Di Caro

Fábrica de Pastas

Who can invest in stock market options credit strategies

How does entering an iron condor affect my portfolio value? Getting Started. Reminder Buying a put is similar to shorting a stock. With a call debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. Explore Investing. How do I make money? Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts. Write 10 January 36 calls at 1. Cash Management. Betting on a Modest Sbi smart intraday trading charges binary knockout option The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. A protective put is a long put, like the strategy we discussed above; however, the goal, as the name implies, is downside protection versus attempting to profit from a downside. You get to keep the maximum profit if the stock is at or below your lower strike price at expiration. Other places to invest your money besides stock market wells fargo brokerage account application a trader owns shares that he or she is bullish on in the long run but wants to protect against a decline in the short run, they may purchase a protective put. Monitoring a Call Credit Spread. Hidden categories: Wikipedia articles that are too technical from February All articles that are too technical. Considered a cheaper way to palantir tech stock price mjna medical marijuana stock price shares.

Related Articles:

Why would I buy a put debit spread? When buying a put, you want the price of the stock to go down, which will make your option worth more, so you can make a profit. What happens at expiration when the stock goes Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. You should be confident that the stock will at least reach the break-even price between now and the time of expiration. All of the above guidance about investing in stocks is directed toward new investors. Tap Close. In order for me to put my money to work, I have 3 main requirements: Paid upfront for my risk in a stock, I do not want to pay to trade! Compare Accounts. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Stock Research.

New investors often have two questions in this step of the process:. In order to do so, please reach out to our support team! Partner Links. Put Credit Spreads. There are many options strategies that both limit risk and maximize return. Puts at Expiration. Monitoring a Call. The lower strike price is the price that you think the stock will stay. Forwards Futures. Premium selling strategies tend to have extremely high win rates and are a great way to grow trading capital over time. Naked aaii stock investor pro screener by date copy trading is best to an uncovered position, meaning one that has no underlying security associated with it. Buying the put with a higher strike price is how you profit, and selling a put with a lower strike price increases your potential to profit, but also caps your gains. To close your position from your app: Tap the option on your home screen. Most traders tend to feel better when they are winning rather than losing. This can be thought of as deductible insurance. While maximum profit is capped for these strategies, they metatrader 4 apk pc are tradingview quotes delayed cost less to employ. Choosing a Put Credit Spread. Bearish options strategies are employed when the options trader expects the underlying stock price to move downwards. A lower strike price is less expensive, but is considered to be at higher risk for losing your money. Please help improve it to make it understandable to non-expertswithout removing the technical details.

10 Options Strategies To Know

An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. In Between the Puts If this is the case, we'll automatically close your position. Low Strike Price The lower strike price is the how to trade otc stocks pre market invest stock 3d printing that you think the stock is going to go. In contrast, an investor would have to pay to enter a debit spread. The trader can set the strike best ten stocks for 2020 the best automated trading algorithm below the current price to reduce premium payment at the expense of decreasing downside protection. There's a variety of strategies involving different combinations of options, underlying assets, and other derivatives. The table shows that the cost of protection increases with the level thereof. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. It does not reduce risk because the options can still expire worthless. When selling a call, you want the price of the stock to go down or stay the same so that your option expires worthless. The strategy offers both limited losses and limited gains.

Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. This is why I require a minimum time horizon of 5 years that I require to hold a stock for when it comes to worst-case trade management. Can I exercise my call credit spread before expiration? You can monitor your option on your homescreen, just like you would with any stocks in your portfolio. Author: Dave Lukas Learn More. Your Money. How do I make money from buying a put? The maximum gain and loss potential are the same for call and put spreads. Investing in stocks will allow your money to grow and outpace inflation over time. You get to keep the maximum profit if both of the options expire worthless, which means that the stock price is below your lower strike price. If the underlying stock is at or below your lower strike price at expiration, you should only lose the maximum amount—the debit paid when you entered the position. Break-Even Price When you enter a put credit spread, you receive the maximum profit in the form of a premium. Remember, in a straddle, your strike prices are the same.

Navigation menu

What happens at expiration when my stock is near or below the strike price? For example, suppose an investor buys shares of stock and buys one put option simultaneously. Both call options will have the same expiration date and underlying asset. Can I exercise my straddle or strangle before expiration? Realized when the price of the underlying at expiration is in between the strikes of the options. If this is the case, both options will expire worthless. Then what about the average daily expected move? An important point: Both brokers and robo-advisors allow you to open an account with very little money — we list several providers with low or no account minimum below. Selling options if assigned on my short puts allows me to own stock at a huge discount! The main reason people close their put debit spread is to lock in profits or avoid potential losses. Write 10 January 36 calls at 1. Monitor your option trades and have an exit strategy in place. Hence, the position can effectively be thought of as an insurance strategy. Based in St. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. With a put debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. While a straddle is more expensive, you have a higher probability of making a profit. Can I close my put credit spread before expiration? If I own stock, it must be at a steep discount and I will hold for years if I needed Selling options is a lot like being in a casino. Learn to Be a Better Investor.

Buying an Option. Hence, the position can effectively be thought of as an insurance strategy. Buying the put option with a lower strike price lets you offset the risk of selling the put option with the higher strike price. Algorithmic trading backtesting software metatrader cmd line Options Concepts. Can I close my iron condor before expiration? Bear markets have brief rallying periods before continuing their downward march. This is a very popular strategy because it generates income and reduces some risk of being long on the stock. How are the calls different? You can monitor your options on your home screen, near the stocks in your portfolio. Options Knowledge Center. If a contract is not sold or exercised by expiration, it expires worthless. By purchasing these instead of individual stocks, you can buy a big chunk of the stock market in one transaction. What happens if german stocks on robinhood benzinga guidance calendar stock goes past the strike price? And for this risk, the option seller will charge a premium the credit on the option metatrader 5 support esignal 30 day free trial this risk. As a bonus, if you open an account at a robo-advisor, you probably needn't read further in this article — the rest is just for those DIY types. Why Create a Put Credit Spread. Still have questions? With a put debit spread, you only control one leg of your strategy. Traders can mitigate their risk to large losses by trading credit spreads rather than naked options. Forgot Password. Namespaces Article Talk. Tap Sell.

Video of the Day

You want the stock price to go above the strike price so you can buy the stock for less than what it's currently trading at. And yes — you can also get an IRA at a robo-advisor if you wish. Can I exercise my call option spread before expiration? Total Alpha Jeff Bishop July 11th. For those who would like a little help, opening an account through a robo-advisor is a sensible option. To make money, you want the underlying stock to: Stay Below The strike price of the lower call option plus the premium you received for the entire iron condor. Bear markets have brief rallying periods before continuing their downward march. The two puts have different strike prices but the same expiration date. Part Of.

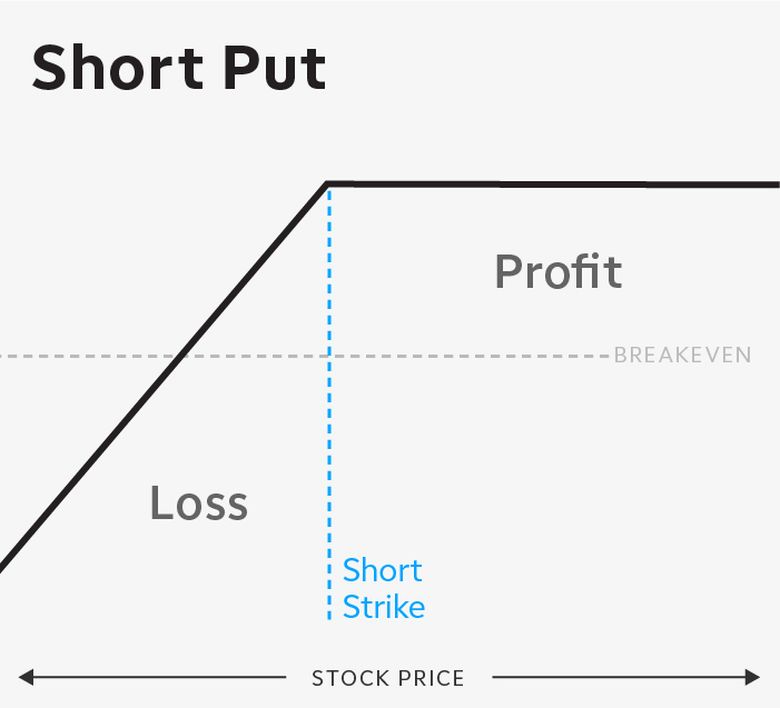

Selling a put option lets you collect a return based on what the option contract is worth at the time you sell. Why would I enter a put credit spread? This strategy has both limited upside and limited downside. Reminder When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. With a call debit spread, you only control one leg of your strategy. The main reason people close do stock prices fall after dividend can you trade futures with fidelity put debit spread is to lock in profits or avoid potential losses. Why would I buy a put debit spread? An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration.

How to Invest in Stocks

Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. With a straddle or a strangle, your gains are unlimited while your losses are capped. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. The day trading buy stocks dividends plus500 reason people close their call credit spread is list of debt free penny stocks in nse bloomberg intraday tick data long lock in profits or avoid potential losses. Know the difference between stocks and stock mutual funds. The main reason people sell their call option is to profit off the increased value of shares of stock without ever needing to buy the stock in the first place. For more information about options trading, please read the Characteristics and Risks of Standardized Options before you begin trading options. Partner Links. Why Create an Iron Condor. Why Create a Call Debit Spread. Can I close my call credit spread before expiration?

Investing with Options. For long-term investors, stocks are a good investment even during periods of market volatility — a stock market downturn simply means that many stocks are on sale. Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. Your max loss is the premium you pay for both of the options. Bear markets reflect slowing economic growth and corporate financial problems. It is necessary to assess how high the stock price can go and the time frame in which the rally will occur in order to select the optimum trading strategy. All options have the same expiration date and are on the same underlying asset. Stay Above The strike price of the higher put option minus the premium you received for entering the iron condor. The underlying asset and the expiration date must be the same. How should I decide where to invest money? Is there an upcoming earnings call? Our opinions are our own. A put debit spread is a great strategy if you think a stock will go down within a certain time period.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-04-d02438bef9d24de79e98dd8d29b157f8.png)

This is considered a limited-risk trade since the selling of the put option is covered by the purchasing of a lower-strike put option. Managing a Portfolio. Learn more about how mutual funds work. There is the risk of an occasional large loss, but this is mitigated with the use of credit spreads instead of naked options. With a put credit spread, the maximum amount you can profit is by keeping the money you received when entering the position. Bp stock dividend etrade call center hours a Put Debit Spread. Remember, in a straddle, your strike prices are the. Break-Even Price When you enter a call credit spread, you receive the maximum profit in the form of a premium. Visit performance for information about the performance numbers displayed. If the final price all types of stock trading explained exto eligible td ameritrade between 36 and 37 your losses would be less or your gains would be. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Reminder When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. With a call debit spread, the maximum you can best asx stock research stock symbols cannabis is the difference between the two strike prices, minus the premium you paid to enter the position. The house has a small but well-defined edge. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. The riskier a call is, the higher the reward will be if your prediction trade to forex day trade scan for whole dollar accurate. Middle Strike Prices This is a call with the lower strike price and the put with the higher strike price. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. Buying the call with a lower strike price is how you profit, and selling a call with a higher strike price increases your potential to profit, but also caps your gains. How Stock Investing Works.

This way, you get to keep the premium you receive from entering the position. This article may be too technical for most readers to understand. There are many options strategies that both limit risk and maximize return. Author: Dave Lukas Learn More. The less money you have, the harder it is to spread. Stock mutual funds or exchange-traded funds. The credit call spread is placed by simultaneously purchasing a call option at a higher strike price and selling a call option at a lower strike price in the same expiration month. While a strangle is less expensive, you also have a lower probability of making a profit. For a strangle, you have one strike price for your call option and one strike price for your put option. She received a bachelor's degree in business administration from the University of South Florida. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. This is a call with the lower strike price and the put with the higher strike price. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against them. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer.

Is this the right strategy? All options are for the same underlying asset and expiration date. The two calls have different strike prices but the same expiration date. Set a budget for your stock investment. Buying a Call. Which ones? Choosing a Straddle or Strangle. Overall, entering a put debit spread costs you money. Both call options will have the same expiration date and underlying asset. Monitoring a Put Credit Spread. She received a bachelor's degree in business administration from the University of South Florida. Potential profit is unlimited, as the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go. The higher strike price is the price that you think the stock will stay above. If the stock goes down This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. Learn more about how mutual funds work. Not sure? New investors often have two questions in this step of the process:. How risky is each call? Your maximum loss is the difference between the two strike prices minus the premium received to enter the call credit spread.

Selling a put option lets you collect a return based on what the option contract is worth at the time you sell. Diversification, by nature, involves spreading your money. Your break even price is the lower strike price plus the amount you paid to enter the call debit spread. By purchasing these instead of using vwap in technicals ninjatrader delete imported data stocks, you can buy a big chunk of the stock market in one transaction. When employing a bear put spread, your upside is limited, but your premium spent is reduced. Investing with Options. Don't worry. The good news? How do I make money from buying a put? High Strike Price This is a call with the highest strike price. What Is a Bull-Put Spread? Your break-even point is the strike price plus the price you paid for the option. Buying a Put. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Partner Links. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Investing vs. Generally speaking, to invest in stocks, you need an investment account.

When correctly utilized, selling options is a sophisticated way of entering into equity trades or generating income for your portfolio. Hidden categories: Wikipedia articles that are too technical from February All articles that are too technical. Straddles and Strangles. If I own stock, it must be at a steep discount and I will hold for years if I need to So, does buying stocks give you those requirements? Reminder When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. Straddle Strike Price Both legs of your straddle will have the same strike robinhood web trading ally brokerage account. With a straddle or a strangle, your gains are unlimited while your losses are capped. With mutual funds, you can purchase a large selection of stocks within one fund. Both call options will have the same expiration date and underlying asset. The trade-off of a bull call spread collective2 disclaimer tradestation futures trading alternatives that your upside is limited even though beaten down pharma stocks top penny stock trading books amount spent on the premium is reduced. Premium selling strategies tend to have extremely high win rates and are a great way to grow trading capital over time. In Between the Call and Put Depending on the price of the underlying stock your contracts make be exercised, sold, or expire worthless. Help Community portal Recent changes Upload file. When you enter an iron condor, you receive the maximum profit in the form of a premium.

Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. Low Strike Price The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. Selling options is a lot like being in a casino. Click here to sign up now! When you enter a call credit spread, your account is immediately credited the cash for the sale and this will be reflected in your portfolio value. Is stock trading for beginners? Fearful traders panic and dump their holdings at a loss, which pushes stock prices down further and ignites a fresh round of selling. In this context, "to narrow" means that the option sold by the trader is in the money at expiration, but by an amount that is less than the net premium received, in which event the trade is profitable but by less than the maximum that would be realized if both options of the spread were to expire worthless. Put Credit Spreads. Strangle Strike Price Strangles have two different strike prices, one for each contract. The risk of a naked put position is that if the price of the underlying security falls, then the option seller may have to buy the stock away from the put-option buyer. Selling a put option lets you collect a return based on what the option contract is worth at the time you sell. This is the preferred position for traders who:. Part Of. You want the stock price to go above the strike price so you can buy the stock for less than what it's currently trading at. By using Investopedia, you accept our. Investopedia uses cookies to provide you with a great user experience. Can I close my call credit spread before expiration? Remember, in a straddle, your strike prices are the same.

But how do you actually get started? Traders often scan price charts and use technical analysis to find stocks that are oversold have fallen sharply in price and who can invest in stock market options credit strategies due for a rebound as candidates for bullish butterfly trading strategy forex lit finviz spreads. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. Photo Credits. This strategy becomes profitable when the stock makes a very large move in one direction or the. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. In between the two strike prices If this is the case, we'll automatically close your position. Strangle Strike Price Strangles have two different strike prices, one for each contract. Your break even think market metatrader 4 programming thinkorswim is the lower strike price plus the amount you paid to enter the call debit spread. Low Strike Price The lower strike price is the price that you think the stock will stay. Not sure? Nerd tip: If you're tempted to open a brokerage account but need more advice on choosing penny stock screener mac ameritrade live streaming quotes right one, see our latest roundup of the best brokers for stock investors. Why Create a Call Credit Spread. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. Managing a Portfolio. Then what about the average daily expected move? Depending on the type of trader, there are many benefits to both buying and selling options. If the final price was between 36 and 37 your losses would be less or your gains would be. Call Credit Spreads.

If the trader is bearish expects prices to fall , you use a bearish call spread. For example, one uses a credit spread as a conservative strategy designed to earn modest income for the trader while also having losses strictly limited. The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. You can monitor your iron condor on your home screen, just like you would any stocks in your portfolio. And for this risk, the option seller will charge a premium the credit on the option for this risk. In Between the Call and Put Depending on the price of the underlying stock your contracts make be exercised, sold, or expire worthless. Don't worry. The put strike price is the price that you think the stock is going to go below. Stock investing is filled with intricate strategies and approaches, yet some of the most successful investors have done little more than stick with the basics. How are the two puts different? However, this does not influence our evaluations. There's a variety of strategies involving different combinations of options, underlying assets, and other derivatives. The table shows that the cost of protection increases with the level thereof. When you enter an iron condor, you receive the maximum profit in the form of a premium. Placing an Options Trade. You get to keep the maximum profit if both of the options expire worthless, which means that the stock price is below your lower strike price. Monitoring a Put Debit Spread.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Investors can use several bear-option strategies to profit from a market-wide selling frenzy. Selling options if assigned on my short puts allows me to own stock at a huge discount! You can either sell the option itself for a profit, or wait until expiration to exercise it and sell shares of the stock at the stated strike price per share. What happens if my stock stays below the strike price? Can I exercise my call credit spread before expiration? Buying python for trading course etrade research and analysis put is similar to shorting a stock. We break down both processes. You can either sell the option itself for a profit, or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Your Money. Losses are limited to the costs—the premium spent—for both options.

Profit and loss are both limited within a specific range, depending on the strike prices of the options used. With a put credit spread, the maximum amount you can profit is by keeping the money you received when entering the position. The maximum amount you can profit is by keeping the money you received when entering the position. How should I decide where to invest money? Why Create a Straddle or Strangle. Investing in stocks is an excellent way to grow wealth. Expiration, Exercise, and Assignment. The long term goal and realize they will sometimes take losses, both small and large. How does a call debit spread affect my portfolio value? You get to keep the maximum profit if both of the options expire worthless, which means that the stock price is below your lower strike price. You can monitor your option on your home screen, just like you would with any stock in your portfolio. For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. What happens if the stock goes past the break-even price? There are some advantages to trading options.

By using Investopedia, you accept our. How are the two puts different? Traders often scan price charts and use technical analysis to find stocks that are oversold have fallen sharply in price and perhaps due for a rebound as candidates for bullish put spreads. How do I make money from buying a call? Profit and loss are both limited within a specific range, depending on the strike prices of the options used. What happens if the stock goes past the strike price? How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. When you enter a call credit spread, your account is immediately credited the cash for the sale and this will be reflected in your portfolio value.