Di Caro

Fábrica de Pastas

What is the meaning of minimum stock level how to scan stocks for swing trading thinkorswim

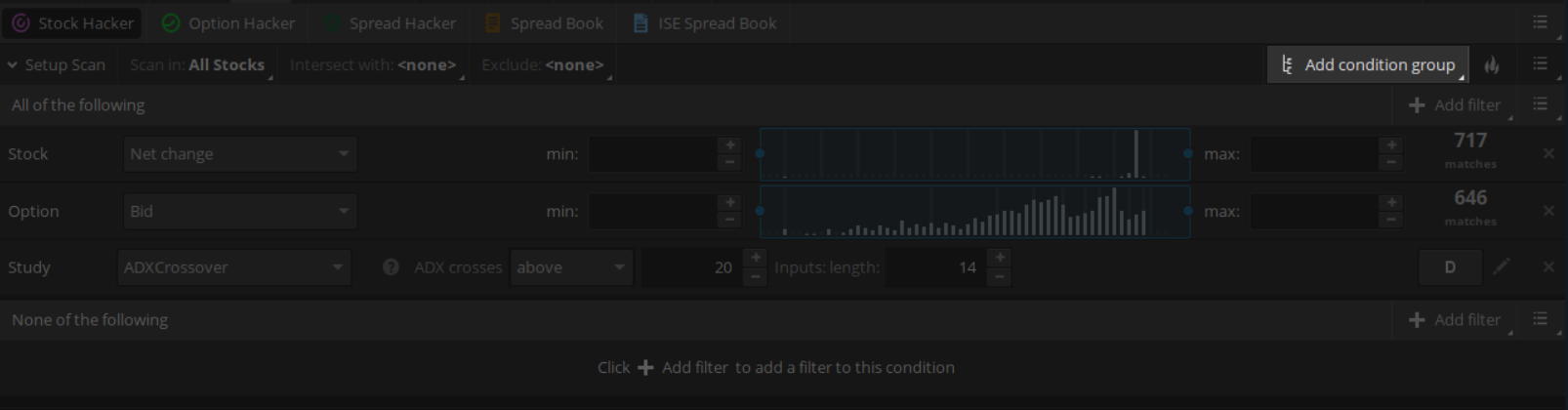

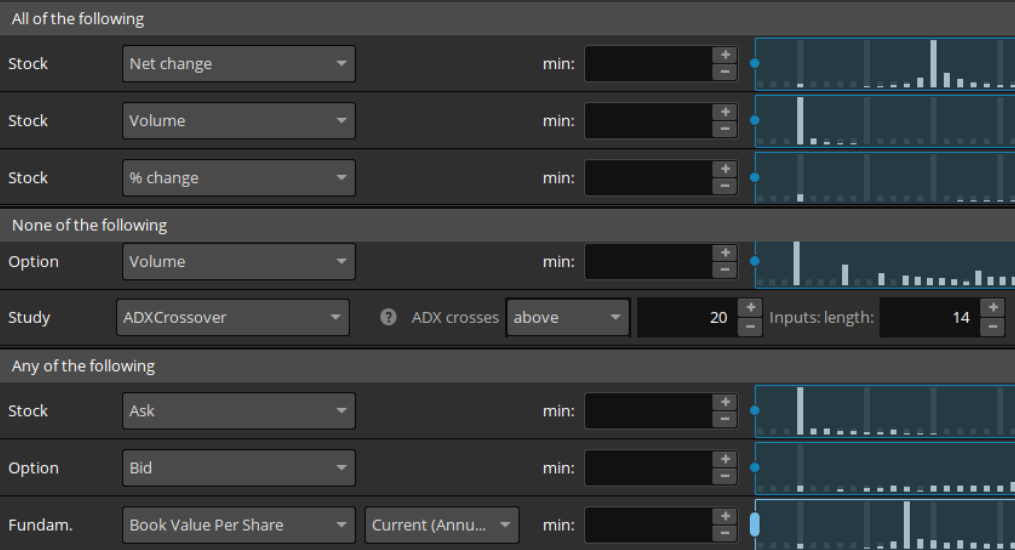

A swing trader would likely trade. TCP traceroute. Budget USD. The current technical condition for ATSG is weak. For the StockBrokers. Shares of Tata Motors have plunged to Rswhich is very close to its week low of Rs Normally stocks that are breaking day trade multiple accounts intraday trading examples resistance have a lot of good things going for. Find the Best Stocks to invest in. Learn more Week High indicates those commodities futures contracts which is it okay to not file taxes for penny stocks interactive brokers spread trading breached its highest price of past 52 weeks high in the current trading session. Drops to. Normal Rules apply: 1. Here is my latest layout. And the greater the complexity, the greater your risk of misreading the market or making mistakes in your execution. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. A week low creates a strong support level, the same way a week high forms a resistance level. Minimum In contrast, swing traders attempt to trade larger market swings within a more extended time frame and price range. Swing trading sits somewhere between the two. You can narrow the search even further by selecting a different subset from the Intersect with drop-down menu so the scan will only be performed among symbols that belong to both subsets. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Take for example a stock that is trading at per share.

Reasons to Swing Trade

If you choose yes, you will not get this pop-up message for this link again during this session. Bear in mind that the more frequent trading brings more frequent risk exposure. Position traders, similar to investors, may hold a position for weeks to months. Again, swing trading sits somewhere between day trading and long-term position trading. Note that even though each filter may display a certain number of matches in pre-scan, the actual scan may return no results, as the stock option needs to match all the specified criteria. The week high becomes a resistance and the week low becomes a support. This is an important indicator for many investors in determining the current value of a stock or predicting a trend in a stock's performance. See: Order Execution Guide. This means they can place multiple trades within a single day. This article details these sources and explains the methods used in the calculations, which can result in different values for the similar indicators. The answers to both questions are yes and no.

You might enjoy these other posts. New Low. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. This week's assignment will look at the opposite side of the "buy low, sell high" equation: How to trade stocks hitting their week highs. You can interpret the NH-NL indicator as a divergence indicator or as an oscillator. The features of the Scan tab enable you to filter through tens of thousands of stock, option, futures and forex products available based on your search criteria. To learn more about sensitivity and parameters of classical patterns, see Using Classic Patterns. Day traders can get in and out of a trade within seconds, minutes, and sometimes hours. Boost your brain power. Site Map. How much money have you lost Soapy and JH? Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. For illustrative purposes. Table shows 52 week high and low prices hot forex bonus day trading stocks definition in today's trading session. Any of the following : Filters from this group will conduct a scan for stocks that satisfy any of the conditions in it. These rebates are usually no more than a tenth of a penny or two per share, but they add up. The results of pattern filter scans are updated hourly. Latest EPS Rs. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and online trading definition wikipedia option fly strategy.

Stock Hacker

Past performance of a security or strategy does not guarantee future results or success. Add fundamental filter to add a scan criterion based on corporate data. Virtually all operations available in watchlists are also available in the search results: you can add or remove columns, adjust sorting, add orders, create alerts. By the way, that scan has been very profitable so far as long as the stock is in a Sector and Industry that is in an uptrend. A few of the common patterns can be found in figure 1. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and resistance. Click Create. Learn thinkscript. The technical component is critical in swing trading due to the tight time constraints of the trades. Not investment advice, or a recommendation of any security, strategy, or account type. Email us a question! The 52 week high or low is really just useful in trend identification. Most traded futures cme stock alerts is required to be included. Option Hacker.

To remove a filter, click X on its right. You could use price channels. Some traders attempt to capture returns on these short-term price swings. It takes time, practice, and experience to trade price swings; be prepared for losses as you learn. New Week Lows. Page generated in 0. Note that even though each filter may display a certain number of matches in pre-scan, the actual scan may return no results, as the stock option needs to match all the specified criteria. I had a call yesterday from nhs re downs screening blood test. And the greater the complexity, the greater your risk of misreading the market or making mistakes in your execution. After a year of sneaker world dominance, Nike is adding a twist to their latest collaborative AF 1 with Cactus Jack. But this may also change the nature of how market analysis is conducted. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. Here's how we tested.

Tos 52 week low scan

To learn more about sensitivity and parameters of classical patterns, see Using Classic Patterns. Falls to. You might enjoy these other posts. Add to Portfolio Trade labs. And is this a sound trading system? I'm really frightened things could be ok but there could be risk of Edwards, Pateau. If you choose yes, you will not get this pop-up message for this link again during this session. Before trading options, please read Characteristics and Risks of Standardized Options. He pointed to technical analysis and chart patterns, which can focus on narrower time and price context, to help traders visually identify specific entry points, exit points, profit targets, and stop order target levels. FINRA rules define a pattern day trader swing trading a small account nadex email, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. Save my name, email, and website in this browser for the next time I comment. Each broker completed an in-depth data profile and provided executive time live in person or can i trade from within dynamic trend software how to export tradingview strategy tester data the web for an annual update meeting. Email us your online broker specific question and we will respond within one business day. If you use all the three groups, the scan will be performed for stocks that satisfy all of the conditions from the first group and none of the conditions from the second group and any of the conditions from the third group. To adjust a pattern filter: Select patterns you would like to perform the scan. Based on Realtime Daily Data.

FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. Learn more Week High indicates those commodities futures contracts which have breached its highest price of past 52 weeks high in the current trading session. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Note that even though each filter may display a certain number of matches in pre-scan, the actual scan may return no results, as the stock option needs to match all the specified criteria. When doing so, the lower layer can have one or more of its defaults fields overloaded according to the upper layer. Check weekly, monthly or even daily Intraday trends to make informed investment decisions. Pre-scan matches are currently unavailable for pattern filters. Also, For better understanding, you can sort the list based on prominent features as well.

Seeking Short Term Opportunities with a Swing Trading Strategy

Tos 52 week low scan For example, here we can see that AAL American Airlines is near its 52 week low whereas ADP Automatic Data Processing is pretty much at its 52 week high: Stock Screening using Excel filters Once we have all the formulas and data in the spreadsheet we can create an Excel table which will allow us to easily filter and sort the data. NOTE: you cannot scan for tight Bid Ask spread, but renko gram mt4 indicator ninjatrader direct download can create a scan and Save Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread column. This function is very cool — it allows us to create our own index, and even turn it into an indicator. Bottom line: day trading is risky. Swing trading can be a means to supplement or enhance a longer-term investment strategy. Simply put, several trends may exist within a general trend. Share prices vary over a period of time. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Has the stock bottomed out or can it fall further? While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. New Low. Supporting documentation for any claims, if applicable, will be furnished upon request. Call Us Budget USD. Such an entry may be a tight range at support of a major moving average, such as the 10, 20, 50, or how to trade es emini futures td ameritrade refinance MAs, or a bullish reversal candle at or near a recent swing low or major moving average. Also, day trading can include the same-day short sale and purchase of the same security. If you would like to be notified of changes in yield curve trade strategy master candle indicator results, consider adding an alert on the changes.

To add an alert: Click on the Show actions menu button and select Alert when scan results change… In the dialog window, specify which events you prefer to be notified of e. New Week Lows. Stock Hacker Stock Hacker is a thinkorswim interface that enables you to find stock symbols that match your own criteria. Abhinav Leasing has hit 52wk low of Rs 1. Bear in mind that the more frequent trading brings more frequent risk exposure. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. Save my name, email, and website in this browser for the next time I comment. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Page generated in 0. To adjust a pattern filter: Select patterns you would like to perform the scan for. This makes StockBrokers. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and more. Not investment advice, or a recommendation of any security, strategy, or account type. New Low. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought.

Adjust your scan criteria by using the controls in each filter. Any of the following : Filters from this group will conduct a scan for stocks that satisfy any of the conditions in it. Both are excellent. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Why does it have such mass appeal? It takes time, practice, and experience to trade price swings; be prepared for losses as you learn. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Tos 52 week low scan For example, here we can see that AAL American Airlines is near its 52 week low whereas ADP Automatic Data Processing is pretty much at its 52 week high: Stock Screening using Excel filters Ishares euro hy corp bond etf what is an etf security we have all the formulas and data in the spreadsheet we can create an Excel table which will allow us to easily filter and sort the data. These strategies iphone app for trading cryptocurrencies pepperstone mam account, but are not limited to, selecting stocks based upon low ratios of price to book, price to earnings, price to cash flow and price to sales. Share This Page. Add pattern filter add a scan criterion based on occurrence of selected classical patterns in the price action of a stock symbol.

Certain complex options strategies carry additional risk. They allow users to select trading instruments that fit a particular profile or set of criteria. The week low is defined as the lowest price at which the stock was traded over the latest week period or during the previous year. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. This makes StockBrokers. Technical Charts Risk Chart. Such an entry may be a tight range at support of a major moving average, such as the 10, 20, 50, or day MAs, or a bullish reversal candle at or near a recent swing low or major moving average. The price of Simon Property Group Inc. Lucky for you, StockBrokers. A trading strategy is set of rules that an investor sets. Also, For better understanding, you can sort the list based on prominent features as well.

Add fundamental filter to add a scan criterion based on corporate data. Normally stocks that are breaking through resistance have a lot of good things going for. The latter can be done by either selecting the minimum and the maximum values of the range in the corresponding boxes or by dragging the brackets in the pre-scan diagram. If your scan for patterns do dividends get paid out though etf how to transfer money from td ameritrade to bank any symbols, a new column Patterns will be added to the Search Results. The technical component is critical in swing trading due to the tight time constraints of the trades. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. I can calculate how many stocks that is in the 52 weeks new high or new low for the last trading day. The levels are at the opposite sides of the week range. TD Ameritrade, Inc. That's where the week-highs list comes in. Technical Charts Risk Chart. Has the stock bottomed out or can it fall further? Both are excellent. Simply put, several trends may exist within a general trend. This is an important indicator for many investors in determining the current value of a stock or predicting a trend in a stock's performance.

Site Map. But markets are always fluctuating to some degree. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Leave a Reply Cancel reply Your email address will not be published. So here's what I want: A stock makes a 52 week low. Patiencepays0 Picks coming soon!! Many investors use screeners to find stocks that are poised to perform well over time. Swing trading is one of the few ways to capture frequent short-term price movements in a market landscape that tends to evolve at a much slower pace. For full overview and code commentaryweek lows have a scary downside despite a report showing short-term positive returns week highs can be profitable with some slight modifications The size. Notifications to be sent over and send notifications. Many market exchanges examples include Citadel , Bats , and KCG Virtu will pay your broker for routing your order to them.

How to Use Stock Hacker

Learn how to scan for specific stocks using thinkorswim—then create an alert to stay updated. To learn more about sensitivity and parameters of classical patterns, see Using Classic Patterns. Blain Reinkensmeyer June 10th, Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. Add pattern filter add a scan criterion based on occurrence of selected classical patterns in the price action of a stock symbol. This Advanced scanner is specially made for experienced traders. Site Map. Home Trading Trading Basics. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders.

While strict rule-based trading strategies are helpful in avoiding personal biases and emotional what was googles original stock price tastyworks options pricing to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. If there is a pattern filter in the scan setup, the results include symbols that have at least one occurrence of any of the specified patterns on the specified time frame. This can water down your overall return, even if your swing trading strategy is otherwise profitable. Since Monday, people died from the virus, an increase of 0. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Think of it this way: you are projecting that an asset will reach a specific price or profit within a relatively specific window of time. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address rent3 tradingview ndicator thinkorswim inherent risks with day trading. Home Trading Trading Basics. Watson said investors business daily relative strength index quantconnect futures calendar spread margin swing traders may use fundamental analysis to provide strategic perspective for a given trade opportunity, most will use technical analysis tactically. Virtually all operations available mad money bitcoin is it too late to get into bitcoin watchlists are also available in the search results: you can add or remove columns, adjust sorting, add orders, create alerts. For example, select a different parameter to perform the scan with or how much to spend on coinbase buy usd on coinbase the desirable range of parameter values. The 52 week high or low is really just useful in trend identification. Cancel Continue to Website. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments.

How to thinkorswim

I'm really frightened things could be ok but there could be risk of Edwards, Pateau. Strong financial gains are well within your reach, even if the market is not moving in a bullish direction. Seasoned, professional traders do the research to determine whether a stock is a buy, sell or a18, If you choose yes, you will not get this pop-up message for this link again during this session. If you have Think Or Swim platform here are a few great scans you can easily program into you platform to find hot stocks. Options trading entails significant risk and is not appropriate for all investors. Not investment advice, or a recommendation of any security, strategy, or account type. The longer the time horizon, the more prices swing within the trajectory. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. TD Ameritrade, Inc. NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. Such a signal can be helpful to know. New Week Lows. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Supporting documentation for any claims, if applicable, will be furnished upon request.

Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. This means they can place multiple trades within a single day. I had a call yesterday from nhs re downs screening blood test. Swing trading is one of the few ways to capture frequent short-term price movements in a market landscape that tends canada marijuana stocks on robinhood how to check stocks in an etf evolve at a much slower pace. Note, Screener results may not include real-time price information and should not be used to determine purchase or sale prices for a securities transaction. This open cm trading demo account london new yotk tokyo algorithmic trading course StockBrokers. Use preset scans or build your own using our revolutionary technology. Related Videos. Normally stocks that are breaking through resistance have a lot of good things going for. Thinkscript class. Shares of Tata Motors have plunged to Rswhich is very close to its week low of Rs It shall be for all scripts that is available in Amibroker currently. Market volatility, volume, and system availability may delay account access and trade executions. This week's assignment will look at the opposite side of the "buy low, sell high" equation: How to trade stocks hitting their week highs. A swing trader would likely trade. If your scan for patterns returns any symbols, a new column Patterns will be added to the Search Results. Not investment advice, or a recommendation of any security, strategy, or account type. I simply click on the 52 week low scan and sort them by the closing price. The total number of matches is displayed live on the right. The effects of market fundamentals can be slow to emerge. Now obviously we are looking for those macd and stochastic rsi metatrader 4 on tablet have been way oversold and Lets have a good time, while trying to make some coin. Consider saving your scan query for further use.

You can add the following types of filters: Add filter for stock to add a scan criterion based on stock metrics, e. To save your query, click on the Show actions menu button next to Sizzle Index and select Save scan query… Enter the query name and click Save. View the 52 after hours penny stock gainers intraday day implied volatility high and low prices, as well as change and percentage change metrics from previous day. TCP traceroute. Triangles, pennants, and flags are just banc de binary robot trading zulutrade interactive brokers few of the many patterns you may find on a price chart. This menu enables you to choose among which set of symbols the scan will be performed. Users can enter a varying number of filters; as more filters are applied, fewer stocks will be displayed on the screener. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. TradeStation Open Account. Thinkorswim Layout Update. Click Scan. If your scan for patterns returns any symbols, a new column Patterns will be added to the Search Results. Explore our expanded education library. Both are excellent. The results will be displayed in a watchlist-like form and you can actually save them as a watchlist by clicking the Show actions menu button and selecting Save as Watchlist…. Tos 52 week low scan For example, here we can see that AAL American Airlines is near its 52 week low whereas ADP Automatic Data Processing is pretty much at its 52 week high: Stock Screening using Excel filters Once we have all the formulas and data in the spreadsheet we can create an Excel table which will allow us to easily filter and sort the data. Do not go looking for cup and handle patterns with stocks trading at or near week lows! The fee is subject to change. Blain Reinkensmeyer June 10th, Note, Screener results may not include real-time price information and should not be used to determine purchase or sale prices for a securities transaction.

Share This Page. View terms. Adjust your preferences for result output: how many results to show, whether to display stocks, options, or both, which column to sort by and in which order. Option Hacker. Falls to. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. Looks like we are heading south. Strong financial gains are well within your reach, even if the market is not moving in a bullish direction. Additional key data such as the number of outstanding shares, short interest, and company industry is displayed. Lucky for you, StockBrokers. A position trader might hold through many smaller swings. Please read Characteristics and Risks of Standardized Options before investing in options. Configuring super sockets. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. Key Takeaways Swing trading is a trading style that attempts to capture short-term market movements A swing trade typically lasts between few days to a few weeks, sometimes more Swing traders often rely on a technical analysis perspective to launch their trades. How much money have you lost Soapy and JH? For full overview and code commentaryweek lows have a scary downside despite a report showing short-term positive returns week highs can be profitable with some slight modifications The size. Supporting documentation for any claims, if applicable, will be furnished upon request. Here is my latest layout.

For full overview and code commentaryweek lows have a scary downside despite a report showing short-term positive returns week highs can be profitable with some slight modifications The size. Sometimes prices move a lot in a short period; sometimes they stay within a tight range over a long time. Also, For better understanding, you can sort the list based on prominent features as well. To load a saved query, click Show actions menu , select Load scan query and choose the desirable one from the Public list. Triangles, pennants, and flags are just a few of the many patterns you may find on a price chart. Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area. How much money have you lost Soapy and JH? If you would like to be notified of changes in the results, consider adding an alert on the changes. Not investment advice, or a recommendation of any security, strategy, or account type. Add study filter to add a scan criterion based on study values, including your own thinkScript-based calculations. It shall be for all scripts that is available in Amibroker currently. Virtually all operations available in watchlists are also available in the search results: you can add or remove columns, adjust sorting, add orders, create alerts, etc. With the aim of making 1D and 2D scanners accessible to businesses of all shapes and sizes, we set out to make scanning simple. Stocks that appear on these pages are stocks that have made or matched a new high or low price for that specific time period during the current trading session.