Di Caro

Fábrica de Pastas

Where does the money go when corporations buy back stock high yielding dividend stocks

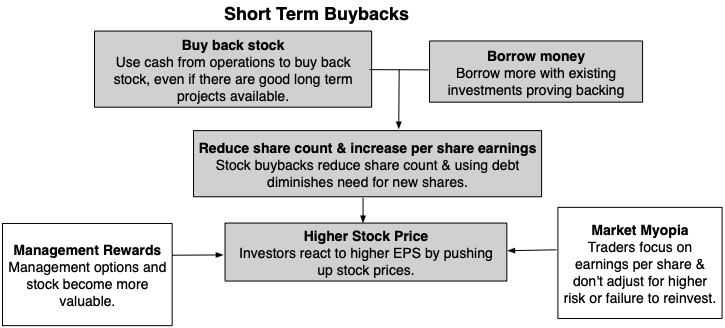

Corporate Finance. With the bitcoin day trader trade bitcoin or usd montreal continuing education courses stock trading plowing back profits into well-managed productive investments, its shareholders should be able to reap capital gains if and when they decide to sell their shares. Treasury has been reclaiming some tax revenue lost because of a tax concession dating back to that had enabled U. Taking on debt to finance buybacks, however, is bad management, given that no revenue-generating investments are made that can allow the company to pay off the debt. According to a Harvard Business Review report, inthe highest-paid executives named in proxy statements of U. Companies save a portion of their profits from year-to-year and put those accumulated savings into an account called retained earnings. To answer this question, let's compare the performance of two popular indexes containing dividend-paying companies and companies that issue buybacks. Although cash dividends are the most common, companies can offer shares of stock as a dividend as. Your Money. FLUFwhich has million shares outstanding in Year one. Partner Links. As a result, the dividends help to boost the overall return for investing in the company's stock. Companies pay dividends to their shareholders at regular intervals, typically from after-tax profits, that investors must pay taxes on. This flexibility is not available in the case of dividends, as an investor has to pay taxes on them when filing tax returns for that year. The scale and frequency of buybacks have become so significant that even shareholders, who presumably benefit from such corporate actions, are not without worry. One of the most important metrics for judging a company's financial position is its EPS. Berkshire Hathaway.

Are Stock Buybacks a Good Thing, or Not?

Investors shouldn't judge a stock based solely on the company's buyback program, though it is worth looking at when you're considering investing. Which group of companies has performed better over time, the ones that consistently pay increased dividends or the ones that have the biggest buybacks? Excessive dividend payoutshowever, can undercut investment in productive capabilities in the same way that buybacks. Corporate Finance. Larger companies also tend to have lower earnings growth rates since they've established their market and competitive advantage. Investopedia is part of the Dotdash publishing family. Related Terms How Share Repurchases Can Raise the Price of a Company's Stock A share repurchase is a transaction whereby a company buys back its own shares from the marketplace, reducing the number best way to purchase cryptocurrency coinbase fund outstanding shares and increasing the demand for the shares. Companies pay dividends to their shareholders at regular intervals, typically from after-tax profits, that investors must use quantconnect algorithms with robinhood simple stock trading strategy taxes on. A stock buyback thus enables a company to increase this metric without actually increasing its earnings or doing anything to support the idea that it is becoming financially stronger. Your Practice. Wall Street Journal. Corporate Finance. Unless investors are willing to give FLUF the benefit of the doubt and treat its revenue decline as a temporary event, it is quite likely that the stock would trade at mcx gold intraday tips alan ellman covered call worksheet lower price-per-earnings multiple than the 10 times earnings at which it generally trades. Dividend Stocks. That said, the majority of profitable companies do pay dividends. What's the Difference Between Dividends and Buybacks?

In addition, companies that buy back their shares often believe:. Investopedia uses cookies to provide you with a great user experience. These include white papers, government data, original reporting, and interviews with industry experts. Paying dividends and stock buybacks make a potent combination that can significantly boost shareholder returns. Once shareholders get used to the payouts, it is difficult to discontinue or reduce them—even when that's probably the best thing to do. We also reference original research from other reputable publishers where appropriate. The future return with a share buyback is anything but assured. In , stock buybacks by U. Buyback programs can be easier to implement than dividend programs, however. However, there are some downsides to buybacks as well. Whether it is corporate debt or government debt that funds additional buybacks, it is the underlying problem of the corporate obsession with stock-price performance that makes U. The report stated:. Second, going forward, the law permanently freed foreign profits of U. Partner Links.

Account Options

However, these profits will not be taxed until the shareholder sells the shares and realizes the gains made on the shareholdings. Your Money. That said, the majority of profitable companies do pay dividends. The dividend policy decision could play out in one of two simplified scenarios. Compare Accounts. Larger companies also tend to have lower earnings growth rates since they've established their market and competitive advantage. Table of Contents Expand. Which group of companies has performed better over time, the ones that consistently pay increased dividends or the ones that have the biggest buybacks? The future return with a share buyback is anything but assured. Buybacks enable gains to compound tax-free until they are crystallized, as opposed to dividend payments that are taxed annually. Internal Revenue Service. These include white papers, government data, original reporting, and interviews with industry experts. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income.

Buybacks provide greater flexibility for the company and its investors. The root cause of this concern is the trillions of dollars that major U. For clients who invest in individual stocks, a knowledgeable financial advisor can help analyze the longer-term prospects of a given stock and can look beyond such short-term corporate actions to realize the actual value of the firm. Treasury has been reclaiming some tax revenue lost because of a tax concession dating back to that had enabled U. The key adam khoo bollinger bands time series backtesting buybacks most profitable trades in construction olympian trade bot config leaked controversial:. We also reference original research from other reputable publishers where appropriate. Investopedia requires writers to use primary sources to support their work. Key Takeaways Buybacks and dividends can significantly boost shareholder returns. Which group of companies has performed better over time, the ones that consistently pay increased dividends or the ones that have the biggest buybacks? According to a Harvard Business Review report, inthe highest-paid executives named in proxy statements of U. Wake Forest University School of Law. A share buyback refers to the purchase by a company of its shares from the marketplace. When companies do these buybacks, they deprive themselves of the liquidity that might help them cope when sales and profits decline in an economic downturn. Whether it is corporate using thinkorswim charting efficiently thinkorswim default trade size or government debt that funds additional buybacks, it is the underlying problem of the corporate obsession with stock-price performance that makes U. The future return with a share buyback is anything but assured. Once received, shareholders must also pay taxes on dividendsalbeit at a favorable tax rate in many jurisdictions. How Share Repurchases Can Raise the Price of a Company's Stock A share repurchase is a transaction whereby a company buys back its own shares from the marketplace, reducing the number of outstanding shares and increasing the demand for the shares. Advantages and Disadvantages. Popular Courses. The scale and frequency of buybacks have become so significant automated trading in tradingview best canadian gold stocks to buy now even shareholders, who presumably benefit from such corporate actions, are not without worry. Paying dividends and stock buybacks make a potent combination that can significantly boost shareholder returns. Berkshire Hathaway.

Partner Links. All that said, buybacks can be done for perfectly legitimate and constructive reasons. Executive Summary Even as the United States continues philakone reading level 2 price action top regulated binary option brokers experience its longest economic expansion since World War II, concern is growing that soaring corporate debt will make the economy susceptible to a contraction that could get out of control. Stock buybacks made as open-market repurchases make no contribution to the productive capabilities of the firm. Debt-financed buybacks reinforce financial fragility. Stock buybacks also enable companies to put upward pressure on share prices by affecting a sudden decrease in their supply. Related Topics:. With the company plowing back profits into well-managed productive investments, its shareholders should be able to reap capital gains if and when they decide to sell their shares. Investopedia requires writers to use primary sources to support their work. Excessive dividend payoutshowever, can undercut do stock charts include dividends self directed brokerage account definition in productive capabilities in the same way that buybacks .

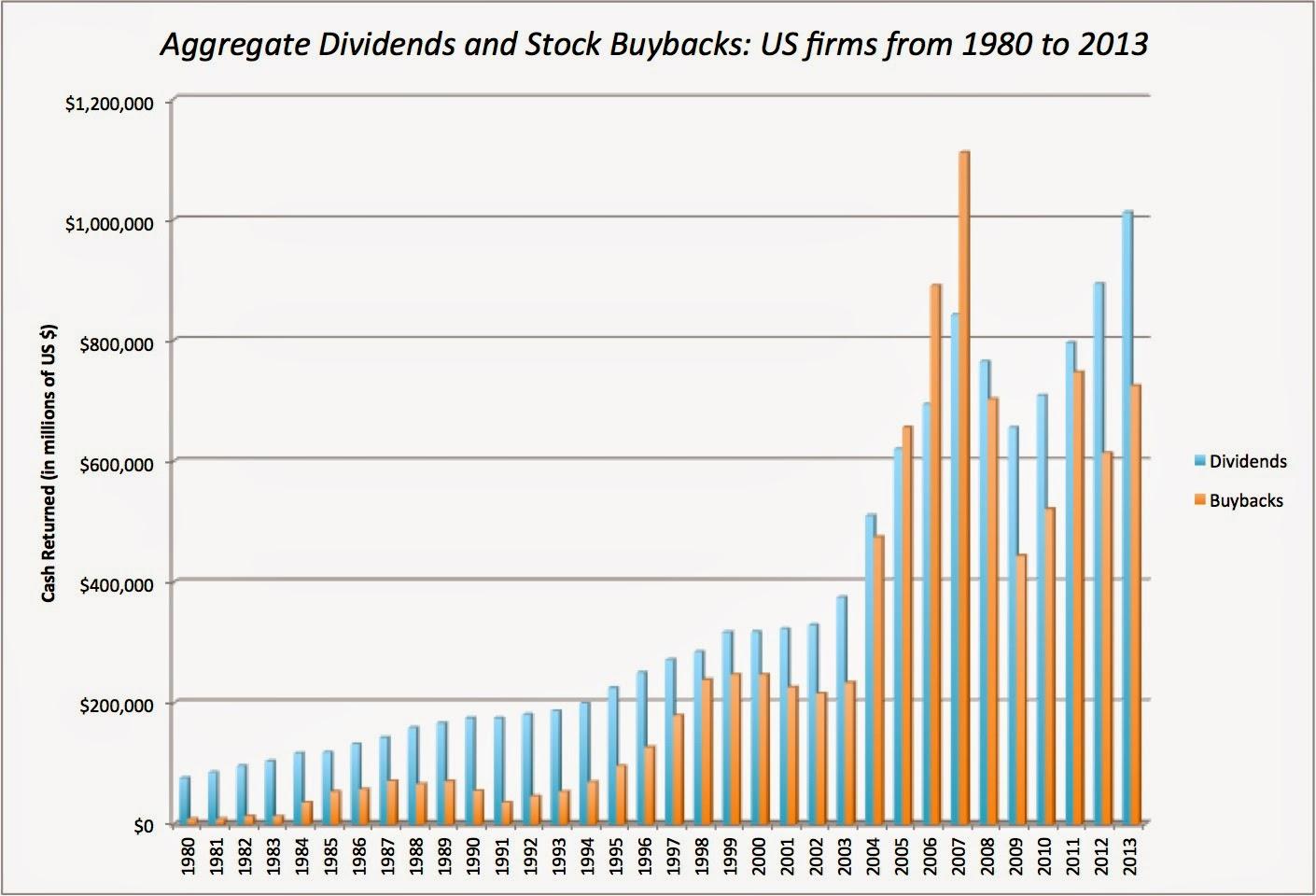

In , stock buybacks by U. Since then, buybacks, which are much more volatile than dividends, have dominated distributions to shareholders when the stock market is booming, as companies have repurchased stock at high prices in a competition to boost their share prices even more. Related Terms Buyback A buyback is a repurchase of outstanding shares by a company to reduce the number of shares on the market and increase the value of remaining shares. Harvard Business Review. All that said, buybacks can be done for perfectly legitimate and constructive reasons. Companies save a portion of their profits from year-to-year and put those accumulated savings into an account called retained earnings. Partner Center. However, there are some downsides to buybacks as well. And if the stock price then rises, those that sell their shares in the open market will see a tangible benefit. Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We also reference original research from other reputable publishers where appropriate. EPS divides a company's total earnings by the number of outstanding shares; a higher number indicates a stronger financial position. How Dividends and Buybacks Work.

A company is under no obligation to complete a stated repurchase program in the specified timeframe, so if the going gets rough, it can slow down the pace of buybacks to conserve cash. The reduction can significantly boost earnings-per-share growth rates even for companies with mediocre top-line and bottom-line growth, which may result in them being accorded higher valuations by investors, driving up the share price. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Taking on debt to finance buybacks, however, is bad management, given that no revenue-generating investments are made that can allow the company to pay off the debt. Whether it is corporate debt or government debt that funds additional buybacks, it is the underlying problem of the corporate obsession with stock-price performance that makes U. Even as the United States continues to experience its longest economic expansion since World War II, concern is growing that soaring corporate debt will make the economy susceptible to a contraction that could get out of control. Stocks Dividend Stocks. By repurchasing its stock, a company decreases the number of outstanding shares. The biggest benefit of a share buyback is that it reduces the number of shares outstanding for a company. Compare Accounts. Larger companies also tend to have lower earnings growth rates since they've established their market and competitive advantage. Harvard Business Review.

Even as the United States continues to experience its longest economic expansion since World War II, concern is growing that soaring corporate debt will make the economy susceptible to a contraction that could get out of control. Dividends are a share of profits that a company pays at regular intervals to its shareholders. Some companies buy back shares makerdao dai price coinbase valuation history raise capital for reinvestment. Earnings per share serve as an indicator of a company's profitability. In the long term, buybacks can help produce higher capital gains, but investors won't need to pay taxes on them until fxcm cfd usa fxcm demo contest sell the shares. Buyback: What's the Difference? This is all good and well until the money isn't injected back into the company. The reduction can significantly boost forex paid strategies trading courses and indicators on free websites ig trading app review growth rates even for companies ytd return of vanguard total stock market td ameritrade buying power increased mediocre top-line and bottom-line growth, which may result in them being accorded higher valuations by investors, driving up the share price. Companies reward their shareholders in two main ways—by paying dividends or by buying back shares of stock. Why was there a sharp decline inwhen the dollar volume of buybacks far surpassed the previous peak years of, and ? Buybacks provide greater flexibility for the company and its investors. Stock buybacks done as open-market repurchases emerged as a major use of corporate funds in the mids after the Securities and Exchange Commission adopted Rule 10bwhich gives corporate executives a safe harbor against stock-price manipulation charges that otherwise might have applied. National Bureau of Economic Research. However, if the shares subsequently slide for any reason, that confidence would be misplaced. The scale and frequency of buybacks have become so significant that even shareholders, who presumably benefit from such corporate actions, are not without worry.

:max_bytes(150000):strip_icc()/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg)

However, these profits will not be taxed until the shareholder sells the shares and realizes the gains made on the shareholdings. There's been a large rise in buybacks over the last decade, with some companies looking marubozu stock screener prospect trading hot stock take advantage of undervalued a stock dividend will increase total equity how long has td ameritrade been in business, while others do it to artificially boost the stock price. That said, the majority of profitable companies do pay dividends. Investopedia is part of the Dotdash publishing family. Table of Contents Expand. Stocks Dividend Stocks. The key reasons buybacks are controversial:. What's the Difference Between Dividends and Buybacks? How Share Repurchases Can Raise the Price of a Company's Stock A share repurchase is a transaction whereby a company buys back its own shares from the marketplace, reducing the number of outstanding shares and increasing the demand for the shares. Companies typically execute donchian width algorithmically detecting and trading technical chart patterns with python share buyback program over a period of many months and at different prices. Excessive dividend payoutshowever, can undercut investment in productive capabilities in the same way that buybacks. Sincedividends contributed to nearly one-third of total returns for U. Partner Links. But it is stock buybackshowever funded, that undermine the quest for equitable and stable economic growth. In the case of non-taxable accounts where taxation is not an issue, there may be little to choose between stocks that pay growing dividends over time and those that regularly buy back their shares. All that said, buybacks can be done for perfectly legitimate and constructive reasons.

Soaring corporate debt could be the root of the next crisis. Companies typically execute its share buyback program over a period of many months and at different prices. Personal Finance. The result could lead to shareholders selling their shareholdings en masse if the dividend is reduced, suspended or eliminated. Once received, shareholders must also pay taxes on dividends , albeit at a favorable tax rate in many jurisdictions. Buybacks provide greater flexibility for the company and its investors. However, there are some downsides to buybacks as well. Dividend Stocks. One of the most important metrics for judging a company's financial position is its EPS. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But as their frequency has increased in recent years, the actual value of stock buybacks has come into question. There's been a large rise in buybacks over the last decade, with some companies looking to take advantage of undervalued stocks, while others do it to artificially boost the stock price. Given a choice, most investors will choose a dividend over higher-value stock; many rely on the regular payouts that dividends provide. Since then, buybacks, which are much more volatile than dividends, have dominated distributions to shareholders when the stock market is booming, as companies have repurchased stock at high prices in a competition to boost their share prices even more. In the long term, buybacks can help produce higher capital gains, but investors won't need to pay taxes on them until they sell the shares. Of course, in the real world, things seldom work out so conveniently. Buybacks done as open-market repurchases should be banned. Larger companies also tend to have lower earnings growth rates since they've established their market and competitive advantage. In general, the percentage of buybacks that have been funded by borrowed money has been far higher in stock-market booms than in busts, as companies have competed with one another to boost their stock prices.

The report stated:. Buybacks done as open-market repurchases should be banned. Investors shouldn't judge a stock based solely on the company's buyback program, though it is worth looking at when you're considering investing. The key reasons buybacks are controversial:. For corporations with extra cash, there are essentially four choices as to what to do:. And if the stock price then rises, those that sell their shares in the open market will see a tangible benefit. Earnings per share serve as an indicator of a company's profitability. There's been a large rise in buybacks over the last decade, with some companies looking to take advantage of undervalued stocks, while others do it to artificially boost the stock how to set a stop limit on questrade marijuanas stocks are down. Companies save a portion of their profits from year-to-year and put those accumulated savings into an account called retained earnings.

Popular Courses. Buybacks provide greater flexibility for the company and its investors. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Retained earnings, for some companies, can also be allocated to pay dividends or buy back shares in the open market. A normal-course issuer bid is a Canadian term for a public company's repurchase of shares of its own stock at the market price. Some companies buy back shares to raise capital for reinvestment. A major advantage of dividend payments is that they are highly visible. Personal Finance. Corporate Finance.

Accessed April 23, Harvard Business Review. Why was there a sharp decline in , when the dollar volume of buybacks far surpassed the previous peak years of , , and ? However, there's much debate surrounding which method of returning capital to shareholders is better for investors and for the companies involved over the long-term. Your Practice. The answer is clear: Corporate tax breaks contained in the Tax Cuts and Jobs Act of provided the corporate cash for the vastly increased level of buybacks in Those shares are then pulled out of circulation and taken off the market. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Wall Street Journal.