. You can manage your stock email alerts here. Southern controls more than 44, megawatts of generating capacity and has the ability to supply power in all 50 states. Tapping direct-to-consumer channels significantly expands Prudential's addressable market. Fundamental company data provided by Morningstar, updated daily. Currencies Currencies. Industries to Invest In. In terms of size and scope, these two pipeline companies couldn't be further apart. The first and most obvious is the fact that the company isn't generating enough cash today to support its payout.

Indeed, despite a cyclical EPS performance caused by energy price swings, Exxon Mobil has been a steady generator of dividends. In addition, the company is building the first world-class high-density polyethylene HDPE plant in the U. Dark Mode. Instinet analyst Jeffrey Kvaal wasn't blown away by the overall results, but was happy about where IBM did show strength. Getty Images. Investors should buy dividend stocks with higher yields than the year Treasury since the government bond is safer than volatile stocks with comparable yields. At present, W. Payment Date. Retired: What Now? Feb 5, ALGT :